The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, May 27, 2014

Natural Disasters: Loss of life means reduced economic growth

Monday, November 11, 2013

Typhoon Yolanda and the Phisix

Weather forecasters explain that tropical cyclones that form in the Pacific Ocean during the last few months of the year usually hit land because of the Siberian High, the prevailing high pressure system over Asia during the winter months. The Siberian High prevents cyclones from moving upwards, which why they make landfall in the central and southern Philippines, said Glaiza Escullar, a weather forecaster at PAG-ASA.

the typhoon’s impact to the stock market has largely been immaterial over all timeframes considered and tends to reflect on the major trends from which undergirds the stock market cycle.

Wherever business is increased in one direction, it must (except insofar as productive energies may be generally stimulated by a sense of want and urgency) be correspondingly reduced in another.

Our lives teem with numbers, but we sometimes forget that numbers are only tools. They have no soul; they may indeed become fetishes.

Thursday, October 24, 2013

Humor: Krugman teaches Gilligan the broken window (fallacy)

Friday, November 02, 2012

Quote of the Day: God is a Vulgar Keynesian Just Trying to Help

After every disaster, someone says, “This will be good in the long run for the economy. Think of all the homes and infrastructure that must be rebuilt. Think of all the new cash that will come out reserves and go into circulation. This is just the stimulus we need.”To those who genuinely believe this, I have a modest proposal. Instead of waiting patiently for hurricanes to fix our economy, why don’t we just manufacture our own disasters? For instance, the government could order a mandatory evacuation of California. We could then bomb the hell out of the state. Think of the stimulus this would create to the hotel, oil, military manufacturing, and ailing construction industries. Indeed, we could require Californians to leave their cars at home (to be bombed), and thus help the American auto industry as well. I understand insurance doesn’t cover acts of war, but surely this doesn’t count as war, does it?At any rate, if you really believe this kind of stuff, it sort of solves the problem of evil, doesn’t it? Hurricanes aren’t apparent divine evil in need of explanation. Rather, God is a vulgar Keynesian just trying to help.

Thursday, November 01, 2012

Quote of the Day: Demand and Supply are Two sides of the Same Coin

It’s not that “supply creates its own demand,” but rather that supply is demand. One produces a good either to consume it oneself or, more commonly, to trade it for another good. Demand and supply are two sides of the same, well, coin—which reminds me to add that Say’s Law holds not just in a barter economy but a monetary one also—a freed one, that is, unlike the corporate state we all occupy.True, someone might sell a good and not spend the money received. But this would lead to idleness only if the economy did not consist in a time structure of production coordinated by interest rates. In other words, money not spent is saved and available for investment (that is, payments for producer goods and labor, which will be spent on consumer goods) at stages remote from the consumer-goods level; that is, long-term investment in production for future consumption…Given our insatiable demand for goods, in a freed market a general glut couldn’t happen; if prices were free to fluctuate in response to changed conditions or entrepreneurial error, the price of goods plentiful relative to demand would fall, while the price of goods deficient relative to demand would rise. Entrepreneurs would then adjust their plans, but since change is the rule, the market would never reach a state of rest. Say’s Law is about a (free) process through time, not general equilibrium.

Wednesday, July 18, 2012

Wednesday, June 06, 2012

Brain Dead Economics: Wars as Economic Stimulus

Marketwatch columnist and former war veteran Paul Farrell is aghast at politicians who are agitating for war in the guise of ‘stimulating the economy’

Mr. Farrell writes, (bold original)

Yes, I’m mad as hell again. I just read some bad news that should make every American mad as hell. In fact, two bad news items.

First, as a U.S. Marine vet, I got angry reading that there have been more military suicides than war deaths the past decade. Yes, more Iraq and Afghan war vets have killed themselves than were killed by America’s enemies in combat. And more are expected as we had more than two million serve in the two wars.

A soldier from the U.S. Army's Charlie Company, 1/12 Infantry, 4th Brigade Combat Team, 4th Infantry Division scans across the border at houses in Pakistan during a Sunday patrol near Dokalam village in Afghanistan's Kunar Province.

Second, if the economic, psychological, political and moral consequences of the past two wars aren’t bad enough, many politicians and candidates — some of whom never served in the armed forces — are proposing that the full Congress pass the Ryan budget and force Pentagon generals to spend billions more than they requested.

Mr. Farrell questions the underlying motives for such calls… (bold italics mine, bold original)

Treating war as an economic stimulus program became clear a decade ago in the early years of the Iraq war. That fact was stressed in a Huffington Post interview with Oliver Stone. Ryan Grim said that in a 2004 meeting President George W. Bush said to the Argentine prime minister: “All the economic growth that the U.S. has had, has been based on the different wars it had waged.”

Apparently that same ideology remains strong in today’s election politics.

Let’s put all this in the larger macroeconomic context. War should be about national defense. Wars should have nothing to do with scoring domestic political points. And yet, increasing the Pentagon budget has become a political hot button in today’s election drama.

This is insane: Do politicians plan to start new wars?

Ask yourself, are they already itching for a new war? After two exhausting wars? Eleven years? We put 2.3 million in Iraq and Afghanistan; 800,000 served multiple deployments, one of the big reasons for vet suicides. So why demand bigger budgets? Why in a time of national austerity? Why when they’re complaining about high taxes?

No, war shouldn’t be about domestic politics, but it is. And that’s bad news for taxpayers, for investors, for America’s values.

Somebody’s got to pay for all this. The taxes of all Americans will go up if the Senate passes the Ryan budget plan, forcing Pentagon generals to spend $554 billion in 2013, billions more than they requested. Plus it’ll add $6.2 trillion new debt and taxes over the next decade.

Yes, this is insane. A few private contractors will get richer but taxpayers will suffer in this zero-sum economics game.

National defense? No, it’s about getting rich, the rest pay the price

America is on a dangerous and costly path. Not just politicians. Americans love war, it’s in our genes. Congress spends over 50% our tax dollars on the Pentagon war machine. America spends 47% of the total military budgets of all nations in the world.

Why does the public tolerates such absurdities? Why do we hide this insanity deep in our collective conscience? Why are we planning new wars? Why do we see war as an economic stimulus program? The Iraq-Afghan “economic stimulus” strategy got us in the mess we’re in; are we really crazy enough to try it again?

Forget all the campaign rhetoric about national defense. That is not why our politicians want to spent trillions more on the Pentagon war machine. Politician are interested in reelection not national defense. They need votes and will keep military bases open because that means local jobs, satisfied voters.

They need campaign cash. Military contractors are great donors. Cutting war-related jobs is political suicide. So they pass big military budgets, waste billions on outdated weapon systems. Keep throwing money at the Pentagon war machine. Anything to get reelected. National defense is not a first priority; their job, their reelection is.

I share Mr. Farell’s revulsion

For me, it’s only politically brain dead people who really argue that destruction (war or natural catastrophes) serves as economic ‘stimulus’.

Post destruction economic activities extrapolates to REPLACEMENT and NOT VALUE ADDED. Yet loss of lives CANNOT be replaced. And deaths along with incapacitated citizens, decreases productivity. This is essentially the Broken Window Fallacy.

And it would be a mistake to relate war with creative destruction. Innovation or advances of technology, which renders obsolete old products or business models, is the outcome of markets in pursuit of consumer satisfaction.

During war, consumers become subordinated to the political forces, particularly through taxes, price controls and rationing, as in World War II.

The point is in war, the economy produces guns, tanks and warplanes and NOT TVs, telephones, private cars. This simply shows how naïve and absurd any such supposed economic comparison is. And this also shows of the dangers of making analysis based on statistical aggregates which tend to discount the real costs, particularly the human factor.

During the World War II, Keynesian economists worried about what would happen to the US economy once the war would culminate.

Then the Keynesian high priest Paul Samuelson quoted by Professor David R. Henderson

When this war comes to an end, more than one out of every two workers will depend directly or indirectly upon military orders. We shall have some 10 million service men to throw on the labor market. [DRH comment: he nailed that number.] We shall have to face a difficult reconversion period during which current goods cannot be produced and layoffs may be great. Nor will the technical necessity for reconversion necessarily generate much investment outlay in the critical period under discussion whatever its later potentialities. The final conclusion to be drawn from our experience at the end of the last war is inescapable--were the war to end suddenly within the next 6 months, were we again planning to wind up our war effort in the greatest haste, to demobilize our armed forces, to liquidate price controls, to shift from astronomical deficits to even the large deficits of the thirties--then there would be ushered in the greatest period of unemployment and industrial dislocation which any economy has ever faced. [italics in original]

Of course, the end of World War II turned out in total contrast to Samuelson’s prediction, the US economy boomed.

Today, brain dead economics turn the table to tells us that the boom that followed World War II had been due to ‘stimulus’. This is a wonderful example of verbal manipulation.

On moral grounds, how is it righteous for people to wish ill for the others? People who really see war as economic growth ought to go to the battlefront, along with their families, and fight the wars themselves. The reason for their chutzpah is because they know someone else will do the dying for them. The same applies to any destruction as stimulus. Talk about pretentious moral high grounds.

Politicians urge for war because war is the health of the state. Aside from the war as the origin the state, wars provide the pretext for the expansion of the state or the “ratchet effect” as coined by Professor Robert Higgs.

Professor Art Carden explains,

In Crisis and Leviathan, Higgs argues that during a crisis a "ratchet effect" produces net increases in government discretion that are not completely reversed after the crisis. Two things happen when government intervenes. First, the bureaucracy naturally tends to expand beyond its stated goals — mission creep. Second, intervention alters incentives; that is, the creation of a bureaucracy to address some problem also spawns a rent-seeking pressure group with interests that will prevent reversion to the status quo ante.

The bottom line is that war as stimulus has never been about economics but about propaganda to expand the power of the state and of the economic interests of those attached to the state or the political clients or the cronies.

For those wishing for war, be reminded of the Golden rule (Matthew 7:12)

Therefore all things whatever you would that men should do to you, do you even so to them: for this is the law and the prophets.

If not they deserve this.

Thursday, February 02, 2012

Quote of the Day: World War II Did Not End the Great Depression

Unemployment fell during the war entirely because of the buildup of the armed forces. In 1940, some 4.62 million persons were actually unemployed (the official count of 7.45 million included 2.83 million employed on various government work projects). During the war, the government, by conscription for the most part, drew some 16 million persons into the armed forces at some time; the active-duty force in mid-1945 numbered in excess of 12 million. Voila, civilian unemployment nearly disappeared. But herding the equivalent of 22 percent of the prewar labor force into the armed forces (to eliminate 9.5 percent unemployment) scarcely produced what we are properly entitled to call prosperity.

Yes, officially measured GDP soared during the war. Examination of that increased output shows, however, that it consisted entirely of military goods and services. Real civilian consumption and private investment both fell after 1941, and they did not recover fully until 1946. The privately owned capital stock actually shrank during the war. Some prosperity. (My article in the peer-reviewed Journal of Economic History, March 1992, presents many of the relevant details.)

It is high time that we come to appreciate the distinction between the government spending, especially the war spending, that bulks up official GDP figures and the kinds of production that create genuine economic prosperity. As Ludwig von Mises wrote in the aftermath of World War I, “war prosperity is like the prosperity that an earthquake or a plague brings.”

That’s from the economist Robert Higgs who debunks the popular myth.

Common sense tells us that it would be foolish to ever think that society prospers from death and destruction, despite what statistics say. Yet many fall for sloppy generalizations, which has been founded on the post hoc fallacy and the broken window "war prosperity" myth.

Again Professor Art Carden on the Broken Window Fallacy

Sunday, August 28, 2011

The Broken Window Fallacy as seen from my Damaged Computer

Wednesday, August 24, 2011

My Prayer to the Lord on Krugman’s Wish for More Destruction

[IMPORTANT UPDATE: The Krugman google+ quote below is an admitted forgery. Although Mr. Krugman could have said this in different ways. Forgery isn't justifiable.]

The Nobel Laureate Paul Krugman posted at the google+

People on twitter might be joking, but in all seriousness, we would see a bigger boost in spending and hence economic growth if the earthquake had done more damageDear Lord,

In reading the above, I became distraught when I realized that people of high stature would actually wish or even impliedly invoke harm, damage or loss on other people for the sake of statistics.

In case You should grant Mr. Krugman and his followers their wishes, I do pray that You would not include them in that specter of greater destruction.

That’s because if you did, they will be spending for repairs, hospitalization expenses, reconstruction and etc…, money which they would have spent for other useful and more desirable things than on contingents.

Although they could be helping out the economy as they claim this would, it would be better that they be left unscathed, so that they can keep on telling half truths which the world so badly needs.

I pray too that Mr. Krugman and his followers would not suffer from the losses of lives and injuries associated with the accompanying devastation.

Because if You allowed this to happen, I would suppose that Mr. Krugman and company will also suffer from the misery, trauma and tragedy of the losses of family members, relatives close friends, colleagues and or associates.

Also they might even endure the agony of medical recuperation and therapy if they have been wounded. And if this is so, they will have to consume their savings unless they are adequately covered by insurance. Again they would be diverting money to spending on emergency than on attaining more convenience during 'normal' times.

And under the period of rehabilitation they may not be able to spread their negative knowledge to their disciples and to the gullible.

And they may not be also paid by their respective employers if their treatment will be prolonged or if they become permanently handicapped.

As I understand, the economy is about interacting human beings, where losses of lives and physical impairment translates to the reduction of human capital. And losses of human life, I understand essentially reduces, and not adds to, real economic growth.

If You so decide to take away all our lives and leave only Mr. Krugman and his followers alive, there won't be much to spend on because there will hardly be anyone left to produce to serve the needs of these hallowed survivalists. And countless green pieces of paper won't do anything too.

Most importantly I pray that Mr. Krugman and his followers will be forgiven for their misanthropic desires and dogmatic superciliousness.

And that such forgiveness be extended to me for my aghast response over what seems for me as a demented opinion.

Thanks for listening,

Benson

Wednesday, June 08, 2011

Myth of War as Political and Economic Solution

Some people here or abroad seem to be agitating for war.

In the Philippines, recent unfortunate incidents over at the Spratlys Islands have prompted some officials to call for increased military spending as countermeasure against alleged provocations by foreign marauders.

As earlier pointed out, suggestions of an ‘arms race’ are foolish because they are not only economically unfeasible but political brinkmanship risks escalation which might lead to undesired consequences that may be baneful for both parties. In addition war spending robs the local economy of productivity and resources which leads to poverty.

Since the Philippines have an existing Mutual Defense treaty with the US, which other nations recognize, then perhaps current incursions by China represents a test of this relationship or has been merely been flexing her brawn in order to flaunt her new hardwares of destruction.

Besides, China’s actions have not shown aggressiveness elsewhere, and to the contrary, has been more investment oriented.

This is unless China’s military and incumbent political leaders have different agendas.

In the US, experts like Dr. Paul Krugman seem to be arguing for increased war spending to bolster the economy. Professor William Anderson quotes Krugman

“If we had the threat of war, had a military buildup, you’d be amazed at how fast this economy would recover.”

For people who view the world in the context of dollar and cents, then this view would seem plausible.

Yet as rightly pointed out by Professor Anderson the US has been waging war on different fronts,

I'm not sure what we call Iraq, Afghanistan, Libya, and wherever else the U.S. Armed Forces are shooting people. I think I call it war, and we can see just how good it has been not only for our economy, but also the economies of the lands this government has attacked.

From Google’s Public Data

From Cato.org

In relative terms, the US has the largest share of military spending in the world and has continuously outspent the world. And this has been growing trend since 2000 (obviously post 9/11).

So has increased war spending or other forms of government spending been boosting the US economy? Unfortunately not.

From Dan Mitchell

War as a demand booster is a myth.

Henry Hazlitt in his must read classic Economics in One Lesson debunked this fallacious dollar and cents view based on ‘aggregates’.

The great Mr. Hazlitt, (italics original)

Now there is a half-truth in the "backed-up" demand fallacy, just as there was in the broken-window fallacy. The broken window did make more business for the glazier. The destruction of war will make more business for the producers of certain things. The destruction of houses and cities will make more business for the building and construction industries. The inability to produce automobiles, radios, and refrigerators during the war will bring about a cumulative post-war demand for those particular products.

To most people this will seem like an increase in total demand, as it may well be in terms of dollars of lower purchasing power. But what really takes place is a diversion of demand to these particular products from others

In wars, it is not just the diversion of resources from productive to consumptive activities, which brings about a lower standard of living, but the intangible costs from losses of human lives (capital)! Death from war or disasters or any form of destruction cannot serve as economic boosters.

Those who argue for war do so either because they know someone else will do the dying for them or have not envisioned of the brutalities of a real war.

Maybe this is part of what historian Arnold Toynbee calls as the “Generational Cycle in the transmission of a social heritage”.

Dr. Marc Faber quotes Toynbee,

The survivors of a generation that has been of military age during a bout of war will be shy, for the rest of their lives, of bringing a repetition of this tragic experience either upon themselves or upon their children, and... therefore the psychological resistance of any move towards the breaking of a peace ....is likely to be prohibitively strong until a new generation.... has had the time to grow up and to come into power. On the same showing, a bout of war, once precipitated, is likely to persist until the peace-bred generation that has been lightheartedly run into war has been replaced, in its turn, by a war-worn generation'

In short, the lack of exposure to war whets the desire for war.

Here is a suggestion: Dr. Krugman and all his ilk and his followers (including Filipino politicians and their adherents), who yearn for war for whatever reasons, should go to the front line, instead of getting ensconced in the proverbial ‘ivory towers’, and bring their family along with them.

If you want war, go fight them yourself!

Sunday, March 13, 2011

Will Japan’s Earthquake-Tsunami Be Market Bearish Or Bullish?

The glazier's gain of business, in short, is merely the tailor's loss of business. No new "employment" has been added. The people in the crowd were thinking only of two parties to the transaction, the baker and the glazier. They had forgotten the potential third party involved, the tailor. They forgot him precisely because he will not now enter the scene. They will see the new window in the next day or two. They will never see the extra suit, precisely because it will never be made. They see only what is immediately visible to the eye.-Henry Hazlitt, The Broken Window, Economics in One Lesson

Next week’s front running issue will likely be the double whammy of the earthquake-tsunami that struck Japan.

There might be a third factor—risks of a nuclear meltdown[1] as consequence to the above.

Capital Accumulation As Life Preserver

The largest of the massive earthquakes had been one for the record books.

Figure 3: Economist: World Largest Earthquake

According to the Economist[2],

ON Friday March 11th a huge earthquake of magnitude 8.9 struck off the north-east coast of Japan's main island, triggering a tsunami seven metres tall. The earthquake is thought to be the largest ever to hit Japan, and the fifth-largest since decent records began in 1900. According to the US Geological Survey, 15 of the 16 largest earthquakes occurred in and around the Pacific "Ring of Fire". Fortunately, many of the biggest, known as "megathrust" earthquakes, as one tectonic plate is forced under another, have occurred in sparsely populated areas.

While it may be true that megathrusters have occurred in sparse areas, the terrifying aspect is when the body counts begin to pile up. And the issue isn’t about the magnitudes of earthquakes but about how wealth from capital accumulation[3] has prepared society for such contingencies.

The 2010 earthquake in Haiti which only had a 7.0 magnitude took an estimated 92,000 to 220,000 lives[4]. However, the Philippines lost about 1,621 lives when a 7.8 tremblor struck in Northern Luzon on July 16th 1990[5]. Strict building codes can’t be enforced if there is no wealth to fund it. That’s basic.

Earthquakes compounded by tsunamis increases the casualty rate. The 2004 Indian Ocean earthquake and tsunami took some estimated 227,000 lives across 15 countries and is considered as one of the ten worst earthquakes in recorded history[6]. Indonesians bore the brunt of the death toll (130,736) or about 70% of fatalities.

Outside the escalation of a nuclear radiation disaster, I am hopeful that Japan’s fatality will be fraction of Haiti and or the 2004 Indian Ocean earthquake and tsunami incident.

Framing The Impact of the Earthquake-Tsunami

Some say that the Japan tragedy is market bearish. Others see this as market bullish.

My position is that while the initial reaction could be negative, this woeful episode would be a neutral or a nonevent over the medium to the long term.

Basically it’s all about the issue of risk and uncertainty.

While it is true that such large scale devastation would likely impact the insurance industry the most, as insurance companies would have to indemnify insured claims, looking solely at the damage-indemnity framework wouldn’t be sufficient or won’t reveal market dynamics in action.

My presupposition is that these companies have factored in the Japan’s geographic risk profile, and naturally, the calamity risk that Japan is faced with, as Japan is situated in the Pacific ring of fire[7] where 10% of the most active volcanoes are.

In other words, most of them would have assumed on the risk-reward balance of actualizing insurance contracts. Otherwise failure to do so means the risk of bankruptcy.

And if there are any clues towards Japan’s earthquake risks, many geologists have spent so much time and money to predict the “big one” coming but apparently failed to do so[8]. The point is the Japanese or the insurers are most likely well aware of such risks.

Nor do I agree with the suggestion that such disaster would trigger a fiscal crisis in Japan. All Japan would need is to open its doors to rehabilation and reconstruction to domestic and international private investors, as well as, to liberalize labor.

The assumption that reconstruction should be undertaken solely by Japan’s government represents as analytical myopia.

What we should also look at instead is if Japan or Japan’s financial companies would repatriate funds from abroad, and how this might put pressure on the US dollar, as well as, US Treasuries.

To add, I think Japan will, from this event, be forced to import labor or liberalize migration given its declining population due to rapidly falling fertility rates[9].

Figure 4: Bespoke Invest[10]: Framing The Kobe Earthquake

Many charts will frame peoples thoughts as Figure 4. By looking at the Kobe incident also known as the Great Hanshin earthquake[11] without ascertaining the backround would possibly mislead people into thinking that the past performance equals the future.

The Nikkei has already been in a downtrend following the 1990 bubble bust. Thus, the Kobe Earthquake only became an aggravating circumstance rather than the key driver.

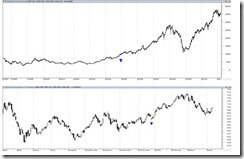

Figure 5: Jakarta Composite Index and Thailand’s SET Post 2004 Tsunami

To balance the perspective, the 2004 Indian Ocean earthquake hardly put a dent on the Indonesia’s (upper window) or even Thailand’s (lower window) stock markets, see figure 5. While both did suffer from a very short term decline they eventually proceeded higher.

Also economic data proved that the Kobe earthquake had been much less of an impact.

Figure 6: Kobe Earthquake had limited impact (Danske Bank)

According to Danske Bank[12]

From a macroeconomic point of view, the overall impact from the Kobe quake in January 1995 was limited. Industrial production dipped in February in the wake of the quake not least because of Kobe’s importance as a distribution centre, but recovered in the following two months as reconstruction started. It is harder to see any visible impact on GDP growth in 1995, but on balance we believe the impact will be positive because of the positive impact from reconstruction. Hence, the quake today is unlikely to derail the current recovery in Japan. If anything it will be a short-term boost to growth.

As you can see, when viewed from many comparisons, and from other angles, the source of “pessimism” fades.

Critical Analysis Matters

Eventually the issue boils down to uncertainty versus risk.

Event uncertainty, unless further worsened by more unseen untoward events (such as the risk of nuclear meltdown), will tend to get discounted. People learn to weigh in on the risk-reward balance as they see through the events unfold.

The diminishing returns of information or marginal value of information as I previously wrote[13],

Because the emergence of such unforeseen events are considered as uncertainty (immeasurable risk, and not possible to calculate), the markets work to reappraise of ‘uncertainty’s’ influence or impact, which gradually digests on them. So the influence of uncertainty depends mostly on the scale and the time value of influence...

Once the markets learned of and adjusted to such uncertainty, or to the new information, and subsequently established its cost-benefit expectations around it, uncertainty gets to be transformed into risks (measurable potential losses) via discounting. Discounting, thus, signifies as the diminishing returns of information or the marginal value theorem applied to information.”

And this is why critical analysis matters alot.

Broken Window Fallacy and Conclusion

On the other hand, I can’t see how such reconstruction can be positive overall.

Numerous people lost their precious lives which also mean lost human capital. Damaged property also equates to capital losses. And such capital losses are NOT captured by statistics on nominal GDP.

Capital meant for increasing productivity will now have to be redirected towards replacement. And replacement adds no value, and that’s why there’s no growth in the overall.

But what I wouldn’t deny is that there will be some sectors or entities who will profit from these. I think Filipino labourers will see an opportunity to grab. And yes, statistics could register a short term boost. But again statistics don’t capture the human experience.

On balance, the negative impact of disasters on the financial markets tends to be short term as effects of disasters get to be discounted overtime.

The underlying market trends will likely be determined by the general market direction overtime and not from a lasting impact of Japan’s earthquake-tsunami.

[1] See Aftermath of Japan’s Earthquake: Risk of A Nuclear Reactor Meltdown, March 12, 2011

[2] Economist Daily Charts, Terrifying tremors, March 11, 2011

[3] See Economic Freedom And Natural Disasters: Haiti's Tragic Earthquake, January 15, 2010

[4] Wikipedia.org 2010 Haiti earthquake

[5] Wikipedia.org 1990 Luzon earthquake

[6] Wikipedia.org 2004 Indian Ocean earthquake and tsunami death toll and casualties

[7] Wikipedia.org Pacific Ring of Fire Japan

[8] See Science Models Fail To Predict Japan’s Earthquake, March 12, 2011

[9] Japan Times, Population decline worsening January 15, 2010

[10] Bespoke Invest, Japan's Stock Market Post Kobe Earthquake in 1995, March 11, 2011

[11] Wikipedia.org Great Hanshin earthquake

[12] Danske Bank, Japan: Impact from quake should prove limited, March 11, 2011

[13] See “I Told You So!” Moment: Being Right In Gold and Disproving False Causations, March 6, 2011