The Social Security pamphlet of 1936 read, “Beginning November 24, 1936, the United States Government will set up a Social Security account for you. … The checks will come to you as a right” (http://tinyurl.com/maskyul). Therefore, Americans have been led to believe that Social Security is like a retirement account and money placed in it is their property. The fact of the matter belies that belief.A year after the Social Security Act’s passage, it was challenged in the U.S. Supreme Court, in Helvering v. Davis. The court held that Social Security is not an insurance program, saying, “The proceeds of both employee and employer taxes are to be paid into the Treasury like any other internal revenue generally, and are not earmarked in any way.” In a 1960 case, Flemming v. Nestor, the Supreme Court held, “To engraft upon the Social Security system a concept of ‘accrued property rights’ would deprive it of the flexibility and boldness in adjustment to ever-changing conditions which it demands.”Decades after Americans had been duped into thinking that the money taken from them was theirs, the Social Security Administration belatedly — and very quietly — tried to clean up its history of deception. Its website explains, “Entitlement to Social Security benefits is not (a) contractual right.” It adds: “There has been a temptation throughout the program’s history for some people to suppose that their FICA payroll taxes entitle them to a benefit in a legal, contractual sense.… Congress clearly had no such limitation in mind when crafting the law” (http://tinyurl.com/49p8fl2). The Social Security Administration failed to mention that it was the SSA itself, along with Congress, that created the lie that “the checks will come to you as a right.”Here’s my question to those who protest that their Social Security checks are not an entitlement or handouts: Seeing as Congress has not “set up a Social Security account for you” containing your Social Security and Medicare “contributions,” where does the money you receive come from? I promise you it’s neither Santa Claus nor the tooth fairy. The only way Congress can send checks to Social Security and Medicare recipients is to take the earnings of a person currently in the workforce. The way Congress conceals its Ponzi scheme is to dupe Social Security and Medicare recipients into thinking that it’s their money that is put away and invested. Therefore, Social Security recipients want their monthly check and are oblivious about who has to pay and the pending economic calamity that awaits future generations because of the federal government’s $100 trillion-plus unfunded liability, of which Social Security and Medicare are the major parts.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, November 05, 2013

Why Social Security Is Not an Insurance

Friday, June 29, 2012

Understanding Political Terminologies 2: Social Justice, Greece, Austerity and Insurance

Political language have been deliberately mangled to suit and promote the interests of political agents and their followers. I have given a few examples earlier.

More examples:

1. SOCIAL JUSTICE

Once again here is the brilliant Thomas Sowell on “Social Justice”

If there were a Hall of Fame for political rhetoric, the phrase "social justice" would deserve a prominent place there. It has the prime virtue of political catchwords: It means many different things to many different people.

In other words, if you are a politician, you can get lots of people, with different concrete ideas, to agree with you when you come out boldly for the vague generality of "social justice."

Justice Oliver Wendell Holmes said that a good catchword can stop thought for 50 years. The phrase "social justice" has stopped many people from thinking, for at least a century -- and counting.

If someone told you that Country A had more "social justice" than Country B, and you had all the statistics in the world available to you, how would you go about determining whether Country A or Country B had more "social justice"? In short, what does the phrase mean in practice -- if it has any concrete meaning?

In political and ideological discussions, the issue is usually whether there is some social injustice. Even if we can agree that there is some injustice, what makes it social?

Surely most of us are repelled by the thought that some people are born into dire poverty, while others are born into extravagant luxury -- each through no fault of their own and no virtue of their own. If this is an injustice, does that make it social?

The baby born into dire poverty might belong to a family in Bangladesh, and the one born to extravagant luxury might belong to a family in America. Whose fault is this disparity or injustice? Is there some specific society that caused this? Or is it just one of those things in the world that we wish was very different?

If it is an injustice, it is unjust from some cosmic perspective, an unjust fate, rather than necessarily an unjust policy, institution or society.

Investing guru Doug Casey also shares more verbal twisting (Greece and Austerity)…

2. GREECE

it's not "Greece" we're talking about, but the Greek government. It's the Greek government that's made the laws that got people used to pensions for retirement at age 55. It's the Greek government that's built up a giant and highly paid bureaucracy that just sits around when it's not actively gumming up the economy. It's the Greek government that's saddled the country with onerous taxes and regulations that make most business more trouble than it's worth. It's the Greek government that borrowed billions that the citizens are arguably responsible for. It's the Greek government that's set the legal and moral tone for the pickle the place is in.

3. AUSTERITY

the term "austerity" is used very loosely by the talking heads on TV. It sounds bad, even though it just means living within one's means… or, for Europeans, not too insanely above them. But who knows what's actually included or excluded from what the EU leaders think of as austerity? Take the Greek pension funds, for example: exactly how are they funded? I'd expect that private companies make payments to a state fund, as Americans do via the Social Security program. I suspect there's no money in the coffers; it's all been frittered on high living and socialist boondoggles. Tough luck for pensioners. Maybe they can convince the Chinese to give them money to keep living high off the hog…

4. I would add INSURANCE as camouflage for the Welfare State

From Murray N. Rothbard,

The answer is the very existence of health-care insurance, which was established or subsidized or promoted by the government to help ease the previous burden of medical care. Medicare, Blue Cross, etc., are also very peculiar forms of "insurance."

If your house burns down and you have fire insurance, you receive (if you can pry the money loose from your friendly insurance company) a compensating fixed money benefit. For this privilege, you pay in advance a fixed annual premium. Only in our system of medical insurance, does the government or Blue Cross pay, not a fixed sum, but whatever the doctor or hospital chooses to charge.

In economic terms, this means that the demand curve for physicians and hospitals can rise without limit. In short, in a form grotesquely different from Say's Law, the suppliers can literally create their own demand through unlimited third-party payments to pick up the tab. If demand curves rise virtually without limit, so too do the prices of the service.

In order to stanch the flow of taxes or subsidies, in recent years the government and other third party insurers have felt obliged to restrict somewhat the flow of goodies: by increasing deductibles, or by putting caps on Medicare payments. All this has been met by howls of anguish from medical customers who have come to think of unlimited third-party payments as some sort of divine right, and from physicians and hospitals who charge the government with "socialistic price controls" — for trying to stem its own largesse to the health-care industry!

In addition to artificial raising of the demand curve, there is another deep flaw in the medical insurance concept. Theft is theft, and fire is fire, so that fire or theft insurance is fairly clear-cut the only problem being the "moral hazard" of insurees succumbing to the temptation of burning down their own unprofitable store or apartment house, or staging a fake theft, in order to collect the insurance.

In the world of politics,lies, distortions and equivocations are the norm.

Don't fall for them

Saturday, November 19, 2011

Key Man Risk: With Steve Jobs Gone, Apple In A Funk

From Bloomberg,

Anyone who expects Apple Inc.’s growth to rebound after sales and earnings shortfalls last quarter is “living in denial,” according to David Nelson, chief strategist at Belpointe Asset Management LLC.

As the CHART OF THE DAY shows, shares of the maker of iPhones and iPad tablet computers have trailed the Standard & Poor’s 500 Index and a gauge of S&P 500 technology companies since the company reported fourth-quarter results a month ago.

“This is no longer a hyper-growth company,” Nelson said yesterday in a telephone interview. Apple’s products are now reaching customers who are less likely to upgrade as newer models are released, he added…

Let me first disclose that I have no interest in Apple [AAPL] since I don’t use Apple’s products nor am I a stockholder.

The reason I posted this is to show what in insurance is known as Key Man Risk—the effect of losing one important member of the team.

I have no judgment of Apple except to say that the market currently prices the company as undergoing an uncertain transition process without the presence of the Key Man—Steve Jobs. In short, Apple appears to be suffering from a Key Man Risk.

I think the same Key Man dynamics will apply to Warren Buffett’s Berkshire Hathaway [BRK/A and BRK/B] or to Bill Gates’ Microsoft [MSFT] or to any successful company whose image has been built as an alter ego of the owner-manager.

Nonetheless, I don’t think that the markets has entirely written off Apple, as all will depend on the performance of the current team (owners and managers) in serving the consumers, which should theoretically reflect on the company’s stock prices.

Thursday, April 09, 2009

Negative Chain Effects from Regulatory Arbitrage: The AIG experience

In the Freakonomics blog, Daniel Hamermesh commented on a review of Kat Long’s The Forbidden Apple where he notes of how prohibitions have triggered unintended consequences.

Mr. Hamermesh wrote, ``The review describes a number of incidents where efforts to ban or restrict transactions in one market spilled over with negative consequences into a related market.

``To eliminate drinking on Sundays, New York City restricted it to hotels. In response, bars created makeshift hotel rooms, separated by dividers, which in turn created a burgeoning prostitution business. To avoid having men buy a drink in a bar in order to use the only publicly available restroom, the city opened public restrooms. But this created places where gay sex could proliferate.

``Both of these examples illustrate the law of unintended consequences: actions that restrict quantity or price in one market will affect them in related markets. Indeed, they may even create markets that nobody had heretofore imagined. No doubt there are many other, equally prurient examples.” (bold highlight mine)

Mr. Hamermesh’s remarks reminds us of how the “restrictions” based regulatory arbitrages in the financial sector spawned “related markets” in derivatives, the shadow banking system and other “structured finance” instruments.

As Paul Farrell wrote in the marketwatch.com in 2008, `` The fact is, derivatives have become the world's biggest "black market," exceeding the illicit traffic in stuff like arms, drugs, alcohol, gambling, cigarettes, stolen art and pirated movies. Why? Because like all black markets, derivatives are a perfect way of getting rich while avoiding taxes and government regulations. And in today's slowdown, plus a volatile global market, Wall Street knows derivatives remain a lucrative business.” (bold highlight mine)

These innovative vehicles ultimately served as the principal financing conduits or the “black markets” which fueled the colossal real estate bubble that subsequently shaped today’s crisis.

Essentially the banking system which sought for higher yields took advantage of legal loopholes to assume more risks by leveraging up. Hedge instruments became speculative and Ponzi financed.

Although the actions of the "bailout cultured" banking system had been partially typical of an arbitrageur, which as Michael Mauboussin of Legg Mason says is driven by “The idea is simple and intuitive: a smart subset of investors cruise markets seeking discrepancies between price and value and make small profits closing those aberrant gaps.”

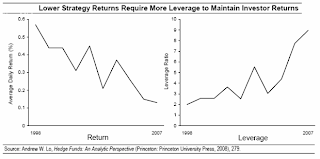

Chart from Michael Mauboussin of Legg Mason

Chart from Michael Mauboussin of Legg MasonNonetheless Chris Whalen of Institutional Risk Analytics gives an example of how AIG morphed from an insurance and reinsurance business model to a Ponzi by virtue of “regulatory arbitrage” or “may even create markets that nobody had heretofore imagined” (Daniel Hamermesh)…

``One of the first things we learned about the insurance world is that the concept of "shifting risk" for a variety of business and regulatory reasons has been ongoing in the insurance world for decades. Finite insurance and other scams have been at least visible to the investment community for years and have been documented in the media, but what is less understood is that firms like AIG took the risk shifting shell game to a whole new level long before the firm's entry into the CDS market….

``One of the most widespread means of risk shifting is reinsurance, the act of paying an insurer to offset the risk on the books of a second insurer. This may sound pretty routine and plain vanilla, but what most people don't know is that often times when insurers would write reinsurance contracts with one another, they would enter into "side letters" whereby the parties would agree that the reinsurance contract was essentially a canard, a form of window dressing to make a company, bank or another insurer look better on paper, but where the seller of protection had no intention of ever paying out on the contract…

``It is important to understand that a side letter is a secret agreement, a document that is often hidden from internal and external auditors, regulators and even senior management of insurers and reinsurers….

``It appears to us that, seeing the heightened attention from regulators and federal law enforcement agencies such as the FBI on side letters, AIG began to move its shell game to the CDS markets, where it could continue to falsify the balance sheets and income statements of non-insurers all over the world, including banks and other financial institutions.

Read the rest here