Last week was marked by a string of bad news from local and international fronts, particularly geopolitical tensions with China over the disputed Scarborough Shoal, rolling Brownouts in Mindanao, record earthquake in Indonesia[1] and also a major earthquake in Mexico and reemergent concerns over the unraveling debt crisis in Spain.

Rotation to the Blue Chips

Yet the local equity benchmark, the Phisix, seemed to have defied the adverse developments by posting a modest weekly gain of 1.16%

Most of these gains were driven by this year’s sectoral leaders; specifically the property, the financial and holding companies.

And in reinforcing this year’s rotational trend, the mining and the service sectors continued to lag.

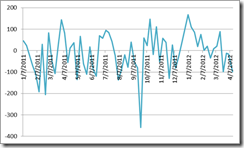

The actions of the Phisix seem to have departed from the actions of the broader market where there had been more declining issues than advancing issues. The graph above exhibits that market breadth has been tilted towards profit taking.

Aside from sectoral performances, the gains of the Phisix have mostly emanated from select issues mostly the biggest market caps or the blue chips.

Holiday blues from an abbreviated trading week or extended vacation seem to characterize last week’s market actions. Peso volume (averaged on a weekly basis) materially slackened on the account of this week’s gains. The decline in the Peso volume adds to the evidence of a profit taking mode.

Foreign trades have also been sluggish with paltry changes over the last two weeks. Yet, despite the marginal actions by foreign investors, the Philippine Peso posted modest advances.

So essentially, last week’s action suggest of a rotation away from second and third tier issues back into the blue chips.

Yet I expect to see normalization of trading activities in terms of Peso volume which should undergird either the current consolidation phase or a fresh attempt to break away into new highs.

When the markets to defy the spate of bad news that signifies as a bullish signal.

Catechism of Inflation

It is important to note too that the Phisix and the major US benchmark, the S&P 500, has seen a tightening of correlations since March of last year.

Nonetheless tight correlation does not imply of causation.

Both charts have even spelled out the failed bearish head and shoulders pattern and the accompanying rally that had been fueled by collaborative central bank actions.

However, one would note that the difference between them has been in the degree of the rebound. The Phisix blitz past the consolidation range whereas the S&P 500 has just been drifting above the breakout zone. And one would further observe that both the Phisix and the S&P 500 seem as in a consolidation phase.

The actions of the Phisix and the S&P 500 are intertwined through the policies of the US Federal Reserve, where a slew of credit easing measures from artificially suppressed interest rates, bond purchases, interest on excess reserves, and foreign currency swaps have also influenced policy making in the Philippines and elsewhere through policy induced negative real rates regime and partly from the acquisition of dollar foreign exchange reserves in the domestic economy.

I may add that in the near future, policy induced carry trades will become more pronounced[2].

While events in the Eurozone could pose as somewhat a drag to US markets, this should be viewed as temporary, as the money supply growth in the US continues to balloon.

And part of the substantial growth in money supply exudes from Quantitative Easing (QE) programs or bond purchases which have partly been designed to inject money to the economy which bypassed the banking system through stock payments.

German Economist and Professor Thorsten Polleit explains[3],

However, it may also be due to the Fed's purchases of bonds from so-called nonbanks (for instance, private households, pension funds, and insurance companies). Under such operations the Fed increases the means of payments directly; it is a policy of increasing money by actually circumventing bank credit expansion.

The marked increase in the stock of payments in recent years is an unmistakable sign of what can be called, economically speaking, inflation, a view held by the Austrian School of economics.

And given the series of massive short covering and yield chasing actions that has translated into a gigantic “boom” over a very short period, a reprieve or profit taking process or a countercyclical trend would account for as a natural order, current events nothwithstanding.

The short of it, is that no trend moves in a straight line.

It is innate upon us to rely on heuristics and cognitive bias to scour for descriptive explanations to market outcomes, whether these events are truly relevant or not.

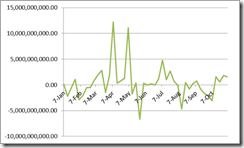

Moreover, should stress levels over Spain or Italy’s debt intensify (left window), the European Central Bank (ECB) would most likely resuscitate its recently mothballed bond purchases (Securities Markets Programme-SMP; right window[4]) despite isolated rhetoric in opposition to its revival[5].

A poll recently noted that experts unanimously expect the ECB to intervene[6] mostly through SMP, and like Pavlov’s experimental dogs, the financial marketplace has been conditioned to expect that any market pressures would be counteracted by interventions after interventions.

Such feedback loop mechanism, which I previously pointed out[7], between market actions and political responses and vice versa, has not only become the central banker’s main tool in dealing with the crisis, but now represents the catechism of inflation.

Faced with increasing risks of a hard landing, the People’s Bank of China (PBoC) cut reserve requirements for select banks anew[8] yesterday. Moreover, China’s lending and money supply has substantially jumped in response to earlier policy accommodation[9]. As one would note, whether China or Western central bankers, the operating procedure has been the same.

And for as long as the public remains unaware of the abstruse nature of central banking in manipulating and gaming the system to the benefit of the cronies and the welfare-warfare state, and importantly for as long as the effects or impacts on the markets by such policies remain mild and nonthreatening, central bankers will continue to resort to such measures.

Profit from political folly.

[1] Reuters.com Indonesia quake a record, risks for Aceh grow, April 12, 2012

[2] See Will Japan’s Investments Drive the Phisix to the 10,000 levels?, March 19, 2012

[3] Polleit Thorsten The Worst of All Monetary Policies April 4, 2012, Mises.org

[4] Danske Research Q&A on Spain April 12, 2012

[5] Bloomberg.com Knot Says ECB ‘Very Far’ From Resuming Bond-Purchase Program April 13, 2012

[6] Business Standard, ECB favours buying bonds over bank loans April 14, 2012

[7] See Chart of the Day: The Inflation Cycle April 5, 2012

[8] China Daily China cuts reserve requirements for county lenders April 14, 2012

[9] See China’s Tiger by the Tail, April 13, 2012