We humans, facing limits of knowledge, and things we do not observe, the unseen and the unknown, resolve the tension by squeezing life and the world into crisp commoditized ideas, reductive categories, specific vocabularies, and prepackaged narratives, which, on the occasion, has explosive consequences- Nassim Nicolas Taleb, The Bed Of Procrustes

It’s crystal ball peeking time.

Much of what we’ve been saying here isn’t likely to change for 2011, except to say that perhaps most of what we have been predicting may accelerate or escalate.

Here are the factors, which I perceive, constitute as the major drivers of the global asset markets (this includes the Philippines):

1. Monetary authorities of developed economies will fight to sustain low interest rates.

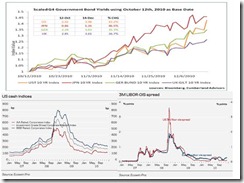

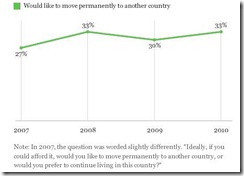

This comes even amidst pressures on the bond markets (see figure 1)

Figure 1: Economagic: US Treasury Yields leads Fed Fund Rate

Rising treasury yields (see green line) almost always leads Fed interest rates (red line). Said differently, markets influence policies than the other way around.

In addition, the Fed’s rates only reveal the path dependency or the penchant to artificially keep down interest rates until forced by hand by the markets.

Yet, rising interest rates do not automatically equate to financial markets turmoil, as suggested by some perma bears, who desperately keeps looking for all sorts of excuses to pray for the markets to go lower. The US S&P 500 index (blue) shows how US equities had surfed the rising interest tide over the years, until they have reached some pivotal point.

Nevertheless, it is important to determine the genuine dynamics of the interest rate movements[1] rather than to impute personal bias-based conclusions that are largely unfounded.

And as we earlier pointed out[2],

Rising interest rates presuppose one of the following drivers: increased demand for credit, concerns over credit quality, emerging scarcity of capital or the deepening inflation expectations.

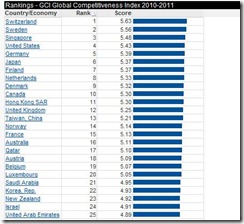

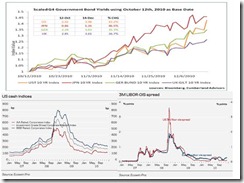

Figure 2: Rising Yields A Global Phenomenon (charts courtesy of Cumberland Advisors[3] and Danske Bank[4])

Let me further point out scarcity of capital can be a consequence of perceived insecurities from political environment or protectionism.

Yet, the fact that rising interest rate appears to be a global phenomenon (see figure 2-upper window) suggest that the current interest dynamics has been less about credit quality concerns (despite the ongoing PIIGs crisis) but more about emerging inflation expectations, and secondarily, rising demand for credit.

Even China, whom sporadically applied some brakes over her system’s rapidly growing credit due to bubble concerns this year, has also been vacillating to implement a tight monetary environment despite posting inflation rates at 28-month high[5]. China reportedly plans to allow some 7 trillion yuan ($1.1 trillion) in new loans for 2011[6].

So like any conventional approach, when caught between the bind of choosing between the proverbial devil (the temporal benefits from inflationism) and the deep blue sea (prospects of having to suffer from economic rebalancing). Authorities as will most likely choose the former.

2. More Inflationism: Bailouts and QEs To Continue

In spite of the rhetoric on austerity, authorities of major developed economies will likely engage in more inflationism, stealthily coursed through central banks or in central banking vernacular “quantitative easing” or “credit easing”.

At the start of the year, policymakers blabbered about ‘exit strategies’ which we accurately debunked and exposed as poker bluff[7].

Even if the US had been declared out of recession by the National Bureau of Economic Research (NBER) in June of 2009[8], a non profit group in charge of ascertaining recession and business cycles, the Federal Reserve have stubbornly persisted on using the printing press option.

Incidentally and ironically, popular economic experts have again failed miserably with their misguided forecasts, such as Keynesian high priest Paul Krugman[9] and populist Nouriel Roubini[10] both whom had predicted of a large probability a double-dip recession, which apparently did NOT materialize this year.

Just how could these so called experts be so frequently awfully wrong, yet get so much the public’s attention?! As Nassim Taleb rightfully dissects, economics cannot digest the idea that the collective (and the aggregate) are disproportionately less predictable than individuals[11]. Of course Mr. Taleb refers to mainstream economics which fixates on mathematical-empirical formalism rather than the study of people’s actions or conduct (praxeology).

This also demonstrates that the public has hardly been concerned about accuracy or about dealing with reality. Instead the public have been indulging or assimilating dogmatic ideas that confirms to their beliefs or which runs along with their line of thinking, regardless if they work in the real world.

Nonetheless, we further argued that such inflationist policies had been actually directed at the banking system, which actually operates as some form of cartel under the aegis of central banks. Officials have only used the economy, particularly the employment figures, as cover[12] in order to continue with the redistributive process of ‘privatizing profits and socializing losses’ in order to buttress the banking sector.

To add, if higher treasury yields will translate to higher mortgage rates and thereby put renewed pressure on the housing markets, then we can expect more versions of QE to be activated. QE 2.0 has barely waded into the water and now Fed officials as Bernanke appear to be telegraphing or conditioning the public for a QE 3.0[13].

And this isn’t going to change anytime soon. Not unless consumer inflation runs berserk and consequently weigh on the political dimensions that would affect policymaking.

Yet while I am very pleased that Congressman Ron Paul will take over as the chairman of the Domestic Monetary Policy Subcommittee of the House Financial Services Committee[14], it remains uncertain whether Congressman Paul can successfully overhaul, or diminish the role of, or dismember the deeply entrenched interest groups that constitute the banking cartel, or at the least make a dent on the making the Federal Reserve transparent. Subjecting monetary policies to free market forces should salvage the system from self-disintegration (read: sell gold).

And the same dynamics appears to take hold whether in the Eurozone or Japan or the United Kingdom. Every perceived crisis would be met by the same approach.

My point is: bailouts and flooding the world with liquidity would remain instrumental in determining the direction of asset prices in 2011.

3. Effects of Divergent Monetary Policies

Divergent monetary policies will impact emerging markets and developed markets distinctly, with the former benefiting from the transmission effects from the latter’s policies.

While most economic experts will talk about interrelationships of the output gap, economic growth and trilemma of international finance or the impossible trinity[15] of fixed exchange rate, free capital movement and independent monetary policies-where only two of the three conditions can be attained, we see current coordinated policies as no more than designed to artificially promote growth by inflating bubbles.

Artificial low interest rates, which punish savers and rewards borrowers, have been the conventional or the orthodox policy treatment to modern financial and economic maladies. Thus, suppressed interest rates are likely to impact both domestic and international reallocation of resources applied to nations under the rubric of emerging markets and of nations classified as developed.

For nations whose banking and financial system have not been directly affected or impaired by the recent financial crisis, and for economies that had been relatively unscathed and whose financial system have been less leveraged and has been marked by high rate of savings, the impact from such interest rate policies have been dramatically magnified.

And this appears to be case for ASEAN bourses (see figure 3).

Figure 3: Policy Divergences And ASEAN Bourses

With the exception of Malaysia (green), the bellwethers of major ASEAN bourses, namely Philippines (yellow), Indonesia (Orange), and Thailand (red) has broken above the pre-crisis highs largely driven by the above stated dynamics.

Local investors will likely continue to ramp up speculations on asset prices (stocks, real estate[16] and private sector bonds) which should give some semblance of or will likely be interpreted as an ongoing economic boom, where in truth, many will account for misdirected investments.

And this will be amplified by portfolio flows from foreign funds, whose incentives to arbitrage on global markets have been driven by home policies of similar depressed interest rates and the deliberate debasement of their currency.

Add to that would be pressures from resurgent domestic inflation that would force up rates or the appreciation of the domestic currency or both, whose yield spreads would equally attract foreign arbitrage. Thus, in cognizance of the volatility of policy induced portfolio flows, some emerging markets have either been contemplating on capital controls[17] or have begun implementing them, albeit largely in a benign scale.

Yet one can’t discount the role of momentum or the herd mentality in the bidding up of asset prices, where psychology fuelled by circulating credit would lead to irrationality or extreme valuations which would be justified as “new paradigm”.

4. The Globalization Factor

Aside from globalization of monetary and administrative-fiscal policies, globalization of trade, migration and finance similarly plays a significant role in shaping asset prices.

While inflationism does play a role in the allocation of resources, so does globalization. So in one way globalization somewhat offsets the malinvestments from inflationism. However it remains to be seen how much of malinvestments can be muted by globalization.

Nevertheless, mainstream economics not only to tend misread the effects of globalization for political ‘mercantilist’ purposes, but likewise underestimate on the role it plays on the economy, as well as the rapidly changing dynamics behind these[18].

For instance many perma bears have mainly used “lack of aggregate demand” from developed economies as the principal reason to argue for “depression economics”.

But this is false for the simple reason that it oversimplifies and underestimates the impact of trade and of people’s action and likewise sees past performance as a static trend going forward!

And this is why high profile experts have entirely missed out predicting the recent rally or the recent improvements in the global economy

A good example of sicj underestimation is the dynamics of Asia’s domestic consumption (see figure 4).

Figure 4: DBS Research: Asia 2011 How Scissors Cut

According to the DBS Group Research[19],

Remember all that talk about global imbalances and the worry that if the US did not consume then Asia, which purportedly lived off the US, could not grow? Oops. Since 3Q08, US consumption has grown by 1%, or by paltry $27 bn. Asia’s consumption has grown by 22%, or by $225 bn. That’s an expansion 8x bigger than in the US. With new consumption running 8:1 in Asia’s favor, it’s simply no longer credible to claim that Asia’s growth depends on the US or that failure to fix some ‘imbalance’ puts global growth in peril. It doesn’t. US growth maybe in peril...but that’s another kettle of fish: one that everything to do with explosive leverage and abysmal risk management and nothing to do with current account surpluses or deficits.

So aside the mainstream missing out the improvement of Asia’s domestic consumption, the DBS Research group goes on to argue that the region’s growth has been spurred mostly by the private sector in spite of the safety nets applied (bottom window).

And as we have long argued, trade openness and economic freedom lubricates demand, which serves as the ultimate end of production. And demand isn’t constructed based on circular flows but on people’s changing subjective value preferences.

And for as long people are allowed to openly engage in free markets, depression-deflation economics, which stems largely from government bubble and protectionist policies that induces such systemic distortions, is no more than a figment of a mercantilists imagination. Under free markets, greater output translates to growth deflation that increases the public purchasing power.

Besides, the aggregate demand deflation camp also tends to underestimate the fundamental function of why central banks ever exist at all: they exist not only as a lender of last resort, but as financer of government liabilities or the financier of political goals of the political leaders.

To repeat, what generates market instability or what are called as “market failures” are fundamentally bubble policies and interventionism and not some random flux arisng from from the lack of confidence or “animal spirits”.

My Working Targets for 2011

So here is how I see 2011:

Unless inflation explodes to the upside and becomes totally unwieldy, overall, for ASEAN and for the Philippine Phisix we should see significant positive gains anywhere around 20-40% at the yearend of 2011 based on the close of 2010. Needless to say, the 5,000 level would seem like a highly achievable target. What the mainstream sees as an economic boom will signify a blossoming bubble cycle.

Of course my foremost barometer for the state of the global equity markets would be the price direction of gold, which I expect to continue to generate sustained gains and possibly clear out in a cinch the Roubini hurdle of $1,500[20].

To repeat, Gold hasn’t proven to be a deflation hedge as shown by its performance during the 2008 Lehman collapse. The performance of Gold during the Great Depression and today is different because gold served as a monetary anchor then. Today, gold prices act as a temperature that measures the conditions of the faith based paper money system.

In addition if inflation will become more widespread, then we should likewise see the oil jump above $100 per barrel and this will be accompanied by general increases in other commodity prices, particularly in food prices.

And in my opinion, while everyone likes to focus on what seems sensational, I’d focus on what I think is more important. I don’t expect the Euro to evaporate soon as some others suggest. I’d probably pay a closer look to China, whose yield curve appears to be flattening (see figure 5).

Figure 5 Asianbondsonline: China’s Flattening yield curve

And I will get to scream fire once the yield curve turns negative.

Finally, surging inflation may not be good for the stock market in the entirety but that would be conditional. It should be good for certain assets as commodities or real properties (see figure 6).

Figure 6: Stagflation’s Winners (courtesy of Dr. Marc Faber[21])

Based on a seemingly similar economic environment or during the stagflation days of 1970-1980, hard assets turned out to be the winner.

Of course, it would be a different picture once hyperinflation gets into play; equities became store of value in Weimar Germany (1921-1923) and in Zimbabwe (2000s-2009).

But this could be one of the two options that could likely happen once the next bubbles go bust. The other one is debt default.

For now, identifying the whereabouts of the bubble cycle is my primary concern. And it should be yours too.

[1] see Rising US Treasury Yields: Credit Quality Concern or Symptoms of Bubble Cycles, December 14, 2010

[2] see Global Markets And The Phisix: New Year Rally Begins, December 6, 2010

[3] Kotok, David R. The Bond Herd, 6% and Gold, Financialsense.com December 16, 2010

[4] Danske Bank, Basel III impact study published, Fxstreet.com December 16, 2010

[5] BBC.co.uk China sees inflation jump to 5.1%, a 28-month high, December 11, 2010

[6] Bloomberg.com China Said to Aim for at Least 7 Trillion Yuan Loans, December 13, 2010

[7] See Poker Bluff: The Exit Strategy Theme For 2010, January 11, 2010

[8] Marketwatch.com U.S. recession ended June 2009, NBER finds September 10, 2010

[9] Bloomberg.com, Krugman Sees 30-40% Chance of U.S. Recession in 2010, January 4, 2010

[10] Reuters.com Roubini says U.S. economy may dip again next year, May 29, 2009, Roubini, Nouriel Beware Of A Double-Dip Recession, March 11, 2010 Forbes.com

[11] Taleb, Nassim Nicholas The Bed of Procrustes, Philosophical and Practical Aphorisms Random House

[12] See QE 2.0: It’s All About The US Banking System, November 18, 2010

[13] See QE 3.0: How Does Ben Bernanke Define Change, December 6, 2010

[14] Norris, Floyd, Ron Paul Appears Poised to Irk the Fed Chief, December 16, 2010

[15] Wikipedia.org Impossible trinity

[16] See The Upcoming Boom In The Philippine Property Sector, September 12, 2010

[17] See The Possible Implications Of The Next Phase Of US Monetary Easing, October 17, 2010

[18] See iPhone Shows Why Global Imbalances Will Remain, December 16, 2010

[19] DBS Research, Asia 2011: How Scissors Cut, Economics Markets Strategy, December 9, 2010

[20] In 2009 Jim Rogers and Nouriel Roubini went into a heated public debate, where celebrity guru Roubini predicted that gold won’t surpass $1,500. See Jim Rogers Versus Nouriel Roubini On Gold, Commodities And Emerging Market Bubble, November 5, 2009

[21] Faber, Marc Tomorrow's Gold: Asia's Age of Discovery