Yesterday, I noted that despite the interventions by the Bank of Japan, retail sales have fallen markedly. Apparently, like China, Japan’s economic deterioration has been intensifying and spreading.

From Bloomberg,

Japan’s industrial production unexpectedly fell in July, adding to signs that faltering global demand is undermining the economy’s recovery.

Production slid 1.2 percent in July from June, when it advanced 0.4 percent, the Trade Ministry said in Tokyo today. The median estimate of 27 economists surveyed by Bloomberg News was for a 1.7 percent increase.

A slowdown in exports and the winding down of subsidies for car purchases are dimming the outlook for manufacturing and growth in the world’s third-biggest economy. Bank of Japan (8301) Governor Masaaki Shirakawa said on Aug. 24 that demand related to reconstruction from last year’s earthquake and tsunami is “gradually gaining momentum” and may help to sustain growth.

“Looking ahead, Japan’s economy will probably lose steam,” Kohei Okazaki, an economist at Nomura Securities Co. in Tokyo, said before the report. “Overseas demand is slowing, affecting production and capital spending.”

It’s really not about the lack of demand which has been more a symptom than the cause, but rather that much of productive capital have been diverted into unproductive undertakings through political rescues of the banking and other politically favored zombie companies.

Thus the ensuing dearth of capital spending means less output, less jobs and less demand.

And as much as Japan’s political economy has been tainted or economically weighed by crony capitalism so goes with the Western peers, thus a transmission of a global slowdown which amplifies the contagion risks.

Yet a substantial part of the economic adjustments brought about by the previous artificially inflated boom, has been liquidations of misallocated capital. Combined with lack of capital spending, the slowdown in economic activities has resulted to reduced consumer prices.

From another Bloomberg article,

Japan’s consumer prices fell for a third month in July, underscoring concern that the central bank is too optimistic about the outlook for achieving its 1 percent inflation goal.

Consumer prices excluding fresh food dropped 0.3 percent from a year earlier, the statistics bureau said in Tokyo today. That matched the median estimate in a Bloomberg News survey of economists. The jobless rate stayed at 4.3 percent, a government report showed.

Today’s data may reinforce doubts over the central bank’s efforts to reverse more than a decade of deflation as the European debt crisis hurts Japan’s economy by dragging down exports. Central bank Governor Masaaki Shirakawa last week said that it’s likely the inflation goal will be realized after the end of fiscal 2013.

“Japan is still in a deflationary phase,” Masayuki Kichikawa, Tokyo-based chief economist at Bank of America Merrill Lynch, said before today’s release. “The bad news is that the global slowdown has been prolonged so the BOJ will probably have to delay its time line to achieve the inflation goal.”

Despite bouts of negative consumer prices, which in a free economy means higher purchasing power of money out of more production, Japan’s supposed “deflation”, which has misled mainstream, has truly been about disinflation.

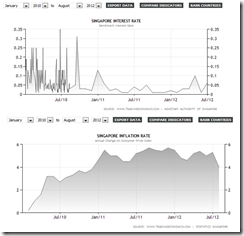

Notice that since the bubble bust in 1990, the Japan’s CPI index has wavered, and in times when it turned negative, the index hardly breached 1% except in 2009 to early 2010 which came in the aftermath of a global recession. (chart from tradingeconomics.com).

This is hardly “deflation” in the context of the US Great Depression which many try to erroneously correlate.

(From the Economist’s View).

The above is an example of the CPI "deflation" of the US Great Depression whose conditions are immensely dissimilar from Japan and today.

Instead, the vacillating inflation-deflation signifies as stagnation out of Japan’s sustained policies to prop up unsound and unprofitable but politically connected enterprises which has prompted for the “lost decades”, as I previously discussed.

Nonetheless the negative CPI will give the Bank of Japan (BoJ), whom will be pressured by Japan’s politicians, more excuses to expand monetary intervention via asset purchases.

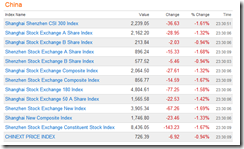

So far, most of global equity markets have not factored in the intensification of a global economic slowdown which has become evident in China and Japan. Recession in the Eurozone compounds the dire global economic conditions. The US seems likely to follow.

Yet the simultaneous economic deterioration extrapolates to increasing risks of a world economic recession.

Global equity markets have artificially bolstered by the charm offensive made by central bankers on promises of rescue. But until now they have refrained from making any major moves.

If the current dynamic will worsen, and without or with less than expected central bank interventions, market expectations may shift swiftly and dramatically to incorporate the real risk environment.

Be careful out there.