Three names are widely associated with the cause of human freedom and economic liberty in the 20thcentury: Friedrich A. Hayek, Ludwig von Mises, and Ayn Rand. Indeed, it can be argued that Hayek’s The Road to Serfdom (1944) and The Constitution of Liberty (1960), Mises, Socialism ((1936) Human Action(1949), and Rand’s The Fountainhead (1943) and Atlas Shrugged (1957) did more to turn the intellectual tide of opinion away from collectivism in the second half of the twentieth century than any other works that reached out to the informed layman and general public.Now, in the second decade of the 21st century their enduring influence is seen by the continuing high sales of their books, and the frequency with which all three are referred to in the media and the popular press in the face of the current economic crisis and the concerns about the revival of dangerous statist trends in the United States and other parts of the world.The Influence of Mises, Hayek, and RandIn Hayek’s case, his influence has reached inside academia, that bastion of the social engineering mentality in which too many professors, especially in the social sciences, still dream wistfully about society being remade in their own images of “social justice” and political correctness – regardless of the expense in terms of people’s personal and economic liberty.Hayek’s message of intellectual humility – that there is more to the complexities of the world than any government planning or intervening mind can ever master – has forced some in that academic arena to take seriously the possibility that there may be “limits” to what political paternalism can achieve without undermining the essential institutional foundations of a free and prosperous society.Mises continues to be recognized as the most original and influential member of the Austrian School of Economics during the greater part of the 20th century. Mises stands out as that unique and original thinker who proved why socialist planning cannot work, that government intervention breeds inescapable distortions and imbalances throughout the market, and how central bank manipulation of money and interest rates sets in motion the booms and busts of the business cycle. The current recession has brought new attention to the Austrian theory of money and economic fluctuations, which was first formulated by Mises in the early decades of the 20th century.While the academe of philosophers is still not willing to give Ayn Rand the respect and serious attention that others believe she rightly deserves, it is nonetheless true that her novels and non-fiction writings, especially The Virtue of Selfishness (1964) and Capitalism: the Unknown Ideal (1966), continue to capture the interest and imagination of a growing number of students in the halls of higher education in the United States. In other words, her ideas continue to reach out to that potential generation of “new intellectuals” that Rand hoped would emerge to offer a principled and morally grounded defense of individualism and capitalism.The Common Historical Contexts of Their TimeHayek, Mises and Rand each made their case for freedom and the political order that accompanies it in their own way. While Mises was born in 1881 and, therefore, was 18 years older than Hayek (who was born in 1899) and nearly a quarter of a century older that Rand (who was born in 1905), there were a number of historical experiences they shared in common, and which clearly helped shape their ideas.First, they came from a Europe that was deeply shaken by the catastrophic destruction and consequences of the First World War. Both Mises and Hayek saw the horrors of combat and the trauma of military defeat while serving in the Austro-Hungarian Army, as well as experiencing the economic hardships and the threat of socialist revolution in postwar Vienna. Rand lived through the Russian Revolution and Civil War, which ended with the triumph of Lenin’s Bolsheviks and the imposition of a brutal and murderous communist regime; she also experienced “socialism-in-practice” as a student at the University of Petrograd (later Leningrad, now St Petersburg) as the new Marxist order was being imposed on Russian society.Second, they also experienced the harsh realities of hyperinflation. Rand witnessed the Bolshevik’s intentional destruction of the Russian currency during the Russian Civil War and Lenin’s system of War Communism, which was designed as a conscious attempt to bring about the abolition of the market economy and capitalist “wage-slavery.” In postwar Germany and Austria, Mises and Hayek watched the new socialist-leaning governments in Berlin and Vienna turn the handle of the monetary printing press to fund the welfare statist and interventionist expenditures for instituting their collectivist dreams. In the process, the middle classes of Germany and Austria were decimated and the social fabric of German and Austrian society were radically undermined.Third, Rand was fortunate enough to escape the living hell of socialism-in-practice in Soviet Russia by being able to come to America in the mid-1920s. But from her new vantage point, she was able to observe the rise and impact of “American-style” collectivism, during the Great Depression and the coming of Franklin Roosevelt’s New Deal in the 1930s. In Europe, Mises and Hayek watched the rise of fascism in Italy in the 1920s and then the triumph of Hitler and National Socialism in Germany in 1933, the same year that FDR’s New Deal was implemented in the United States. For both Mises and Hayek, the Nazi variation on the collectivist theme not only showed it to be one of the most deadly forms that socialism could take on. It represented, as well, a dark and dangerous “revolt against reason” with the Nazi’s call to the superiority of blood and force over the human mind and rational argumentation.Their Common Premises on Collectivism and the Free SocietyWhat were among the common premises that Mises, Hayek and Rand shared in the context of the statist reality in which they had lived? Firstly, I would suggest that it clarified conceptual errors and political threats resulting from philosophical and political collectivism. The “nations,” “races,” “peoples” to which the totalitarian collectivists appealed resulted in Mises, Hayek and Rand reminding their readers that these do not exist separate or independent from the individual human beings who make up the membership of these short-hand terms for claimed human associations. Anything to be understood about such “collectives” of peoples can only realistically and logically begin with an analysis of and an understanding into the nature of the individual human being, and the ideas he may hold about his relationships to others in society.Furthermore, political collectivism was a dangerous tool in the hands of the ideological demagogues who used the notions of the “people’s will,” or the “nation’s purposes,” or the “society’s needs,” or the “race’s interests,” to assert their claim to a higher insight that justified the right for those with this “special intuitive gift” to guide and rule over others.Secondly, all three rejected positivism’s denial of the human mind as something real, and as source for knowledge about man and his actions. Mises and Rand, especially, emphasized the importance of man’s use of his reasoning ability to understand and master the world in which he lived, and the importance of reasoned reflection for conceiving rational rules and institutions for a peaceful and prosperous society of free men. Mises and Rand considered the entire political trend of the 20thcentury to be in the direction of a “revolt against reason.”Even Hayek, who is sometimes classified as an “anti-rationalist” due to his emphasis on the limits of human reason for designing or intentionally constructing the institutions of society, should also be classified as an advocate of man’s proper use of his reasoning powers when reflecting on man and society. While the phrasing of his arguments sometimes created this confusion, in various places Hayek went out of his way to insist that he was never challenging the centrality of man’s reasoning and rational faculty. Rather, he was reminding central planners and social engineers that one of the important uses of man’s reasoning ability is to understand the limits of what man can and cannot know or hope to do in terms of trying to remake society according to some preconceived design.Thirdly, all three firmly believed that there was no societal arrangement conceivable for free men and human betterment other than free market capitalism. Only a private property order that respects and protects the right of the individual to his life, liberty, and honestly acquired possessions give people control over their own lives. Only the voluntary associative arrangements of the marketplace minimize the use of force in human relationships. Only the market economy allows each individual the institutional means of being free from the power of the government and its historical patterns of plunder and abuse. And only the market economy gives each individual the latitude to live for himself and use his knowledge and abilities to further his own ends as he best sees fit.And, finally, Mises, Hayek, and Rand all emphasized the importance of the intellectuals in society in influencing the tone and direction of political, economic, and social ideas and trends. These “second-hand” thinkers of ideas were the driving force behind the emerging and then triumphing collectivist ideas of the 19th and 20th centuries. They were the molders of public opinion who have served as the propagandizers and rationalizers for the concentration of political power and the enslavement and deaths of hundreds of millions of people – people who were indoctrinated about the need for their selfless obedience and sacrifice to those in political power for a “greater good” in the name of some faraway utopia.The Consequentialist Rationale for FreedomBut where they differed was on the philosophical justification for the free society and the rights of individuals within the social order. Both Mises and Hayek were what today might go under the term “rule utilitarians.” Any action, policy or institution must be evaluated and judged on the basis of its “positive” or “negative” consequences for the achievement of human ends.However, the benchmark for such evaluation and judgment is not the immediate “positive” or “negative” effects from any action or policy. It must, instead, be placed into a longer-run context of theoretical insight and historical experience to determine whether or not the policy or action and its effects are consistent with the sustainability of the overall institutional order that is judged to be most effective in furthering the long-run possible goals and purposes of the members of society, as a whole.Thus, the rule utilitarian is concerned with the “moral hazard” arising from an action or policy implemented. That is, will it create “perverse incentives” that results in members of society acting in ways inconsistent with the long-run betterment of their circumstances?Welfare payments may not only involve a transfer of wealth from the productive “Peters” in society to the unproductive “Pauls.” It may also reduce the motives of the productive members of society to work, save and invest as much as they had or might, due to the disincentive created by the higher taxes to pay for the redistribution. At the same time, such wealth transfers may generate an “entitlement” mentality of having a right to income and wealth without working honestly to earn it. Thus, the “work ethic” is weakened, and a growing number in society may become welfare dependents living off the honest labor of others through the paternalistic transfer hands of the State.The net effect possibly is to make the society poorer than it otherwise might have been, and therefore making everyone potentially worse off in terms of the longer-run consequences of such policies.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, May 29, 2013

Richard Ebeling: The Case For Freedom and Free markets in the writings of Ludwig von Mises, F.A. Hayek and Ayn Rand

Wednesday, March 06, 2013

Quote of the Day: I, Coke: No One Knows How to Make a Can of Coke

The number of individuals who know how to make a can of Coke is zero. The number of individual nations that could produce a can of Coke is zero. This famously American product is not American at all. Invention and creation is something we are all in together. Modern tool chains are so long and complex that they bind us into one people and one planet. They are not only chains of tools, they are also chains of minds: local and foreign, ancient and modern, living and dead — the result of disparate invention and intelligence distributed over time and space. Coca-Cola did not teach the world to sing, no matter what its commercials suggest, yet every can of Coke contains humanity’s choir

Friday, September 16, 2011

Will Burma Embrace a Market Economy?

Forbes Magazine’ Simon Montlake thinks so (bold highlights mine)

It usually pays to be bearish on Burma. But a flurry of initiatives by a new, semi-elected government has raised hopes of a fresh start. Since taking power in March, it has begun tackling barriers to economic growth, such as commodity import cartels and restrictive investment and labor laws. President Thein Sein, a retired general, has pledged to support local entrepreneurship and to attract foreign investors to special economic zones. He's also tapped independent thinkers as economic advisors and appointed businessmen as ministers. In much of Asia this would be mainstream politics. In Burma it's almost a Tea Party movement. Even the political standoff that has defined Burma on the world stage--the Lady versus the Generals--appears to have eased with a warm presidential reception on Aug. 19 for Aung San Suu Kyi, the opposition leader. "Things have moved surprisingly quickly," says a European diplomat. A veteran foreign aid worker concurs: "The political conversation has changed."

Burma's political history is strewn with false starts and reversals. The question on everyone's lips is whether this time is different. Skeptics say Thein Sein has yet to deliver on his reformist rhetoric and faces resistance from political hardliners and conservative bureaucrats, as well as rent-seeking tycoons who thrived under the dictatorship.

This uncertainty, as much as sanctions and boycotts, prevents many Western firms from taking the plunge, says Luc de Waegh, founder of West Indochina, a consultancy in Singapore. "The business environment isn't friendly to foreign investors yet. It's challenging to do business there," he says. Asian manufacturers have also been deterred by high costs for inputs and dilapidated infrastructure, despite a cheap labor pool. Only Burma's natural resources have attracted significant investment, led by China, though this has proven controversial.

Still, some Western executives are keen to size up a potential market of 54 million people with an estimated GDP of $43 billion. Tourist arrivals rose 23% in the first half of 2011, and not all were vacationers. "The big guys from the big companies are going there for tourism and business curiosity. It's like the last frontier," says De Waegh, who used to run British American Tobacco's Burma operations. Under political pressure at home, BAT exited in 2003.

While some will think that a seminal market economy for Burma will pose as threats to them, I think Burma’s possible conversion should be very positive, not only for Burma, but for ASEAN and for the world.

This means more business opportunities and access to a previously closed market that is not only resource rich but likewise has significant human capital and also fabulous recreational sites or vacation spots for potential tourists (like me).

A universal axiom is that de-politicization of any economy extrapolates to the empowerment of the masses through the markets, where the interests of the consumers should reign supreme than the interests of the political overlords.

As the great Ludwig von Mises once wrote,

The fundamental principle of capitalism is mass production to supply the masses. It is the patronage of the masses that makes enterprises grow into bigness. The common man is supreme in the market economy. He is the customer "who is always right

I hope Burma will indeed commence on the path of embracing a market economy.

Thursday, July 14, 2011

Will We be part of the 100 years old Club?

Will we live to be 100 years old?

Me, no. Maybe for you and the younger generation the chances are likely a yes.

The rapid advances in technology will likely enhance this process. Futurist Ray Kurzweil predicts that man may reach immortality by 2045. It’s an incredible, fascinating and optimistic thought.

Nevertheless, the Economist projects there will be more than 1 million centenarians by 2100, they write

MOST countries celebrate the survival of a citizen for a century with a letter from a president or monarch, or even some cash. This is just about feasible at the moment, when centenarians are still comparatively rare, but it will not be the case for much longer. The chart below, drawn from UN data, shows projections for the five countries that will have more than a million centenarians by the end of the century. China will get there first in 2069, 90 years after its one-child policy was implemented.

I don’t know how the UN came up with these projections.

What I know is that:

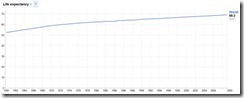

The US has the most centenarians 70,490 as of September 2010. Japan has 44,449. (Wikipedia.org) Following charts from Google's Public Data

Life expectancy has been expanding as more people have been enabled to trade freely.

Trade brings about the innovation in technology which has vastly contributed to this extended lifespan. Of course increasing wealth from trade has also been a factor.

Yet if people will indeed grow older as the UN or Kurzweil predicts, then there will be further strains on current Bismarckian government welfare system. This means radical changes will confront the current governments founded on the industrial age society.

Also despite longer lifespans which should add to the global population, I don’t believe in the Malthusian crap about “peak” resources. Under free markets, people’s ingenuity will prevail.

At the end of the day, the sustainability of longer lifespans will ultimately depend on the state of free markets and economic freedom.

Saturday, February 26, 2011

Globalizing Hollywood and the Philippine Entertainment Industry

The Economist hits the proverbial nail on the head, (bold highlights mine)

THE film-awards season, which reaches its tearful climax with the Oscars next week, has long been only loosely related to the film business. Hollywood is dedicated to the art of funnelling teenagers past popcorn stands, not art itself. But this year’s awards are less relevant than ever. The true worth of a film is no longer decided by the crowd that assembles in the Kodak Theatre—or, indeed, by any American. It is decided by youngsters in countries such as Russia, China and Brazil.

Hollywood has always been an international business, but it is becoming dramatically more so. In the past decade total box-office spending has risen by about one-third in North America while more than doubling elsewhere (see chart). Thanks to Harry Potter, Sherlock Holmes and “Inception”, Warner Bros made $2.93 billion outside North America last year, smashing the studio’s previous record of $2.24 billion. Falling DVD sales in America, by far the world’s biggest home-entertainment market, mean Hollywood is even more dependent on foreign punters.

Read the rest here

Since I’ve learned about the importance of free markets, I have also veered from watching TV talent competitions or Film awards for the simple reason that I’ve realized that a handful of judges cannot substitute for the real voters—the consumers.

And that’s exactly the message of the Economist.

Where media contests are decided by the subjective preferences of select judges (typically represented here as ‘experts’-yes again modeled after technocratic government), they tend to get politicized, and importantly, overlook discovering talents with immense potentials.

The Philippines has two good examples:

One, our local version of the Oscar Awards, the Metro Manila Film Festival, have been repeatedly plagued by controversies.

I’d prefer to see local production outfits compete with international filmakers for international or even local migrant audiences than have second raters squabble over what I see as “mediocre” titles.

In the food industry, the dominance of Jollibee in the local market and her expansion as an international brand should serve as an example of how local outfits can achieve global competitive standards. If Jollibee can do it, so could other industries like media.

The problem is the dominant filmmakers or media outfits here appear to have either reached their comfort zones or have been operating as political enterprises.

Two, this is also why I’ve cheered for online discovered celebrities such as Ms. Charice Pempengco.

Ms. Pempegco’s early stints with the local TV contests had not borne fruit, instead it took the youtube and foreigners to discover her.

From this, it would seem that either the domestic audience did not appreciate her talents (or her type of music) or that local scouts or judges may have simply discounted her. I would suspect the latter because her overseas success has prompted the local audience to also embrace her.

I would even further my hunch: the reason she has not been recognized early on here is that there appears to be a bias for mestiza-looking with model shaped features for female celebrities (except in comedies). So mainstream talent scouts may have misjudged her from this angle.

Nevertheless the Economist shows how the US film industry has been globalizing.

And it is also likely that local entertainment industry will have to pattern along with the major trend or otherwise get consumed or overwhelmed by fast expanding international players who might likewise tap on the local audience.

As the Economist notes, (bold emphasis mine)

The success of a film outside America is not purely a marketing matter. As foreign box-office sales have become more important, the people who manage international distribution have become more influential, weighing in on “green-light” decisions about which films are made. The studios are careful to seed films with actors, locations and, occasionally, languages that are well-known in target countries.

Things are likely get done a lot differently from now on.

Friday, August 20, 2010

Can Government Prevent Disasters?

I am disheartened by the news of the recent bus tragedy in Benguet whereby some 41 people died when the Bus fell into the ravine.

Yet we hear some sectors intuitively propose government to intervene, in the assumption that government can indeed forestall disaster. Again “romancing the government” without examining the cost benefit tradeoffs.

Here is why I think government can’t help in preventing disasters, (even if you install a communist government)

1. Government officials don’t know and can’t tell the future.

2. Government officials don’t know and can’t tell ALL the ongoing changes in the environment.

3. Government officials don’t know and can’t tell ALL the spontaneous actions of tens of millions of people.

4. Government officials don’t know and can’t tell ALL the conditions of the vehicles that people use.

5. Government officials don’t know and can’t tell ALL the impact of the interactions of the people, the vehicles and the environment.

In short, it will ALWAYS BE A KNOWLEDGE problem.

So unless, someone can enlighten me on the supposed omniscience of government, from such premises, no matter what the government does, they won’t be able to prevent disasters.

At worst, they could enhance it.

How?

First, every government intervention entails a bureaucracy.

Two, every bureaucracy comes with financing charged to taxpayers. So if the government plans to reduce accidents by having people NOT to travel by imposing onerous taxes, then this would be the way to go. That’s because people will be too poor to travel. Yet quality of life can be associated with impact of disasters (Think Haiti)

Three every regulations will benefit one group at the expense of the other.

A great example of this would be the Philippine Maritime industry.

Out of the world’s 176 worst maritime disaster, the Philippines owns 6 of them and has the inglorious status of having the worst, the MV Dona Paz.

Well, it’s NOT that the maritime industry has been lacking regulation. The fact is the opposite the industry have SATED with regulations.

As I previously wrote,

It is a peculiar development why despite the repeated accidents by the same shipping company, consumers continue to patronize such private entity. The answer is the lack of choice.

None in the media has brought out the fact that the domestic shipping industry is a very tightly regulated industry.

Imagine, aside from 5 agencies that directly supervise the industry; namely, Maritime Industry Authority, Philippine Ports Authority, Bureau of Customs Bangko Sentral ng Pilipinas and the Philippine Shippers Bureau, there are another twenty six (26) other agencies directly or indirectly regulate the inter-island freight shipping industry (NEDA’s Philippine Institute for Development Studies). Incredible red tape!

THIRTY ONE Agencies regulating the Shipping Industry yet the repeat disasters?! Why?

Because the bureaucratic red tape has served as a substantial barrier from competition to the benefit of the incumbent industry players.

And when consumers have been left with no choice, they will be forced to patronize even when the services offered are inferior or when their lives are put to risk. Ergo, the repeat disasters.

Another, there is such a thing called “regulatory capture”. It’s when the interests of the industry have “captured” the regulators, or when regulators and the protected industry dance the proverbial tango.

In many instances, regulators find their career outside public service in the industry which they once regulated. In short, the interest of the regulators tends to align with the interest of the regulated for personal motives such as career or otherwise. (As I said regulators are HUMAN Beings and look after their personal interest FIRST). Thus, by keeping chummy they open the doors for laxity in supervision and risk of disasters.

Four, regulators are obsessed with rules and NOT with pleasing the consumers. Yet rules don’t and won’t incorporate everything that is known for the benefit of society. The fundamental premise of which anew is the Knowledge problem and of the interest of diverse groups involved in shaping the laws.

So instead of looking for the welfare of their clients or the consumers, industry providers will be forced to pay attention FIRST to comply with the web of laws.

And the cost of compliance is the obverse side of disaster, industry players tend to stick by the standards (regulations) and ignore the cost of a potential disaster from a black swan or a random event.

Remember life is dynamic, new technology, environmental changes and evolving consumer patterns among others contribute to “randomness”. Even new laws contribute to changes in people’s behaviour, which add to randomness or life’s complexities.

At the end of the day, if an accident from a black swan event happens, then the industry players can go scotch free since they are outside the ambit of government imposed standards.

Of course, unless consumers are deemed to be so dumb, then always the excuse for government intervention.

But in contrast to this, consumers can always be empowered to render discipline on the providers, if given the chance.

That is if they allow competition to determine their cost-benefit tradeoffs relative to the price, quality and safety of the product they use or consume.

It’s funny and an irony how we tend to TRUST the people to make the “right” choices about the leadership in elections, yet degrade their capabilities when they account to choose for their own self-interest which they have a direct stakeholding, when dealing with personal needs and wants. It’s a reasoning gone backwards.

Another, outside regulations and the consumers, the other source of discipline are tort laws. If the judicial system will be facilitative into rendering judicious resolution and indemnity to the aggrieved parties, then obviously no business interests would in the right mind NOT to seek the interest of the consumers because they will and can be sued out of existence.

In short, you don’t need more government intervention, what you need is more competition and judicious facilitation of tort laws.

Update:

I’d like to thank Nonoy Oplas for his most valued input (see comment section).

Nevertheless, let me clarify that the Jeepney industry can’t be classified as an open competition but a regulated competition. As an analogy, if you have (x number of) pets in a cage and throw food into it, your pets will “compete” for the food you throw. There is “competition” but the competition is limited by your actions (as pet owner), or in the case of the Jeepney, the government.

Jeepneys are essentially covered by a slew of regulations, these includes franchise restrictions, territorial coverage, allowable fees to charge (public tolls), vehicle type and engine specifications, road use, traffic regulations—the latter, of which are vacillatingly implemented, and perhaps many more (this would need to be researched and a topic for another day).

Thus, I wouldn’t generalize that discourteousness of many Jeepney drivers as a result of “competition” but from a combination of many of these regulations which has skewed the behaviour of drivers towards “incivility”.

One shouldn’t forget the uneven application and occasional boorish behaviour of the implementing officers and notwithstanding the “palakasan” attitude as a result of political dependence could also be contributing factors. So there are many many many factors influencing the Jeepney industry.

Since buses have “higher barriers to entry”, one might say they seem more professional in competition. But I have my reservations. This needs more research before making any conclusions. Some like Victory Liner which has been a favourite of mine seem to respond to “competition”.

The transport sector is more a regulated competition than a free market competition. Hence, the beneficial effects from competition may NOT be apparent, since they are suppressed.

Of course, in agreement with Nonoy's suggestion, open competition, the abolishment of government agencies, facilitation of the tort laws, and the rule of law should matter most. One can use the this experiment as example.

Tuesday, July 06, 2010

iPhone Global Supply Chain, The Power of the Market Through The Division of Labor

The New York Times talks about supply chain structure of the iPhone and its costs,

``According to the latest teardown report compiled by iSuppli, a market research firm in El Segundo, Calif., the bulk of what Apple pays for the iPhone 4’s parts goes to its chip suppliers, like Samsung and Broadcom, which supply crucial components, like processors and the device’s flash-memory chip.

``In the iPhone 4, more than a dozen integrated circuit chips account for about two-thirds of the cost of producing a single device, according to iSuppli.

``Apple, for instance, pays Samsung about $27 for flash memory and $10.75 to make its (Apple-designed) applications processor; and a German chip maker called Infineon gets $14.05 a phone for chips that send and receive phone calls and data. Most of the electronics cost much less. The gyroscope, new to the iPhone 4, was made by STMicroelectronics, based in Geneva, and added $2.60 to the cost.

``The total bill of materials on a $600 iPhone — the supplies that go into final assembly — is $187.51, according to iSuppli.

However, when I reached the portion when the article mentioned “The world of contract manufacturers is invisible to consumers”, it dawned upon me that the author was dealing with wonders of the division of labor in passing.

Yes indeed, the iPhone is a product of a global division of labor!

And a great illustration of the magic of the division of labor was written by Leonard Read in his classic “I, the Pencil”, where he shows how people from diverse places and distinct cultures work spontaneously and invisibly in harmony to produce what seems like a simple product- the pencil- which you and I use.

The illustrious Milton Friedman does a great job discussing Mr. Read’s classic, below…

Tuesday, June 22, 2010

Currency Values Hardly Impacts Merchandise Trade

Wednesday, May 26, 2010

Gary North On Why Asia Will Surpass The West

``How is it that Asia has had a huge trade surplus with the United States? Because its people work long hours. They are finally getting access to capital. This capital increases their productivity. The tools they need to compete are made available through thrift. Then they put capital to use in a long work week. They have little time for leisure. They are at work many hours per day.

``In contrast, Americans are losing capital through consumer debt and withdrawal from the labor force. I don't mean unemployed people. I mean underemployed people. The person who watches TV for 4 hours a day is consuming his most precious capital: time.

``When we see a society committed to work, we see a society that has the basis for economic growth. If people work hard to get ahead, they will accumulate capital. Their work will become more efficient. If they work merely to buy spare time for play, then they will not experience economic growth.

``Asia is growing economically, because of the people's future-orientation. The United States is barely growing, because of its present-orientation. We see this in the waste of time associated with entertainment. This is a culture-wide phenomenon. It has been accelerating in the West for at least 85 years. The rise of radio and the movies marked the transition. World War II delayed the advent of the entertainment culture. The 1950s produced the first teenage subculture. It had its own movies, music, and entertainment. Why? Disposable income from parents and part-time jobs. The money went into our pockets. That was my generation. We spent as children spend, but we spent more money than children ever had spent in history. We got used to entertainment. The counter-culture, 1965–70, was even more committed to entertainment. It even turned cultural revolution into entertainment.

``This happened all over the West. It was not a uniquely American phenomenon. The student revolt in France in 1968 was worse than anywhere else.

``We now live in a nation that has suffered capital consumption. Foreigners are providing capital for us. Asians buy something like 40% of Treasury debt sold to the public. This will not go on indefinitely.

``When we learned to waste time and money in our youth, we developed bad habits. These bad habits are not easily broken. Asians never developed these bad habits. The youth of Asia headed for the cities to get jobs, not entertainment."

While it is true that attitude, behavior and time preference are key factors necessary to an Asian outperformance, I think these are insufficient.

Accumulation of capital can only come from a political and economic environment that permits it to do so. As Ludwig von Mises wrote, ``The masses, in their capacity as consumers, ultimately determine everybody's revenues and wealth. They entrust control of the capital goods to those who know how to employ them for their own, i.e., the masses', best satisfaction."

In other words, Asia will be able to surpass West only if Asians pursue and maintain a more capitalist society or an environment of greater economic freedom which allows her people save and accumulate capital, from competition and production of more goods and services to serve the masses, whom as Mr. von Mises said, determines the wealth of the society.

Monday, March 22, 2010

Learning From Sweden's Free Market Renaissance

In the following video, the Center for Freedom and Prosperity gives a succinct economic history on how Sweden attained her wealth based on limited government, rule of law and property rights, and how Sweden's success had been stalled by the emergence of big government.

And in learning from the recent mistakes, Sweden has embarked on a reform to scale down big government. (hat tip: Cafe Hayek)

Thursday, February 18, 2010

US Leads In Global Service Exports

Aside from earlier evidences where we noted that manufacturing in the US has reclaimed the top spot in the world [see US Manufacturing Update: Separating Fact From Fiction] and where the US still remains the lead recipient of global Foreign Direct Investments [Global Foreign Direct Investments Down; US Still Dominates], we find additional proofs:

1. of a shifting dynamic in the composition of the US economy from the industrial to the information model, [see Statistics Don't Reveal Extent Of The Evolution To The Information Age]

2. of a manifestation that US growth momentum would likely be oriented towards the free trade paradigm in support of the Information Age and lastly,

3. that debunks the myth that US investments and jobs are being sucked out by emerging markets through "low wages"

This from W. Michael Cox, the former chief economist for the Federal Reserve Bank of Dallas who writes at the New York Times, (all bold highlight mine)

``Equally important, Commerce Department data show that the United States is a top-notch competitor in many of the high-value-added services that support well-paying jobs.

``One of the brightest spots is operational leasing — a segment of the industry that handles short-term deals on airplanes, vehicles and other equipment — in which exports exceeded imports by eight to one. Our edge was six to one in distributing movies and television shows, and nearly four to one in architectural, construction and engineering services. Royalties and license fees, one of the largest categories in dollar terms, came out better than three to one, as did exports in advertising, education, finance, legal services and medicine.

``All told, the United States is competitive in 21 of 22 services trade categories. It recorded striking surpluses in 12 of them. Only in insurance did America run a significant deficit, a persistent outcome that reflects foreign prowess in reinsurance (that is, policies insurers take out from other insurance companies to protect against catastrophic losses).

Chart from Mark Perry’s Carpe Diem

``This pattern holds over time. The pecking order may change from year to year — for example, industrial engineering had the biggest surplus in 2006 and film and television held the top spot in 2007 — but the data consistently show the United States is highly competitive in a wide range of services categories.

``So, given how well we are selling services abroad already, can we reach President Obama’s five-year goal of doubling exports? Actually, it shouldn’t be that daunting. Our overseas sales of goods and services combined rose nearly 80 percent from 2003 to 2008. In fact, the current weak dollar and continuing economic growth in Asia might be enough to carry us the rest of the way to the goal even if the president’s proposed National Export Initiative fails to get off the ground. That said, there are some concrete measures that should be taken now that will pay off in the longer term, most having to do with free trade.

``The president said he would “reform export controls” and “continue to shape” an agreement that opens global markets during the so-called Doha round of World Trade Organization negotiations. But those talks are in their ninth year, and a final accord is a long way off. For now, we have to look at trade as a two-way street: increasing our opportunities to export entails giving other countries greater access to the American market.

Mr. Cox's zinger to the liberal cavilers,

``We can complain as much as we want about China and other nations stifling domestic sales of our products, but our companies will get nowhere if the United States comes to the bargaining table with a something-for-nothing mindset."

All these has been presciently captured by Alvin and Heidi Toffler in Revolutionary Wealth who wrote,

``Where the Second Wave built ever more-towering- vertical heirarchies, the Third wave tends to flatten organizations and brings a shift to networks and many alternative structures.

``And these only begin the lenghty list of radical changes. Thus, manufacturing things we can touch-the core function of Second Wave economies-has increasingly become an easily commoditized, comparatively simple, low-value-added activity.

``By contrast, such intangible functions as financing, designing, planning, researching, marketing, advertising, distributing, managing, servicing and recycling are frequently difficult and costly. They add more value and generate more profit than metal bending and muscle work. The result is a profound change in the relations of different sectors in the economy."

For us, investments are shaped by the market dynamics and or forward looking consumer trends as the above.

Tuesday, January 12, 2010

Asia Goes For Free Trade

``there are many other reasons to suggest why emerging markets seem to be on a secular trend to play catch up with advanced economies, particularly positive demographic trend, urbanization, high savings rate, low debt or systemic leverage, unimpaired banking system, rising middle class and most importantly a trend towards embracing economic freedom via more freer trade, investments, financial and migration flows [e.g. see Asian Regional Integration Deepens With The Advent Of China ASEAN Free Trade Zone]

We found this from the Investor's Business Daily, (all bold highlights mine) [hat tip: Professor Mark Perry]

``Largely ignored over the weekend, Jan. 1 signaled the arrival of the world's third-biggest free trade area. China and Asia's Tigers — the Association of Southeast Asian Nations — scrapped 7,000 different tariffs to form a $200 billion open market for about 2 billion consumers, one-third of the world's population.

``That's not the half of it. Jan. 1 also heralded another ASEAN free-trade pact with mighty India, ending tariffs on 4,000 products staggered through 2016. This deal will expand a $50 billion market for 1.5 billion consumers into something even bigger.

``ASEAN also signed off on free trade with Australia and New Zealand, tacking on another $50 billion market to expand for their 600 million consumers. It follows ASEAN's Dec. 1 agreement with Japan, which created a $240 billion market for 670 million. In addition, Thailand and South Korea completed the last step of 2007's ASEAN-Korea pact, finalizing expansion of the zone to a $72 billion market for 600 million.

``ASEAN's six freest members — Thailand, Indonesia, Singapore, Philippines, Malaysia, Brunei — even enacted a free-trade deal among themselves on Jan. 1, ending tariffs on goods sold to each other, freeing a $60 billion market for 500 million consumers.

``ASEAN wasn't the only one moving on free trade. Over the same weekend, India announced that three years of talks with South Korea were complete, uniting the third- and fourth-largest economies in the Far East. India's leaders said a one-year deadline for negotiating a pact with the European Union was set this week, too.

``All this points to something major: While the Obama administration has put its energy into trade wars with China, enacting punitive tariffs on steel, tires, nylon, paper, and other goods and has signed no new pacts in 2009, free trade is marching on without the U.S."

Here we have a clear case of policy divergence. Asia (most especially ASEAN) openly goes for free trade while the Obama regime seems backtracking on economic freedom.

Guess where capital will flow?

Lastly this goes in patent defiance to the mercantilist perspective that the world will go protectionist.