Britain’s Royal Mint, established in the 13th century, sold more than three times more gold coins this month than a year earlier as prices declined.Sales are more than 150 percent higher than last month, according to Shane Bissett, director of bullion and commemorative coin at the Royal Mint. Gold is down 11 percent this month, heading for the biggest drop since September 2011.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, April 25, 2013

Cash Hoarding No Security Against Confiscation, UK’s Panic Buying of Physical Gold

Friday, February 24, 2012

Are Surging Oil Prices Symptoms of a Crack-up Boom?

Dr. Ed Yardeni thinks that there has been a mismatch between oil prices and oil demand

Dr. Yardeni writes

The price of Brent crude oil is up again this morning over $124 a barrel. It’s up from $107.65 at the end of last year as a result of increasing tensions with Iran following the imposition by the US and Europe of tough new sanctions on Iran. They are already reducing the ability of Iran to export crude oil. Last year, Iran exported about 2mbd. That is likely to get cut by half or more. That’s not enough to explain why oil prices are soaring given that global oil supply is around 88mbd. Of course, concerns are mounting that the diplomatic and economic confrontation with Iran could turn into a military conflict that would disrupt oil traffic coming out of the Persian Gulf. This certainly explains why oil prices are rising.

Global oil demand, on the other hand, is weakening and suggests that oil prices could fall sharply if the Iranian issue can be resolved without push coming to shove. As I’ve explained previously, I believe that the sanctions are rapidly crushing Iran’s economy and may force the Mullahs to give up their ambitions to build nuclear weapons. This may take some time, of course. Meanwhile, if oil and gasoline prices continue to rise, I expect that the Obama administration will coordinate a global release of supplies from the Strategic Petroleum Reserves, as occurred last summer in response to the drop in Libya’s exports.

While tensions over Iran partly contributes to the elevated state of oil prices, there are deeper factors involved as previously explained

Importantly when mainstream economists talk about demand they usually refer to consumption demand and ignore the second type of demand—reservation demand.

The distinguished dean of the Austrian school of Economics Murray N. Rothbard explained,

The amount that sellers will withhold on the market is termed their reservation demand. This is not, like the demand studied above, a demand for a good in exchange; this is a demand to hold stock. Thus, the concept of a “demand to hold a stock of goods” will always include both demand-factors; it will include the demand for the good in exchange by nonpossessors, plus the demand to hold the stock by the possessors. The demand for the good in exchange is also a demand to hold, since, regardless of what the buyer intends to do with the good in the future, he must hold the good from the time it comes into his ownership and possession by means of exchange. We therefore arrive at the concept of a “total demand to hold” for a good, differing from the previous concept of exchange-demand, although including the latter in addition to the reservation demand by the sellers.

Yet what prompts for an increase in reservation demand?

Again Professor Rothbard

an increase in reservation demand for the stock may be due to either (a) an increase in the direct use-value of the good for the sellers; (b) greater opportunities for making exchanges for other purchase-goods; or (c) a greater speculative anticipation of a higher price in the future

Speculative activities also drive the increased demand to hold a stock of goods. Or in the case of oil prices, increased speculation has also been responsible for the recent spike.

This means that monetary policies designed to ease credit via zero interest rates and quantitative easing have been responsible for encouraging, not only consumption but speculative activities too, by increasing people’s time preferences.

One would note that oil prices and stock market prices (S&P 500) have been ramping up. These are symptoms of an inflationary boom.

Of course, inflationary boom extrapolates to a boom bust cycle or to a crack-up boom.

As Professor Ludwig von Mises wrote

The boom could continue only as long as the banks were ready to grant freely all those credits which business needed for the execution of its excessive projects, utterly disagreeing with the real state of the supply of factors of production and the valuations of the consumers. These illusory plans, suggested by the falsification of business calculation as brought about by the cheap money policy, can be pushed forward only if new credits can be obtained at gross market rates which are artificially lowered below the height they would reach at an unhampered loan market. It is this margin that gives them the deceptive appearance of profitability. The change in the banks' conduct does not create the crisis. It merely makes visible the havoc spread by the faults which business has committed in the boom period.

Neither could the boom last endlessly if the banks were to cling stubbornly to their expansionist policies. Any attempt to substitute additional fiduciary media for nonexisting capital goods (namely, the quantities p3 and p4) is doomed to failure. If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders. However, as a rule, the banks in the past have not pushed things to extremes. They have become alarmed at a date when the final catastrophe was still far away.

While a crack-up boom is not imminent, current monetary policies have brought us into this direction. The more governments engage in reckless policymaking in our monetary affairs, the greater risks of spiraling commodity prices.

Rising oil price, thus can be seen as symptoms of a chronic disorder in the current state of money.

Sunday, April 10, 2011

Rampaging Global Equity And Commodity Markets Are Symptoms Of Rampant Inflationism!

Credit expansion not only brings about an inextricable tendency for commodity prices and wage rates to rise it also affects the market rate of interest. As it represents an additional quantity of money offered for loans, it generates a tendency for interest rates to drop below the height they would have reached on a loan market not manipulated by credit expansion. It owes its popularity with quacks and cranks not only to the inflationary rise in prices and wage rates which it engenders, but no less to its short-run effect of lowering interest rates. It is today the main tool of policies aiming at cheap or easy money. Ludwig von Mises

Global stock markets appear to be on a juggernaut!

Figure 1: Stockcharts.com: Where Is the Oil-Stockmarket Negative Correlation?

Figure 1 tells us that despite soaring oil prices, last traded at $113 per barrel as of Friday (WTIC), global equity markets have been exploding higher in near simultaneous fashion as demarcated by the blue horizontal line.

The Global Dow (GDOW)[1] an index created by Dow Jones Company that incorporates the world’s 150 largest corporations, the Emerging Markets (EEM) Index and the Dow Jones Asia Ex-Japan Index (P2DOW) have, like synchronized dancing, appear as acting in near unison.

We have been told earlier that rising oil prices extrapolated to falling stock markets (this happened during March—see red circles), now where is this supposed popular causal linkages peddled by mainstream media and contemporary establishment analysts-experts[2]?

Yet, the current actions in the global financial and commodity markets hardly represent evidence of economic growth or corporate fundamentals.

And any serious analyst will realize that nations have different socio-political and economic structures. And such distinction is even more amplified or pronounced by the uniqueness of the operating and financial structures of each corporation. So what then justifies such harmonized activities?

As we also pointed out last week[3], major ASEAN contemporaries along with the Phisix have shown similar ‘coordinated’ movements.

In addition, the massive broad based turnaround in major emerging markets bourses appear to vindicate my repeated assertions that the weakness experienced during the past five months had been temporary and signified only profit taking[4].

Yet if we are to interpret the price actions of local events as one of being an isolated circumstance, or seeing the Philippine Phisix as signify ‘superlative performance’ then this would account for a severe misjudgment.

Doing so means falling into the cognitive bias trap of focusing effect[5] —where one puts into emphasis select aspect/s or event/s at the expense of seeing the rest.

Ramifications of Rampant Inflationism

So how does one account for these concerted price increases? Or, what’s been driving all these?

We have been saying that there are two major factors affecting these trends:

One, artificially low interest rates that have driven an inflationary boom in credit.

That’s because simultaneous and general price increases would not be a reality if they have not been supplied by “money from thin air”.

As Austrian economist Fritz Machlup wrote[6],

If it were not for the elasticity of bank credit, which has often been regarded as such a good thing, a boom in security values could not last for any length of time. In the absence of inflationary credit the funds available for lending to the public for security purchases would soon be exhausted, since even a large supply is ultimately limited. The supply of funds derived solely from current new savings and amortization current amortization allowances is fairly inelastic, and optimism about the development of security prices, inelastic would promptly lead to a "tightening" on the credit market, and the cessation of speculation "for the rise." There would thus be no chains of speculative transactions and the limited amount of credit available would pass into production without delay.

Some good anecdotal examples:

Credit booms are being manifested in several segments of the finance sector across the world, such as the US Collateralized Mortage Obligations (CMO)

From Bloomberg[7], (bold emphasis mine)

The biggest year since 2003 for the packaging of U.S. government-backed mortgage bonds into new securities has extended into 2011, bolstered by banks seeking investments protecting against rising interest rates.

Issuance of so-called agency collateralized mortgage obligations, or CMOs, reached $99 billion last quarter, following $451 billion in 2010, according to data compiled by Bloomberg. The creation of non-agency bonds, which force investors to assume homeowner-default risks, is down more than 90 percent from a peak with parts of the market still frozen.

Facing limited loan demand and flush with deposits on which they pay close to zero percent, banks are turning to agency CMOs to earn more than Treasuries and gird for when the Federal Reserve boosts funding rates. Insurers, hedge funds and mutual- fund managers such as Los Angeles-based DoubleLine Capital LP are seeking different pieces of CMOs, which slice up mortgage debt, creating new bonds that pay off faster or turn fixed-rate notes into floating rates.

Or in Europe, the leveraged buyout markets...

Again from the Bloomberg[8], (bold emphasis mine)

ING Groep NV, the top arranger of buyout loans in Europe this year, sees a “liquidity bubble” building as lenders forego protection and accept lower fees.

“There is a liquidity bubble in the European leveraged loan market at the moment, driven by institutional fund liquidity,” said Gerrit Stoelinga, global head of structured acquisition finance at Amsterdam-based ING, which toppled Lloyds Banking Group Plc as no. 1 loan arranger to private-equity firms, underwriting 10 percent of deals in the first quarter.

Investors more than doubled loans to finance private-equity led takeovers in the first quarter to $6.7 billion as the economy shows signs of strengthening, reducing risk that the neediest borrowers will default. Inflows to funds dedicated to loans and floating-rate debt jumped to $8.5 billion this year, compared with $1.7 billion in the same period in 2010, data from Cambridge, Massachusetts-based EPFR Global show.

Second, it’s all about the dogmatic belief espoused by the mainstream and the bureaucracy where printing of money or the policy of inflationism is seen as an elixir to address social problems.

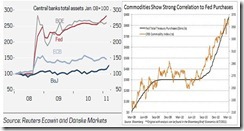

Figure 2: Swelling Central Bank Balance Sheets and Commodity Prices (Danske Bank[9] and Minyanville[10])

The balance sheets of developed economies central banks have massively been expanding (except the ECB, see figure 2 left window), as respective governments undertake domestic policies of money printing or Quantitative Easing (QE) programs, even as the global recession has passed.

Commodity prices have, thus, risen in conjunction with central banks QE programs (right window).

What this implies is that both inflationary credit and the ramifications of various QE programs appear to be mainly responsible for the rise in most commodity markets. This is a phenomenon known as reservation demand, which as I wrote in the past[11]

“commodities are not just meant to be consumed (real fundamentals) but also meant to be stored (reservation demand) if the public sees the need for a monetary safehaven.”

As the great Ludwig von Mises explained[12], (bold highlights mine)

with the progress of inflation more and more people become aware of the fall in purchasing power. For those not personally engaged in business and not familiar with the conditions of the stock market, the main vehicle of saving is the accumulation of savings deposits, the purchase of bonds and life insurance. All such savings are prejudiced by inflation. Thus saving is discouraged and extravagance seems to be indicated. The ultimate reaction of the public, the “flight into real values,” is a desperate attempt to salvage some debris from the ruinous breakdown. It is, viewed from the angle of capital preservation, not a remedy, but merely a poor emergency measure. It can, at best, rescue a fraction of the saver’s funds.

Ironically as I earlier pointed out, even the Bank of Japan (BoJ) has recognized the causal effects of money printing and high food prices[13], but they continue to ignore their own warnings by adding more to their own “lending” program using the recent disaster as a pretext [14]!

Yet despite increases of policy rates by some developed economy central banks as the European Central Bank (ECB) and the Denmark’s Nationalbank[15], not only as interest rates remain suppressed but the ECB pledged to continue with its large scale liquidity program[16].

To add, policy divergences will likely induce more incidences of leveraged carry trade or currency arbitrages.

Record Gold Prices and Poker Bluffing Exit Strategies

And it is of no doubt why gold hit new record nominal highs priced in US dollars last week (now above $1,470 per oz.)

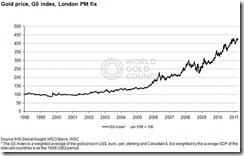

Figure 3: Surging Gold prices versus G-5 currencies (gold.org)

It wouldn’t be fair to say that gold has been going ballistic only against the US dollar because gold has been in near record or in record territory against almost all major developed and emerging market currencies.

Gold, as shown in Figure 3, has been drifting near nominal record highs against G-5 currencies[17] (US dollar, euro, Yen, sterling and Canadian dollar).

Figure 4: Gold Underrepresented as an Asset Class (US Global Investors[18])

Gold, despite record nominal prices, appears to be vastly underrepresented as a financial asset class compared to other assets held by global finance, banking, investment, insurance and pension companies.

Should the scale of inflationism persists, which I think central bankers will[19], considering the plight of the foundering “too big to fail” sectors or nations e.g. in the US the real estate markets (see figure 5), in Europe the PIIGS, this will likely attract more of mainstream agnostics (see figure 4) to gold and commodity as an investment class overtime.

This only implies of the immense upside potential of gold prices especially when mainstream finance and investment corporations decide to load up on it or capitulate.

Figure 5: Tenuous Position of US Real Estate, Bank Index and Mortgage Finance

This brings us back anew to “Exit” strategies that is said to upend gold’s potentials.

The Fed can talk about exit strategies for all they want, but they are likely to signify another poker bluff similar to 2010[20].

The Fed’s inflationist programs which had been mostly directed at the US banking system seem to stand on tenuous grounds despite all the trillions of dollars in rescue efforts.

US real estate appears to stagger again[21] (left window), while the S & P Bank Index (BIX) and the Dow Jones Mortgage Finance (DJUSMF) appears to have been left out of the bullish mode seen in the S&P 500 Financials (SPF) and the Dow Jones US Consumer Finance (DJUSSF), possibly reflecting on the renewed weakness of the US real estate.

In addition, there is also the problem of financing the enormous US budget deficits. And there is also the excess banking reserves dilemma.

So in my view, the US Federal Reserve seems faced with the proverbial devil and the deep blue sea. Other major economies are also faced with their predicaments.

Going back to the stock markets, as Austrian economist Fritz Machlup explained[22],

if all of these indices show an upward (or downward) movement, the presumption is very strong that inflation (or deflation) in the sense defined is taking place, even if the level of commodity prices does not show the least upward (or downward) tendency.

Well some commodity prices have paralleled the actions in the stock markets if not more.

Bottom line: Rampaging stock markets and commodity markets are symptomatic of rampant inflationism.

[1] Wikipedia.org The Global Dow

[2] See “I Told You So!” Moment: Being Right In Gold and Disproving False Causation, March 6, 2011

[3] See Phisix and ASEAN Equities: The Tide Has Turned To Favor The Bulls! April 3, 2011

[4] See I Told You So Moment: Emerging Markets Mounts A Broad Based Comeback! April, 8, 2011

[5] ChangingMinds.org, Focusing Effect

[6] Machlup, Fritz The Stock Market, Credit And Capital Formation Mises.org p.92

[7] Dailybusiness.com CMO sales at 7-year high as banks gird for Fed: credit markets, Bloomberg, April 5, 2011

[8] Bloomberg.com ING Sees ‘Liquidity Bubble’ in European LBO Financing Market, April 5, 2011

[9] Danske Bank Flash Comment Japan: BoJ upgrades its view on economy, April 7, 2011

[10] Minyanville.com When Will Fed-Created Melt-Up Turn Into a Meltdown?, April 8, 2011

[11] See Oil Markets: Inflation is Dead, Long Live Inflation November 4, 2010

[12] Mises, Ludwig von The Effects of Changes in the Money Relation Upon Originary Interest, Human Action, Chapter 20 Section 5 Mises.org

[13] See Correlation Isn't Causation: Food Prices and Global Riots, April 2, 2011

[14] Bloomberg, BOJ Offers Earthquake-Aid Loans, Downgrades Economic Assessment, April 7, 2011

[15] Reuters.com Danish c.bank raises lending rate by 25 bps, April 7, 2011

[16] See ECB Raises Rates, Global Monetary Policy Divergences Magnifies, April 8, 2011

[17] Gold.org, Daily gold price since 1998

[18] Holmes, Frank The Bedrock of the Gold Bull Rally, US Global Investors

[19] See The US Dollar’s Dependence On Quantitative Easing, March 20, 2011

[20] See Poker Bluff: The Exit Strategy Theme For 2010, January 11, 2010

[21] Economist.com Weather warning America's housing market is in the doldrums, March 30, 2011

[22] Machlup, Fritz Op.cit p.299

Sunday, February 20, 2011

Resurgent Gold Equals Resurgent Emerging Market Bourses?

By the way, full employment was one of the main justifications for the Reichsbank's inflationist monetary policies. So nothing has changed. Central bankers still believe that monetary policy can lower the unemployment rate. Patrick Barron The Nightmare of 1923 and Its Cause

Don’t look now, but gold is surging right back! (I have to wait for a successful test of 1,430 before I could blurt out ‘I told you so’[1])

If gold is surging right back, then it is likely that global equity markets will follow gold’s path. And this includes the Philippine Phisix.

Figure 1: Stockcharts.com: Phisix-Gold

We’ve been saying that gold has been a reliable barometer of the equity markets.

As you can see in figure 1, gold (black line main window) seems highly correlated with the actions of the Phisix (candle chart main window), as well as with the movements of key emerging markets as the BRIC (Brazil, Russia, India and China via BKF) as well as ASEAN equities (via FSEAX).

However such correlation doesn’t imply causation. The link between gold and emerging markets can be traced to concerted monetary inflationism by global central banks most especially by the Fed’s QE programs.

And places which were said to suffer from the risks of deflation, as the US[2], UK[3] or Euro[4], have actually been experiencing the opposite—inflation has begun to seep in and has even been accelerating.

Earlier, mainstream had been telling us that inflation wouldn’t be a factor. How consistently ‘spectacularly’ wrong they have been[5].

Inflation hasn’t just been manifested in the asset markets but has also been spreading throughout the commodity space (see figure 2).

Figure 2: Price Shocks in Food and $100 Brent Crude (sources: Danske Bank[6] and tradingeconomics[7])

Some in mainstream media has pointed to the soaring food and energy prices[8] as representing effects of the unfolding political events in the Middle East and Africa.

However the causation has, in fact, been the opposite—the unintended effects of the cocktail mix of monetary, fiscal and administrative policies of global governments has caused a widespread boom (signs of crack up boom) in commodity prices that has partly added to the public’s political discontent which have led to the spate of unrest in many countries. While rising food and energy prices has functioned as trigger, there are deeper underlying problems from which has caused the public to vent their dissatisfaction.

Concerns of the risks of supply shocks represent as only ‘secondary’ effects or as a feedback mechanism from the main cause—government inflationist policies.

The False Allure Of Negative Knowledge

This reminds me of Nassim Nicolas Taleb’s “Subtractive Prophecy” knowledge theory where the knowledge of the consensus can be characterized as generally “negative”.

Mr. Taleb’s proposition holds that (from his forthcoming “must buy” book-AntiFragility[9]): [bold emphasis mine]

we know a lot more what is wrong than what is right, or, phrased according to the fragile/robust classification, negative knowledge (what is wrong, what does not work) is more robust to error than positive knowledge (what is right, what works). So knowledge grows by subtraction, a lot more than addition —given that what we know today might turn out to be wrong but what we know to be wrong cannot turn out to be right, at least not easily.

Mr. Taleb’s negative knowledge theory melds with my own when I alluded to why many celebrity gurus remain highly popular[10] despite being constantly ‘spectacularly’ wrong on their predictions—the public may not all be concerned with what really works but espouses on what may seem as the traditionally or conventionally accepted wisdom. Peer pressure, or the informational bandwagon, seems to be the single most influential factor in disseminating ‘negative knowledge’.

In addition, a secondary factor could one of projecting the acquisition of ‘positive knowledge’ built around empiricism modelled through scientism or as Professor Russ Roberts writes[11], “the use of the language and tools of science to reach a conclusion that is not merited”.

In short, scientism could signify a form of social signalling aimed at exhibiting one’s intellectual prowess through math based models.

Or simply said, the desire to build self esteem or social capital by projecting themselves as intellectuals. Thus, much of mainstream’s actions have hardly been about the quest to achieve positive knowledge, instead they are focused on sprucing up image or reputation for the intent of social interactions.

As prudent investors our main concern should not be about what is conventionally accepted, but about being right, and importantly, what works. That’s because return of investments depend on ‘positive knowledge’ rather than the false allure or the wishful thinking from a top-down engineered social utopianism.

Soaring Gold Investment ‘Reservation’ Demand

It is important to also point out that as we have been predicting[12], the demand composition for gold has been shifting from a typical commodity to one of money, and this has been represented by the substantial expansion of ‘investment’ demand (figure 3).

Figure 3: US Global Investors[13]: Changing Composition of Gold’s Demand

Investment demand for gold leapt 70% in 2011 with China as a big factor in the demand growth.

According to this Bloomberg report[14],

Investment demand in 2010 jumped 70 percent and consumption by the jewelery sector gained to a record, it said. Investment was 179.9 metric tons, surpassing Germany and the U.S., as buyers sought out gold bars and coins, according the London- based industry group. Demand from the jewelry sector was 400 tons, it said....

Chinese investors have shown great enthusiasm amid lack of other alternative investments,” Wang Lixin, China representative for the council, said today in Beijing. Wang said the forecast was a “conservative estimate.”

As for the supposed reasons for such growth in demand, the same Bloomberg article quotes a report from the World Gold Council...

“The main motivation behind this demand has been concern over domestic inflation pressure and poor performance of alternative investments, combined with expectations of further gold price gains,” the council said in a report released today.

Again the report only further confirms what we have repeatedly been talking about—a shift of gold’s demand dynamics to one of ‘reservation demand’. As I previously wrote[15],

“money’s “store of value” is increasingly being factored into gold prices (unit of account). Hence, relative to gold pricing, this implies that reservation dynamics or the reservation model (and not consumption model) determines gold valuations or that the exchange ratio or monetary valuations relative to fiat currency applies-- where valuations are determined by the expected changes in relationship between the relative quantity of, and the demand for, gold as money vis-a-vis paper currencies.”

So while jewellery still accounts for as the largest demand for gold, the gist would likely shift towards investments. Nevertheless, statistics can’t assimilate on what people actions represent.

Applied to gold, people can buy jewellery not only for aesthetics or for ornamental purposes, but also as investments.

Official Buying And Monetary Stablization

Figure 4: WGC: Official Purchases First Time in 21 Years

It hasn’t been only the man on streets and the financial markets whom has contributed to a surge in the demand for gold. Governments, perhaps, may have equally been afraid of their own shadows and have begun to stockpile.

In 2010, the official sector, writes the World Gold Council[16], became a net buyer of gold for the first time in 21 years. (see figure 4)

Two factors seem to bear this out, one emerging markets became significant net buyers and secondly, Europe, with significant gold holdings, has greatly reduced their traditional sales activities.

The end in the streak of official selling, should serve as a pellucid and practical example of the error prone predictive value of rigidly relying on statistics and or on the anchoring effect (linear expectations) of past performances. Numbers cannot and will not substitute for people’s actions (this includes the government, who are also comprised of individuals).

As to whether the shift in the attitudes of some governments as reflected by their gold buying patterns would parlay into prospective policies would be another matter.

Yet unless governments act in the way a gold standard is in place (which is to severely downsize on the welfare state and various forms of political economic interventionism), or that government democratizes the banking system to allow for mass competition (by dismantling the banking cartel structure), we are not likely to see governments stabilize the monetary system soon. Adjustments will likely happen at the brink of or during a crisis or what I would call the Mises Moment.

That’s because central banks can always surreptitiously work for the state’s political agenda camouflaged by the esoteric nature of the operations of central banking.

In the fitting and resonant words of Henry Ford,

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

So while the fiscal side of governments may be scrutinized by a vigilant public over the perceived profligacy of a government, central banks actions can and will likely substitute for such a loss.

In the US the Federal Reserve’s recent actions appear to reflect on this.

Fund manager Axel Merk glibly explains[17],

Many of the Fed’s policies since the onset of the financial crisis have not been traditional monetary policies: a central bank usually applies a very broad brush in managing economic growth by controlling levers such as interest rates or money supply. However, when the Fed, for example, bought mortgage-backed securities (MBS), it steered money to a specific sector of the economy. That’s fiscal, not monetary policy, traditionally reserved for elected policy makers in Congress. Just like the MBS program, many of the Fed’s policies continue to appear to be attempts at addressing the “shortcomings” of Congress.

In short, what the Congress cannot do, the central bank can.

So any talk of monetary stability should translate to the reining of the actions of central banks or to a more radical extent—abolishing the central banking platform.

Alternatively this also means that given the absence of popular discontent with central banking, the monetary skulduggery can and will likely go on, in spite of globalization or the internet.

Thus, like all price trends, gold will not go up on a straight line but will sporadically encounter severe headwinds, as seen in the previous months.

Nevertheless, the general trend for gold is that it will continually move higher, and most importantly, increasingly assimilate more of money’s characteristics in the face of the persistent central bank manipulation of the monetary system coupled with competitive debasement for political goals.

Even in the political front we seem to be seeing the evolution of gold as money gain significant ground.

I mentioned earlier the World Bank Chief Robert Zoellig[18] has called for the inclusion of gold in monetary reforms. This seems to be shared too by Kansas Federal Reserve President Thomas Hoenig[19] whereby Mr. Hoenig says gold standard is "legitimate”. And so with 10 US states which had “introduced bills in the past few years to allow state commerce to be conducted with gold and silver.[20]”

Moreover, there has been NO fear factor or fear premium in gold[21] as the vicissitudes (rise and fall) of gold prices has been along with risk assets.

To stubbornly insist on this is to put misplaced belief rather than acting on the basis of evidence required for any serious examination.

Having said so, with the momentum of gold seemingly regaining the upside path, we are likely to see a similar price inflation on equity assets as gold and equity prices have shown strong correlations.

This is most likely to be seen on many emerging market bourses that has started the year on the wrong side of the fence.

The Philippine Phisix included.

[1] See Gold Fundamentals Remain Positive, January 31, 2011

[2] Wall Street Journal, Deja Deflation Fear, February 18, 2011

[3] bbc.co.uk UK inflation rate rises ‘hitting savers’, February 15, 2011

[4] Bloomberg.com Trichet Says ECB Doesn’t Exclude Possibility of Inflation Risks, February 19, 2011

[5] See Inflation Expectations: The Widening Chasm Between Households And Experts, February 12, 2011

[6] Danske Bank, Inflation so far not a risk to growth February 17, 2011

[7] Tradingeconomics.com, Brent Crude

[8] Bloomberg.com Brent Crude Trades Near Two-Year High on Mideast Supply Concern, February 17, 2010

[9] Taleb Nassim Nicolas Anti Fragility, How To Live In A World We Don’t Understand, Chapter 5, How (NOT) To Be A Prophet fooledbyrandomenss.com

[10] See Explaining Popularity In Terms of Predictions: Dr. Nouriel Roubini’s Case, February 17, 2011

[11] Roberts Russ Scientism, Cafe Hayek, January 10, 2011

[12] See Is Gold In A Bubble?, November 22, 2009

[13] US Global Investors, Investor Alert - February 18, 2011

[14] Bloomberg.com China 2011 Gold Investment May Jump 50%, Council Says, February 17, 2010

[15] See What Gold’s Latest Record Prices Mean, June 21, 2011

[16] World Gold Council, Gold Demand Trends Full year 2010

[17] Merk Axel, Politics of Inflation, safehaven.com February 16, 2011

[18] See World Bank Chief Robert Zoellig: Bring Gold Back As Part Of The New Monetary Order, November 9, 2010

[19] Reuters.com Fed's Hoenig says gold standard "legitimate", January 5, 2011

[20] TPMDC, At Least 10 States Have Introduced Gold Coins-As-Currency Bills, January 5, 2011

[21] See Four Reasons Why ‘Fear’ In Gold Prices Is A Fallacy, April 26, 2009

Monday, November 22, 2010

The Peak Oil Myth

Here are my thoughts on Peak oil

While peak oil (via Hubbert Peak Theory) may be a valid engineering theory, it is a poor economic concept for the simple reason that engineering theories (like quant models) do not capture people’s behaviour.

Let us learn from the history of oil as narrated by investment guru Steve Leuthold

500 Years Ago… England

First let’s go back about 500 years. During the Renaissance, wood was the critical energy component in England and other European economies, much as fossil fuel is today. Wood was the primary provider of heat, light, and food preparation. However, England, having chopped down most of its trees became a large wood importer, primarily from the Scandinavian countries.

Of course prices rose as wood became more scarce causing domestic brewers, bakers, and others to go out of business hit by lower priced imports from wood rich countries. The English citizenry rebelled, having to pay exorbitant rates for wood to heat their homes, light their nights, and cook their food. Thus in 1593 and again in 1615, Parliament enacted energy conservation legislation, including limiting the use of wood in construction and mandating the use of bricks (but it took more wood to bake the bricks than to build wood structures).

From 1600 to about 1650 the price of firewood soared 80%. Then in a single year the price of wood jumped another 300%. Some families were forced to burn furniture and even parts of their houses to survive the winters. Back then, there were no government wood subsidies for freezing families.

The Wood To Coal Transition

In the early 1600s, people were aware coal was an alternative energy source. But prior to the huge rise in wood, coal was far too dirty and expensive. Chopping down trees was easier and cheaper than hacking the coal out from underground. But, as the coal industry grew, mining sophistication and technology reduced the extraction costs and as coal supplies rose prices fell.

Coal was soon found to be a far superior industrial fuel and with vast improvements in coal mining productivity the price of coal kept falling. First iron production increased with quality improving. Then came steel and steam power. The Industrial Revolution was underway led by England, which was bigger, better and earlier than old Europe. England had become the world’s industrial revolution leader. The real catalyst was the Wood Crisis.

Over 150 Years Ago… United States

Now let’s go back about 200 years to the early 1800s. Once again it’s the beginning of another hugely important energy revolution. Since Colonial times, the primary source of illumination in the U.S. had been whale oil. But by 1850 the North Atlantic had almost been whaled out by New England’s whaling fleet. The shore price of whale oil doubled and then doubled again, even though new whaling technologies had maximized oil recovery from the whales that were taken.

The high whale oil prices were also making it profitable to harpoon smaller and smaller lesser yield whales.

The U.S. was growing fast while the North Atlantic with the whale oil field yielding less and less. At the time there were, on the East Coast, no known substitutes for whale oil. By 1848 prices had skyrocketed by 600%. Then in 1848 the shortage was temporarily alleviated by the discovery (and subsequent decimation) of the South Pacific whale herds. Whale oil prices temporarily moved lower. Yes, it was a long and expensive journey for the New England whalers exploiting the new whale oil find. A whaling expedition around the horn and back could take as much as two years.

By the advent of the Civil War even this new whale oil field was played out. Low grade whale oil was $1.45 a gallon by 1865, up from 23 cents in the 1840s. To put this in to perspective, in 1868 a complete dinner in a New York restaurant cost 19 cents. A customer could buy over seven dinners for the price of a single gallon of lighting oil. It cost restaurant owners more to light the place at night than they were paying for the food they served.

The Whale Oil To Kerosene Transition

An alternative energy source became essential as high prices, population growth and shrinking supplies of whale oil combined into a crisis for businesses in east coast cities such as New York, Boston and Philadelphia. Edwin Drake set out to find that alternative. In 1858 he first found it in Titusville, Pennsylvania.

The U.S. entered the Petroleum Age. By 1867, kerosene, refined from Pennsylvania crude broke the whale oil market. By 1900 whale oil prices had fallen 70% from their highs and whale oil lamps had become collector items. Kerosene prices, with production efficiencies, became cheaper and cheaper. More importantly, just as with the development of coal as an energy alternative 200 years earlier, a chain reaction of technological and economic development was triggered. Oil soon became the new foundation of the economy not merely the low cost provider of light at night.

Lessons gleaned from the history of oil

1. People (via supply and demand) adjust to prices, where high prices leads to conservation or substitution, e.g. the wood crisis that triggered a shift to coal, whale oil crisis that led to kerosene

2. commodities obtain values only when it becomes an economic good, e.g. oil was nothing or did not have value during the age of the wood and coal or whale oil.

3. technology enhances production.

We seem to be seeing a combination of the above dynamics playout today, where alternative energies such as the production of Shale oil has been vastly expanding

To quote University of Michigan’s Professor Mark Perry (chart from Professor Perry)

New, advanced techniques for drilling oil have revolutionized the domestic oil industry in North Dakota in ways that couldn't have even been predicted just a few years ago, and will likely also open up new oil production in other parts of the world in the near future (like the Alberta Bakken in Canada) that also would have been unimaginable before this year. That's one reason that "peak oil" is peak idiocy: it always underestimates the ultimate resource - human capital (i.e. human ingenuity and the resulting innovation, advances, new technology) - which is endless and boundless, and will never peak.

Let me add that the current high prices of energy and commodities are not only from the consumption model but also from the reservation demand model—where monetary inflation influences prices.

Of course, there are other factors involved, most of which have been government imposed: geographical access restrictions, trade restrictions, price controls, subsidies, cartels, tariffs and other forms of protectionism (aside from inflationism)