Social Security has been sold to the public as insurance. The reality is that coercive redistributive welfare programs (Rothbard, Friedman) have been hijacked and repackaged as “insurance” by the progressive left to make these sound or appear politically palatable.

Even legalistically, Social Security isn’t an insurance. American economist, author and professor Walter E. Williams explains at the Lew Rockwell.com (bold mine)

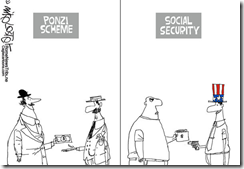

The Social Security pamphlet of 1936 read, “Beginning November 24, 1936, the United States Government will set up a Social Security account for you. … The checks will come to you as a right” (http://tinyurl.com/maskyul). Therefore, Americans have been led to believe that Social Security is like a retirement account and money placed in it is their property. The fact of the matter belies that belief.A year after the Social Security Act’s passage, it was challenged in the U.S. Supreme Court, in Helvering v. Davis. The court held that Social Security is not an insurance program, saying, “The proceeds of both employee and employer taxes are to be paid into the Treasury like any other internal revenue generally, and are not earmarked in any way.” In a 1960 case, Flemming v. Nestor, the Supreme Court held, “To engraft upon the Social Security system a concept of ‘accrued property rights’ would deprive it of the flexibility and boldness in adjustment to ever-changing conditions which it demands.”Decades after Americans had been duped into thinking that the money taken from them was theirs, the Social Security Administration belatedly — and very quietly — tried to clean up its history of deception. Its website explains, “Entitlement to Social Security benefits is not (a) contractual right.” It adds: “There has been a temptation throughout the program’s history for some people to suppose that their FICA payroll taxes entitle them to a benefit in a legal, contractual sense.… Congress clearly had no such limitation in mind when crafting the law” (http://tinyurl.com/49p8fl2). The Social Security Administration failed to mention that it was the SSA itself, along with Congress, that created the lie that “the checks will come to you as a right.”Here’s my question to those who protest that their Social Security checks are not an entitlement or handouts: Seeing as Congress has not “set up a Social Security account for you” containing your Social Security and Medicare “contributions,” where does the money you receive come from? I promise you it’s neither Santa Claus nor the tooth fairy. The only way Congress can send checks to Social Security and Medicare recipients is to take the earnings of a person currently in the workforce. The way Congress conceals its Ponzi scheme is to dupe Social Security and Medicare recipients into thinking that it’s their money that is put away and invested. Therefore, Social Security recipients want their monthly check and are oblivious about who has to pay and the pending economic calamity that awaits future generations because of the federal government’s $100 trillion-plus unfunded liability, of which Social Security and Medicare are the major parts.

I previously made the same argument against the local pseudo health insurance (Philhealth) here