In the Freakonomics blog, Daniel Hamermesh commented on a review of Kat Long’s The Forbidden Apple where he notes of how prohibitions have triggered unintended consequences.

Mr. Hamermesh wrote, ``The review describes a number of incidents where efforts to ban or restrict transactions in one market spilled over with negative consequences into a related market.

``To eliminate drinking on Sundays, New York City restricted it to hotels. In response, bars created makeshift hotel rooms, separated by dividers, which in turn created a burgeoning prostitution business. To avoid having men buy a drink in a bar in order to use the only publicly available restroom, the city opened public restrooms. But this created places where gay sex could proliferate.

``Both of these examples illustrate the law of unintended consequences: actions that restrict quantity or price in one market will affect them in related markets. Indeed, they may even create markets that nobody had heretofore imagined. No doubt there are many other, equally prurient examples.” (bold highlight mine)

Mr. Hamermesh’s remarks reminds us of how the “restrictions” based regulatory arbitrages in the financial sector spawned “related markets” in derivatives, the shadow banking system and other “structured finance” instruments.

As Paul Farrell wrote in the marketwatch.com in 2008, `` The fact is, derivatives have become the world's biggest "black market," exceeding the illicit traffic in stuff like arms, drugs, alcohol, gambling, cigarettes, stolen art and pirated movies. Why? Because like all black markets, derivatives are a perfect way of getting rich while avoiding taxes and government regulations. And in today's slowdown, plus a volatile global market, Wall Street knows derivatives remain a lucrative business.” (bold highlight mine)

These innovative vehicles ultimately served as the principal financing conduits or the “black markets” which fueled the colossal real estate bubble that subsequently shaped today’s crisis.

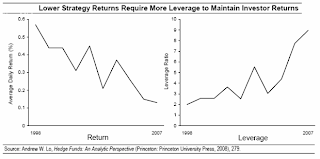

Essentially the banking system which sought for higher yields took advantage of legal loopholes to assume more risks by leveraging up. Hedge instruments became speculative and Ponzi financed.

Although the actions of the "bailout cultured" banking system had been partially typical of an arbitrageur, which as Michael Mauboussin of Legg Mason says is driven by “The idea is simple and intuitive: a smart subset of investors cruise markets seeking discrepancies between price and value and make small profits closing those aberrant gaps.”

Chart from Michael Mauboussin of Legg Mason

Chart from Michael Mauboussin of Legg MasonNonetheless Chris Whalen of Institutional Risk Analytics gives an example of how AIG morphed from an insurance and reinsurance business model to a Ponzi by virtue of “regulatory arbitrage” or “may even create markets that nobody had heretofore imagined” (Daniel Hamermesh)…

``One of the first things we learned about the insurance world is that the concept of "shifting risk" for a variety of business and regulatory reasons has been ongoing in the insurance world for decades. Finite insurance and other scams have been at least visible to the investment community for years and have been documented in the media, but what is less understood is that firms like AIG took the risk shifting shell game to a whole new level long before the firm's entry into the CDS market….

``One of the most widespread means of risk shifting is reinsurance, the act of paying an insurer to offset the risk on the books of a second insurer. This may sound pretty routine and plain vanilla, but what most people don't know is that often times when insurers would write reinsurance contracts with one another, they would enter into "side letters" whereby the parties would agree that the reinsurance contract was essentially a canard, a form of window dressing to make a company, bank or another insurer look better on paper, but where the seller of protection had no intention of ever paying out on the contract…

``It is important to understand that a side letter is a secret agreement, a document that is often hidden from internal and external auditors, regulators and even senior management of insurers and reinsurers….

``It appears to us that, seeing the heightened attention from regulators and federal law enforcement agencies such as the FBI on side letters, AIG began to move its shell game to the CDS markets, where it could continue to falsify the balance sheets and income statements of non-insurers all over the world, including banks and other financial institutions.

Read the rest here