…the

fact that economists, respected or not, are not anything like economic experts.

They are, almost in total now, simple mathematicians and statisticians. Their

world consists not of flesh and humanity, but of overly simplified, though elegant, regressions and equations

that are supposed to represent the impulses of shorn human behavior. Thus,

their correlations especially of the past few decades have forced an attentive

drift away from the direct focus upon wages and productive investment and into

asset prices and financials because that is what their numbers tell them has

been driving wages and productive investment. From that point, there has been

no evaluation about whether such correlations are at all appropriate and

consistent with a truly healthy and advancing economy; the math banishes all

such judgment—Jeffrey P. Snider

In this issue:

Phisix 6,900: APEC’s Cost: Php 20 Billion, ALI's

Cash Flow Strains Explains Capex Cuts!

-APEC Will Cost Php 20 Billion Just To

Rehash 1996 Statements!

-APEC’s Illusions of Free Trade

- ‘Free Trade’ Versus Inflationism

-China’s Free Trade Automotive Bubble

-Paris Attacks: Blowback from ECB

Financed French Government’s Geopolitical Interventionism

-The UNSEEN Legacies

from APEC PLUS Central Banks’ Policies

-Despite

Magnificent Profits, ALI’s Cash Flow Strains Explains Capex Cuts!

-MEG, FLI and CPG:

More Evidences of Growing Strains at the Real Estate Sector!

-Snips: OECD Frets Over Global Recession, September

Philippine Exports Tailspins, November 9 PSE Volume Falls to January 2014 Lows!

Phisix 6,900: APEC’s Cost: Php 20 Billion, ALI Cash Flow Strains Explains Capex Cuts!

APEC Will Cost Php 20 Billion Just To

Rehash 1996 Statements!

The Philippine

government will be hosting the Asia Pacific Summit next week.

The Asia-Pacific

Economic forum represents a forum for 21 Pacific

Rim members intended to “support sustainable economic growth and prosperity

in the Asia-Pacific region” by “championing free and open trade and investment,

promoting and accelerating regional economic integration, encouraging economic

and technical cooperation, enhancing human security, and facilitating a

favorable and sustainable business environment”

While I am all in

all for free trade and economic freedom (as well as for civil liberties), I

believe that such events really showcases the aggrandizement of the egos of

domestic and international political leaders rather than what they have declared to

accomplish.

The Philippine

quack boom has also been sold as part of this ego boosting campaign.

Another, the

summit represents a wholesale junket for political leaders along with their bureaucratic

entourage, as well as cronies. This will all come at the expense of taxpayers

and currency holders.

To be fair, the

locations of the APEC annual meetings are rotated among members. So apparently, 2015

marks the turn of the Philippines.

Curiously, the

last time the Philippines played host to the APEC

at Subic was in 1996. Guess what happened a year later or in 1997?

Of course, it

would be a post hoc fallacy to say APEC caused the Asian financial

crisis. Nonetheless, the sequence of these events could have signified

untimely coincidence, a jinx, or a symptom of wanton overconfidence or all of

the above packaged into one.

Playing host to

the APEC summit entails massive real and opportunity (aside from social) costs:

the

suspension of (most of) government offices from November 17-20, a declared

non-working public holiday on November 18-19, the cancellation

of over 1,100 flights to give way to the delegates, more

checkpoints and tighter security measures and even Manila Bay declared as a

no sail zone! Remarkable.

The Philippine

Stock Exchange will

be closed during the designated holidays, but remain open on November 17 and 20

because the BSP, despite being a government office, will keep Philippine Payments and Settlements System (PhilPaSS)

operational

during these stated dates.

Yet all these

privileges coming at the expense (and even convenience) of the public!

Most of these

officials have been elected to supposedly serve the voters. But in high profile

events as these, real priorities are demonstrated. Voters and the other

non-voting constituents have been waylaid to accommodate for the convenience of

political authorities.

At the rudiment,

free trade represents decentralized social activities. But modern day politics

are centrally structured. In essence, forces of decentralization and

centralization collide or are diametrically opposed. So this has NOT been and

will NOT be about free trade.

As Alisa

Zinov'yevna Rosenbaum popularly known as free market champion Ayn Rand wrote[1]:

Wealth,

in a free market, is achieved by a free, general, “democratic” vote—by the

sales and the purchases of every individual who takes part in the economic life

of the country. Whenever you buy one product rather than another, you are

voting for the success of some manufacturer. And, in this type of voting, every man votes only on those matters

which he is qualified to judge: on his own preferences, interests, and needs.

No one has the power to decide for

others or to substitute his judgment for theirs; no one has the

power to appoint himself “the voice of the public” and to leave the public

voiceless and disfranchised.

Let us go back to

the costs.

This data from

the government’s Philippine

Statistics Authority exhibits that in 2014, the average daily GDP for the

National Capital Region was at Php 12.82 billion a day (current prices)

So if the APEC

holiday would reduce output by conservatively

50%, then this means Php12.8 billion lost! That would represent only nominal

losses. How about the other costs, higher wage burdens from holiday payments,

lesser profits, lost investment opportunities, lesser trading fees, among many

other economic factors?

And how about the

dislocation on commercial activities that depend on government offices which

will be closed in four days?

The mainstream

will say but this will mean ‘holiday economics’! Yet as I have explained before,

aside from the mistaken focus on the (SEEN) gains/benefits which on the other

hand, disregards on the (UNSEEN) costs, real economic growth comes from growth

in productivity, income and capital accumulation and not from spurious spending

from the impression that these are funded by ‘manna from heaven’.

Not only that,

the government has reportedly allocated Php 10 billion for this event which

politicians hail

will benefit the economy over the long term. Really?

Yet who pays for

the Php 10 billion junket of domestic and international leaders? Yes it is us,

the taxpayers and the peso holders. And for what type of benefits should

society reap? Abstract benefits?

Interestingly,

what economic benefits did the 1996 APEC summit deliver to the Philippines? An

economic crash which lasted several years for bubble excesses to clear?

Even if I reckon that the crash was

coincidental with the APEC summit, measured in terms of external trade,

Philippine exports

and imports

hardly improved in the aftermath of the 1996 summit from a ten year

perspective.

Moreover, it was even worse in terms of merchandise

trade as % of gdp, the Philippines became less about external trade but more

about OFW diaspora ‘exports’! This should even be magnified today where the BSP,

in response to the great recession, acted to pivot monetary policies with

the objective to “end its dependence on exports,” and to “boost

domestic consumption”

And so whatever happened to

ex-President FVR’s “Manila

Action Plan for APEC 1996 (MAPA ?96), strengthening economic and technical

cooperation and engaging the private sector in the APEC process”…and to…”recommendations

of the various APEC fora as measures of APEC's progress toward free and open

trade”?

Hasn’t such 19

year old rhetoric sound eerily familiar today?

And for APEC 2015,

media and politicians should specify on the details of benefits rather than

just to make general statements?

Or will benefits

accrue and be disbursed to just a few?

Examples. To the

hotels where the political guests will be billeted? To politically connected travel firms who will

facilitate part of these trips? To the private security and security related

firms whom will be hired to complement the government’s security measures? To politically

connected elites on cross border deals?

The Philippines

will incur more than Php 20 billion of costs for what? To rehash statements

made in 1996 premised on abstract benefits and from promises made to be broken?

APEC’s Illusions of Free Trade

APEC

2015’s theme is “Building

Inclusive Economies, Building a Better World” through four priorities: -Enhancing the Regional Economic Integration Agenda, - Fostering Small

and Medium Enterprises’ Participation in Regional and Global Markets,-Investing

in Human Capital Development and Building Sustainable and Resilient Communities

Let us see how

in essence free trade/markets apply to them.

I quote the four

priorities along with some of their explanations:

On Regional

Integration

APEC initiatives will focus on connectivity and trade

facilitation, particularly in areas that will promote trade in services and the

ease of doing business.

Ease of doing business? What’s the

cause of the unease or difficulties of doing business? Haven’t these been mostly

about politics: regulations, mandates, welfarism and taxes? And haven’t the

solution to the easing of doing business been plain and simple deregulation?

Does the Philippine government need the APEC for this?

On regional SMEs’ Participation: APEC

will continue to support SMEs through trade facilitation measures to link SMEs

to global value chains and promote their full participation in markets by

removing barriers to entry and promoting greater access to finance, technology,

training programs and tools.

Barriers to entry? Again, have these not been mostly about domestic

politics and its natural consequences? Aside from dirigisme, have institutional

deficiencies, infrastructure barriers, underdeveloped capital markets among

many others not signified as an offshoot to these?

The Philippine informal sector is a

testament to SME’s free market dynamics operating under economic repression. Simply

stated, the main cause of the informal economy is economic repression. Yet they

have proven to be resilient even without political support. The informal sector

has even mitigated the effects of the bursting bubble and buoyed the Philippines during

the Asian crisis.

For the SME’s to flourish, the government should

just get out of their way or to stop harassing them. If they grow enough, they

will join the mainstream.

More importantly, by scraping those trade

barriers, the informal sector migration to the formal economy should hasten.

Just liberalize.

Furthermore, domestic SMEs will find ways

to connect with her external trade partners if these trade barriers are junked.

We don’t need free trade agreements for these. People from Zamboanga and

Mandaluyong don’t need free trade agreements to conduct exchanges. In the same

way, the Philippine government can UNILATERALLY liberalize. Political borders

should not be an obstacle for voluntary exchanges. It’s an obstacle created by

politics.

Access to finance. Aside from possible

cultural quirks, haven’t this been about suffocating capital controls?

On Human Capital Development: APEC’s

human capital development initiatives will be designed to foster economic

competitiveness coupled with equal opportunity. APEC looks to enhanced

cooperation between education providers and businesses as employers—to help

realize human resource development goals.

Why the lack of

economic competitiveness and equal opportunity? Have these not been due to

protectionist laws embedded in the system? Do the Philippines need a behest

from Obama–Xi-Putin-Abe to emancipate the economy from these domestic barriers?

Why are OFWs

still streaming out of the Philippines in spite of the supposed boom? Have

these dynamic not been due to the lack of economic competitiveness and deficient

economic opportunities that subsequently, has led to deficient job and income

growth due to political interference and barriers?

The peso’s slomo

crash from 1960 should serve as primary

evidence for such policy interventionist failures.

Yet even without

the government’s prodding, OFWs act and take risks to seek better future in the

wake of such handicaps. OFWs are merely responding to an economy shackled by

protectionism and state-crony capitalism.

On Sustainable

and Resilient Communities: Preparedness such as investing in resilient infrastructure,

rather than just relief and recovery, are coming to the fore of APEC’s agenda.

APEC looks to create and promote risk reduction and management, build SMEs’

resilience to disaster, and ensure business continuity.

What’s

the cause of the lack of infrastructure? Yet is the government only the sole

provider of infrastructure?

Well

let me say that the major causes of the lack of infrastructure have again been

political: regulatory, legal, institutional and funding barriers among many

others. Had government liberalized infrastructure, infrastructure investments would

have surged. But the government wants to control everything. And so they prefer

the Public Private Partnership route. A route which essentially politicizes the

infrastructure

resource deployment that leads to cronyism.

The political mission by the APEC hardly

has been about the “championing free and open trade and investment, promoting

and accelerating regional economic integration, encouraging economic and

technical cooperation, enhancing human security, and facilitating a favorable

and sustainable business environment”, but rather represents political control

of trade in the guise of free markets.

To add, the Trans

Pacific Partnership (TPP) reportedly will be a side event at the APEC sans the

Philippines.

Yet rules and regulations covering the TPP,

according to the Breitbart,

accrue to a shocking 5,544 pages long! The bundle of TPP documents weigh more

than 100 lbs! It is also represents 3,500 pages more than Obamacare!

With all the stunning byzantine of rules

and regulations, incentives of people engaged in voluntary exchange will shift!

Instead of focusing on satisfying consumers, producers or service providers

will be more concerned on lobbying for favors from unelected bureaucrats who

essentially will play gods (choose winners and losers). The horrifying maze of

rules and regulations will only whittle away competition, solidify the interests

of politically connected entities and or invite a boatload of lawsuits! All

these will extrapolate to less and NOT more trade.

This is government’s version or definition of

free trade. War is

peace. Freedom is slavery. Ignorance is strength.

Government dictated trade is free trade.

As the great Austrian economist Ludwig von

Mises wrote[2]

(bold mine)

It is vain to expect anything from purely technical

changes in the methods applied in international negotiations concerning

foreign-trade matters. If Atlantis is resolved to bar access to cloth

manufactured abroad, it is of no importance whether its delegates must

negotiate directly with the delegates of Thule, or whether the subject can be

dealt with by an international board in which other nations are represented. If

Atlantis is prepared to admit a limited amount—a quota—of cloth from Thule only

because it wants to sell a corresponding quota of wheat to Thule, it is not likely

to yield to a suggestion that it allot a part of this quota to other nations.

If pressure or violence is applied in order to force Atlantis to change its

import regulations so that greater quantities of cloth can be imported, it will

take recourse to other methods of interventionism. Under a regime of government

interference with business a government

has innumerable means at hand to penalize imports. They may be less easy to

handle but they can be made no less efficacious than tariffs, quotas, or the total

prohibition of imports.

Under present conditions an international body for

foreign-trade planning would be an assembly of the delegates of governments

attached to the ideas of hyper-protectionism. It is an illusion to assume that such an authority would be in a position

to contribute anything genuine or lasting to the promotion of foreign trade.

It is in the same context for so-called

competition enhancing laws like the Philippine

competitive act. Instead of promoting economic activities, it bogs down

parties with bureaucratic red tape and therefore reduces economic activities

which defeat the very goal that it purports to achieve. For instance, the PSE’s

proposed takeover of the operator of

the fixed-income exchange, the PDS Holdings,

Inc has been hobbled by the said anti-monopoly law.

Some game

changer.

‘Free Trade’ Versus Inflationism

Unless one is engaged in barter, most trade

whether free (voluntary) or forced (e.g. political services such as taxes,

fines and etc) are coursed through a medium of exchange or a currency.

Said differently, HALF of every trade being

conducted is made through a medium of exchange.

And because

medium of exchanges, such as the peso, has a price (exchange ratio between

currency unit and specific goods and services), changes in the pricing of the

medium of exchange would also alter the incentive for trade.

In short, the pricing mechanism expressed

through currency units coordinates the ever dynamic balance between demand and

supply of goods and services.

So

when government, through their respective central banks, meddle with the price

of the currency, they effectively influence a change in the incentives to

trade.

And since

tinkering with the price of a currency is a result of policy (backed by an

underlying political and economic motive/s), this means that certain groups are

being accorded privileges through invisible redistribution at the expense of

other groups.

Financial repression through the

suppression of interest rates is an example of intervention in money prices.

Suppression of interest rates rewards

borrowers and speculators that come at the expense of savers and pension

holders.

Furthermore, suppression of interest rates

serves as subsidies to the government and to the big borrowers in the banking

system and in the capital markets.

And because suppression of interest rates

translates to an expansion of money supply brought about by the credit

expansion, which lowers the value of a domestic medium of exchange relative to

foreign currencies, this effectively represents subsidies to foreign currency

revenue earners (exports, tourism, for the Philippines BPOs and OFWs) which

comes at the expense of domestic purchasing power.

And because suppression of interest rates

translates to an expansion of money supply brought about by the credit

expansion rewards speculative activities, it fosters malinvestments or economic

disequilibrium.

And since suppression of interest rates

represents a political redistribution scheme, which again protects (through

subsidies) certain segments of society and which is paid for or taxed or

transferred from the rest, such political redistribution scheme channeled

through the monetary channel represents implied protectionism.

And so when governments engage in suppression

of interest rates (zero bound, negative bound or QE) they are engaged in subtle

protectionism.

And when the assault on interest rates

becomes a de facto standard for

global central banks, where they have been labeled as ‘currency

manipulation’ or ‘currency

wars’ or ‘beggar thy

neighbor’ policies this again implies protectionism.

So trade activities will correspond to the

consequential changes in money prices from monetary inflationist

‘protectionist’ policies that would have offsetting functions to the ‘trade

agreements’ based on conventional tariffs and non-tariff

barriers. This won’t be visible on the surface.

In short, protectionism in government’s

rhetoric is Free Trade.

But a wolf in a sheep’s clothing remains a

wolf.

China’s Free Trade Automotive Bubble

China’s massive automotive malinvestments

should be a worthy example of monetary distortions from political interventions

on money prices that has masqueraded as free trade.

I have pointed out here how China’s stimulus

and credit easing policies have

ballooned capacity of the automotive industry by an incredible 17 million units

since 2009 even when demand has only expanded by 10.6 million units over

the same period.

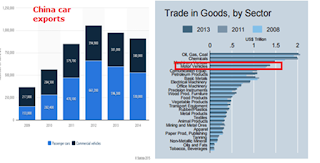

China has been the

largest car producing country as of 2013.

China’s vehicle

output, which includes foreign producers, exceeds the overall share of European

Union and accounts for one fifth of the global passenger car production,

according to Statista.com.

Yet only about 3% of domestic production

has been destined for exports (see left). Additionally, China’s major car

exports have been to developing or emerging markets.

Car exports

accounted for a third largest traded goods in the world as of 2013 based on a

report from UNCTAD

(United Nations Conference on Trade and Development). So this highlights of the

importance of the industry to global trade.

In other words, credit easing policies around the world

artificially expanded demand for motor vehicles that prompted for a colossal

expansion in China’s domestic capacity, as well as, cross border trade for

motor vehicles.

I might add that

other parts of the world could have added to the industry’s capacity.

Now that domestic demand for cars has been

slowing, Chinese producers have been undercutting prices through “margin-destroying discounts” and are considering to “tapping the brakes”

on expansion.

Yet with such amazing

degree of overcapacity, selling through “margin-destroying discounts” will not only be limited to

domestic markets but will likely be exported abroad. But that’s if there will

be demand for Chinese cars. As of September, year on year change in China’s car

exports have plunged: passenger vehicles -24.7% and commercial vehicles -35.7%

according to China

Association of Automobile Manufacturers

Like steel,

China will likely be exporting abroad price deflation from the industry’s excess

capacity. And like Chinese steel, which now is subject to US protectionism that

has reportedly contributed to slowing global trade, Chinese cars may vulnerable

to conventional protectionist policies imposed on her by her trading partners.

Accounts of rising protectionism, according

to analysts quoted by the Wall

Street Journal Real Time Economics Blog, have mainly been from the

following nations: India, Russia and the U.S. have

imposed the most “trade-distorting” measures since 2008.

Ironically, haven’t

the two of them, namely US and Russia been part of the APEC summit? Two supposed

champions of free trade as the top protectionists? War is peace? Freedom is

slavery? Down is UP?

As a side note: Two

presidents of APEC member states, Russia’s

Putin and Indonesia’s Widodo, have reportedly begged off the summit.

The exporting of

deflation will also apply when Chinese vehicle producers cut capacity, as this

will ripple across the supply chains and credit networks directly and

indirectly attached to the industry.

So ‘globalization’ has not only transmitted bubbles

from one nation to another, but more importantly abetted in the inflation of

bubbles across the globe.

These are NOT products of laissez faire capitalism (free

markets) but one of STATE capitalism.

Again a wolf in a sheep’s clothing remains

a wolf.

Paris Attacks: Blowback from ECB Financed

French Government’s Geopolitical Interventionism

It saddens me to

see civilians needlessly slaughtered due to wars.

Yes media calls

the concerted

bombings that claimed 129 lives in Paris acts of terrorism. Yet terrorism

is a form of warfare. Like guerilla warfare,

since terrorists are inferior in organization and equipment, they confront

their adversaries through unconventional or irregular means. But unlike

guerilla warfare, their targets have been civilians. Such has been intended to

sow fear, which according to a Rand Corporation paper,

are carried out by an organization, and devoted to political ends—which could

be about “narrow goals of payment of ransom or release of prisoners to the

broad goals of worldwide publicity for a cause”

Yet wars have to

be funded. They are either funded by plunder, taxation or inflation.

Since 2008, the

ECB has engaged in various stimulus measures. For instance, the

ECB has deposit facility rates (overnight deposit) from a high of 3.25% in

October 2008 to -.2 in September 2015. Marginal lending facility (overnight

lending) was likewise cut from a high of 4.25% to just .3% over the same span

of time.

The ECB’s serial

interest rates cuts plus other easing

measures have provided significant subsidies for the French government to fund her

ladder like increases in spending activities through debt. (Austerity,

really? Where?). These included military spending which steadily accounted for

2.2-2.3% of GDP from 2006-2014 based on World

Bank data. And even prior to the Paris attacks, the

French government announced a hike in defense spending for 2016. Hence, French public debt to

GDP has risen from 68.2% in 2008 to 95% in 2014 and will continue to rise.

And because the

French has been active in geopolitics, historian Eric Margolis recently noted

that[3]: To put things in context, France has emerged as one

of the most active interveners in the Muslim world, conducting military

operations in Libya, Mali, Chad, Ivory Coast, Central African Republic,

Djibouti, Abu Dhabi, Afghanistan, Iraq and Syria. Critics accused

France of a new era of Mideast and African colonialism.

Naturally with about

5-6 million of Muslims residing in France most of them North African and Black African in origin,

these Muslims are “third

class citizens marginalized by French society and discriminated against, living

in poverty with no prospects for their futures. They have become an

angry, dangerous, alienated sub-class seething with resentment and prone to

criminality.”

Thus the unfortunate January 7, 2015 shooting Charlie Hebdo

incident which claimed 12 lives could have been a precedent or was a prologue to yesterday’s

attacks but at a larger scale.

Aggravating the French political drama has been the

refugee crisis as an offshoot to the Syrian civil war. The French government actively

supported rebels that fought to topple the Syria’s Assad regime. On the

same plane, the French

government joined the US on airstrikes against the Islamic State last

September. Paradoxically, the ISIS has been also at war with the Syrian

government.

The French government’s response to the Paris

attack has been to declare a state

of emergency which included the closing of her borders. Such action

essentially violates the Schengen Agreement

which calls for free movement of people within EU member nations. The Schengen

Agreement is a core part of EU law wherein

all EU member states are without an opt-out option.

Even prior to the Paris attacks, in response to the

brewing refugee crisis, the EU

gave a go signal to the governments of Germany and Sweden for them to institute

temporary border controls. Meanwhile Austria

announced that it would build a fence across its borders with Slovenia. So

one of the core creeds or pillars of the EU’s integration have been dissipating.

In other words, the

blowback from ECB’s funding of political will not just be about refugee crisis

and terrorist attacks but likewise the increased risks of social instability,

protectionism and more importantly the dismantling of the EU!

Thanks to the unelected bureaucrats at the ECB,

what was sold as free markets, free people movements and a currency union will

now be in jeopardy due to free lunch financing of pet projects of power hungry

politicians.

A final note on geopolitics. While it is terrifying

to see the carnage from the Paris attacks, what media has not shown have been

the bloodshed of innocent victims from Western interventions in the Middle

East, Africa or elsewhere. This is with the exception of the US government’s deliberate

bombing of a hospital

run by the volunteers from Doctors Without Borders at the Afghan City of Kunduz

that claimed 22 lives.

Where’s the outrage?

The UNSEEN Legacies

from APEC PLUS Central Banks’ Policies

This brings me back to the free trade rhetoric versus

inflationism

Do you know what has been the legacy from APEC in

combination with current central banks inflationism?

This Bloomberg report has the answer[4]:

(bold mine)

Debt

in developing markets is estimated to

have reached $58.6 trillion at the start of 2015, with credit in China, Hong Kong, India, Indonesia, Malaysia, Singapore,

South Korea and Thailand exceeding that of Latin America, emerging Europe

and the Middle East, according to the Institute of International Finance.

Emerging-market debt has grown $28

trillion since 2009, according to the IIF, which on

Monday introduced a database tracking 18 developing markets. Global debt has

soared $50 trillion during the period to

surpass a total of $240 trillion, or 320 percent of gross domestic product, in

early 2015.

While

credit has increased for almost all countries included in the new monitor over

the past decade, debt-to-GDP ratios

in developing Asia for non-financial corporate, household and financial

corporate sectors have risen the most. Debt in Asia topped all categories

except in the public sector, which has “limited” exposure across emerging

nations compared with developed markets, the report said.

Non-financial corporate sector

debt in emerging markets has risen $13 trillion since 2009, increasing more

than five-fold over the past decade to surpass $23.7 trillion in the first

quarter of 2015. The advance has been most concentrated in emerging Asia, where

it rose to 125 percent of GDP.

The above have accounted

for the ramifications of the collective actions of global central banks. Global

central banks have cut interest rates 697 times and have bought $15 trillion of

financial assets in 110 months, according to the Bank of America as quoted by Zero

Hedge. And such easing policies have partly led to the amassment of the

gargantuan debt stocks based on the financing of carry trades, cross border

investments and cross border trades.

I am tempted to

ask: 1997 déjà vu?

Oh when this whole

thing blows up (on the process now), pls don’t blame free markets for this.

There have NO been free markets in today’s politicized money.

Despite Magnificent

Profits, ALI’s Cash Flow Strains Explains Capex Cuts!

Curiously, last September, they slashed

their capex by 20% in 2015 or this year!

ALI officials already knew much of the sales

performance for the Quarter. So why the capex cut given the huge profit gains?

Their publicized reason for the capex cut: tighter

cash management.

Why the need for “tighter cash management” in the

face of magnificent profit growth?

The same question I asked on SM’s playing with fire

last week[5]

applies to ALI.

Just what happened to all those supposed

“strong earnings”? Just

where exactly are those earnings to be found? Why haven’t the firm been

generating enough cash flows enough to cover internal debt refinancing to

prompt them to borrow externally?

Apparently Ayala

Land shares much of SMPH’s conditions.

Such marvelous

profits are really just accounting profits that have been brought about by

money illusions.

First and

foremost, despite the rip roaring headlines, topline real estate sales have

been slowing significantly. 9 month growth for 2015 has fallen to just 10.02%

from 2014’s 16.42% (left). 10% is still a big number though.

Second, trade receivables

now account for an astounding 40.43% of current assets (right)

ALI has declared in

her aging of receivables as Php 50.1 billion will be due in 6 months, Php 8.1

billion will be due on 6 months to 1 year and Php 24.98 billion over one year.

According to ALI’s

2014 annual report (p 39), “Titles to real estate properties are

transferred to the buyers only once full payment has been made”. My impression

is that the installment payments for the units that have been technically sold may

have still been accounted for as part of their inventory. If my reading is

right then this would entail a double counting in their current assets.

Nonetheless, even

if this hasn’t been so, ALI’s inventory shows of a massive inventory buildup

indicative of oversupply. Receivables PLUS inventory now accounts for 73% share

of current assets.

Third and most

important. Based on her 3Q

17Q, ALI has apparently insufficient cash flows from their operations, so

they have to rely heavily on short-long term loans to bridge finance her

operations, as well as to pay outstanding due debt.

In the 3Q, ALI

raised Php 15 billion which padded her debt proceeds from Php10.5 billion (2Q)

to Php 25.991 billion

Add to this ALI

raised Php 16 billion in January

2015 from top-up private equity placement at Php 33/share.

As a side note: Now

if ALI’s share falls below 33 then sorry to these investors who provided the

company with Php 16 billion. This would be an example of how ALI transferred

market risks to the subscribers of this year’s equity top placement offering.

The Php 16 billion raised

from their January offering now serves as cash reserves.

From the above,

we see why the need to

implement “tighter cash management”.

Aside from the risks of a slowdown in real estate,

ALI appears to prioritize COLLECTION more than sales.

ALI’s parsimony can be seen as a shift to a

defensive conservation mode.

MEG, FLI and CPG:

More Evidences of Growing Strains at the Real Estate Sector!

Now let me just demonstrate more incidences of the

money illusion profits based on the balance sheet of the other real estate

companies.

Megaworld’s 3Q17Q.

Quick numbers. 3Q sales grew by

10.9%. 9 months sales grew by 11.4%. 9 month DEBT surged by an incredible 50%!

Trade receivables soared by 23% in 9 months.

Awesome leveraging!

Filinvest 3Q17Q

Quick numbers. Real estate sales grew by just 2.75%

in 3Q! In 9 months topline sales added 6.5%. Interestingly, rental revenues

DROPPED -1.9% in 3Q but expanded 8.4% in 9 months.

Meanwhile 9 month debt swelled by 21.8%!

Century

Properties 3Q17Q

This looks as the

most interesting of all. 3Q real estate sales PLUMMETED by a fantastic 33%! 9

month sale was down by 8.38%.

In the meantime,

debt expanded 5.6% in 9 months.

Now my suspicions

on the latest

media concerted barrage to promote the real estate industry have partially

been proven.

The real estate sector

appears to showing increasing signs of strains!

Snips: OECD Frets Over Global Recession, September

Philippine Exports Tailspins, November 9 PSE Volume Falls to January 2014 Lows!

ICT magnate Mr. Enrique

Razon’s call "another crisis is coming" has company. The OECD worries that

global trade has fallen to recessionary levels

The Quartz on

OECD[6]

Secretary-general

Angel Gurria elaborated in a speech summarizing the group’s forecasts: “Global

trade, which was already growing slowly over the past few years, appears to

have stagnated and even declined since late 2014, with the weakness centering

increasingly on emerging markets, particularly China. This is deeply concerning

as robust trade and global growth go hand in hand. In 2015 global trade growth

is expected to grow by a disappointing 2%. Over the past five decades there

have been only five other years in which trade growth has been 2% or less, all

of which coincided with a marked downturn of global growth.

A presentation accompanying the forecast (pdf) was

more pointed, saying that such depressed trade levels are usually associated

with global recessions:

Add to this dour

global trade sentiment, the 24.7% collapse in Philippine

September exports.

Except for Hong

Kong which posted a 13.4% gain, Philippine exports to the top four trading

partners have all crashed: Japan 47.7%, USA 19.4%, China 28.9% and Singapore

38.4%

At the Philippine

Stock Exchange, the Phisix fell by 3.1% this week. If momentum holds then we

should see a test at 6,800 and 6,700.

But here is what

captured this week’s trade activities. Monday November 9 volume shriveled to

just Php 3.73 billion! This level was last seen in January 2014.

It appears that

the bid, in support of these extremely overvalued securities, has been fast

losing ground.

[1]

Ayn

Rand “America’s Persecuted Minority: Big Business,” Capitalism:

The Unknown Ideal, 47 Aynrandlexicon.com

[2]

Ludwig von Mises, Omnipotent

Government: The Rise of the Total State and Total War [1944]

oil.libertyfund.org

[3]

Eric

Margolis Attacks

of the Lone Wolves January 10, 2015 Lew Rockwell.com

[4]

Bloomberg.com

Asia's

Rapid Debt Buildup Tops Developing Markets, IIF Says November 10, 2015

[5]

See

Phisix

7,100: Surprise! ICTSI Chief Enrique Razon Warns: Another Financial Crisis is

COMING!!!! SM Plays with Fire! November 9, 2015