A delirious stock-exchange speculation such as the one that went crash in 1929 is a pyramid of that character. Its stones are avarice, mass-delusion and mania; its tokens are bits of printed paper representing fragments and fictions of title to things both real and unreal, including title to profits that have not yet been earned and never will be. All imponderable. An ephemeral, whirling, upside-down pyramid, doomed in its own velocity. Yet it devours credit in an uncontrollable manner, more and more to the very end; credit feeds its velocity—Garet Garett

S&P 500 and Global Equities: Behind The Best 71-Day Returns Since 1987; China’s Credit Rockets! Continued Ascent of US Primary Dealer Holdings of T-Bills

Figure1

This first chart shows that the S&P 500 has registered the fourth-best return in 71 days and the best return since 1987. (chart courtesy of Charlie Bilello)

But here’s the rub. Beneath the surface, of the top four best returns in 71-days, namely, 1975, 1930, 1987 and 1943, yearend returns were either strikingly single digit or stunningly negative.

Said differently, by the close of the year, the gains of the top four were completely or mostly reversed.

The possible reasons:

-1930 represented the onset of the Great Depression

Will the SPX follow the same path?

Figure 2

The next chart (also from Charlie Bilello) shows the intensifying euphoria that has engulfed global equity markets.

Forty-six of the forty-eight national ETFs including the Philippines have posted positive returns! The average returns have been an astounding 12%, the best start since 1987! (returns in USD)

1987 again!

Will global equity markets share the same fate of the SPX?

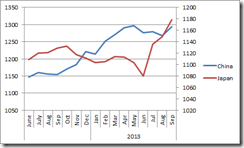

The third chart comes from Ed Yardeni’s Country Briefing: China

It shows how the Chinese government has panicked to have incited the unleashing a tsunami of credit at a scale never seen before!

Figure 3

China’s Aggregate Financing (approximately system Credit growth less government borrowings) jumped 2.860 billion yuan, or $427 billion – during the 31 days of March ($13.8bn/day or $5.0 TN annualized). This was 55% above estimates and a full 80% ahead of March 2018. A big March placed Q1 growth of Aggregate Financing at $1.224 TN – surely the strongest three-month Credit expansion in history. First quarter growth in Aggregate Financing was 40% above that from Q1 2018.

Over the past year, China's Aggregate Financing expanded $3.224 TN, the strongest y-o-y growth since December 2017. According to Bloomberg, the 10.7% growth rate (to $31.11 TN) for Aggregate Financing was the strongest since August 2018. The PBOC announced that Total Financial Institution (banks, brokers and insurance companies) assets ended 2018 at $43.8 TN.

March New (Financial Institution) Loans increased $254 billion, 35% above estimates. Growth for the month was 52% larger than the amount of loans extended in March 2018. For the first quarter, New Loans expanded a record $867 billion, about 20% ahead of Q1 2018, with six-month growth running 23% above the comparable year ago level. New Loans expanded 13.7% over the past year, the strongest y-o-y growth since June 2016. New Loans grew 28.2% over two years and 90% over five years.

China’s consumer lending boom runs unabated. Consumer Loans expanded $133 billion during March, a 55% increase compared to March 2018 lending. This put six-month growth in Consumer Loans at $521 billion. Consumer Loans expanded 17.6% over the past year, 41% in two years, 76% in three years and 139% in five years.

China’s M2 Money Supply expanded at an 8.6% pace during March, compared to estimates of 8.2% and up from February’s 8.0%. It was the strongest pace of M2 growth since February 2018’s 8.8%.

South China Morning Post headline: “China Issues Record New Loans in the First Quarter of 2019 as Beijing Battles Slowing Economy Amid Trade War.” Faltering markets and slowing growth put China at a competitive disadvantage in last year’s U.S. trade negotiations. With the Shanghai Composite up 28% in early-2019 and economic growth seemingly stabilized, Chinese officials are in a stronger position to hammer out a deal. But at what cost to financial and economic stability?

Beijing has become the poster child for Stop and Go stimulus measures. China employed massive stimulus measures a decade ago to counteract the effects of the global crisis. Officials have employed various measures over the years to restrain Credit and speculative excess, while attempting to suppress inflating apartment and real estate Bubbles. Timid tightening measures were unsuccessful - and the Bubble rages on. When China’s currency and markets faltered in late-2015/early-2016, Beijing backed away from tightening measures and was again compelled to aggressively engage the accelerator.

Credit boomed, “shadow banking” turned manic, China’s apartment Bubble gathered further momentum and the economy overheated. Aggregate Financing expanded $3.35 TN during 2017, followed by an at the time record month ($460bn) in January 2018. Beijing then finally moved decisively to rein in “shadow banking” and restrain Credit growth more generally. Credit growth slowed somewhat during 2018, as the clampdown on “shadow” lending hit small and medium-sized businesses. Bank lending accelerated later in the year, a boom notable for rapid growth in Consumer lending (largely financing apartment purchases). And, as noted above, Credit growth surged by a record amount during 2019’s first quarter.

China now has the largest banking system in the world and by far the greatest Credit expansion. The Fed’s dovish U-turn – along with a more dovish global central bank community - get Credit for resuscitating global markets. Don’t, however, underestimate the impact of booming Chinese Credit on global financial markets. The emerging markets recovery, in particular, is an upshot of the Chinese Credit surge. Booming Credit is viewed as ensuring another year of at least 6.0% Chinese GDP expansion, growth that reverberates throughout EM and the global economy more generally.

So, has Beijing made the decision to embrace Credit and financial excess in the name of sustaining Chinese growth and global influence? No more Stop, only Go? Will they now look the other way from record lending, highly speculative markets and reenergized housing Bubbles? Has the priority shifted to a global financial and economic arms race against its increasingly antagonistic U.S. rival?

Chinese officials surely recognize many of the risks associated with financial excess and asset Bubbles. I would not bet on the conclusion of Stop and Go. And don’t be surprised if Beijing begins the process of letting up on the accelerator, with perhaps more dramatic restraining efforts commencing after a trade deal is consummated. Has the PBOC already initiated the process?

April 12 – Bloomberg (Livia Yap): “The People’s Bank of China refrained from injecting cash into the financial system for a 17th consecutive day, the longest stretch this year. China’s overnight repurchase rate is on track for the biggest weekly advance in more than five years amid tight liquidity conditions.”

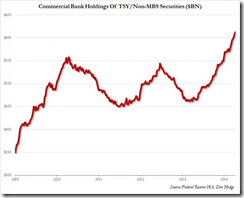

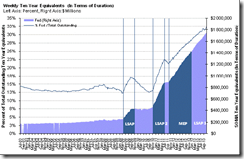

Figure 4

US primary dealer holdings of T-Bills and Floating Rate Notes have been spiraling upwards. Why? Have they been accumulating USTs for their account or on behalf of clients? Have these intensifying accumulation been about the growing scarcity of risk-free collateral?

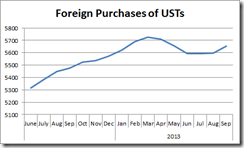

Four different charts that are related (see Garet Garrett excerpt)

The year of the pig.