``Devaluation is the modern euphemism for debasement of the coinage. It always means repudiation. It means that the promise to pay a certain definite weight of gold has been broken, and that the devaluing government, for its bonds or currency notes, will pay a smaller weight of gold.”- Henry Hazlitt, From Bretton Woods to Inflation

Peso Bears: Being Right For the Wrong Reason

The US dollar rallied spiritedly against major global currencies for the second week.

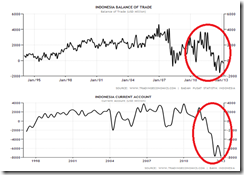

In Asia except for Indonesia’s rupiah, currencies fell across the board see figure 1.

Figure 1: Bloomberg: Bloomberg-JP Morgan Asia Dollar Index Breaks Down!

Figure 1: Bloomberg: Bloomberg-JP Morgan Asia Dollar Index Breaks Down!The Bloomberg-JP Morgan Asia Dollar Index is a trade and liquidity weighted index that incorporates the 10 most-active currencies in the region excluding the Japanese yen.

And as you can see from above chart, the market action during the past two weeks has been relatively volatile on a downside bias. Along with the global tide, the Philippine Peso fell 1.04% to Php 48.8.

And with the obvious breakdown, momentum appears to favor MORE weakening of Asian currencies over the INTERIM.

And for those forecasting a weaker peso, they may likely be proven correct BUT for the WRONG reasons.

From The CEE To The South Korean Won Contagion

As we have discussed in last week’s Central And Eastern Europe’s “Sudden Stop” Fuels US Dollar Rally, the problem in Europe have now reached Asian shores, where the principal manifestation of the apparent contagion has been through the nexus in the South Korean Won which hit an 11 year LOW see Figure 2.

Figure 2: Reuters: Rising Default Risks Weigh on the South Korean Won

Figure 2: Reuters: Rising Default Risks Weigh on the South Korean WonAccording to a report from Reuters (highlight mine), ``South Korea's massive dollar-selling intervention late last year had helped the won recover some momentum, but fears of defaults and balance of payments crises in eastern European this year have sapped investors confidence anew.

``Investors are worried that the heightened risk aversion would make it extremely difficult for South Korea to tap into the global market to secure sufficient dollar funding to pay back maturing foreign debt.”

In other words, our observation of Europe’s CEE asphyxiation of capital flows or the typical emerging market crisis symptom known as the “sudden stop” appears to validate our thesis.

More from the same Reuters report, ``The won's drop came even after data showed on Friday that South Korea's balance of payments surplus hit a near 2-year high in January as domestic investors sold off their foreign portfolio holdings and foreigners bought local shares.

``Banks in South Korea, including those run by foreigners, had $126.6 billion of foreign debt due this year as of the end of January, out of the total $182.3 billion worth, the government said Friday.

``South Korea has said its foreign currency reserves of more than $200 billion and currency swap arrangements sealed with the United States, Japan and China totalling some $90 billion were more than sufficient to cover any emergency situation.

``It has also said it was not obliged to repay all the debts because some were owed by foreign banks and some others were linked to currency hedging by their corporate clients.”

It is rare to find mainstream articles that are objectively framed such as the above.

Figure 3 Reuters: Asia’s Corporate Debt Maturity

Figure 3 Reuters: Asia’s Corporate Debt MaturityNonetheless the problem of the won seem to focus on securing “rollover” financing for maturing US dollar corporate debts (see figure 3) as the immediate concern.

The scramble for US dollars as consequence to the “sudden stop” in the CEE region compounded by the near term maturities of mostly South Korean debt comprising 51% of Asia’s debt exposure for 2009, appears to have created an artificial US dollar shortage. Thus, the surge of the US dollar across Asia.

Notice that ASEAN’s share of maturing corporate debts are spread over the coming years albeit with incremental increase in volume. This suggests that there seem to be less liquidity constraints over the interim but nonetheless the region’s currency performances have been weighed by predominantly glum sentiment than warranted by fundamentals.

And South Korea’s policy approach to help alleviate the problem, again from the Reuters, ``it would exempt foreign investors from income and capital gains taxes on investment in local treasury bonds and monetary stabilisation bonds to lure more foreign capital into the country.”

Put differently, the South Korean government appears to be reacting out of the confusion wrought from the market distress. On one hand, South Korea threatens to default on loans acquired from currency hedges which could further raise property right issues and compound capital efflux, and on the other hand, the recent tax exemption on taxes on foreigners have been designed to attract capital flows.

Fooled By Both Complexity and Simplicity

Yet in nearly every article, almost every “experts” quoted blamed Asia’s falling currencies on the collapse of exports which for us is highly fallacious. Why?

Because:

One, NOT because “A” and “B” regularly occur together, does it necessitate the conclusion that “A” is the cause of “B”. This known as the fallacy of “Confusing Cause and Effect”.

Falling exports are last month’s data, while the currency markets should be “forward looking”. Therefore, the reading of last month’s data which is used as basis to project into the future is almost equivalent to interpreting events linearly (or assuming continuity of past events) in a highly complex world. If you read into the terms of services of investment institutions, the fine print usually says “Past Performance does not guarantee future outcome”.

This rationalization seems similar to our homegrown experts who, on the other hand, diagnose the ‘weakening’ of the Philippine Peso to the prospects of falling remittances. But even worst, such oversimplification appears hardly associated at all!

As we pointed in The Tenuous Correlation of Remittances and the Philippine Peso, ``Here are the facts: The Peso in 2008 fell 15% even as remittance growth accounted for 15% for the first 11 months according to the IHT (estimated by World Bank to account for 18% growth for 2008). Growing remittances against a falling Peso, so how valid is this concept?”

Two, lacking the depth of analysis meant for oversimplified explanation for public consumption, the availability of current events are then utilized as the functional cause-and-effect variables. This is a cognitive folly known as the Available bias.

News outfits are meant to cater to easy explanations more than comprehensive analysis, thus the public usually gets what they deserve.

To quote my favorite client, who delivers an incisive comment, ``It's a paradox: those involved are fooled by complexity and those analyzing the situation are fooled by simplicity.”

The world or markets isn’t merely about “demand” or “exports” only, as some experts would like us to believe. To quote Friedrich August von Hayek in a 1992 interview, ``You can't explain anything of social life with a theory which refers to only two or three variables.” Currency values reflect on the complexity of social phenomenon.

Three, this represents as wooly economic reasoning.

The problem of falling exports or falling remittances as driver for currency prices is established upon reduced foreign exchange receipts, which obviously, revert to the concern of the relative state of the Balance of Payment (BoP) of the countries in focus.

But what if imports fall FASTER than exports, as in the case of China (see Figure 5)?

The palpable reply is that net Balance of Trade remains a surplus. Similar to China’s case, despite a nasty fall in exports which had been offset by an even nastier collapse in imports, China’s trade surplus remained at second to the highest recorded level seen last November.

The principal concern is that current account deficit countries, like those in the CEE region, won’t be adequately financed and would prompt for sharp adjustments in currency values which subsequently would percolate to the real economy in the manifestation of an economic recession or a crisis.

Although, fundamentally, current account deficits derived from falling exports can always be financed out of foreign currency reserves or by foreign currency borrowing from the local or international markets or as in the past case of US- exports of toxic financial claims. All these depend on the degree of deficits or the availability and the accessibility of financing and importantly the prevailing market sentiment.

And as the Reuters report aptly pointed out, concerns over these “rollover refinancing” on US dollar denominated debts has raised default concerns.

Fourth, currencies are like a coin, they are two faced.

As we have repeatedly been saying the currency market is basically a zero sum game, where one wins and the other loses. This means you can’t evaluate currencies from a ONE dimensional perspective.

If the concerns in Asia seem mainly about the prospective “deficits” arising from the slackening of foreign exchange receipts, then the US which has had substantial improvements in its current account balances, but still remains on a deficit, would also most likely encounter prospective funding pressures as their government embarks on a massive fiscal program.

According to CNN, ``Based on the proposed budget, the administration projects the deficit for fiscal year 2009 will reach $1.75 trillion, or 12.3 percent of U.S. gross domestic product. That's a record in dollar terms and is the highest as a share of GDP since World War II.”

The ballooning fiscal deficit will eventually translate to expanded current account deficits as the expanded budget will be realized as government spending. And we believe that more government spending will be in store not only for the US but for most of the world.

In short, both Asia and the US are faced with the risks of deficit financing.

Figure 6: Financial Times: Sectoral and Public Debt Distribution

Figure 6: Financial Times: Sectoral and Public Debt DistributionFifth, the law of scarcity means competition for funds.

In the US, today’s deflating debt bubble discernibly means a shriveling of the financial and household sector debt which constituted as the core of the boom in credit growth during the bubble years see figure 6 (left pane). And government debt which remained “underutilized” has now been calibrated as a substitute (right pane) and is seen as exploding.

As Doug Noland aptly comments in this week’s Credit Bubble Bulletin, ``Today’s unparalleled expansion of federal debt and obligations is being dressed up as textbook “Keynesian.” It’s rather obvious that we are in dire need of some new books, curriculum and economic doctrine. But from a political perspective, the title is appropriate enough. From an analytical framework perspective such policymaking is more accurately labeled “inflationism” – a desperate attempt to prop inflated asset prices, incomes, business revenues, government receipts and economic “output”. There have been many comparable sordid episodes throughout history, and I am not aware of any positive outcomes.”

In other words, the exhaustive attempt to prop the old bubble system with government as the surrogate could extrapolate to multifaceted risks in the future. And as governments accelerate “reflation” with even more dosage of “reflation” in the future, global governments will actively be competing against each other to secure financing from global or local investors or savers.

Therefore, Asia and the US doesn’t only face risks from financing deficits, they will be competing feverishly against each other if only to pay for the present government expenditures.

Sixth, the silence of King Dollar’s role.

Everybody talks about “deficits” (exports, trade, current account etc…), but nobody talks about relative deficits. Are risks from deficits only an ex-US dollar phenomenon? Particularly, nary an interest has been made to categorically distinguish between the deficit risks of the US dollar and of the other currencies.

As the de facto currency international standard, whose liabilities are denominated on its own currency, the US dollar operates on a privileged platform. Since the global banking reserves and world trade are mostly anchored to the US dollar, the US has the ability to underwrite its own deficits. On the other hand, foreigners fund US deficits by buying US denominated financial claims.

Nonetheless, the US dollar’s authority doesn’t come without limitations. If there will be a funding shortfall, this implies of higher interest rates and greater than expected “inflation” or the risks of hyperinflation which may also translate to currency risks.

To quote Joachim Fels of Morgan Stanley, ``given the size of the current and prospective economic and financial problems, and given the size of the monetary and fiscal stimulus that central banks and governments are throwing at these problems, investors would be well advised not to ignore this tail risk, especially as markets are priced for the opposite outcome of lasting deflation in the next several years. Put differently, we believe that buying some insurance against the black swan event of high inflation or even hyperinflation makes sense and is relatively cheap currently.”

The Case For A Short Term US dollar Rally

Finally, the presently falling Asian currencies could reflect a combination of the following factors:

1. Improving US trade account balances in the US suggests of lesser US dollars in circulation worldwide. As the US buys less than what she sells to the world, this implies that more US dollars are going INTO the US than headed overseas.

2. The persisting turmoil in the US banking and financial system as signified by the concerns over the outright nationalization of key banks as the Citibank and Bank of America suggest that the gargantuan money printed by the US Federal Reserve and or money from the US Treasury earmarked for the financial system on its alphabet soup of programs, hasn’t been enough to cover the losses in the US financial system. This seems to be validated by the continued decline of US equity markets which have been weighed by banking and finance related losses. The top 5 industries with most losses according to bigcharts.com on a year to date basis are US Full line insurance 67.31%, Life insurance index 53.41%, Forestry and Paper Index 50.86%, Paper Index 50.86% and Banks 48.82%.

Therefore, such deficits appear to signify continued drainage of substantial liquidity in the global financial system despite the collective measures of central banks to patch these.

3. The ensuing capital deficiencies in the US and European banking system have diffused into emerging markets. This has triggered a “sudden stop” in the CEE region, which has exacerbated the present economic conditions. Combined with the unintended consequences from government guarantees (where capital or savers temporarily seek refuge or have shifted their monies to countries with guarantees on the financial system that has an international reserve currency stamp), the dearth in liquidity and overwhelmingly morose market sentiment (such as chatters of dismemberment of the Euro) have prompted for capital flight and exodus in the region. Conversely, this means greater demand of US dollars.

4. Sporadic evidences of speculative attacks on emerging market currencies such as in Mexico’s Peso, according to the Northern Trust.

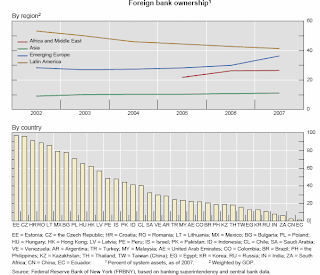

5. The deglobalization trends in the financial world. Government rescues of several home institutions have mandated reduced overseas exposure. The Financial Times Alphaville’s Gwen Robinson quotes a study from Greenwich Associates, ``the shift in corporate banking business from global to local providers appears to be gathering steam as the world’s biggest financial firms face new political pressures that make international lending more difficult, the report noted. Right now, there is little incentive for the big UK and US banks to extend credit to companies outside of their home markets and it is becoming increasingly hard to operate as an international bank, it noted.”

Deglobalization trends imply less liquidity in the system.

6. Lastly concerns over the paucity of systemic liquidity have raised concerns over the ability to rollover maturing near term US dollar denominated debt seem to have fueled a speculative run on the South Korean won.

The run in the won has equally undermined most of Asia’s currencies last week, except the Indonesia’s rupiah which was bolstered by speculations of a possible currency swap arrangement with the US.

According to Bloomberg, ``Indonesia proposed a currency-swap accord with the U.S. to help bolster the rupiah, during Secretary of State Hillary Clinton’s visit to Jakarta last week.” Despite the appearance of exemplary performance, the Rupiah is reportedly down 4.5% over the month.

As you can see the recent softening of Asian currencies can’t be read simplistically from an “export meltdown” or “slowdown in remittances” angle.

Using the Occam Razor’s rule or where “one should not increase, beyond what is necessary, the number of entities required to explain anything,” the deflationary and recessionary pressures appear to be twin forces that have conspiring to suction out liquidity from the financial sphere.

Seen from the obverse perspective, despite the surge in its fiscal deficit, the recent strength of the US dollar has virtually been drawn from its authority as the world’s reserve currency status more than anything else.

However, with the US government attempting to massively inflate the system by undertaking direct expenditures, which is a similar route taken by Zimbabwe’s Dr. Gideon Gono; funding concerns, higher interests rate and greater than expected inflation could likely undercut the strength of the US dollar. This gets to be highlighted once the distribution of government financing exceeds the losses in the system. Until when such deflationary forces shall prevail is something we can’t say, albeit we appear to be witnessing signs of recovering commodity prices.

In short, the strength of the US dollar is likely to be temporary (short to medium term) feature.