Dr. Ed Yardeni thinks that there has been a mismatch between oil prices and oil demand

Dr. Yardeni writes

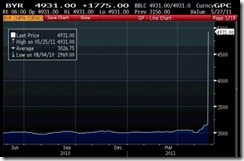

The price of Brent crude oil is up again this morning over $124 a barrel. It’s up from $107.65 at the end of last year as a result of increasing tensions with Iran following the imposition by the US and Europe of tough new sanctions on Iran. They are already reducing the ability of Iran to export crude oil. Last year, Iran exported about 2mbd. That is likely to get cut by half or more. That’s not enough to explain why oil prices are soaring given that global oil supply is around 88mbd. Of course, concerns are mounting that the diplomatic and economic confrontation with Iran could turn into a military conflict that would disrupt oil traffic coming out of the Persian Gulf. This certainly explains why oil prices are rising.

Global oil demand, on the other hand, is weakening and suggests that oil prices could fall sharply if the Iranian issue can be resolved without push coming to shove. As I’ve explained previously, I believe that the sanctions are rapidly crushing Iran’s economy and may force the Mullahs to give up their ambitions to build nuclear weapons. This may take some time, of course. Meanwhile, if oil and gasoline prices continue to rise, I expect that the Obama administration will coordinate a global release of supplies from the Strategic Petroleum Reserves, as occurred last summer in response to the drop in Libya’s exports.

While tensions over Iran partly contributes to the elevated state of oil prices, there are deeper factors involved as previously explained

Importantly when mainstream economists talk about demand they usually refer to consumption demand and ignore the second type of demand—reservation demand.

The distinguished dean of the Austrian school of Economics Murray N. Rothbard explained,

The amount that sellers will withhold on the market is termed their reservation demand. This is not, like the demand studied above, a demand for a good in exchange; this is a demand to hold stock. Thus, the concept of a “demand to hold a stock of goods” will always include both demand-factors; it will include the demand for the good in exchange by nonpossessors, plus the demand to hold the stock by the possessors. The demand for the good in exchange is also a demand to hold, since, regardless of what the buyer intends to do with the good in the future, he must hold the good from the time it comes into his ownership and possession by means of exchange. We therefore arrive at the concept of a “total demand to hold” for a good, differing from the previous concept of exchange-demand, although including the latter in addition to the reservation demand by the sellers.

Yet what prompts for an increase in reservation demand?

Again Professor Rothbard

an increase in reservation demand for the stock may be due to either (a) an increase in the direct use-value of the good for the sellers; (b) greater opportunities for making exchanges for other purchase-goods; or (c) a greater speculative anticipation of a higher price in the future

Speculative activities also drive the increased demand to hold a stock of goods. Or in the case of oil prices, increased speculation has also been responsible for the recent spike.

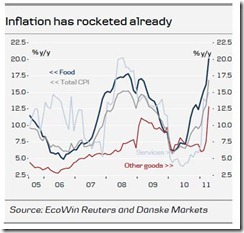

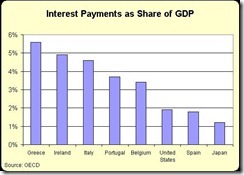

This means that monetary policies designed to ease credit via zero interest rates and quantitative easing have been responsible for encouraging, not only consumption but speculative activities too, by increasing people’s time preferences.

One would note that oil prices and stock market prices (S&P 500) have been ramping up. These are symptoms of an inflationary boom.

Of course, inflationary boom extrapolates to a boom bust cycle or to a crack-up boom.

As Professor Ludwig von Mises wrote

The boom could continue only as long as the banks were ready to grant freely all those credits which business needed for the execution of its excessive projects, utterly disagreeing with the real state of the supply of factors of production and the valuations of the consumers. These illusory plans, suggested by the falsification of business calculation as brought about by the cheap money policy, can be pushed forward only if new credits can be obtained at gross market rates which are artificially lowered below the height they would reach at an unhampered loan market. It is this margin that gives them the deceptive appearance of profitability. The change in the banks' conduct does not create the crisis. It merely makes visible the havoc spread by the faults which business has committed in the boom period.

Neither could the boom last endlessly if the banks were to cling stubbornly to their expansionist policies. Any attempt to substitute additional fiduciary media for nonexisting capital goods (namely, the quantities p3 and p4) is doomed to failure. If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders. However, as a rule, the banks in the past have not pushed things to extremes. They have become alarmed at a date when the final catastrophe was still far away.

While a crack-up boom is not imminent, current monetary policies have brought us into this direction. The more governments engage in reckless policymaking in our monetary affairs, the greater risks of spiraling commodity prices.

Rising oil price, thus can be seen as symptoms of a chronic disorder in the current state of money.