The benefits of population growth come from the fact that the more people there are in the world, the more people you have to interact with, the more potential friends you have, the more potential mates, the more potential business partners, customers, employers, employees. But even more than any of that is the fact that we all free ride on each other’s ideas. Virtually all of our prosperity comes from the fact that each generation free rides on the ideas of the previous generation, and improves on them — not just uses those ideas in and of themselves, but uses them to inspire the next generation of ideas. We use them to build on and to make the world a more prosperous place. A lot of that is invisible. You have all this technology around you and you tend to forget the fact that had there been half as many people, there would have been half as many ideas — probably fewer than half, in fact, because ventures actually inspire each other, so there’s a more than linear buildup of ideas as the population grows.I like to say that when you’re stuck in traffic on a hot summer night, it’s very easy to remember that the guy in front of you is imposing the costs, and, unfortunately, you also easily forget that the guy who invented air conditioning has conferred on you quite a benefit. You remember that if the guy in front of you had never been born, your life would be a little easier right now — but it’s also easy to forget that if one less person had been born it might very well have been the guy who would’ve invented air conditioning, not the guy who’s in front of you. So, the real way in which people get this wrong, I think, is that the mind immediately goes to the fact that there is such a thing as too large a population. And there is such a thing as a population so large that the earth cannot support it — we all know that. But that does not address the question of whether the current population is too large or too small. And somehow people often confuse one of those questions with the other. I’m not sure why, but I’m out to unconfuse them.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, February 19, 2013

Quote of the Day: The Benefits of Population Growth

Sunday, February 10, 2013

Quote of the Day: Greatest Costs of Declining Fertility Are Missed Opportunities

Because the greatest costs of declining fertility aren't visible disasters, but missed opportunities. The millions and billions of people who are never born won't share their ideas with the world. They won't help spread the fixed costs of idea creation, product variety, and infrastructure. And they won't enjoy the gift of life. (If you're already objecting by listing the upsides of non-existence, think again). Low fertility isn't bad because we'll lose what is. Low fertility is bad because of we won't gain what could have been.

Thursday, June 14, 2012

Quote of the Day: Welfare Crisis Aggravated by Demographics

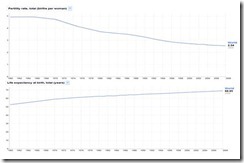

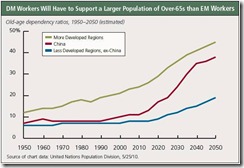

Demography is destiny. If so, then the future will be challenging in many countries around the world where fertility rates have dropped below the replacement rate. At the same time, people are living longer. So dependency ratios--the number of retirees divided by the number of earners--are destined to soar.

Why have fertility rates fallen around the world? There are a few plausible explanations. One of them stands out, in my opinion: Socialism may breed infertility! In the past, people relied on their children to support them in their old age. Your children were your old-age insurance policy. Over the past few decades, people have come to depend increasingly on social security provided by their governments. So they are having fewer kids.

That’s fine as long as the ratio of retirees to workers isn't so high that the burden of supporting our senior citizens crushes any incentive to work resulting from excessively high tax rates. The cost of increasingly generous and excessive entitlements has been soaring relative to taxable earned incomes even before dependency ratios are set to rise in many countries. Governments have chosen to borrow to finance social security and other entitlements, to avoid burdening workers with the extremely high tax rates that are necessary to balance entitlement-bloated budgets.

Median ages are highest in advanced economies with large social welfare states. Among the 45 major countries, Japan has the highest median age (44.7), while the Philippines has the lowest (22.2). Advanced economies tend to have higher median ages than emerging ones because they provide more social welfare, which boosts longevity and depresses fertility.

Bond markets may be starting to shut down for countries that have accumulated too much debt. That’s creating a Debt Trap for debt-challenged governments. If they slash their spending and raise their tax rates, economic growth will tend to slow. If tax revenues fall faster than spending, their budget deficits will widen. There has recently been an outcry about the hopelessness of such “austerian” policies that perversely lead to higher, rather than lower, debt-to-GDP ratios.

The demographic reality is that people around the world are living into their 80s and 90s. Some of them believe that they are entitled to retire in their late 50s and early 60s even though they are living longer. Yet, they didn’t have enough children to support them either directly (out-of-pocket) or indirectly (through taxation). Instead, they expect that their governments will support them. So governments have had to borrow more to fund retirement benefits. That debt is mounting fast and will be a great burden for our children. The result can only be described as the Theft of Generations.

That’s from Dr Ed Yardeni at his blog. To “depend increasingly on social security” has not really been about socialism (government ownership of production) but about the welfare state that has played a significant role in driving today’s debt crisis. The Santa Claus principle is being unraveled.

Saturday, March 17, 2012

Graphic: Spending Patterns of Americans Over Time

Below is a sample from a deck of graphs depicting the intertemporal changes in the spending habits of Americans

Writes the Business Insider

HS Dent, an economic forecasting firm, compiled Census data spending behavior and presented them as demand curves, which measure average annual expenditure for a given product over age.

HS Dent's charts couldn't be more simple, but we can't stop looking at them. They offer an elegant glimpse into how spending really evolves over time.

Among the graphs, I like this…

…this seems true on my part (as the urge is there)

Thursday, July 14, 2011

Will We be part of the 100 years old Club?

Will we live to be 100 years old?

Me, no. Maybe for you and the younger generation the chances are likely a yes.

The rapid advances in technology will likely enhance this process. Futurist Ray Kurzweil predicts that man may reach immortality by 2045. It’s an incredible, fascinating and optimistic thought.

Nevertheless, the Economist projects there will be more than 1 million centenarians by 2100, they write

MOST countries celebrate the survival of a citizen for a century with a letter from a president or monarch, or even some cash. This is just about feasible at the moment, when centenarians are still comparatively rare, but it will not be the case for much longer. The chart below, drawn from UN data, shows projections for the five countries that will have more than a million centenarians by the end of the century. China will get there first in 2069, 90 years after its one-child policy was implemented.

I don’t know how the UN came up with these projections.

What I know is that:

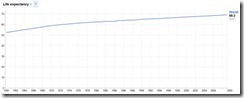

The US has the most centenarians 70,490 as of September 2010. Japan has 44,449. (Wikipedia.org) Following charts from Google's Public Data

Life expectancy has been expanding as more people have been enabled to trade freely.

Trade brings about the innovation in technology which has vastly contributed to this extended lifespan. Of course increasing wealth from trade has also been a factor.

Yet if people will indeed grow older as the UN or Kurzweil predicts, then there will be further strains on current Bismarckian government welfare system. This means radical changes will confront the current governments founded on the industrial age society.

Also despite longer lifespans which should add to the global population, I don’t believe in the Malthusian crap about “peak” resources. Under free markets, people’s ingenuity will prevail.

At the end of the day, the sustainability of longer lifespans will ultimately depend on the state of free markets and economic freedom.

Thursday, May 19, 2011

Can We Survive a World with 9 billion people?

Prolific author Matt Ridley says yes (bold emphasis mine)...

We trebled yields in the last 60 years without taking extra land under the plough. If we did that again – by getting fertilizer to farmers in Africa and central Asia, by cutting losses to pests and droughts through ever more subtle genetic manipulation, by improving roads and encouraging trade – then we could feed nine billion better than we feed seven billion today. And still retire huge swathes of land from farming to rainforest and other forms of wilderness.

The two most effective policies for frustrating this uplifting ambition are: organic agriculture and renewable bio-energy. Organic farming means growing your nitrogen fertilizer rather than fixing it from the air. That requires more land, either grazed by cattle or planted with legumes. The quickest way to destroy what wilderness we have left is to go organic. Bio-energy (growing crops to make fuel or electricity) takes food out of the mouths of the poor. In 2010, the world diverted 5% of its grain crops into making fuel, displacing just 0.6% of oil use yet killing an estimated 192,000 people by tipping them into malnutrition through higher food prices. We should stop such madness now.

...provided environmental politics would not lead to vicious government meddling which would subvert earlier victories with deleterious policies that would function as the proverbial cure which is worse than the disease.

He writes about how Malthusians like Paul Ehrlich, who wrongly forecasted for a worldwide cataclysmic famine, had mainly been foiled by creative persistency of the father of Green Revolution Nobel Laureate Norman Borlaug, one of the genuine unsung heroes of the world (my earlier post here).

He also writes about how technology has substantially increased farming efficiency which has led to a massive reduction in land usage for agriculture. (bold emphasis mine)...

We currently feed nearly seven billion people by farming about 38% of the land surface of the planet. If we wanted to feed that many people by using the techniques, varieties and – mostly organic – fertilizers of the 1950s, we would need to cultivate roughly 84% of the land surface. There goes the rain forest, the national parks, the wetlands. The intensification of agriculture has saved wilderness.

...and also how famine prevention defused the population time bomb.

Read Mr. Ridley’s fantastic article here

Bottomline: Mr. Ridley bets on human ingenuity (and not on econometric models) brought upon mostly by free trade. And so do I.

Tuesday, April 12, 2011

Restricting Social Mobility Equals Poverty

Economist Bill Easterly commenting on the incidences of ghost towns in the US makes a point where restriction of social mobility leads to impoverishment.

I quote Bill Easterly, (bold highlights mine)

What if we had a law that everybody had to stay in their home state? What if North Dakotans had to stay in North Dakota despite the collapsing economy there? Then wages would collapse and we would have very poor North Dakotans. Happily no one would dream of such a stupid law. Instead we have middle class North Dakotans moving to other places voluntarily, where employers want to hire them voluntarily. And so (former) North Dakotans stay middle class.

For states…but not for countries. We treat migration usually as a non-option if Zambia has an economic decline, so Zambians stay there and get even poorer as the economy declines.

This is the great point made by Lant Pritchett in a classic article and in a CGD book. Why can’t we start treating Zambians like North Dakotans? If their home economy is declining, let them move to other places voluntarily, where employers want to hire them voluntarily. Why do we recognize the right to live wherever you want for North Dakotans and not for Zambians?

I guess the Philippines should be a worthy example.

Had many of our countrymen (kababayan) been prohibited from finding greener pastures around the globe, then we’d be worst off economically considering the relatively unfree political and economic environment that continues to beleaguer us.

That’s why anyone who claims that the exodus of people results to “brain drain” is no less than prescribing poverty for us.

Regional share of Philippine remittances (ADB)

Bottom line:

Freedom should encompass people’s mobility or to move around or migrate in accordance with their perceived interests.

We should allow people to come in, in as much as to go out. Where free markets is about voting with money on products and services, freedom of movement is about voting with the feet.

As Ludwig von Mises wrote, (bold highlights mine)

The principles of freedom, which have gradually been gaining ground everywhere since the eighteenth century, gave people freedom of movement. The growing security of law facilitates capital movements, improvement of transportation facilities, and the location of production away from the points of consumption. That coincides, not by chance, with a great revolution in the entire technique of production and with drawing the entire earth's surface into world trade, The world is gradually approaching a condition of free movement of persons and capital goods. A great migration movement sets in. Many millions left Europe in the nineteenth century to find new homes in the New World, and sometimes in the Old World also. No less important is the migration of the means of production: capital export. Capital and labor move from territories of less favorable conditions of production to territories of more favorable conditions of production.

Wednesday, April 06, 2011

Will Younger Political Leaders Translate to an Overhaul in the Welfare System of the West?

I came across this Economist chart which says that the age of western leaders appear to be getting younger.

The Economist writes,

THE developed world is getting older. But oddly enough, its leaders are getting younger. The chart shows the average age of the leaders of four Western countries (America, Britain, France and Germany) since 1950. In the 1950s, voters were happy to elect venerable leaders like Winston Churchill and Konrad Adenauer. The election of Jack Kennedy was the first sign that the cult of youth was flowering but then came the dominance of Ronald Reagan and Francois Mitterrand in the 1980s. Now the West’s leaders, including 40-somethings Barack Obama (just) and David Cameron, have never been younger. If the trend continues, the leaders will end up younger than the average citizen.

It dawned upon me that if the age trend of western leaders is indeed getting younger while their welfare programs (like in the US) has been benefiting seniors almost disproportionately, could these young leaders spearhead a radical change in the current welfare system?

For example in the US, a writer proposed that the future holds not for “class” warfare but for an “intergenerational” warfare—where the young will be pitted against the old.

Bruce Krastings at Businessinsider writes, (bold highlights mine)

As if on cue, the Congressional Budget Office has thrown out some numbers to fire up this emotive issue. The CBO report confirmed (to me) that age warfare is in our future.

CBO looked at all of the scenarios regarding Social Security. They ran a total of 500 simulations that reflect the different variables of the puzzle. The analysis assumed that there would be no changes in current law on SS. The objective of the exercise was to quantify the probabilities of which generation would most likely not get the benefits they were (A) paying for, (B) entitled to and (C) expecting.

The results of the CBO analysis is that there is societal/economic trouble in front of us on this issue. It should come as no surprise to readers that if you are young, you have a problem. The CBO report defines which generation(s) will be hurt and by how much. I found their conclusions to be very troubling.

If you were born in the 1940’s the probability that you will receive 100% of your scheduled benefits is nearly 100%. The people in this age group will die before SS is forced to make cuts in scheduled benefits.

If you were born in the Sixties things still do not look so bad. Depending on how long you will live the odds (76+%) are pretty good that you will get all of your scheduled benefits. However, if you were born in the Eighties you have a problem. The numbers fall off a cliff if you are between 30 and 40 years old today. In only 13% of the possible scenarios you will get what you are currently expecting from SS. If you were born after 1990 you simply have no statistical chance of getting what you are paying for. The full CBO report can be found here. This (hard to read) chart is from that report.

Could it be that the proverbial shot across the bow to reform the unsustainable welfare system has already been fired with the recent proposal of Congressman Paul Ryan?

Read Paul Ryan’s proposed Path to Prosperity here

As a caveat, I know the young Mr. Obama represents the other side of political fence which favors the continuation of the unsustainable system. But the point is, what cannot be sustained cannot last. And no amount of political prestidigitation will work for long because the laws of economics will make sure it doesn't.

And perhaps in the realization that this system can only mean imminent destabilization, thus young leaders might have the mettle to undertake drastic measures to reform the system.

Bottom line: The proverbial “kick the can down the road” for the West’s welfare system has perhaps has reached its near limits. And it might be possible that the trend of younger political leaders might just presage the required change to an unsustainable system.

Tuesday, January 18, 2011

Will Falling Population (Demographic Time Bomb) Lead To A Reversal Of Globalization?

Lately I have encountered several commentaries suggesting that the “demographic time bomb” (falling population) will pose a risk to globalization by creating imbalances that would lead to political upheavals.

Here are two:

From Neil Howe and Richard Jackson in Global Aging And The Crisis Of The 2020's (bold emphasis mine)

“Rising pension and health care costs will place intense pressure on government budgets, potentially crowding out spending on other priorities, including national defense and foreign assistance. Economic performance may suffer as workforces gray and rates of savings and investment decline. As societies and electorates age, growing risk aversion and shorter time horizons may weaken not just the ability of the developed countries to play a major geopolitical role, but also their will.”

From Morgan Stanley’s Spyros Andreopoulos and Manoj Pradhan in ‘Ten for the Teens’(bold emphasis mine)

“The increase in macro instability comes at a time of major demographic transition in most DM and many EM economies. As populations become older, the demand for economic security - stable jobs, pensions - increases. This tension between higher instability and increased demand for security is likely to find its political expression in a backlash against globalisation. So far, the benefits of globalisation - higher income levels for most, i.e., the large middle class - have outweighed its drawbacks - increased competition and job instability. This has kept the globalisation show on the road until now. As this balance tips because the preferences of the middle class shift towards more security/stability, globalisation is likely to stall or reverse.”

There seems to be two separate issues here: unsustainable welfare states and globalization.

However the comments above attempt to make a connection which, for me, looks tenuous and confusingly premised on the fallacious ‘aggregate demand’.

Protectionism Equals Security?

Here is how I understand this: stripped out of the spending capacity due to old age, and with a government hobbled by fiscal straitjacket, the lack of demand (from both the private and the public) means slower economic growth which likewise would extrapolate to a political milieu that shifts from risk appetite (globalization) towards demand for ‘security and stability’ (protectionism), or in short, political stress.

For instance the Morgan Stanley tandem does an incredible turnaround, ``So far, the benefits of globalisation - higher income levels for most, i.e., the large middle class - have outweighed its drawbacks - increased competition and job instability. This has kept the globalisation show on the road until now.”

Are they suggesting that people who benefited from globalization will eventually bite the proverbial hand that feeds them? Are they suggesting too that people will see “security and stability” from lower incomes?

Will protectionism or restricting market activities make goods and services needed by the ageing society abundant and affordable? To the contrary, protectionism will only highlight on the shortages and the exorbitance of these economic goods that should lead to even more instability.

Murray N. Rothbard refuted this age old fallacy, he explained, (bold highlights mine)

It is difficult to see how a decline in population growth can adversely affect investment. Population growth does not provide an independent source of investment opportunity. A fall in the rate of population growth can only affect investment adversely if

-All the wants of existing consumers are completely satisfied. In that case, population growth would be the only additional source of consumer demand. This situation clearly does not exist; there are an infinite number of unsatisfied wants.

-The decline would lead to reduced consumer demand. There is no reason why this should be the case. Will not families use the money that they otherwise would have spent on their children for other types of expenditures?

Thus the problem of declining population can be helped by accepting immigrants or adopting to greater social mobility or the globalization of labor and by even more free trade.

We shouldn’t underestimate how people adjust to the new realities from the current underlying conditions. Importantly, we shouldn’t write off productivity of the senior citizens too (why? see below).

Illusion Or Reality?

Next would be the issue of welfare states. Once society realizes that the welfare state has been unsustainable, will people fight violently to retain the status quo (even if this is recognized as not possible) or will they cope up with the new reality?

The former would fall as part of the entitlement mentality engendered by excessive dependency or the moral hazard from political distribution while the latter will likely result from the realization that there’s no free lunch.

And perhaps in the realization that bellicosity won’t further society’s interests, they may opt for the latter (accepting harsh reality) than the former (live in a charade). And any political tensions from the succeeding reforms would signify as symptoms of ‘resistance to change’ than from a key reversal of political sentiment.

In the context of abrupt political-economic transitions from a crisis, Iceland’s violent riots from her financial crash of 2008 didn’t mechanically translate to close door ‘security’ based policies, as Iceland remains “moderately” economic free (44th), according to Heritage Foundation, even as the crisis did have some negative impact on her economic freedom ratings (due to higher taxes and government spending).

From Heritage Foundation

The point is that the notion that crisis will instigate a radical reversal of people’s sentiment from openness to protectionism seems likely misguided.

Today, Iceland has shown signs economic recovery and has even applied to join the European Union (aimed at achieving more financial and trade openness, aside from social mobility)!

Protectionism likewise did not spread like wildfire in 2008, as earlier discussed.

Ignoring Technology

Another factor would be technology.

While it may true that fertility rates may be going down (upper window), it is often ignored how the advances in technology has continually enhanced people’s living conditions.

From Google Public Data

Global Life expectancy (lower window) has lengthened from 50 years to 68.95 years over the past 50 years. Japan reportedly has some 41,000 centenarians (over 100 years old)! [But I won’t be lucky to live this long, because of my love affair with beer]

And if futurist Ray Kurzweil is correct, people’s life span may extend to 120 years (by 2030) or even more (180 years) as rate of technology advances accelerates.

Again Murray Rothbard on the importance of technological advancement

“technological progress, is certainly an important one; it is one of the main dynamic features of a free economy. Technological progress, however, is a decidedly favorable factor. It is proceeding now at a faster rate than ever before, with industries spending unprecedented sums on research and development of new techniques. New industries loom on the horizon. Certainly there is every reason to be exuberant rather than gloomy about the possibilities of technological progress.”

In short, should these advances occur then all demographic projections should be thrown to the garbage bin, as they are falsely premised and would be rendered irrelevant.

The basic problem with mainstream insights is that people are treated like unthinking automatons. And because of this they’re most likely wrong.

The ultimate threat to globalization is inflationism and not demographic trends.

Tuesday, December 21, 2010

Reductio Ad Absurdum on Wage Disparities, Supply of Labor and Exports

In trying to demonstrate the importance of the distinction between causation and correlation, my favorite marketing guru Seth Godin asks “Does a ski trip to Aspen make you a successful bond trader, or do successful bond traders go skiing in Aspen?”

This applies to political economic analysis as well.

Mainstream analysis, particularly those of the rigid Keynesian persuasion, would take the former - ski trip to Aspen make you a successful bond trader-over the latter as the answer or correlation mistaken as causation.

Applied to the political economic sphere they would argue that in order to preserve employment at home, the policy prescription should be a mercantilistic one: inflate (currency devaluation) or impose protectionism (limiting trade via tariffs). Never mind if this flawed argument has been a discredited idea even by 18th century economists. For Keynesian mercantilists, subtraction and not addition equals prosperity (gains).

Their assumption, which mostly signifies from a reductionist perspective, oversimplifies trade as operating in fixed pie wherein one gains at the expense of the other (zero sum).

And this is supported by their rationalization which sees every economic variable as homogenous.

And through selective statistical aggregates, they derive the conclusion that only government, equipped by the knowledge on how to adjust the knobs, can rightly balance out the interest of the nation. [Applied to Seth Godin’s riddle, government should send everyone to Aspen to make them all successful bond traders!]

And also from such perspective they see employment as the only driver of businesses and of economies-forget profits, capital, productivity, property rights, market accessibility and everything else-in the rigid Keynesian world, what only counts are labor costs.

In other words, labor cost, not profits, determines investments which subsequently translate to employment. Thus for them government policies must be directed towards accomplishing this end.

It has further been alleged that the supply of labor accounts for as a vital part in determining wage levels.

The reductionism: large supply of labor equates to low wages and consequently export power.

Let’s see how true this is applied to the real world.

Since labor basically is manpower then population levels would account for as the critical denominator.

One might argue that demographic distribution per nation would be different, which is true, but the difference does not neglect the fact that population levels fundamentally determine the supply of available labor.

Here is the world’s largest population, according to Wikipedia.org,

Given the reductionism which postulates that large labor force equates to low wages, then we should expect these countries, including the US and Japan to have the lowest wage rates in the world!

Yet even without looking at wage statistics we know this to be patently false (as seen from the bigger picture)!

Since wage levels are different per nation or per locality, perhaps the best way to gauge wages would be to use minimum wages as a yardstick.

Minimum wage account for as the national mandated minimum pay levels that are directed towards the lowest skilled workers.

Going back to the mercantilist postulate, since the largest population (largest pool of available labor) per continent belongs to Asia,...

...then the mercantilist logic implies that the lowest wages should be in Asia. Chart courtesy of Geo Hive (xist.org).

Yet according to the International Labor Organization (ILO), based on median minimum wages per country (US $PPP) the lowest wages would be in South East Europe and the CIS!

Asian wages are even higher than Africa and Southeast Europe and the CIS. Another disconnect!!

In addition, if broken down on a per country basis, based on the level of minimum wages in 2007 (PPP US$).... (again from ILO)

We would find that NONE of the largest or most populous countries (all in red arrows) are at the lowest echelon, except for Bangladesh and the Russian Federation seen at the lowest decile. (Yet the latter two are NOT export giants)

In pecking order, China, Brazil, Indonesia, Nigeria Pakistan and India are mostly situated at the upper segment of the lower half of the graph.

Meanwhile the Philippines can be seen on the higher second quartile, and the US having the highest minimum wages (among the highest populated nations), along with European countries.

So what this proves?

There is hardly any correlation between population levels (supply of labor) and wage levels! The assertion that supply of labor equals low wages is outrageously naive and inaccurate!

And let us further examine how these minimum wage levels impact exports. The following chart of the world’s largest exporters is from Wikipedia.org

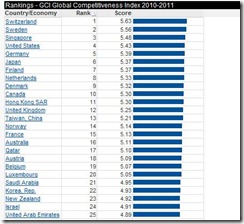

And I would also include global competitiveness as measured by the World Economic Forum (Global Competitiveness report)

So what do we see?

We see a strong correlation between the world’s biggest exporters and the most competitive nations. And one might add to that HIGH minimum wages!

While it would be tempting to argue that high minimum wages equals strong competitiveness/exports, we would be falling for the same post hoc argument trap of misreading correlation as causation like those employed by rigid Keynesians.

The real answer to such wage disparity is the high standards of living in developed economies which arises from the greater capital stock (or productive assets in the economy) and a higher productivity of the citizenry.

As Professor Donald J. Boudreaux explains, (bold highlights mine, emphasize his)

Low-wage labor is generally not low-cost labor. The reason is that the productivity of low-wage workers in China and other developing countries is much lower than is the productivity of workers in America. While low-wage foreigners outcompete high-wage Americans at many low-skill, routine, and repetitive tasks, high-wage Americans can (and do) outcompete low-wage foreigners in those tasks that can be performed efficiently only in advanced economies that are full of the machinery and intricate infrastructure – physical, legal, and cultural – that raise wages by raising worker productivity

In short, high American wages aren’t a disadvantage; they are a happy reflection of the fact the typical American worker is a powerhouse of production.

In short to argue from a wrong premise would mean wrong conclusions.

Why?

Because for politically blinded people, their intuitive tendency is to selectively pick on events or data points (data mining, e.g. low value low skill industries, China) and deliberately misinterpret them (to create a strawman-China's low wages stealing American and Filipino jobs) in order to fit all these into their desired conclusions (cart before the horse reasoning-erect trade barriers).

They similarly deploy false generalizations based on the perceived defects interpreted as a general condition (fallacy of composition-low wages equals export strength).

These represent not only as sloppy ‘blind spot’ thinking but likewise, a reductio ad absurdum or a conclusion based on the reduction to absurdity.

Caveat emptor.

Wednesday, December 15, 2010

Migration Twist: Many Britons Desire Relocation While Filipinos Want To Stay Home

It would seem as no news for us to hear people from developing nations yearn to emigrate to developed nations mostly to seek greener pastures.

For instance, the Philippines has been a major exporter of labor or manpower (OFWs), thus the popular desire by locals to work or move permanently abroad has been embedded into my expectations.

Yet recent surveys appear to contradict this—only about 1 in 10 Filipinos, according to ABS-CBN, say that they would like to migrate to another country. This has been significantly down from about 3 in 10 in 2006. The apparent optimism has been reportedly associated with high expectations on the political economy from the new political administration.

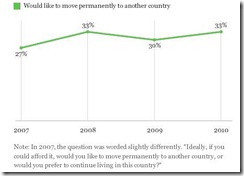

But what surprised me most was this poll from Gallup which reported that in UK, 1 in 3 Britons wanted to migrate to another country. (see below chart from Gallup)

Gallup says that this hasn’t been related to the recent crisis, where “high level of desire to migrate permanently cannot be attributed to the recent global economic crisis or the country's own recession”

And it’s not just the UK, although she ranks the highest, but also among major European contemporaries, as Germany (21%), France (23%), Sweden (19%), Netherlands (18%) and others, all of which registered high levels of desire to migrate.

For Britons, the target places for relocation are Australia, Spain, US and Canada.

While the local survey may not square with Gallup’s survey, enough for me to make a strong conclusion, I suspect that such developments appear to be indicative of a twist: people from developed nations could likely help deepen the globalization of labor or population mobility worldwide.

Importantly, this shows how people’s reaction could be fickle and can’t be aggregated and that meaningful changes could be happening at the fringes.

Nonetheless, it’s a development worth monitoring.

Saturday, August 07, 2010

The Brain Drain Nonsense

In reading media, it’s just amazing how incurably specious their treatment of social issues are.

Take for example the recent issue on supposed “brain drain”. It’s been emphasized that the Philippines appears to be helpless in the exodus of manpower as a result of demand from abroad.

This from the Inquirer.net,

Scientists, engineers, doctors, IT specialists, accountants and even teachers are among the English-speaking talent heading to foreign lands, leaving the government and private companies scrambling to find replacements.

"There is a skills haemorrhage. We are losing workers in the highly professional and skilled categories," Vicente Leogardo, director-general of the Employers' Confederation of the Philippines, told Agence France-Presse.

While they (government and business groups) don’t exactly say it (as this would construed as politically incorrect since OFWs are now an important political force!), the undertone suggests that these should be stopped. How? By Fiat!

I may be wrong but the following seems to be a clue.

More from the same article, (emphasis mine)

The government has been seeking ways to upgrade salaries and benefits, according to Myrna Asuncion, assistant director of the government's economic planning department.

"But local salaries can only go up by so much before they start hurting the competitiveness of local industries," Asuncion told AFP.

"We want to provide employment opportunities in the Philippines but there are some sectors that say salaries are already too high," she said.

You see the problem?

On the supply side, these anecdotes only reveal that the government and Filipino companies are “afraid” or "reluctant" to engage in market competition by paying market rates for these skills. With foreign companies willing to pay local skilled workers enough to tilt the latter’s (cost benefit tradeoffs) choice, thus, they decry the “brain drain”.

In short, this is simply demand and supply or Economics 101 at work.

Of course, media, politicians and their coterie (business interest groups, politically blind academicians and experts) loathe demand and supply. They believe in Santa Claus or free lunch economics.

And here are very important factors which they don’t say:

From TradingEconomics.com

First of all, they don’t tell you that the lowered standards of living have been the result of past collective policies that has resulted to inflation or the loss of purchasing power of the Peso.

Over the years, this has significantly contributed to the reduction of competitiveness. Think capital flight.

Chart from the BSP

Next, they don’t tell you that a lower Peso (falling from an exchange rate against the US dollar at 2 in the 1960s to 55 in 2005) doesn’t necessarily fuel an export-industry boom.

So policy manipulations (such as welfarism) to diminish the Peso’s worth only sustains distortions in the economic system, via protectionism -which favors select political groups (think cronyism). And these exacerbate the outflows of labor force.

In other words, protectionism is mostly a zero sum game and hardly contributes to goods-services value formation.

Chart from the OECD

Another, from the demand side, the demographic imbalances or falling fertility rates in developed economies will sustain the need for labor manpower from emerging markets. And the Philippines given the current political economic setting is likely to be a major participant for a long time.

Importantly, with increasing technology based globalization, skilled jobs will be a major contribution to the “labor” aspect of globalization.

Chart from the TradingEconomics.com

Essentially the so-called “brain drain” is a symptom of an underlying disorder.

And one of the primary variable is lack of desire to compete.

So even at relatively low wages (compared to OECD), the market’s response to price signals set by the downtrodden Peso have been undercut by the regulatory, bureaucratic, legal, (property rights) and tax environment.

According to Trading Economics, ``The Ease of doing business index (1=most business-friendly regulations) in Philippines was reported at 141.00 in 2008, according to the World Bank. In 2009, the Philippines Ease of doing business index (1=most business-friendly regulations) was 144.00. Ease of doing business index ranks economies from 1 to 181, with first place being the best. A high ranking means that the regulatory environment is conducive to business operation.”

The Philippines is shown as one of the world’s least business friendly environments in the world, thus, resonating the signs of refusal to adjust to the global market climate. Instead, these interest groups seek political cover—which doesn’t change the nature of economics.

Finally, it’s equally nonsense to imply that brain drain will suck out the heck out of our skilled workers. This will only be true if you think the Philippines is immune to the basic laws of economics.

Why?

Because price signals say supply will adjust to demand!

Chart from TradingEconomics.com

Exploding remittances and net migration trend reveals how these dynamic would unfold.

The fertile population of the Philippines should “naturally” respond to these dynamic by having more Filipino youth take on more specialized courses that would meet global demand. Hence restrictions on these adjustments should be avoided.

Unless Filipinos are daft, which I don’t think we are, except in the eyes of politicians and media, I trust that the law of economics would prompt “brain drain” to result to a net positive benefit for the Philippine society, because it is a purposeful choice made by millions of individuals (our countrymen) in response to the current environment.

If we truly want to reverse “brain drain”, then we need to build capital.

And how do we that?

By sloughing off protectionism, cronyism, paternalism and embracing competition, free trade and economic freedom.

As Ludwig von Mises once wrote,

Under a system of completely free trade, capital and labor would be employed wherever conditions are most favorable for production. Other locations would be used as long as it was still possible to produce anywhere under more favorable conditions. To the extent to which, as a result of the development of the means of transportation, improvements in technology, and more thorough exploration of countries newly opened to commerce, it is discovered that there are sites more favorable for production than those currently being used, production shifts to these localities. Capital and labor tend to move from areas where conditions are less favorable for production to those in which they are more favorable.

That’s what media and the mainstream won’t likely tell you.

Outside business administration the major growth area in Philippine education is practically where the skilled exports has been taking place (red arrows)--namely, Medical Sciences (strongest), Math and computers sciences and engineering (growing but variable), that's from NSCB data (see below)

Tuesday, August 03, 2010

Demographic Nightmares 2

George Magnus writes,

``capitalism rewards scarcity, and as labour supply fades relative to the availability of capital, returns will shift towards the former...

Huh?

If capitalism rewards scarcity then why at all risk precious capital to invest in order to produce?

What could Mr. Magnus be smoking?

Capitalism is an economic or resource distribution system which operates on the platform of property rights, voluntary exchange, and the profit and loss system in a world of scarcity. And the reason capitalism exist is to satisfy the unease or the pain of consumers from scarcity, hence the incentive to invest to produce.

I am reminded that once we argue using false premises then the conclusion would obviously wrong.

Mr. Magnus is apparently anxious about the world’s demographic trends echoing Pimco’s Bill Gross [see William Gross’ Demographic Nightmare]

His concern is that a smaller labor force would result to reduced corporate earnings and a lower economic growth. Hence, he recommends numerous “policy levers” or interventions to solve these predicaments.

Yet how valid is this?

True, the global rate of population growth has been falling as shown above, but it is still mostly positive (ex- Japan).

However, what is not seen is that the crucial reason why the rate growth has been falling is due to the relatively high nominal levels of world population which has already reached 6.697 billion (!), in 2008, according to the World Bank.

Another important variable in the present global demographic trends is that while population growth rate has slowed in developed economies, the bulk of the growth now comes from emerging markets.

Chart from Oppenheimer Funds

The implication is that this puts to risk the cumbersome welfare system of developed economies, aside from crimping “aggregate demand” (we dealt with this earlier).

Although I would be agreeable to one of Mr. Magnus’ suggestion that changes be made in the welfare system, I’d take a more radical approach.

Since it is to my opinion that welfare systems signify as unsustainable political PONZI programs that had been designed to buy votes of the population and to keep people dependent on politicians, welfare systems should be phased out or trimmed to the essentials.

The reduction or elimination of which would entail diminished financial burdens for the future generations, which should allow our children more room to deploy resources to their interest or pleasure, thereby reduce the barriers to investments.

This should also instill the culture of savings and personal responsibility and importantly advance the cause of personal liberty—where lesser redistribution translates to more efficiency of resource allocation and freedom of choice.

And there is another possible solution which could compliment this: ease immigration barriers to allow for free movement of people or enhance social mobility.

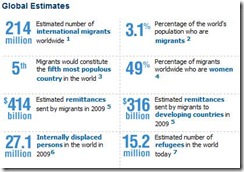

So globalization shouldn’t be limited to trade and finance, but also to migration flows, which at present constitutes only an estimated 3.1% of the global population, according to the International Organization For Migration (IOM).

These two structural reforms will greatly ease the concerns over reduced economic and corporate earnings growth, thus, needing less government activist (boom-bust) policies which would only worsen whatever demographic nightmare envisaged by interventionists.

![clip_image001[4] clip_image001[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgIlFHhnB5aTPTTZk_zNenaTG5bSqraNfTihCHadOLhRqKOymoUsckp1Mnt9vsIiHjehBweRBhQclb3RFw6xPLeaeW7N_BL4IJjny04iRIBUsf-esxRJbGks5gOIkC4x0VON_6S/?imgmax=800)