But at some point, markets won’t take central bank policies anymore, and interest rates go up regardless of how much bond buying they do. Market timing is tough. As for the fixed income market, I’m short junk bonds. In any market, the marginal stuff goes first. This could precede problems with sovereign debt.- Jim Rogers

At advent of the 2013 here is what I wrote about main dynamic that will drive the Philippine asset markets[1]: (italics original)

Let me repeat: the direction of the Phisix and the Peso will ultimately be determined by the direction of domestic interest rates which will likewise reflect on global trends…Yet interest rates will ultimately be determined by market forces influenced from one or a combination of the following factors as I wrote one year back: the balance of demand and supply of credit, inflation expectations, perceptions of credit quality and of the scarcity or availability of capital…In short, expect markets to be fluid and highly, if not wildly, volatile. So far volatility has been on the upside

I expect that the interest rate dynamic will even be more pronounced in the coming days.

Phisix Boom: 15 minutes of Fame

Just last week, I warned about the growing risks of a meltdown (bold original)[2].

What I am saying is that unless the upheavals in global bond markets stabilize, there is a huge risk of market shock that may push risk assets into bear markets.Bottom line: Current markets seem as in crossroads; if political actions will be able to soothe the mercurial bond markets, then current conditions represents an interim bottom.If not, or if the conditions of the bond markets deteriorates further, then the imminence of a bear market on risk assets.

The astounding two day 11.4% collapse by the Phisix essentially expunged a substantial bulk of this year’s advances. Worst, this brought the local benchmark to the brink of the technical definition[3] of a bear market: a 20% price decline over at least a 2 month period.

Over the week, the Phisix crashed by 6.86% to whittle down year to date gains by a measly nominal currency based 7.30%.

What was once the breathtaking 5% monthly return for the past 5 months has almost been gruesomely vaporized in just two weeks. From “rising star” to a “falling star”. This signifies as the Phisix’s proverbial “15 minutes of glory”.

Based on the highest close of 7,392.2 last May 15th, the bear market threshold stands at 5,913 or 5,900 which is just about 5+% away.

Foreign money, which I described as the 800 lb. gorilla in the Philippine Stock Exchange, has partly been responsible for the selloff. I say “partly” because the rate of foreign selling this week (Php 2.35 billion) accounted for only about a little more than a quarter of the amount of the previous week (Php 8.43 billion).

Yet the BSP recently reported “record” outflows of foreign “hot” money[4] to the tune of US $640 million in May or at the peak of the mania.

Nonetheless, PSE data shows net inflows (Php 18.6 billion or US $433 million) for the Philippine Stock Exchange over the same period, which means hot money outflows may have emanated from other channels.

It’s the Global Bond Markets, Stupid

I have never seen media and their quoted experts so incredibly “out of touch” with reality or so incorrigibly clueless with the current developments.

Thursday’s 6.8% nosedive by the Phisix has earned the event the top billing on the front page for some of the major broadsheets.

In one article I read, there was ZERO, NADA, ZILCH mention by the lengthy spiel of the rioting bond markets and of the growing interest rate risks.

The only “bond” cited was the so-called investor response to the possible pullback of FED’s “bond-buying program that have propped up global stock markets”[5]. This according to the news provoked market crash.

The article can summed up as “because of Taper Talk, thus market’s crash”. This represents the logical fallacy known as the Post hoc ergo propter hoc—“after this, therefore because of this"[6].

All the rest signified as defense or denials from such actions; “hardest profit taking”, “price-earnings becoming high”, “pullout of foreign funds to be short-lived”, and “underlying fundamentals remain sound”.

Yet the Nikkei crash in Japan had been attributed to same context, central bank policies, “disappointment over the Bank of Japan’s decision earlier in the week to refrain from additional monetary easing measures”.

Examine mainstream’s logic. If FED policies have indeed propped up global stock markets, and if Japan’s Nikkei depends on “additional monetary easing measures”, then what’s the relationship between “underlying fundamentals”—depicted in the conventional sense—with that of stock market actions?

None of the experts came even close to addressing this.

Just think of it, if the quoted Philippine official thinks that “underlying fundamentals remain sound” then why would such bloody events ever happen at all? Are markets so fickle, so blind and so wantonly silly as to drive up price earnings and later to realize that all their actions have been a mistake? From what basis: the confidence fairy?

Fear and greed are factors but they are secondary incentives.

The mainstream logic goes: if markets go up, then it is because of fundamentals (or for politicians—because of my policies), but if markets go down then this events are unreal or (for politicians—this must be someone else’s fault). Such expression represents the cognitive self-attribution bias[7].

The same cockiness can be seen via the “new order” blissful thinking where the same official recently declared that the Philippine economy can maintain growth at “6-7% over the medium to long term” and where 4-5% growth is a “thing of the past”[8].

Such stupendous embrace of policymaking nirvana represents what the great Austrian economist F. A. Hayek calls as the “fatal conceit”[9] or the notion that “man is able to shape the world around him according to his wishes”

Importantly this also signifies as signs of mania’s pinnacle: the four most feared words in investing: THIS TIME IS DIFFERENT.

The reality is that the cornerstone of the so-called soundness of the “underlying fundamentals” operates around the illusions of statistical growth, which has been funded by massive credit or debt expansion from prolonged the low interest rates environment, which has benefited the few households, particularly the politically connected ones, with access to the banking system.

Thus the tumult in the global bond markets suggests that the current economic environment, where listed corporations operate on, will get radically altered.

In other words, the lessons from the recent crash are 1) the growing likelihood of a dramatic change on the economic environment (from easy money to tight money) and 2) the consequent deleveraging from highly leveraged systems.

Unfortunately these are scenarios which the mainstream can hardly imagine or absorb.

Proof?

The cost of insuring Asian debt via Credit Default Swaps or the risks of a credit event or default risks continues to rise.

The cost of insuring Asian corporate and sovereign bonds against non-payment jumped, according to the Singapore’s Business Times to the highest in more than eight months[10]. This can be seen above from the chart from Asian Development Bank[11]

The recent jolt in the interest rate markets has already severely spooked or the shocked the equity markets, how about a full scale implosion of the bond bubble?

Furthermore, the misconception that the 4-5% growth represents “thing of the past”, which basically projects the recent past into the future, will become a horrid reversion to the mean[12], if not huge tail risks.

Without structural improvements that would allow people to engage in more productive activities via economic freedom, today’s credit fueled boom will morph into tomorrow’s bust.

If the Phisix falls into a bear market, then the reflexive two-way feedback loop between market expectations and market and economic outcomes will work in the reverse: falling markets will increase incidences of negative events that will spur more risk averse actions that will affect prices.

The same mechanism will impact credit activities: Falling prices and growing risk aversion will reduce collateral values which will spillover to credit activities which subsequently leads to further pressure on prices and vice versa.

Given the huge growth (142% 2006-2012 or CAGR of 13.5%) of financial intermediary loans on the domestic banking system as reported by the BSP[13], which partially may have been channeled through the asset markets like stocks and bonds, falling asset prices mean greater risks of deterioration of credit quality or higher default risks.

This implies that if the selling pressure on the Philippine assets markets will be sustained then the Philippines will have sub-zero growth within the next 3 years. Worse, we could have an economic or banking crisis, if there will be massive deleveraging ahead here and abroad.

“Thing of the past” will become the present.

The appeal to authority has been a predilection of media to defend the status quo.

But the effects of denials by political agents have been well documented which in the past has been foreboding. Some examples: the political cockamamie or spins during the Great Depression of the 1930s[14], the Bernanke housing bubble denials[15] during the pre-Lehman crisis, and the 15 minutes of fame[16] for the supposedly Euro crisis immune[17] Cyprus banking system who eventually meted out punitive haircuts on bank deposits to the unfortunate depositors.

If the bond market rout persists which should impact the rest of the asset markets, today’s denials will become anger (finger pointing), then bargaining, then depression and finally acceptance—or what is known as the Kubler Ross Grief Cycle[18].

Another of media’s fiction has been to suggest that the current meltdown in ASEAN and Japan represents “hardest profit taking” on the “best performing markets”. Such assertion represents data mining or selective perception.

On a weekly basis, the equity benchmark of Brazil (-4.43%) and Russia (-3.32%) tanked almost at par with Thailand (-3.36%) and has been worse than Indonesia (-2.16%). But on a year to date basis, Brazil treads at the borders of the bear market threshold while Russia has been in the red even before the meltdown seen during the last two weeks. The Brazil and Russian episodes reveal that even the worst performers got terribly hit.

Among the best performers, the Nigeria bellwether, the Nigerian Stock Exchange[19], lost 5.85% this week, bringing down year to date gains to 33.85%. However the equity benchmarks of United Arab Emirates, the DFM General[20] and Pakistan’s Karachi 100[21] seemed unscathed by the collapse of her peers, they even posted modest gains this week. Such weekly gains increased their returns to 48.96% and 33.04% (y-t-d) respectively which demolishes anew the reckless generalization that the best performers got hit by profit taking.

The Narrative Fallacy: Ben Bernanke’s Tapering Talk

Let us put into perspective the so-called “Fed stimulus tapering”

If the Fed’s policies did prop the global markets, then transmission mechanism has been through easy money policies via the interest rate channel (ZIRP) and by Quantitative Easing which has been aimed at promoting credit growth.

Effectively a pullback of monetary steroids would translate to a withdrawal syndrome: from easy money to marginally tighter money. Such tightening will be vented on the bond markets.

With the exception of adjustable rate mortgages which tend to follow Fed Fund Rate, the US Treasury of the 10 year US treasury notes serves as yardstick[22] to almost all other interest rates, including long term bonds and fixed mortgage rates[23]. This is why rising 10 year yields are very important.

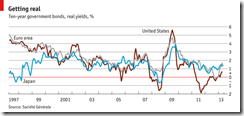

As proof, 10 (upper window) and 30 year (lower window) yields has been moving in close synchronicity.

The most important perspective is that US 10 and 30 year yields have been ascendant since the record lows of July 2012 (see blue line).

The FED’s extension and expansion of her unlimited QE program which was initiated in September 2012[24] had only a 3 month effect of the lowering of yields. Benchmark yields crept higher after the November lows.

In anticipation of aggressive monetary actions, the nomination[25] of Japan’s PM Shinzo Abe of ADB President Haruhiko Kuroda as the chief of Bank of Japan (BoJ) appears to have contributed to the a sharp retreat of coupon yields in March-April. But this didn’t last.

As the new BoJ Governor, Mr. Kuroda’s first move was to announce in early April[26], the bold doubling the monetary base as the one of the “three arrows”[27] of Abenomics. Such audacious gambit appears to have attained the opposite effect.

The BoJ’s actions has not only spiked the yields of Japanese Government Bonds (JGB), but may have also substantially contributed to the surge in UST yields.

Even the European Central Bank’s latest interest rate cut last May 2nd[28] failed to stem the rise in UST yields.

In short, the diminishing returns from central bank easing policies may have reached a critical tipping point. Instead of pushing rates lower as designed, easing policies have begun to compound on the pressure for higher yields.

This is known as the law of unintended consequences[29].

Higher yields in a heavily leveraged system have startled the bond markets first, eventually percolating to emerging markets. As pointed out last week, many leveraged trades which depended on low interest rates had to be winded down, thus compounding on the EM crash.

Moreover, given the supposedly muted consumer price inflation, rising nominal rates extrapolate to a shift from a negative real rate regime to a positive real rate environment[30]. Such a shift essentially negates the “inflation tax” from financial repression policies. Instead, positive real rates increases the onus of debt servicing amidst today’s sluggish growth and the heavily leveraged system. The consequence: growing concerns over default risks as seen in the CDS markets.

Another significant contributing factor to the current bond turmoil could be the prospects of policy haircuts affecting bank depositors and bondholders during a credit event.

In a recent Eurogroup president[31] Jeroen Dijsselbloem said[32] “if the bank can’t [recapitalize itself] then we’ll talk to the shareholders and the bondholders, we’ll ask them to contribute” to recapitalizing the bank, “and if necessary the unsecured depositors.”

With officials whether from Japan[33] or Europe or elsewhere overtly talking about the seizing deposits and bonds, such “bail-ins” or the prospects of haircuts may also have contributed to the incentives of bond market investors to sell, if not, to reduce the appeal of bonds as “safehaven”. These are aggravating circumstances.

The bottom line is that Fed chairman Ben Bernanke’s “taper talk”[34] last May 22nd represents little more than market’s rationalization of rising yields or looking for a scapegoat for the recent market turmoil or of the narrative fallacy.

The narrative fallacy can be described as fooling ourselves with stories that cater to our Platonic thirst for distinct patterns, according to iconoclast author Nassim Nicolas Taleb[35]

Now for the rub, given the proximately $642 billion, or 4 percent of gross domestic product (CBO projections) of budget deficit[36], and where personal savings rate as a percentage of disposable income[37], at 2.5%, the lowest level since the start of the recession in 2007, where oh where will the US government source her funding for social expenditures?

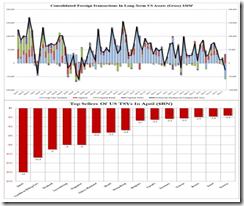

Foreigners are unlikely to fill in the gap, given the continuing turbulence in the bond markets.

In April, just when the Kuroda’s grandest experiment was launched, Japan accounted for as the biggest seller of UST.

According to the Zero Hedge[38] “in April foreign investors, official and private, sold $54.5 billion Why is this number of note? Because it is the biggest monthly sale of Treasurys by foreigners in the history of the data series.”

In short, the Fed cannot afford a “tapering” or an exit, otherwise risks of higher interest rates that could lead to immediate default. So they are likely to hold or even to expand QE.

But again markets are forcing them to realign their actions lest lose credibility. Thus any of such act, if there should be one, will be marginal or will signify as token symbolism.

The International Currency Reserve Curse?

One of the unseen factors that may have influenced today’s EM meltdown has been the domestic bubbles brought upon by the huge accumulation of foreign currency reserves.

Credit Bubble Bulletin’s impressive Doug Noland promptly enumerates[39] of the changes of international reserves

Brazil saw International Reserves double from about $190bn to $375bn over the past four years, and Mexico’s Reserves have grown from about $80bn to $168bn. South Korean reserves have jumped from $212bn to $328bn - and Indonesia from $57bn to $105bn. Russian reserves have increased from $368bn to $480bn - and Turkey from $64bn to $109bn. South African reserves increased from $30bn to $41bn. It’s worth noting that Philippines reserves doubled to $72bn; Indonesia’s almost doubled to $105bn; and Thailand’s jumped about 50% to $166bn

Of course the biggest or the “king” of all reserve buildup would be China, where from $150 billion in the year 2000, international reserves has skyrocketed to today’s $3.443 trillion that’s 71% higher four years ago.

The point is that the current implied tightening of the monetary environment could expose on the vulnerability of domestic bubbles.

Aside from the closure of leveraged trades, the realization of the unsustainability of domestic bubbles may result to even more capital outflows and deleveraging.

And what the mainstream sees as an advantage can from huge reserves can easily permutate into a shortcoming.

The panic reaction by Indonesia’s officials should give us a clue. This week, the Indonesian central bank, Bank Indonesia, raised policy rates via the deposit facility rates or the rate it pays lenders on overnight deposits. But the central bank also promised to buy government debt in the secondary market. So Indonesia will be launching her version of QE.

But the most important development has been a dramatic depletion of huge reserves in response to the abrupt exodus by foreign investors where a total of “$1.9 billion from stocks and local-currency bonds” fled in Indonesia during the past two weeks

From Bloomberg[40]:

Indonesia is consuming foreign-currency reserves at the fastest pace in Asia as policy makers struggle to contain the rupiah’s plunge. Reserves dropped 5.7 percent in a year to $105 billion in May as the central bank sold dollars to bolster the rupiah

Put differently, Indonesia seems caught between preserving the bubble conditions by draining her reserves or keeping the reserves at the risks of a bubble bust.

And current problems are not just in Japan or Indonesia.

China has been exhibiting increasing stress on her monetary system. The Chinese government suffered its first debt auction failure in 23 months supposedly due to a cash squeeze[41].

The result: higher interest rates; the average yield on the debt sales spiked to 3.76% to 3.14% in June 13th.

The average yield of Dim sum bonds[42] or Chinese bonds issued in Hong Kong climbed to a 5 month last week[43]. The yuan as measured by forward contracts also traded weaker last week.

Mr. Noland also notes that Chinese CDS has been very volatile having “jumped from 92 to 113 in three sessions, before dropping back down to 98 on Friday”

Bottom line: the current selloff has exposed the world markets to multitudinous flashpoints for a potential crisis.

The Fragile Emerging Market and Asian-ASEAN Bond Markets

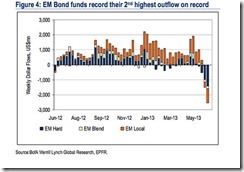

Emerging market equity and bonds continue to bleed as bond markets of developed economies undergo convulsions.

The week posted “record” foreign outflows in Emerging Market equity and bond markets

Reports the Marketwatch.com[44]

According to Lipper, emerging-market debt funds, including exchange-traded funds, saw $622.5 million in net outflows in week ended June 12, the largest on record and up from an outflow of $384 million the previous week and around $30 million two weeks earlier. But its ETFs that are bearing the brunt of the outflows, notes Matthew Lemieux, a Denver-based senior research analyst for Lipper.In particular, the iShares JP Morgan dollar-denominated Emerging Market Bond ETF saw a $268 million outflow in the latest week, bringing the total over the last three weeks to around $528 million. It’s a similar story on the equity side, where total fund outflows in the latest week totaled $2.1 billion, one of the largest on record.Over the last three weeks, emerging equity funds have seen $4.9 billion in outflows. There, ETFs are even more of a driver, with the iShares MSCI Emerging Markets Index Fund witnessing around $5.2 billion in outflows alone over the last three weeks.

Emerging market corporate bonds have grown to a $1 trillion market. Since 2005 annual issuance has doubled to a “record” $200 billion last year which has already been surpassed this year by end-May, according to Reuters[45]. Many of the companies have reportedly taken on dollar based hedges.

While it would be easy to dismiss on the risks from EM outflows, the degree and the duration of volatility aside from effects to domestic rates will play a significant factor.

The EM collapse hasn’t been identical.

For instance, South Africa suffered more from a bond and currency rout than from a stock market carnage. The South Africa’s FTSE 40 lost only 4.46% in two weeks and still is up 2.38% over the year. But the rand suffered the biggest loss[46] among EM currencies since the EM massacre began (left window).

If the mayhem continues, whether ventilated on the currency, stocks and or bonds, the bloodletting in the EM spectrum will highlight the fragile state of Emerging Market assets. And this can be already seen in the recent soaring of CDS (right window).

And such vulnerability applies to Asia, particularly to Asia’s previously booming bond markets.

The following article underscores the lessons of the recent meltdown: the potential consequence from a change in environment from easy to tight money and the risks of deleveraging

From Reuters[47]:

Low global interest rates have made it easier than ever to sell new bonds denominated in dollars, euros or yen, resulting in a boom in issuance that has made Asia and its companies ever more dependent on debt.But the market for trading those bonds is slowly drying up, leaving it susceptible to a sharper selloff if holders of these so-called G3 bonds decide it is time to head for the exit…Asia's low market liquidity could create a more explosive selloff in which a lack of trading creates a price vacuum, leading to sharper price declines as investors scramble to sell assets for cash, a scenario similar to the dark days of the Lehman crisis.

See, low rates equals boom, high rates increases the default risks. Low liquidity magnifies a panic. Boom bust cycles.

A panic hasn’t been a reality yet.

Despite the equity selloffs, ASEAN bonds appear to have resisted any further catastrophic exodus from foreign money similar to other EM contemporaries.

But as shown earlier, ASEAN CDS have commenced an upside move. Low liquidity may have prevented a stampede. On the one hand, the seeming tranquillity of ASEAN bonds, and on the other, volatile stock markets, CDS markets and currency movements these dynamics don’t chime. One of the two divergent forces is wrong, either volatility will subside or agitations will eventually engulf ASEAN bonds.

This is why the coming weeks will be very important. Will markets continue to gyrate violently or will they sober down?

Remember, the yield of the 10 year Philippine bonds seem to suggest that her credit risk profile has been nearly at par with Malaysia and has (astoundingly) surpassed Thailand, which for me, signifies as a bubble.

And as I have earlier pointed out, the interest rate spread between the US and Philippines has substantially narrowed. This reduces the arbitrage opportunities and thus providing incentives for foreign money to depart from local shores to look for opportunities elsewhere or perhaps take on a “home bias” position.

The EM and ASEAN bond markets are highly vulnerable to market shocks as recent events have shown.

Conclusion: Expect the Unexpected

The volatility in global bond markets remains a clear and present danger. Until these markets subside either naturally or through political interventions (in the hope that such interventions will have the desired effect), the prospects of further deterioration of markets should not be discounted. On the contrary, this should be expected.

And continued volatility may push many emerging markets including the Phisix into respective bear markets which increases the risks of a global crisis. There are many flashpoints not limited to Japan. They may come from China, ASEAN, Eurozone or elsewhere. Perhaps the US will be the last in the domino chain.

However, I am in deep suspicion that these broadening bouts of volatility previously from commodity markets and then to bond markets and now to EM currencies and equities are symptoms of the periphery to the core dynamics.

The accrued losses from these highly volatile markets will eventually be felt by one or more major institution/s (ala Bear Stearns) from any crisis prone nation. Once in the open, the impact will be a contagion. Shades of the EM collapse during the past two weeks.

I hope that I am wrong, but I fear that we have just witnessed the overture to the forthcoming global crisis.

Since every crisis is a process, it will take time. Volatility will go on both direction but with a downside bias, unless again, global bond markets are pacified.

Expect governments to intervene too. But whether they will succeed or not in delaying the day of reckoning remains to be seen.

And if the balm from social policies takes effect, the question is until when? The FED’s QE 3.0 brought down yields for just 3 months. Abenomics in less than a month. The intended effects of interventions have been narrowing. The law of diminishing returns appear to be flexing her muscles. Markets appear to have risen in rebellion. Will bond vigilantes become the dominant force?

We have already seen this in Indonesia’s central bank proposing to conduct QE. How long will these assuage nervous investors?

On the other hand, will disorderly markets prompt Indonesia to continually drain her vaunted reserves leaving her exposed or vulnerable to a crisis?

How will Thai and Philippine authorities respond if the unravelling intensifies?

Interesting times indeed.

Here is a humble advise:

Avoid listening to mainstream talking heads, who hardly seem to have any inkling of reality and whose interests are in subtle conflict with that of investors.

Most especially avoid paying heed to political agents who don’t have skin in the game and whose incentives are meant to promote political agendas than the truth.

Do your own research. Think independently.

And trade with extreme caution

[1] See What to Expect in 2013 January 7, 2013

[2] See Phisix Meltdown: A Reality Check on the Bullish Dogma June 10, 2013

[3] Wikipedia.org Bear market Market trend

[4] Xinhua.net Foreign fund managers abandon Philippines as outflow hits record June 15, 2013

[5] Inquirer.net PH stocks plunge 6.8% June 14, 2013

[6] Wikipedia.org Post hoc ergo propter hoc

[7] Behavioural Finance.net Self-Attribution Bias

[8] Inquirer.net BSP chief says GDP growth of 4-5% now a thing of the past June 3, 2013

[9] Friedrich von Hayek THE FATAL CONCEIT The Errors of Socialism p.27 libertarianismo.org

[10] Business Times Singapore Asian bonds insurance costs at 8-month high June 14, 2013

[11] ADBBondsonline.org Emerging East Asia CDS - Senior 5-year

[12] Investopedia.com Mean Reversion

[13] Bangko Sentral ng Pilipinas Economic and Financial Statistics

[15] Daniel J. Sanchez Ben Bernanke Was Incredibly, Uncannily Wrong July 28, 2009 Mises.org

[16] See Example of the Mania Phase: Awards Received by the Bank of Cyprus March 17, 2013

[17] See The Flaws of BSP’s Real Estate Monitoring and Banking Stress Tests May 20, 2013

[18] ChangingMinds.org The Kübler-Ross Grief Cycle

[19] Bloomberg.com Nigerian Stock Exchange All Share Index

[20] Bloomberg.com Dubai Financial Market General Index

[21] Bloomberg.com Karachi Stock Exchange KSE100 Index

[22] About.com 10-Year Treasury Note and Rate

[23] Mike Larson The Worst of the Bond-Market Bust Is Yet to Come, June 14, 2013

[24] CNN.com Federal Reserve launches QE3 September 13, 2013

[25] Bloomberg.com Abe Nominates Haruhiko Kuroda as Next Bank of Japan Governor February 28, 2013

[26] See BoJ’s Kuroda’s Opening Salvo: 7 trillion yen ($74 billion) of Bond Purchases a Month April 4, 2013

[28] Bloomberg.com ECB Cuts Interest Rates to Record Low as Recession Lingers May 2, 2013

[29] Rob Norton Unintended consequences Library of Economics and Liberty

[30] Buttonwood, Too tight or back to normal?, June 11, 2013

[31] Jeroen Dijsselbloem, President of the Eurogroup Eurozone Portal

[32] Yahoo Finance Does the Cyprus ‘Bail-In’ Open the Door for Private Deposit Insurance? April 4, 2013

[33] See Told You So: Japanese Government will Resort to Deposit Confiscations June 12, 2013

[34] Bloomberg.com Bernanke’s Tapering Talk Backfires Amid Bond Yield Surge June 14, 2013

[35] Nassim Nicolas Taleb The Black Swan The Impact of the Highly Improbable Allen Lane p 50

[36] Bloomberg.com Budget Deficit in U.S. Widened in May as Spending Increases 10% June 13, 2013

[37] Fred Economic Data Personal Saving Rate (PSAVERT) St. Louis Federal Reserve

[38] Zero Hedge Treasury Sales By Foreigners Hit Record High In April June 14, 2013

[39] Doug Noland, The King of EM, Credit Bubble Bulletin June 14, 2013 Prudentbear.com

[40] Bloomberg.com Indonesia Raises Fasbi Rate as Martowardojo Acts on Rupiah June 12, 2013

[41] See China Bubble: Oops, China’s Debt Markets Suffers from Cash Squeeze June 14, 2013

[42] Investopedia.com Dim Sum Bonds

[43] Bloomberg.com Yuan Forwards Discount Widening Shows Dim Sum Risk: China Credit, June 13, 2013

[44] Marketwatch.com Emerging-market debt ETFs bear brunt of outflows as market carnage deepens June 14, 2014

[45] Reuters.com Analysis - After emerging corporate bond boom, default risks on rise June 12, 2013

[46] The Economist The end of the affair June 15, 2013

[47] Reuters.com Asia's ticking time bonds; time to cut and run? June 15, 2013