Growth in the US, Europe, Japan and China has been the major spin broached by the consensus on the supposed sustainability of an emerging market rally

Over the past two weeks, such claims have been undergirded by a stream of “positive” news.

Europe: Survey says Growth, Actual Data says Contraction

The mainstream forecast for a major economic recovery for the Eurozone has been partly premised from positive European PMIs for July and August, aside from GDP which supposedly lifted the EU from negative growth since 2012.

The PMI survey said ‘growth’ (left window), while July’s actual industrial output says ‘contraction’ (right window) as Factory production plunged by 1.5% which signifies an ocean apart from consensus expectations of -.3%[1]. What people say and what people actually do can be different.

The chart of Industrial Production Index which includes total Industry (excluding construction)[2] shows that July’s sharp decline has brought the index to a three year low.

In addition, the Eurozone’s monetary aggregate M3[3] chart seems to rhyme with the plunge in factory production.

The declining trend in EU’s M3 appears to be hastening instead of bottoming or reversing.

Should the M3’s descent persist and deepen this would only mean that industrial production will likewise fall further, which equally extrapolates to re-submerging of the EU to a period of negative growth or recession.

Rising interest rates will hardly be a plus factor for debt laden economies.

Will The US Pick Up The Slack?

US retail sales grew slower than expected in August, where much of the growth has been imputed to auto sales. Excluding auto sales growth has been at a lacklustre .1%[4]

Confidence whether consumer or from the markets have always been fickle. Today’s cheery sentiment may instantaneously turn gloomy and vice versa. The question is what drives such changes.

From a different perspective, sales of retailers exhibits a declining momentum as measured by both percentage change (blue) and percentage change from a year ago (red) since 2010.

Contra the wealth effect, rising stocks has hardly been a boost to retail sales.

Yet if the growth in the American consumers has been dismal, where could the other growth come from? Could business spending provide the catalyst?

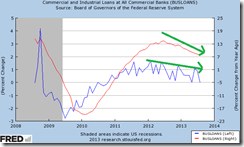

If we are to measure business spending via commercial and industrial loans acquired from the banking commercial banking system, then the rate of changes has hardly been positive.

There has been declining trend in both percentage change (blue) and percentage change from a year ago (red) which appears to have peaked in early 2012.

Slowing bank loans have likewise been reflected on US monetary aggregate M2 which appears to have peaked almost simultaneously with the commercial and industrial loans. Slowing M2 hardly suggests of a pick up on a credit reliant economy.

Since banking represents only one of the other means to finance business spending perhaps the better measure for business spending is net (domestic) private spending which represents a measure of the state of capital stock.

As Austrian economist and professor Robert Higgs explains[5]

Economists largely agree that net private investment is a key variable. Such investment adds to the private capital stock (with its embodied technologies), which makes inputs of labor increasingly productive over time—that is, net private investment (with the technological improvements it embodies) drives economic growth in the long run. And because private investment spending varies much more than consumption outlays (either private or governmental) in the short and medium terms, such investment also drives aggregate fluctuations in output and employment. When investment collapses, recessions ensue; when investment expands, so do output and employment. Economists do not agree, however, about why private investment varies disproportionately in the short and medium runs. Keynesians and Austrians, for example, disagree completely about the explanation of this disproportion and about its consequences.

Unfortunately the St Louis Fed doesn’t have an updated net (domestic) private spending data.

Nonetheless the current trend of rising interest rates will have an impact on savings, investment and consumption or spending patterns.

This means that aside from debt servicing, operating and financing costs, access to financing and sales, rising rates will affect profitability.

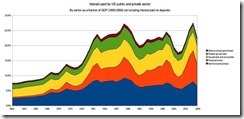

The Wikipedia[6] notes that interest payments on debt by US households, businesses, governments, and nonprofits totaled $3.29 trillion in 2008. The financial sector paid an additional $178.6 billion in interest on deposits. The chart above shows that in 2008 interest debt payment constitutes about 23% of the GDP.

And given the explosive growth in the total systemic debt mostly in nonfinancial debt, particularly via US treasuries PLUS rising rates, the interest payments as a share of GDP are likely much larger than in 2008.

And more on the point of the relationship between economic growth, debt and interest rates, the rate of credit growth by G7 nations has reached a staggering 440% of GDP as of 2012 even as economic performance barely registered meaningful growth rates.

In other words, the credit binge has resulted to diminishing returns in terms of economic growth while simultaneously magnifying interest rate and credit risks.

As the Zero Hedge aptly points out[7]: (bold and italics original)

In a nutshell: the G7 have added around $18tn of consolidated debt to a record $140 trillion, relative to only $1tn of nominal GDP activity and nearly $5tn of G7 central bank balance sheet expansion (Fed+BoJ+BoE+ECB). In other words, over the past five years in the developed world, it took $18 dollars of debt (of which 28% was provided by central banks) to generate $1 of growth. For all talk of "deleveraging" G7 consolidated debt has been at a record high 440% for the past four years. So in the G7, which is a good proxy for the developed world, debt continues to increase whilst nominal growth remains extremely low thus ensuring that the deleveraging process has yet to start.

So if the G7 has been burdened by too much debt, and with the recent surge in interest rates, how will growth in developed economies be enough to pull emerging markets out of the current rut when interest payments in itself will become a huge burden?

Moreover, the ongoing rampage by the bond vigilantes has been prompting for an unexpected contagion effects to the broader fixed income markets.

As PIMCO’s CEO Mohamed El-Erian observed[8], (bold mine)

The impact of higher interest rates overwhelmed the diversifying characteristics of virtually all other fixed income securities.

In many prior episodes of rising U.S. Treasury yields (and especially those associated with materially improving economic fundamentals), credit-sensitive sectors of fixed income were supported by the tightening of credit risk spreads. In the most recent sell-off, however, even spread sectors came under pressure. Displaying higher correlation with Treasuries, credit spreads widened, thus selling off more than Treasury securities (see Figure 3, which includes market proxies for U.S. Treasuries, investment grade corporates, emerging markets sovereigns, municipals and non-agency mortgages).

And the real impact from rising rates can be seen in the US real estate sector where rising mortgage rates have led to a decline in mortgage refinancing and mortgage applications even as existing home sales zoomed[9].

Such unsustainable divergent price actions will soon be settled. Guess in what in direction?

Will Japan’s “Outperforming” Debt Driven Growth Pull Up Emerging Markets?

Most of mainstream media has been raving over Japan’s statistical growth stating that improvements have been “another sign Prime Minister Shinzo Abe's reflationary policies are boosting growth”[10].

Journalists like the above, hardly go about the details of their adulation except to parrot on whatever experts say or what politicians tell them

Looking at Japan’s GDP, the large chunk of statistical growth for the second quarter[11] has been from Public spending (+3%) which boosted public demand (+1.2%).

Residents posted NEGATIVE (-.3%) investments as foreigners (+1.3%) took on the bulk of private demand (+.6%).

Meanwhile household consumption and wage levels posted miniscule gains. Growth rate of household consumption declined from .8% in the first quarter to .7% in the second quarter. Employee compensation grew to .5% in the 2nd quarter from .4% in the first quarter. Such fractional growth rates seem hardly statistically significant.

For Japan’s economy to sustain these growth rates means increasing dependence on more boondoggles from Shinzo Abe’s administration. Yet such government spending growth model will entail a massive build up of government debt. Japan’s quadrillion yen debt levels[12] are already unsustainable. Japan’s interest rate burden of 22.214 trillion yen represents 51.61% of the 43.096 trillion yen expected tax revenues for 2013[13] are all based on pre Abenomics rates. The Ministry of Finance have recently requested for a fourteen 14% increase of debt service payment to 25.3 trillion yen[14] if approved such would now account for 58.7% of Japan’s tax revenues!

By the end of the year, expect the MoF to push for more debt service which should bring debt service levels to 65% more or less. This means Japan will be issuing more and more debt to finance existing debt and at the same time increasing deficit financing which adds to the already strained debt loads. A variation of the Ponzi finance from the Minsky model.

Raising sales tax or whatever taxes will only accelerate the downside spiral of Japan’s economy. Japanese investors have already been reluctant to invest, how would higher taxes encourage investments and more economic output?

So in a very short span of time debt servicing will eat up more and more share of tax revenues with economic growth becoming more reliant on government rather than the private sector. Up to what extent before Japan’s (Japanese government bond) JGB creditors decide to call it quits?

The BoJ will increasingly also play a bigger role in the financing of the Ponzi dynamics behind Japanese government bonds.

But what matters is when investors decide to pull the plug. Either this means the yen collapses (if the BoJ continues to monetize) or a debt default (if the BoJ desist from financing JGBs). When I can’t say, but at the rate by which political actions have been driving Japan’s fiscal balance, a credit event is likely to occur in Japan anytime within 3 years. At 14% increase for every 6 months, government liabilities will eat up current tax revenues in 2 years, ceteris paribus

So how will Japanese investors become bullish on real world investments when Abenomics has been destroying profitability?

In vetting the the Bank of Japan’s Corporate goods price index[15], one would note how price inflation has been affecting different levels of corporate activities.

On a year on year basis, raw materials and intermediate materials have risen 15.9% and 5.2% respectively, whereas final goods only rose by 3.2%. This means while cost of production has been rising, the ability of Japanese companies to raise prices of their products (final goods) to pass on to the consumers has been limited. The net effect has been vastly reduced profitability. Add more taxes, Japanese companies will get maimed.

You might wonder why Japan’s stock markets appear to be rising, it’s hardly because of earnings or economic optimism as one can see from the BoJ data above, but rather Japan’s stocks appear to cast a seminal shadow on the actions of hyperinflating Venezuela.

Will Japan boost emerging markets? From the above account, to the contrary Japan may add to the troubles of emerging markets.

Will China Spur the Emerging Market Rebound?

One of the supposed bright spots during last week has been the several positive economic sensitive data from China. China’s industrial output supposedly grew at the fastest pace in 17 months last August by 10.4%. Retail sales expanded by 13.4% while fixed asset investment excluding rural areas jumped 20.3% during the first quarter[16].

The Chinese government’s stealth stimulus channelled through state owned banks has led to an increase in aggregate financing 1.57 trillion yuan from 1.25 trillion last year via new loans (711.3 billion yuan versus 703.9 billion in August 2012) and money supply M2 jumped 14.7% from last year[17]

First of all I am not comfortable with statistics from the Chinese government in the recognition of the hiding, censoring and editing of data which has not fitted with the government’s agenda[18].

Second credit growth only validates my suspicion that the incumbent Chinese government will sacrifice reforms for statistical growth[19]. Chinese leaders have shown preference for political convenience and privilege over economic weal. The Public choice theory at work

Third sluggish commodity prices have hardly been supportive of the supposed growth in fixed asset investments, unless we are talking of a lagged effect as copper imports have reportedly risen[20]. But Chinese copper imports y-o-y have been rising since 2012, this hardly has been consonant with the price action in the copper markets as with the Australian Dollar-US Dollar currency pair

Fourth some major Chinese banks have been bruised from the recent losses in the bond markets. With $175 billion of maturing debt in 2014 amidst rising interest rates the S&P warns of an escalation of bad loans[21]. So rising rates have begun to bite on China’s real economy. As to how credit will continue to expand in a system inundated with debt as rates continue climb is like water flowing uphill.

Fifth there have been signs of cracks in China’s property bubbles as home sales transaction fell for the second month even as Home prices continue to soar (August posted the biggest monthly gains since December)[22]. Rising prices on diminishing volume means lesser scalability or upside room for the bulls

Sixth the Chinese central bank, the PBOC, reportedly recognizes of the growing credit risks from what seems as Ponzi operation by local government financing vehicles where these state owned firms depend on rising land prices and land sales to finance existing debt[23]. Local government debt in 2011 has been tallied at 10.7 trillion yuan (US $1.75 trillion)

If it is true that the Chinese government has been circumspect of the growing credit risks by local government then the stealth stimulus may be limited and may not be enough to patch up the hissing bubbles.

Bottom line: Risks Remains High

Current meltup in US equity markets have increasingly been signs of a mania as evidenced by overconfidence, the crowded trade psychology manifested by the magazine cover indicator and by a surge in household buying of the stock market as Smart money exits.

Fuel subsidies in Indonesia and India, which are real structural problems, may become the proverbial pin that may pop regional bubbles. Rising markets will hardly wish away the potential negative repercussions from such real imbalances wrought by politically imposed price distortions and wealth transfer.

Losses in the bond market and commodity markets have been impelling the global financial sphere, who has been desperately seeking yields, to frantically bid up on equity markets, thus conjuring up all specious excuses to justify their actions.

Europe will hardly provide any boost to emerging markets as the region’s economy is likely to undergo a recessionary relapse.

The US economy appear to be slowing considerably, these will hardly be a boost for emerging markets especially if the FED does taper.

Media and Japan has been putting lipstick on the statistical growth pig. Japan deficit financing model will add to the unsustainable debt levels. Taxes will short cut Japan’s credit event.

The bond vigilantes have made their presence felt on the Chinese economy, this will limit the ability of the Chinese government to further engage in stealth stimulus.

Expect market volatility to remain mercurial in both directions.

Risk remains high.

[6] Wikipedia.org Debt Financial position of the United States