“I’ve been dealing with these big mathematical models of forecasting the economy…I’ve been in the forecasting business for 50 years…I’m no better than I ever was, and nobody else is. Forecasting 50 years ago was as good or as bad as it is today. And the reason is that human nature hasn’t changed. We can’t improve ourselves.” Alan Greenspan

Baseball legend Yogi Berra once quipped on a sarcastic irony on prediction, ``Prediction is very difficult, especially if it's about the future."

Nevertheless prediction has been hardwired into the mankind’s genes with the implicit goal to overcome risks in order to ensure existential continuity of the specie. As Peter Bernstein aptly wrote in Against The Gods, ``The revolutionary idea that defines the boundary between modern times and the past is the mastery of risk…”

Predictions From A Historian’s Perspective

Well, prediction is a tricky business. Since the advancement of science, the scientific model (quantitative) approach has been frequently utilized to determine probabilistic outcomes given defined set of variables.

However, social science appear to be more complex than anticipated, given that people have different scale of values, which are likewise meaningfully influenced by the divergences in time preferences, and also influenced by sundry cognitive biases, which subsequently makes us respond differently even to the same set of conditions.

As mathematician and scientist Professor Benoit Mandelbrot of the Fractal Geometry fame said in a PBS News Hour Interview, ``The basis of weather forecasting is looking from the satellite and seeing the storm coming but not predicting that the storm will form, the behavior of economic phenomenon is far more complicated than the behavior of liquid and gasses” (underscore mine)

Since markets are essentially economic events, the complications is that they represent endemically a menagerie of action-reaction and stimulus-response feedback loop dynamics to which Professor Mandelbroit elucidated in The (Mis)Behaviour Of Markets as, ``prices are determined by endogenous effects peculiar to the inner workings of the markets themselves, rather than solely by the exogenous actions of outside events.”

So given that markets signify more of human action dynamics than the functional state of natural science then our choice in making predictions will be one similar to the work of historians. Murray N. Rothbard makes the appropriate analogy, ``The latter attempts to "predict" the events of the past by explaining their antecedent causes; similarly, the forecaster attempts to predict the events of the future on the basis of present and past events already known. He uses all his nomothetic knowledge, economic, political, military, psychological, and technological; but at best his work is an art rather than an exact science. Thus, some forecasters will inevitably be better than others, and the superior forecasters will make the more successful entrepreneurs, speculators, generals, and bettors on elections or football games.” (all bold underscore mine)

The point is: Markets are likely to exhibit the causal effects from precursory human actions than from math designed economic models that ignore the aspects of human decision making.

Unfortunately the mainstream appears addicted to apply models even if they’ve been proven to be repeatedly unrealistic, either for reputational (need to be seen as pedagogic) or for social affiliations (need to be seen talking the same language) motivations or due to ideological blindspots (dogmatic treatment of economic theories).

Predictions Based On Dumb Luck

Besides, predictions should be weighed from the angles of opportunity costs and the incentives of the forecaster’s standpoint.

When a forecast for a certain direction of the market is unfulfilled, but at worst, goes into substantially to the opposite direction, losses will be real for those who adhered to them.

For instance, many ‘experts’ who predicted the “crash of the stock market” in 2009, when the market soared anywhere from 20-50% based on G-7 and BRIC and key emerging markets, could have bled their customers dry or would have lost 20-50% in profit opportunities from such erroneous predictions.

Yet for them to bluster “I told you so!” because the markets sizably fell this week would signify as “even a broken clock is right twice a day”! This implies that they’ve been right for the wrong reasons or as indicated by Urban Dictionary “success obtained through dumb luck”.

Market predictions shouldn’t translate to an immediate or outright fulfillment but instead focus on mitigating risks and optimizing profits. When markets move violently against a touted position and the forecaster refuses to badge, then it isn’t about “mitigating risks and optimizing profits” nor is it about accuracy, but about being foolishly arrogant or about obstinately adhering to wrong analytical models.

Remember since markets move in only two directions (up or down)… they are going to be right somehow.

Nevertheless successful investing isn’t myopically about being theoretically right or wrong but about generating maximum profits from the right moves and reducing losses on the wrong moves.

Since as human beings we are susceptible to mundane lapses, then investing is about dealing with the magnitude or the scalability of the portfolio and not of the frequency of transactions. In addition, it is also about the allocative distribution of a portfolio pertinent to perceived risks conditions.

Furthermore, as we said in Reasons To Distrust Mainstream Economists, some forecasters have different incentives for making publicly based predictions.

Some are there for mere publicity purposes (celebrity guru such as Nouriel Roubini makes the spotlight anew with another wondrous shift by predicting a market meltdown in the 2nd half! It’s amazing how media glorifies an expert whose calls have been repeatedly off tangent) or to promote certain agenda- e.g. promote political interventions-example Bill Gross [see Poker Bluffing Booby Traps: PIMCO And The PIIGS], sell newsletters, sell funds, etc...

For instance, some experts recently argued that the recent wobbles in Wall Street validates the state of the economy. Does this translate that markets only reflect on reality on when they conform to the directions advocated by these so-called “seers”? That would be utter crock.

The truth is that the current state of the global economy operates under a fiat money regime which perpetuate on the boom bust cycles, irrespective of the actions by regulators to curtail private greed but not on their actions-which have been the underlying cause of it.

Put bluntly, politically oriented boom bust cycles are the dominant and governing themes for both the global markets and the world economy. Therefore, market actions on both directions have been revealing these dynamics.

They don’t essentially validate or invalidate the workings of the economy, because they are `` endogenous effects peculiar to the inner workings of the markets themselves, rather than solely by the exogenous actions of outside events” as Professor Mandelbroit would argue.

Hence, the “desperately seeking normal” school of thought represents as a daft pursuit to resurrect old paradigms under UNSUPPORTIVE conditions- we don’t use radar to locate for submarines or any underwater objects!

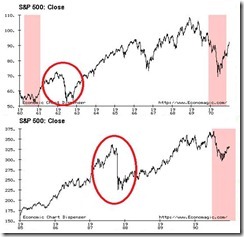

Similarly ludicrous is to show comparative charts of the crash of 1929 as a seeming parallel for today’s prospective outcome. This is a brazen example of the cognitive bias known as the “clustering illusions” or seeking patterns where there is none.

Unfortunately, even professionals fall for such lunacy, which is emblematic of why mainstream analysis should be distrusted [see earlier discussion in Why Investor Irrationality Does Not Solely Account For Bubble Cycles].

These people fundamentally forget that 1920s operated on a GOLD STANDARD while today’s world has been on a de facto US dollar standard. Today we have deposit insurance when in 1929 crash we didn’t.

Today is the age of the internet or Web 2.0, where communications have advanced such that they are done by email, or conducted real time as voice mail, web based conferencing, digital cameras, iPods and etc., and where the cost to do business has substantially fallen to near zero and which has, consequently, attracted the scalability of globalization.

In the 1920s, communications were in a primal mode: stamped postal mails, the electrical telegraphs, manual based switchboard rotary telephones, and photography were based on celluloid film 35mm Leitz cameras. All these were emblematic that the 1920s had operated on an agro-industrial age.

Today we have niche or specialized markets when in the 1900s it was all about mass marketing. These are just a few of the major outstanding differences.

In short, the fact that the basic operating framework of the political economy has been disparate implies that the effects to the markets would be equally distinct. Think of it, fundamentally speaking, monetary policies in the pre Bretton Woods 1900s were restricted to the amount of gold held in a country’s reserves while today central banks have unrestrained capacity for currency issuance.

Columbia Business School’s Charles Calomiris makes this very important policy-market response feedback loop differentiation in an interview,

``From 1874 to 1913, there was a lot of globalization. But worldwide there were only 4 big banking crises…From 1978 to now, there have been 140 big banking crises, defined the same way as the earlier ones: total losses of banks in a country equalling or greater than 10% of GDP.” (bold highlights mine)

As you would notice, the emergence and proliferation of central banking coincided with the repeated and stressful occurrences of big banking crisis. Put differently, where central banking fiat currency replaced the gold the standard, banking crisis became a common feature. So to argue that market actions don’t reflect reality translates to a monumental incomprehension or misinterpretation of facts and theory.

Yet if markets should reflect on the same 1929 dynamics, this would be more the mechanics of dumb luck than representative of economic reality. Besides, to presuppose as engaging in “economic” analysis to support such outlandish theories, but without taking to account on these dissimilarities, would also signify as chimerical gibberish or pretentious knowledge.

Bottom line: I’d be careful about heeding on the predictions of the so-called experts, where I would read between the lines of interests of these forecasters, their way of interpreting facts and the theory used, aside from opportunity costs from lapses, and their forthrightness.

Yet, I’d pay heed to Benjamin Graham, the father of value investing when he admonished, ``If I have noticed anything over these 60 years on Wall Street, it is that people do not succeed in forecasting what’s going to happen to the stock market."