Morality is not equivalent to advocating feel-good courses of action when something bad happens. Sure, we can and should be beneficent. It is good to help fire victims. But it is a good thing in the long run to understand economics. As Jean-Baptiste Say said: A good book on economics should be the first volume of a treatise on ethics.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, May 09, 2013

Quote of the Day: Economics as Foundation of Ethics

Wednesday, October 03, 2012

Quote of the Day: The Ethics of Fascism

Fascist ethics begin ... with the acknowledgment that it is not the individual who confers a meaning upon society, but it is, instead, the existence of a human society which determines the human character of the individual. According to Fascism, a true, a great spiritual life cannot take place unless the State has risen to a position of pre-eminence in the world of man. The curtailment of liberty thus becomes justified at once, and this need of rising the State to its rightful position.

A alter ego of fascism is nationalism.

From Wikipedia: Fascism ( /ˈfæʃɪzəm/) is a radical authoritarian nationalist political ideology

Sunday, September 30, 2012

Lessons from Bernanke’s Thank You Notes

If you have the Federal Reserve’s back, there’s a good chance Ben Bernanke will notice.He may even send you a thank you note.In July, the Fed chairman sent letters of gratitude to five Democratic members of Congress after they delivered speeches on the House floor urging fellow lawmakers to reject the “Audit the Fed” bill authored by retiring Texas Republican Ron Paul, the central bank’s chief antagonist.Their efforts failed to defeat the bill, but they were not in vain, at least in Bernanke’s eyes.“While the outcome of the vote was not in doubt, your willingness to stand up for the independence of the Federal Reserve is greatly appreciated,” Bernanke wrote in the letters, which were obtained by POLITICO through a Freedom of Information Act request.He continued, “Independence in monetary policy operations is now the norm for central banks around the world — and it would be a grave mistake were Congress to reverse the protection it provided to the Federal Reserve more than 30 years ago.”The letters were sent to Reps. Barney Frank, Elijah Cummings, Melvin Watt, Carolyn Maloney and Steny Hoyer.“It's not unusual for the chairman to write thank you notes to members of Congress,” said Fed spokesman David Skidmore.Dated July 26, the notes were written the day after the House voted 327-98 to pass Paul’s bill, which would authorize the Government Accountability Office to audit how the central bank implements monetary policy.

Saturday, June 16, 2012

Quote of the Day: Good Conduct is a Consequence of Freedom

Great part of that order which reigns among mankind is not the effect of government. It has its origin in the principles of society and

the natural constitution of man. It existed prior to government, and would exist if the formality of government was abolished. The mutual dependence and reciprocal interest which man has upon man, and all the parts of civilised community upon each other, create that great chain of connection which holds it together. The landholder, the farmer, the manufacturer, the merchant, the tradesman, and every occupation, prospers by the aid which each receives from the other, and from the whole. Common interest regulates their concerns, and forms their law; and the laws which common usage ordains, have a greater influence than the laws of government. In fine, society performs for itself almost everything which is ascribed to government.

That’s from Thomas Paine, English-American author, pamphleteer, radical, inventor, intellectual, revolutionary, and one of the Founding Fathers of the United States quoted from the Rights of Man Part 2, by libertarian author Sheldon Richman who aptly sums it up…

good conduct isn’t a precondition of freedom; it is a consequence of freedom

Tuesday, August 09, 2011

Misleading Discussion on US Debt Downgrade Crisis

Here is my open letter to broadcasters Paolo Bediones and Cherry Mercado

Dear Paolo Bediones and Cherry Mercado,

Last night, I overheard your supposed cerebral discussion about the US debt downgrade crisis on your radio program while on the way home, on a cab with my family.

I would like to make significant corrections on the litany of false information that had been disseminated on air.

First you claim that after with America’s downgrade, only New Zealand is left with AAA ratings.

This in patently incorrect as shown by the chart from the New York Times

There are 13 countries still with AAA ratings.

Next, you alleged that the Philippine economy mostly depends on the remittances. This is again far from truth. (The downgrade of which you deduce would hurt the OFWs.)

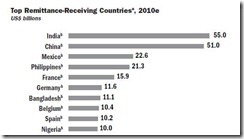

While the Philippines ranks 4th among the largest remittance recipients in the world (US $21 billion in 2010)…

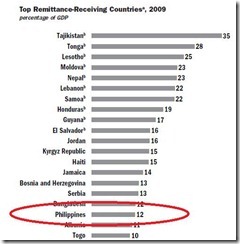

…the share of remittances to our economy is only 12% (see below). This means there are 88% more of non-OFW sectors to consider. Mathematically speaking, 88 should be greater than 12, or am I missing something?

Charts from World Bank’s Migration and Remittance Factbook 2011

True, the multiplier for remittance contribution could mean a lot more share of the economic pie, but this is certainly far from the exaggerated claim that the Philippines entirely or mostly depend on remittances.

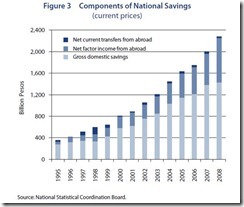

The above chart from ADB shows that while the growth of net factor income from abroad (NFIA) has indeed been substantial, remittances has only been part of this. NFIA also includes contributions from exports and investment inflows. Importantly, gross domestic savings still accounts for the largest share.

So you seem to be pandering to the OFW voting class/audience by overestimating their contributions and underestimating the role of the local economy.

You further moralize on the problem of the 'debt crisis' to Americans as one of having spent too much on things which they didn’t “need”, in as much as they ate in “excess”.

Again both of you seem to be missing out the root of the problem.

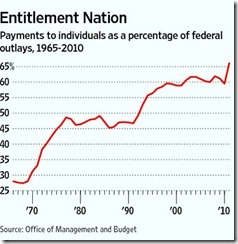

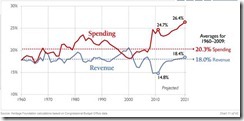

Today’s US debt crisis has been mostly about skyrocketing US government spending emanating from promises to her citizenry from which the US government won't be able to finance (chart from Wall Street Journal)

(chart from Heritage Foundation)

If you think that McMansions and SUV’s are “not” needed by Americans, then that would represent fait accompli thinking.

And yet how do you determine what is needed and what is not? And similarly by what measure would you know what or which levels signify as “enough” for each person? If I value beer most and you value coffee most, should my preferences be forced to conform to you or should I sacrifice my beer for your coffee? On what grounds-because most of the people will agree with you?

You see, the fundamental problem has mainly been about the addiction to acquire debt (not only by the American public but MOSTLY by the government).

Moreover while I applaud you for saying that Filipinos should stay clear from incurring debt, I reject your prescription that 'safety nets' should be provided for by the Philippine government to the OFWs in the face of this crisis.

Such safety nets has exactly been the (borrow and spend) formula which has caused the downgrade of the US

Proof?

This is the press release from the Credit rating agency S & P, whom downgraded the US, (bold highlights mine)

The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.

More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges to a degree more than we envisioned when we assigned a negative outlook to the rating on April 18, 2011.

Since then, we have changed our view of the difficulties in bridging the gulf between the political parties over fiscal policy, which makes us pessimistic about the capacity of Congress and the Administration to be able to leverage their agreement this week into a broader fiscal consolidation plan that stabilizes the government’s debt dynamics any time soon.

None in the above says that this has about excess consumption of food and the needless expenditures on material personal needs. Instead, the above shows that this crisis has been representative of the overdependence on government.

Finally, both of you only see the negative side of the downgrade. The bright side is that these events could mean more investment funds for countries willing to embrace investors.

As a saying goes, money flows to where it is treated best. If the US government can’t treat their resident investors adequately, then the Philippines can offer them an alternative venue.

This will happen only if we make the right policy reforms of embracing greater economic freedom.

Ideas have consequences, especially the bad ones. Spreading half-truths could mislead people into doing something that they shouldn’t have politically.

I hope to see public personalities engage in responsible expositions of our society’s problems than just utter rubbish and unfounded statements, especially directed to gullible audiences who mostly don’t understand the situation and who would easily fall prey to demagoguery which they may assimilate as “truth”.

In short, I hope that that both of you practice responsible journalism.

Hope this helps,

Benson

Thursday, June 16, 2011

The Myth of Good Government

One my favorite video clips is when Milton Friedman was interviewed by Phil Donahue in the 70s on the topics of greed and virtue.

In addressing Mr. Donahue’s suggestion that governments ought to “reward virtue” Mr. Friedman rebutted (bold emphasis added)

"And what does reward virtue? You think the communist commissar rewards virtue? ...Do you think American presidents reward virtue? Do they choose their appointees on the basis of the virtue of the people appointed or on the basis of their political clout? Is it really true that political self- interest is nobler somehow than economic self-interest? ...Just tell me where in the world you find these angels who are going to organize society for us?"

The illusion of “rewarding virtue” can be seen in the appointments of US President Obama,

From the Politico, (bold emphasis mine)

More than two years after Obama took office vowing to banish “special interests” from his administration, nearly 200 of his biggest donors have landed plum government jobs and advisory posts, won federal contracts worth millions of dollars for their business interests or attended numerous elite White House meetings and social events, an investigation by iWatch News has found.

These “bundlers” raised at least $50,000 — and sometimes more than $500,000 — in campaign donations for Obama’s campaign. Many of those in the “Class of 2008” are now being asked to bundle contributions for Obama’s reelection, an effort that could cost $1 billion...

More (from the same article; emphasis added)...

The iWatch News investigation found:

Overall, 184 of 556, or about one-third of Obama bundlers or their spouses joined the administration in some role. But the percentages are much higher for the big-dollar bundlers. Nearly 80 percent of those who collected more than $500,000 for Obama took “key administration posts,” as defined by the White House. More than half the 24 ambassador nominees who were bundlers raised $500,000.

The big bundlers had broad access to the White House for meetings with top administration officials and glitzy social events. In all, campaign bundlers and their family members account for more than 3,000 White House meetings and visits. Half of them raised $200,000 or more.

Some Obama bundlers have ties to companies that stand to gain financially from the president’s policy agenda, particularly in clean energy and telecommunications, and some already have done so. Level 3 Communications, for instance, snared $13.8 million in stimulus money.

And it’s not just President Obama, but also past President Bush (from the same article; emphasis added)

Public Citizen found in 2008 that President George W. Bush had appointed about 200 bundlers to administration posts over his eight years in office. That is roughly the same number Obama has appointed in a little more than two years, the iWatch News analysis showed.

Well, that’s in the US which supposedly is a country whose political institutions are far sounder than the most of the world.

Yet in the Philippines, it’s been no different.

From Sunstar.com.ph (emphasis added)

FRIENDS and allies of President Benigno Aquino III occupying government positions are not considered “untouchables” and will not be spared from corrections, the President’s spokesman said.

Presidential spokesperson Edwin Lacierda admitted that President Aquino prefers to appoint people whom he has level of comfort but it does not mean that they are not beyond criticism.

So there you have it.

Milton Friedman was correct to debunk the romanticized idea that governments’ reward the virtuous.

Instead, the main beneficiaries of the division of the spoils via political appointments (or political concessions) have been from political allies and political clients, vested ‘rent seeking’ interest groups, families and friends. And this dynamic applies to any form of government.

Realize that political leaders or bureaucrats are human beings or self-interested agents too, whom are subject to the same fragilities (biases, knowledge limitations, different interpretations based on diverse value preferences, cultural orientation, education and etc.) as everyone else.

The difference is in the incentives that governs them with those of economic agents.

Instead of profits and losses, these entities use institutional coercion or violence to redistribute resources based on political exigencies (e.g. populism) with the ultimate aim of annexation and preservation of power and of social image. Thus, the reliance on so-called ‘comfort zones’ as every society operates on diversified interests which continually competes for scarce resources.

Despite the popular notion, Government or the State will NEVER be about virtue or morality.

So for those who stubbornly insist of having “good governments”, be it known that dreams or illusions can last forever.

Wednesday, May 18, 2011

Video: Morality of Profits; Should We Give Back Wealth to the Society?

In this video the illustrious Tom Palmer explains the morality of profits by distinguishing between wealth obtained from voluntary and involuntary (pelf) exchanges.

As Ludwig von Mises once wrote,

Profit is the reward for the best fulfillment of some voluntarily assumed duties. It is the instrument that makes the masses supreme.

Wednesday, May 04, 2011

Quote of the Day: Killing is Never Great

Great one from Dr. Robert Higgs,

But mere killing is never great, and those who carry out the killings are not great, either. No matter how much one may believe that people must sometimes commit homicide in defense of themselves and the defenseless, the killing itself is always to be deeply regretted. To take delight in killings, as so many Americans seem to have done in the past day or so, marks a person as a savage at heart. Human beings have the capacity to be better than savages.

Tuesday, April 05, 2011

Agency Problem: David Sokol’s Controversial Resignation From Warren Buffett’s Berkshire Hathaway

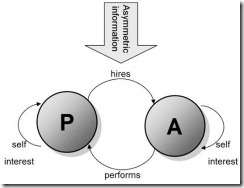

A good running example of the principal-agent or the agency problem in play has been the unravelling controversy over Warren Buffett’s supposed “would be” successor-David Sokol.

David Sokol recently resigned from Berkshire Hathaway following allegations of unethical practice.

According to Steve Shaefer of Forbes,

Berkshire Hathaway executive David Sokol, who served as chairman of MidAmerican Holding Company and Johns Manville as well as Chairman and CEO of NetJets, resigned from the company in a letter to Warren Buffett Monday.

Buffett announced his departure in a press release Wednesday, which also noted that Sokol owned shares in Lubrizol, a company Berkshire recently agreed to acquire for some $9 billion. The departure of Sokol comes as a shock to Berkshire watchers who figured the executive was one of the potential successors for Buffett.

In the announcement, Buffett stressed that he and Sokol do not feel there was anything illegal in his trades of Lubrizol shares.

Although both David Sokol and Warren Buffett via Berkshire Hathaway denied that this has been the cause of his resignation, media has been all over what has been perceived as ethical impropriety.

The Sokol affair simply highlights what we have been talking about as the conflict of interests by participating agents—based not only from asymmetric information but from asymmetric interests or incentives that drives people’s actions.

Principal Agent Problem Diagram from Wikipedia.org

Mr. Sokol, who acquired shares of Lubrizol before pitching it to his boss, Mr. Buffett, saw nothing wrong with this. In fact, in a CNBC interview Mr. Sokol cites Mr. Charles Munger, Mr. Buffett’s close friend and vice chairman of Berkshire Hathaway of doing the same.

“I don’t believe I did anything wrong. Charlie Munger owned 3% of BYD before he asked me to go look at it.” [dawnwires.com]

In the stock market, when agents or brokers pre-empt their clients by taking positions for his/her account, in the expectations that the clients orders could affect the price movements of specific stocks, is known as “frontrunning” (investopedia.com) an illegal practise that is punishable by law.

Although Mr. Sokol’s case hardly resembles frontrunning, because he bought the shares before he offered it to Mr. Buffett, this goes to show how such practices has punctured on the current laws.

Notes Mr. Jason Zweig at the Wall Street Journal, (bold emphasis mine)

Mr. Sokol's trading falls under what Stephen Bainbridge, an expert on securities at the UCLA School of Law, calls "an enormously gray area of the law." It also is a reminder that a basic principle of securities law—disclosure cures conflicts—is nonsense.

"Even assuming that [Mr. Sokol] did nothing illegal, [his action] is typical of the kinds of conflicts of interest permitted by our financial system that undermine the integrity of markets," says Max Bazerman, an ethicist at Harvard Business School and co-author of the new book "Blind Spots."

Most people have what Mr. Bazerman calls an ethical blind spot. Faced with a potential conflict of interest, you automatically conclude that it couldn't possibly offer any temptation to someone of superior character—like you or those closest to you.

While I agree that this seems like an issue of ‘ethical blind spots’, I don’t share the impression that “conflicts of interest permitted by our financial system that undermine the integrity of markets” or of the insinuation that ‘ethical’ laws are needed to keep the “integrity of markets”. That would be misstating the case.

And that’s because it is the nature of people to be guided by self-interest based on the individual’s distinctive value preferences or priorities. And people’s diversified self interests always conflict with each other, but still could represent benefits for all the concerned, though not equally.(This is the essence of trade)

What has actually undermined the financial system is the conflict of interest (agency problem) between the political agents along with their regulatory patrons and their economic clients. Regulatory arbitrages, regulatory capture, revolving door politics, bailouts to name a few, has been significant contributors to the political-economic inequality.

And as one can see from the above account, current disclosure laws can’t stop people from circumventing them.

Besides, if Mr. Sokol’s allegation of Mr. Munger is accurate, then Mr. Buffett has been obviously tolerant of such practice.

To see why, Mr. Buffett probably sees this as a way to reward his underlings, who by diligent scrutiny over the target companies, takes on risks directly to emphasize their vote of confidence. It’s not even sure that what the underlings buy will be bought by Mr. Buffett.

As Mr. Buffett stressed on Berkshire’s recent press release,

Dave’s purchases were made before he had discussed Lubrizol with me and with no knowledge of how I might react to his idea. In addition, of course, he did not know what Lubrizol’s reaction would be if I developed an interest. (bold emphasis mine)

Thus such actions represent risks borne solely by both Mr. Munger and Mr. Sokol.

Perhaps, for Mr. Buffett this could have signified as parallel to a finder’s fee, that’s if he ever agrees with their investment concept.

This also highlights on the differences of what is seen as an ethical issue. What may seem wrong to the others may seem right to Mr. Buffett (although I would assume that he would distance himself from this controversy)

I think the editorial of Financial Times captures this well, (bold highlights mine)

That Mr Sokol has left to build his own investment portfolio is more than unintentionally ironic. The whole affair highlights Berkshire’s informal style of operation. This is possible because of the high degree of confidence reposed in the company by investors. Mr Buffett and his team can scour the world for opportunities untrammelled by investment mandates and other bureaucratic restraints.

The licence exists, of course, because of Mr Buffett’s superior investment record. He has beaten the stock market indices by a broad margin since the mid-1960s. But it will be harder for Berkshire to continue outperforming given its now-vast size, as even Mr Buffett has admitted. This should give investors pause. The risk of executives abusing informal processes is greatest at times when operational performance is under pressure.

In short, this hasn’t been an issue to Berkshire’s investors because of the rewards these investors have been showered with over these years. It would all be a different story if Berkshire lost money or has underperformed.

The other point is that people should be self-vigilant over their investments in the knowledge that there will always be conflict of interest issues at hand.

To rely on government to resolve ethical issues will only bring about dependency, complacency, and equally, conflict of interest issues but not between private agents but among public and private agents, which should even complicate and worsen the case, as manifested during the last crisis. In other words, more problems will arise from regulations meant to address ethical issues.

The market mechanism for discipline enforced by such perceived misconduct is social stigma or ostracism or reputational risk.

Finally, the public trial faced by Berkshire Hathaway and Mr. Sokol simply highlights of the uniqueness of Mr. Buffett’s management style.

Once Mr. Buffett goes, perhaps Berkshire would most likely lose its magic. All these seem ominous with Moody’s projecting the “Sokol affair” as negative for Berkshire’s credit rating standings (Reuters).

Berkshire’s Corporate Structure and Investment Holdings From theofficialboard.com

Still yet, the complexity of Warren Buffett’s flagship Berkshire Hathaway’s organizational structure operating on her vast investment holdings also underscores the FT’s editorial observations of Berkshire at “now-vast size” or perhaps reaching its growth limit.

And that’s why I have argued here that Mr. Buffett has resorted to political entrepreneurship perhaps out of the desperation to maintain public’s high expectations from a Warren Buffett managed Berkshire.

Bottom line: the principal-agent problem is an inherent feature of the marketplace, which has been immensely underappreciated but must be understood by all.

Friday, February 20, 2009

Video Glenn Beck on Money Expansion: Inconvenient Debt

Notable quotes from the video:

Hat tip Jeff Tucker

Friday, February 13, 2009

Bring Back The Gold Standard?

A splendid article in the Wall Street Journal, from Ms. Judy Shelton, opines of the return to the gold standard to compete with modern Central Banking.

Why? Because of the insidious and nasty impacts of policy prompted inflation….

Excerpts from Ms Shelton’s articles (all bold highlights mine)

``Under a gold standard, if people think the paper money printed by government is losing value, they have the right to switch to gold. Fiat money -- i.e., currency with no intrinsic worth that government has decreed legal tender -- loses its value when government creates more than can be absorbed by the productive real economy. Too much fiat money results in inflation -- which pools in certain sectors at first, such as housing or financial assets, but ultimately raises prices in general.

``Inflation is the enemy of capitalism, chiseling away at the foundation of free markets and the laws of supply and demand. It distorts price signals, making retailers look like profiteers and deceiving workers into thinking their wages have gone up. It pushes families into higher income tax brackets without increasing their real consumption opportunities.

``In short, inflation undermines capitalism by destroying the rationale for dedicating a portion of today's earnings to savings. Accumulated savings provide the capital that finances projects that generate higher future returns; it's how an economy grows, how a society reaches higher levels of prosperity. But inflation makes suckers out of savers.

``If capitalism is to be preserved, it can't be through the con game of diluting the value of money. People see through such tactics; they recognize the signs of impending inflation. When we see Congress getting ready to pay for 40% of 2009 federal budget expenditures with money created from thin air, there's no getting around it. Our money will lose its capacity to serve as an honest measure, a meaningful unit of account. Our paper currency cannot provide a reliable store of value.

Thus, the importance to bring about governance based on the principles of sound money…

``So we must first establish a sound foundation for capitalism by permitting people to use a form of money they trust. Gold and silver have traditionally served as currencies -- and for good reason. A study by two economists at the Federal Reserve Bank of Minneapolis, Arthur Rolnick and Warren Weber, concluded that gold and silver standards consistently outperform fiat standards. Analyzing data over many decades for a large sample of countries, they found that "every country in our sample experienced a higher rate of inflation in the period during which it was operating under a fiat standard than in the period during which it was operating under a commodity standard."

``Given that the driving force of free-market capitalism is competition, it stands to reason that the best way to improve money is through currency competition. Individuals should be able to choose whether they wish to carry out their personal economic transactions using the paper currency offered by the government, or to conduct their affairs using voluntary private contracts linked to payment in gold or silver.

``Legal tender laws currently favor government-issued money, putting private contracts in gold or silver at a distinct disadvantage. Contracts denominated in Federal Reserve notes are enforced by the courts, whereas contracts denominated in gold are not. Gold purchases are subject to taxes, both sales and capital gains. And while the Constitution specifies that only commodity standards are lawful -- "No state shall coin money, emit bills of credit, or make anything but gold and silver coin a tender in payment of debts" (Art. I, Sec. 10) -- it is fiat money that enjoys legal tender status and its protections…

Nevertheless, we should learn how the gold standard has contributed immensely to human development, which helped buttress the ethical values in the marketplace.

``Private gold currencies have served as the medium of exchange throughout history -- long before kings and governments took over the franchise. The initial justification for government involvement in money was to certify the weight and fineness of private gold coins. That rulers found it all too tempting to debase the money and defraud its users testifies more to the corruptive aspects of sovereign authority than to the viability of gold-based money.

``Which is why government officials should not now have the last word in determining the monetary measure, especially when they have abused the privilege.

``The same values that will help America regain its economic footing and get back on the path to productive growth -- honesty, reliability, accountability -- should be reflected in our money.

However, economics based on false premises have dominated mainstream thinking which has only misled people…

``Economists who promote the government-knows-best approach of Keynesian economics fail to comprehend the damaging consequences of spurring economic activity through a money illusion. Fiscal "stimulus" at the expense of monetary stability may accommodate the principles of the childless British economist who famously quipped, "In the long run, we're all dead." But it shortchanges future generations by saddling them with undeserved debt obligations.

``There is also the argument that gold-linked money deprives the government of needed "flexibility" and could lead to falling prices. But contrary to fears of harmful deflation, the big problem is not that nominal prices might go down as production declines, but rather that dollar prices artificially pumped up by government deficit spending merely paper over the real economic situation. When the output of goods grows faster than the stock of money, benign deflation can occur -- it happened from 1880 to 1900 while the U.S. was on a gold standard. But the total price-level decline was 10% stretched over 20 years. Meanwhile, the gross domestic product more than doubled.

``At a moment when the world is questioning the virtues of democratic capitalism, our nation should provide global leadership by focusing on the need for monetary integrity. One of the most serious threats to global economic recovery -- aside from inadequate savings -- is protectionism. An important benefit of developing a parallel currency linked to gold is that other countries could likewise permit their own citizens to utilize it. To the extent they did so, a common currency area would be created not subject to the insidious protectionism of sliding exchange rates.”

Yes, while it may seem like a lost cause…bringing back the gold standard would be very ideal as governments hate competition.