``The facts: We have a $10.5 trillion national debt; $53 trillion of unfunded liabilities; a military empire that has US troops in 117 countries and has spent $700 billion on a pre-emptive war that has killed over 4,000 Americans; a $60 billion trade deficit; an annual budget deficit that will exceed $1 trillion in the next year; a crumbling infrastructure with 156,000 structurally deficient bridges; almost total dependence on foreign oil; and an educational system that is failing miserably. We can’t fund guns, butter, banks and now car companies without collapsing our system.” –James Quinn, “Baby Boomers Led Us Into Fiscal, Moral Bankruptcy”, Minyanville In "The Decline and Fall of the Athenian Republic" 1776.", Alexander Fraser Tytler poignantly wrote, ``A democracy cannot exist as a permanent form of government. It can only exist until the voters discover they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising them the most benefits from the public treasury, with the result that a democracy always collapses over a loss of fiscal responsibility, always followed by a dictatorship. The average of the world's great civilizations before they decline has been 200 years. These nations have progressed in this sequence: From bondage to spiritual faith; from spiritual faith to great courage; from courage to liberty; from liberty to abundance; from abundance to selfishness; from selfishness to complacency; from complacency to apathy; from apathy to dependency; from dependency back again to bondage."

It will be the denouement of the US presidential elections this week. And most likely, the popular, based on polls and prediction markets, will prevail.

The Realisms and Illusions of Change

While “change” has been the key theme for both aspirants to the White House, considering the present economic and financial conditions, the only real change we are going to see seems to be what most of Mr. Tytler’s prediction 3 centuries ago.

And what “changes” would that be?

More debt, more government spending, more government intervention, more future taxes, more running down of present assets and more bondage. In short, the road to bankruptcy.

The popular idea is if people get the government to spend more, this should lift us out of the rut. And if Americans get to redistribute more wealth (see Spreading the Wealth? Market IS Doing It!), this should lead to even more progress.

Yet, if the same idea is correct, then Zimbabwe would have been the most prosperous among the all nations for unabated printing of money for its government to liberally spend and redistribute wealth. Unfortunately, Zimbabwe has been mired in a hyperinflation depression (some reports say 231,000,000% others at 531,000,000% inflation) that is continually felt by its countrymen through the apparent interminable loss of its currency by the millisecond to the point that some its citizenry has resorted to Barter (see The Origin of Money and Today's Mackarel and Animal Farm Currencies).

Or how could one easily forget the redistribution strategies of China’s Mao Tse Tung “great leap forward” or USSR’s Joseph Stalin “egalitarian” regimes whose only achievement is the combined death toll “democide” of 79 million citizens (Hawaii.edu) and a decrepit “everybody-is-poor-except-the-leadership” economy.

Many would argue that the US cannot be compared to Zimbabwe in the sense that America has institutions, markets, and a labor force that is more intelligent, flexible, effective and sophisticated. Maybe the recent Iceland experience should be a wake up reminder of how countries can suddenly go “richest-to-rags” story (see Iceland, the Next Zimbabwe? A “Riches To Rags” Tale?) on major policy blunders. Here, the market idiom also applies, “Past performance does not guarantee future results”.

The fact that markets are meaningfully suppressed and substituted for government intervention effectively transfers resources from the economy’s productive sector to the non-productive sector. When people’s incentives to generate profits are reduced then they are likely to invest less. And reduced investments translate to lower standards of living.

As James Quinn in a recent article at Minyanville wrote, ``In our heyday in the 1950s, manufacturing accounted for 25% of GDP. In 1980, it was still 22% of GDP. Today it’s 12% of GDP. By 2010, it will be under 10%. Our government bureaucracy now commands a larger portion of GDP than manufacturing. Services such as banking, retail sales, transportation and health care now account for two-thirds of the value of the US GDP.

``Past US generations invented the airplane; invented the automobile; discovered penicillin; and built the interstate highway system. The Baby Boom generation has invented credit default swaps; mortgage-backed securities; the fast food drive-through window; discovered the cure for erectile dysfunction; and built bridges to nowhere. No wonder we’re in so much trouble.”

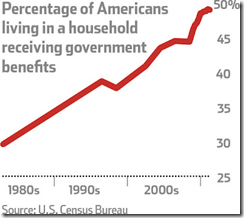

Yet while Americans seem to drool over future welfare spending (a.k.a. free lunch), nobody seems to ask who is going to pay for these or how will it be paid or funded?

The Emerging American Bailout Culture

It is my assumption that most of the Americans are aware of the current crisis, such that the US Congress rapidly passed a fiscal bailout package called the Emergency Economic Act of 2008.

In November of 2006, William Poole, president of the Federal Reserve Bank of St. Louis presciently noted in a panel discussion, “Everyone knows that a policy of bailouts will increase their number.”

How true it is today. Proof?

AIG, which had been originally been accorded a loan of $85 billion in exchange for a government guarantee on its liabilities and a management takeover, has now ballooned to $123 billion (New York Times).

Next are the Bond insurers currently seeking shelter under the current TARF program. According to the Wall Street Journal, ``Bond insurers are urging the government to reinsure their battered portfolios, the latest push by the industry to seek relief under the Treasury's $700 billion financial rescue.”

The US government bailout has expanded its reach outside the banking sector to include credit card issuer Capital One Financial (Australian News) which implies that as a precedent, the next step will probably be an industry wide approach.

Then you have a hodgepodge of interest groups vying for the next bailout. Excerpts from the Hill.com

-A diverse collection of interests — from city transit officials to labor unions to “clean tech” advocates — are clamoring to be added to the second stimulus package Congress may consider after the election.

-Labor groups, meanwhile, want the stimulus bill to pay for new road and bridge construction to put people to work.

-The National Governors Association and the National League of Cities among others on Tuesday wrote to House and Senate leadership, asking them to raise the federal matching rate for Medicaid payments and to increase the money spent on infrastructure projects.

-Lobbyists for these groups argue that more federal spending would help minimize the job losses from a recession. In a white paper being circulated on Capitol Hill, the American Shore & Beach Preservation Association, for example, says $5 billion for water resource projects would create 140,000 new jobs.

Then you have the US government indicating more guarantees for troubled mortgages. This from Bloomberg, ``The U.S. Treasury and the Federal Deposit Insurance Corp. are considering a program that may offer about $500 billion in guarantees for troubled mortgages to stem record foreclosures, people familiar with the matter said.

``The plan, which might put as many as 3 million homeowners into affordable loans, would require lenders to restructure mortgages based on a borrower's ability to repay. Under one option, the industry would keep lower monthly payments for five years before raising interest rates, the people said.”

The government gives in a finger, now everybody wants the arm. From one industry to another, from one interest group to another, everybody seems to be clamoring for a bailout. So who’s gonna pay for all these? When will this culture towards accelerated dependency stop?

Throwing Pack Of Meat To The Wolves

This reminds us of self development author Robert Ringer who, in his recent article, cites Nathaniel Branden quoting staunch liberal Bennett Cerf in his book Judgment Day: My Years With Ayn Rand, ``You have to throw welfare programs at people — like throwing meat to a pack of wolves — even if the programs don't accomplish their alleged purpose and even if they're morally wrong… Because otherwise they'll kill you. The masses. They hate intelligence. They're envious of ability. They resent wealth. You've got to throw them something, so they'll let us live."

In a political season, pandering to the masses is the surest route to seize power. But of course, the hoi polloi can’t distinguish between the real thing and the varied interests behind those propping the candidates or even welfare economics behind all the programs being tossed to the people (or its unintended effects).

Some officials in the US government are actually aware of the perils of too much government intervention. This noteworthy excerpt from the testimony of South Carolina Governor Mark Sanford before House Committee on Ways and Means (all highlights mine)…

``Simply throwing money into the marketplace in the hope that something positive will happen ignores the fact that the government has already put over $2 trillion into the system this year using various bailouts and stimulus packages: including $168 million in direct taxpayer rebates this past spring; an $850 billion bailout last month that cost more than we spend on defense or Social Security or Medicaid and Medicare annually; and myriad loans and partial nationalizations of institutions like Freddie Mac and Fannie Mae, JPMorgan Chase, Bear Sterns and AIG. This doesn’t even include the arguably most effective form of stimulus the country has seen over the past year, a market-based infusion of over $125 billion into the economy and taxpayers’ wallets caused by falling oil prices and subsequently lower prices at the pump.

``This year’s $2 trillion plus in bailouts and handouts seems that much more momentous when you consider that federal tax revenues last year were only $2.57 trillion. Simple math demands we ask ourselves if $2 trillion did not ward off the crisis in confidence we’re currently experiencing, then how much can $150 billion more help? Especially since we’re dealing with a $14 trillion economy and a larger $67 trillion world economy, meaning that this shot in the arm represents merely one-fifth of one percent of the world economy…

``Essentially, you’d be transferring taxpayer dollars out of the frying pan – the federal government – and into the fire – the states themselves. I think this stimulus would exacerbate the clearly unsustainable spending trends of states, which has gone up 124 percent over the past 10 years versus federal government spending growth of 83 percent. It would also dangerously encourage even more growth in governmental programs like Medicaid, which in state budgets across the nation already grew 9.5 percent per year over the last decade – certainly unsustainable in our state. Moreover, the United States Department of Health and Human Services just last week projected that spending on Medicaid will grow at an average annual rate of 7.9 percent over the next 10 years – and possibly faster if this stimulus package passes. State debt across the country has also increased by 95 percent over the past decade. In fact, on average every American citizen is on the hook for $1,200 more in state debt than we were 10 years ago. So if government gives in WHO pays for these?”

Soaring US Fiscal Deficits; Can The World Fund It?

Remember, global trade as a result from today’s crisis seems likely to diminish, as the US, Europe and most OECD economies meaningfully compress from a recession.

This implies that any improvement from the US current account deficit may be offset by a surge in fiscal deficit which is already at a record $455 billion (Bloomberg) to over $1 trillion in 2009, see figure 1.

Yet improving current account deficits for the US translates to almost the same degree of reduction of current account surpluses for Emerging Markets, Asia and other current account surplus nations, which equally means less foreign exchange surplus.

The point is with diminishing accretion of foreign exchange surpluses; such raises the question of funding for US programs, which in the past had been financed by the world, mostly by Asia and EM through acquisition of US financial claims.

Back to basics tells us that governments can only raise revenues in 3 major ways: by borrowing money (issuing debts), by printing money (inflation) or via taxation.

But if global taxpayers can’t fund US programs, and if the world’s capacity to lend and borrow seems limited by the degree of improving current account imbalances, then this leaves one option for the US government; the printing press. And it is a not surprise to see US authorities recognize this option, as it has revved up its monetary printing presses of last resort (see US Federal Reserve: Accelerator to the Floor!).

So while it is true that in the present conditions nation states maybe able to take over the slack or imbue the leverage from the private sector, this isn’t without limits. Unless the world would take upon further risks of the extreme ends of either global depression or hyperinflation as the Austrian School have long warned it to be.

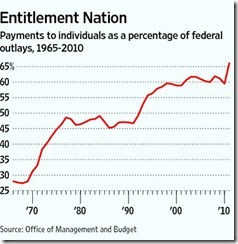

The Coming Super Subprime or Entitlement Crisis

And it doesn’t stop here; today’s crisis has been centered on the credit bubble largely as a function of the US financial sector. What hasn’t been spoken about is the risks of the Baby Boomer or Entitlement Spending Crisis from which David M. Walker, former U.S. Comptroller General, tagged as “super subprime crisis” as even more deadlier than the crisis we face today. (We earlier spoke about this in Tale of The Tape: The Philippine Peso Versus The US Dollar)

This excerpt (Hat tip: Craig McCarty) from David Walker’s article published at CNN/Fortune (all highlights mine),

``The entitlements due from Social Security and Medicare present us with that frightening abyss. The costs of these current programs, along with other health-care costs, could bankrupt our country. The abyss offers no assets, troubled or otherwise, to help us cross it…

``In fact, the deteriorating financial condition of our federal government in the face of skyrocketing health-care costs and the baby-boom retirement could fairly be described as a super-subprime crisis. It would certainly dwarf what we're seeing now.

``The U.S. Government Accountability Office (GAO), noting that the federal balance sheet does not reflect the government's huge unfunded promises in our nation's social-insurance programs, estimated last year that the unfunded obligations for Medicare and Social Security alone totaled almost $41 trillion. That sum, equivalent to $352,000 per U.S. household, is the present-value shortfall between the growing cost of entitlements and the dedicated revenues intended to pay for them over the next 75 years.

Figure 2: GAO: David Walker Fiscal Wake Up Tour in 2006

``Today we are headed toward debt levels that far exceed the all-time record as a percentage of our economy. In fact, by 2040 we are projected to see debt as a percentage of our economy that is double the record set at the end of World War II. Based on GAO data, balancing the budget in 2040 could require us to cut federal spending by 60% or raise overall federal tax burdens to twice today's levels.

``Medicare, Medicaid, and Social Security already account for more than 40% of the total federal budget. And their portion of the budget is expected to grow so fast that their cost, and the cost of servicing our debt, will soon crowd out vital programs, including research and development, critical infrastructure, education, and even national defense.

``The crisis we face is one of numbers and demographics but also of attitudes. Promises were made in an earlier time, when they seemed more affordable. Like homeowners borrowing against the value of their homes in the expectation that the values would go up forever, the American government borrowed against the future and assumed that the economy would grow fast enough to make that debt affordable.

``But our national debt is not limitless, and our foreign lenders are not fools. If we persist on our current "do nothing" path, our future will be jeopardized. Americans need to reconcile the government we want with the taxes we're willing to pay for it.

Mr. Walker’s concern is that unfunded entitlement liabilities will continually mount and take up a significant share of the expenditures relative to the GDP, which can’t be afforded by the US over the coming years. Compound this with the bills from the present programs to bailout the US economy.

Much of the incumbent and aspiring US politicians have had little to say on these matters.

Yet any resolution to this predicament will require vastly unpopular and stringent political decisions. Think of it, rising taxes in general and or cutting retirement benefits or a combination of both will be politically acceptable? Will the next president turn against his supporter to implement the much needed reform?

But like typical politicians the likelihood is that the desire to avoid pain is politically paramount. Because a politician’s political capital or career will be at stake.

Thus, it is likely that the leadership will, once again, adopt a reactionary approach, because it is far more beneficial to game the present rules than to find a solution and enforce them.

Critical Policy Actions Will Draw The Fate Of The World

Steering the US political economy at this very sensitive and fragile stage will be very crucial.

Policies based on populism can set off a very dangerous chain of events. The great depression of the 30s was a result of a series of market stifling government policies that setoff massive waves of unintended consequences.

As analyst John Maudlin aptly points out in his latest outlook on the role of the new US president,

``One is a tax cut for 95% of Americans. The problem is that 47% of Americans do not pay taxes, so what you are really talking about it a massive expansion of welfare. But if you use that tax increase on the "rich" to pay for your "tax cuts" to other Americans, you have no money to pay for other programs, let alone get anywhere close to a balanced budget.

``And of course, as each year passes there is less net Social Security income to the government. If you use your tax increase to fund more expenses today, you will not have that to fund Social Security in 2017 when the program goes into a cash-flow deficit. Or, taxes will really have to rise later in the decade. But then again, that will be another president's problem.

``How do you offer the increased medical programs you propose if you use the tax increase for tax cuts for 95% of Americans (read: welfare for 50%) without really busting the budget? Or any of the $600 billion in programs that you want to see?

``And your serious economic advisors are going to point out (at least in private) that raising taxes on the 5% of wealthiest Americans is eerily similar to what Herbert Hoover did in his administration, along with legislation to restrict free trade and increase tariffs, which you have also advocated. Look where that got him and the country.

``75% of those "rich" you are targeting are actually small businesses that account for 50-75% (depending on how you measure growth) of the net new job growth in the US. When you tax them, you limit their ability to grow their businesses. Further, you reduce their ability to consume at a time when consumer spending is already negative.

``Reduced consumer spending will be reducing corporate profits and thus corporate tax revenues. Just when you need more revenues.

``A tax hike in 2010 of the magnitude you currently propose, in a weak economy, is almost guaranteed to create a double-dip recession. That will not be good for your mid-term elections. Given that the recovery from a second recession is likely to be long and drawn out, it would also make it difficult to get re-elected, as the economy would be the first and foremost issue.”

In short, policy actions will differentiate between the realization of an economic recovery or a fall to the great depression version 2.0.

As we have noted in the past, the 5 cardinal sins in policymaking that may lead to severe bear markets or economic hardships are; protectionism (nationalism, high tariffs, capital controls), regulatory overkill (high cost from added bureaucracy), monetary policy mistakes (bubble forming policies as negative real rates), excess taxation or war (political instability).

Populist policies without the consideration of unintended effects may result to an eventual backlash. Highly burdensome taxes to the productive sectors may lead to lost future revenues which will be inadequate to fund any present redistribution or welfare programs. Inflation will be the next likely path.

In addition, since the US is heavily dependent on the world for both trade (remember little manufacturing) and financing (selling of financial claims), any modern day form of resurrecting the Smoot-Hawley act will equally be disastrous for the US and for the world.

So we hope and pray that the next US President won’t be overwhelmed with hubris enough to send the world into a tailspin by attempting to shape the world in accordance to an unworkable paradigm or ideology or hastily taking upon policy actions without assessing the economic repercussions. After all, financial and economic problems today require financial and economic and hardly political solutions.

US Elections and the Philippines; Final Thoughts

We noted earlier (see Gallup Polls: Filipinos Say US Election Matters, McCain Slightly Favored) that Filipinos and Georgians have acted as the only TWO contrarians nations that has favored the underdog Senator John McCain in a world heavily tilted by 4-1 in favor of the leading candidate Senator Barack Obama.

There is nothing wrong with such contrarianism.

There are many reasons why various nations or even individuals favor certain candidates. Perhaps this could be because the candidate/s and or party aligns with their social-economic-financial political interest, has shared history or culture, agrees with proposed policies, have ties or association with the party or the candidates, shares similar ideology, influenced by the “bandwagon effect” or the desire to be “in” the crowd or captivated to the “charisma” of the candidate or just plain revulsion to the present system or the incumbent.

The latest Philippine senatorial elections (see Philippine Elections Determined by The Contrast Principle!) was an embodiment of the latter’s case from which we even quoted the precept of Franklin Pierce Adams, ``Elections are won by men and women chiefly because most people vote against somebody rather than for somebody.”

It looks the same for the US.

The worsening bear market in stocks and real estate which seems reflective of the prevailing economic conditions appears to be a key driving force which appears to have driven the US public into the open arms of the opposition. Also, the rash of the present bailout schemes appears to be feverishly fueling the “bailout culture” from which has boosted the opposition’s welfare based platform.

Whether or not this would seem as a right choice is called opportunity cost. A George Bush Presidency means a lost Sen. John Kerry leadership in the 2004 elections. We will never know what a Kerry Presidency would have been. But from hindsight we know what a Bush presidency is-“the Biggest Spending President since Lyndon Johnson” (McClatchy.com)-unbecoming of an ideal GOP conservative. Put differently, President Bush was more of a Democrat than a Republican in action or a Democrat in Republican robes.

Besides, Vox Populi Vox Dei –“voice of the people is the voice of God” isn’t always true. Just ask Alexander Fraser Tytler “promising them the most benefits from the public treasury” or Bennett Cerf “You have to throw welfare programs at people — like throwing meat to a pack of wolves”. Or assess the Bush administration or any of the previous Philippine administrations.

Reading into the politician’s actions today is like reading tea leaves during the George Bush versus Al Gore elections in 2000 or a George Bush versus John Kerry in 2004.

Yet, projecting present actions from the candidates’ appearances, slogans, sponsorships, endorsements, proposed platforms and speeches as tomorrow’s policies is a mirage! Many of what both candidates had been saying today, in order to get one’s votes, will probably be reversed once they get elected! Like almost all politicians, voters will eventually get duped.

But elections are atmospheres of entertainment. And people love to be amused by demagoguery to the point of fanatically “believing”. Or to quote Bill Bonner of Agora’s Daily Reckoning, ``People come to believe what they must believe when they must believe it.”

Understand that there will be many painful tough calls which will be politically unpalatable. Think super-sub prime crisis, think the deepening bailout culture. All these are unsustainable over the long run. Combined, they are lethal enough to prompt for a global economic and financial nuclear winter from either a US dollar crash (hyperinflation-yes a Zimbabwe model applied on a world scale!) or a global depression. And all these will need some painful reform or adjustments in American lifestyles sometime in the near future. By then, it wouldn’t matter whether one’s vote would count unless it is time for reelections.

Alas, to believe in purported “change” from today’s imagery is nothing but an unfortunate self-delusion.