The BSP’s Version of Taper Talk

JUST a little over two weeks back, Bangko Sentral ng Pilipinas (BSP) Governor Amando Tetangco said that the low inflation environment, “gives us room to maintain interest rates and our current policy stance”[1].

In short, the easy money environment will prevail.

This week in an interview on Bloomberg TV, the gentle BSP governor signaled a forthcoming change in the BSP’s policy stance noting that since the Philippine economy is “strong”, “we don’t see any real need for stimulus at this point”[2].

Oh boy, the BSP chief echoes on the ongoing predicament of US Federal Reserve of testing the “tapering” waters.

The BSP was cited by the same Bloomberg article as raising its price inflation forecasts by putting the burden of inflation risks on the weakening peso.

So the BSP essentially has begun to signal a backpedalling from easy money stance.

As I’ve noted in the past, similar to the Fed’s “taper talk”, the BSP’s subtle change in communication stance represents “tactical communications signaling maneuver to maintain or preserve the central bank’s “credibility” by realigning policy stance with actions in the bond markets.”[3]

While the BSP’s preferred culprit has been the weakening peso, the reality has been that higher yields in the global bond markets including emerging Asia and the Philippines has forced upon this discreet volte-face.

The attempt to substitute the influence of bond yields on domestic monetary policies with the weakening peso, the latter having been premised on alleged expectations of higher price inflation represents, as the stereotyped political maneuver of shifting of the blame on extraneous forces—the self-attribution bias.

The peso as culprit for general price inflation has been premised on the fallacious doctrine of balance of payments. The weak peso, according to the popular view, will prompt for an increase in price inflation via higher import prices. But in reality, rising import prices will lead to reduced demand for imports or on consumption of other goods, thereby offsetting any increase in general prices.

This means that the depreciation of the Peso represents a symptom rather than a cause where the principal cause has been due to domestic inflationary policies.

As the great Austrian economist Ludwig von Mises explained[4]

Prices rise not only because imports have become more expensive in terms of domestic money; they rise because the quantity of money was increased and because the citizens display a greater demand for domestic goods.

Since 2001, the asset segment of the BSP’s balance sheet have ballooned by a Compounded Annual Growth Rate (CAGR) of 11% where International Reserves comprises 86% of the asset pie as of December 2012 based on the BSP’s dataset[5].

On the other hand, the gist of BSP’s liabilities or 73% has been on deposits. Special Deposit Accounts (SDA) constitutes 57% of total deposits with Reserve deposits from other deposit accounts signifying a 19% share and deposits from the Philippine treasury at 9%.

Meanwhile, currency issued, which had a 17.7% share of BSP’s liabilities, grew by 9.05% CAGR over the same period.

The rate of growth in the BSP’s balance sheet increased in 2006, but has been in acceleration in 2009 through today.

This also implies that the bulk of the credit expansion in the banking sector have ended up as deposits in the BSP.

The CAGR of BSP’s balance sheet at 11% has nearly been double the 5.97% CAGR of Philippine GDP at constant prices[6] over the same period.

Thus inflation pressures hardly emanates from imports but from the rising quantity of money and assets with moneyness functionality or money-substitutes[7].

Of course, when the BSP governor referred to a “strong” economy as basis for the subtle change in his policy signaling of a reduced need for stimulus, he has actually been resorting to the anchoring bias (behavioral finance) and to the time inconsistent dilemma. That’s because “strong” conditions had all been predicated on the easy money environment.

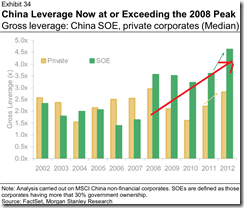

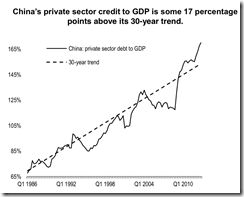

And with the projection of higher interest rates in a system whose leverage has been rapidly building up over the recent years, as shown by the double digit growth of overall banking debt (left) and the surging rate of loans on what I suspect as the epicenter of the Philippine bubble (right), this means higher cost of servicing debt and higher cost of capital. This also means interest rate and credit risk will mount.

And for the financial world who are dependent on computing for Discounted Cash Flows[8] (DCF) analysis based mostly from Net Present Value[9] (NPV), changes in discount rates will impact heavily on the feasibility of projects and investments. New projects or investments built upon discount rates at current levels will likely be exposed to losses from miscalculations or errors brought about by the expectations of the perpetuity of the low interest rate regime when the BSP officially begins its tightening.

All these means that if the path of interest rates is headed higher, as the BSP chief implies, then conditions will materially change and such will likewise be reflected on risks premiums.

As I previously wrote[10], (bold original)

“Fundamentals” tend to flow along with the market, which is evidence of the reflexive actions of price signals and people’s actions. Boom today can easily be a recession tomorrow.

The Unwarranted Fixation on Credit Rating Upgrades

The continuing optimism by the BSP has been based on the fundamental assumption that changes in interest rates are likely to be gradual and stable.

This seems uncertain as the recent actions in the bond markets have been anything but gradual and stable.

Of course the BSP’s view has been consonant with the Philippine President’s Benigno Aquino III. Such concerted efforts are likely representative of a PR campaign to generate high approval ratings.

In his State of the Nation Address (SONA), the Philippine president blustered over the same 7.8% statistical GDP and of the recent “improvements” on trade competitiveness as key accomplishments of his administration. He also mentioned that current conditions should merit another credit rating upgrade.

Mr. Aquino declared[11] “For the first time in history, the Philippines was upgraded to investment-grade status by two out of the three most respected credit ratings agencies in the world, and we are confident that the third may follow”

Well the public just loves the visible which politicians gladly feed them with.

Yet people hardly realize that credit rating upgrades can even signify as the proverbial “kiss of death”.

A historical overview of some sovereign ratings changes from Fitch Ratings[12] serves as great examples. The above table reveals to us that credit rating agencies hardly sees risks even when these have been staring at them on their faces.

From 1995-2008, Greece (upper pane) had a series of upgrades and positive watches (blue box) in both the long and short term of foreign and local currency ratings. The Fitch began a string of downgrades on Greece only when the country’s debt crisis imploded in 2009[13]. Today Greece has been rated junk “substantial credit risk[14]”, four years after the unresolved crisis.

The successions of credit upgrades basically helped motivate the Greek government to indulge in a borrowing spree which eventually unraveled.

Venezuela has a different story (lower pane). But again we the same credit rating upgrades on the socialist country in 2005, who today suffers from a hyperinflationary episode or a real time destruction of the country’s currency the bolivar[15].

The Fitch eventually regretted their decision, they downgraded Venezuela. Ironically hyperinflating Venezuela has a higher rating than deflating Greece where both defaults on their debts but coursed through different means.

The above examples reveal of how credit rating agencies align their assessment with unfolding market conditions. Rating agencies hardly anticipate them accurately.

So a manipulated asset boom may easily draw credit rating agencies to upgrade sovereign debt.

It is important to draw some very vital lessons from history where banking crises, sovereign debt defaults, currency crises, and serial debt defaults, as chronicled by Harvard’s Carmen Reinhart and Kenneth Rogoff, which spanned “more than 70 cases of overt default (compared to 250 defaults on external debt) since 1800”[16] the common denominator has been overconfidence and denigration of history[17] (will not happen to us) [bold mine]

The essence of the this-time-is-different syndrome is simple. It is rooted in the firmly held belief that financial crises are things that happen to other people in other countries at other times; crises do not happen to us, here and now. We are doing things better, we are smarter, we have learned from past mistakes. The old rules of valuation no longer apply. The current boom, unlike the many booms that preceded catastrophic collapses in the past (even in our country), is built on sound fundamentals, structural reforms, technological innovation, and good policy. Or so the story goes.

I would add my conspiracy theory. Credit rating upgrades have been tied with the US bases. The American government has been endeared with the incumbent administration because the President pursues the path of his mother, the former President the late Cory Aquino, who fought to retain US military bases here[18].

Today, using territorial disputes as an excuse or a bogeyman, the Aquino government has allowed and defended the so-called non-permanent access of “allies” on former US bases[19].

The Illusions of the Benefits from Government Spending

Another mainstream obsession today has been the devotion towards statistical economic figures which has been presumed as an accurate measurement of economic growth.

As explained last week[20], the statistical 7.8% growth has been mainly rooted on growth by the construction, real estate and financial sectors, as well as, government spending.

And much of the ballyhooed statistical growth in the private sector has been financed by an unsustainable credit bubble.

Yet the public has been mesmerized by the $17 billion of proposed investments by the incumbent government.

If the government spending is the elixir, then why stop at $17 billion? Why not make it $1 trillion or even $ 10 trillion?

And if such assumption is true, then why has the communist models like China’s Mao and the USSR evaporated?

Why has China’s recent economic growth been substantially slowing amidst a splurge of government spending in 2008-2009? The newly installed Chinese has announced another $85 billion of railway stimulus to allegedly stem the growth slowdown[21].

With enormous money thrown as fiscal stimulus from the late 90s to the new millennium, why has Japan’s lost decade been extended to two decades+ three years?

Apparently this seemingly perpetual economic stagnation has prompted the new administration to launch the boldest monetary modern day experiment by a central bank which will be complimented by even more fiscal spending stimulus and on the minor side trade liberalization.

Yet growing internal dissension[22] on the risks of Abenomics even from within the ranks of the Bank of Japan has been hounding on the popular expectations of the success of such derring-do political program aside from the risks of a fallout from an economic hard landing in China.

No matter the glorification of mainstream media’s on the alleged success of such policies, Japan’s financial markets are saying otherwise. Has the denial rally in Japan’s major equity benchmark Nikkei fizzled? Japan futures suggest that Monday’s opening will likely break below the 14,000 threshold.

Obviously what government spends will have to be financed by debt, taxes or inflation. Or simply said, whatever government spends has to be taken from someone else’s savings and or productive output. Government spending represents thus a disequilibrating force, because the recourse to institutional compulsion to attain political objectives means a shift of resources from higher value (market determined) uses to lower value (politically determined) uses.

Importantly, since most of government services are institutionalized or mandated monopolies, the absence of market prices means that there hardly have been accurate measures to calculate on the cost-benefit utility of the services provided. And since there are no market price utilized, returns are non-existent. Government spending, hence, represents consumption and not investments.

So the contribution of government spending has mostly been negative rather than positive to real economic growth.

But this is a different story from the mainstream’s statistical aggregate demand management based point of view.

And relative to the statistical 7.8% growth, this only means two things, one—economic boom has largely been concentrated on a few sectors which has been benefiting from the zero bound rates induced credit fueled manic speculation on the asset markets, and two—beneficiaries from government spending have always been the political class, their politically connected affiliates and welfare beneficiaries

And regardless of the egging of the Philippine president, in the latest State of the Nation’s Address (SONA), on the Congress to revamp Presidential Decrees 1113 and 1894 which according to news has been a Marcos era legacy that favors “businessmen close to the dictatorial administration”[23], the politicization of economic opportunities, where the government “picks on the winner” means that cronyism and regulatory capture have been the natural consequences or outcome from such anti-competitive politically distributed economic arrangements.

Thus actions meant to purportedly sanitize projected “immorality” are good as photo opportunities or for Public Relations purposes.

The reactionary rant against officials[24] and personnel of the Bureau of Customs, Bureau of Immigration and Deportation and the National Irrigation Administration (NIA) whom the President severely criticized for an unabated smuggling in the SONA should be a great example. That’s because one of the tarnishes of the incumbent approval rating obsessed regime has been in smuggling, where critics have labeled the Philippines as “Asia’s smuggling capital”[25].

In the world of politics, moral order has mostly been a function of either populism or legalities.

Yet what is popular or legal have not always or frequently been moral. Venezuela’s late Hugo Chavez died a popular leader due to massive wealth redistribution even if he ran the Venezuelan economy aground. Adolf Hitler was also a popular leader until he was defeated in World War II.

In the eyes of populist politics, immorality has hardly been thought about as legal or institutional blemishes. It has always focused on personal virtues: the personality cult mentality.

As the 30th President of the US Calvin Coolidge aptly warned[26]:

It is difficult for men in high office to avoid the malady of self-delusion. They are always surrounded by worshipers. They are constantly and for the most part sincerely assured of their greatness. They live in an artificial atmosphere of adulation and exaltation which sooner or later impairs their judgment. They are in grave danger of becoming careless and arrogant.

So when politicians or political leaders impose some edict or restrictions, they mostly expect people to behave like sheep. Such arrogant leaders forget that social policies affect people’s real lives, not limited to commerce.

And in response to such laws, thinking and acting man intuitively find ways to sustain their preferred way of living, and in many times, acting in defiance of arbitrary legislations or regulations or the “rule of men”.

So, for instance, when the Philippine government via the BSP raised sales taxes significantly on gold sales, over 90% of gold output has been smuggled out in reaction[27]: the law of unintended consequences.

The same political agenda goes for India, where gold has a deep cultural attachment. The profligate Indian government wants to ‘balance’ fiscal conditions by reining on gold sales. First they apply import tariffs then restrictions spread to banks, bullion banks, and finally to the retail sector[28]. Remember the Indian government essentially has been attacking India’s culture in the name of fiscal balance.

The consequence: an explosion of gold smuggling. Cases of smuggling has shot up to 205 from 21 a year earlier, value of gold seized by officials has soared by 10 times or 270 million rupees compared to 25 million rupees over the same period, according to the Wall Street Journal[29]

So at the end of the day, the formal sector ends up in the informal ‘illegal’ sector. The government forced the average Indians to migrate underground to maintain tradition. Practicing tradition have now been rendered as illegitimate and a crime. Many will suffer from political oppression out of the insensitive and inhumane whims of the political leaders.

It is still nice to see that the average Indians still have practiced civil disobedience via smuggling. But if the political repressive dragnet intensifies, then perhaps it will not be farfetched to expect civil disobedience to transform into violent public protests, ala Turkey, Brazil, or Egypt.

The bottom line is politicization of the economy have been key sources of social strains. What the largely economically ignorant or politically blind public initially sees as a boon from interventionism and inflationism will mostly regret of their advocacies.

And another thing, in today’s euphoric phase, I even read a commentary proclaiming today’s boom as “unstoppable”.

Well Mr. Tetangco has just fired the warning shot across the proverbial bow. Yet if bond markets continue to unsettle, what has been bruited as “unstoppable”…will not only become stoppable, but they will likely stop soon.

Despite the recent advances, current environment remains risky.

Trade cautiously.

[1] Malaya.com Tetangco: We will stay the course July 10, 2013

[2] Bloomberg.com Philippines Doesn’t Need Additional Stimulus, Tetangco Says July 26, 2013

[3] See Phisix in the Shadows of a Bursting Global Bond Market Bubble June 24, 2013

[4] Ludwig von Mises 1. Inflation III. INFLATION AND CREDIT EXPANSION Interventionism An

[5] Bangko Sentral ng Pilipinas Economic and Financial Statistics

[6] Tradingeconomics.com PHILIPPINES GDP CONSTANT PRICES

[7] Ludwig von Mises 11. The Money-Substitutes XVII. INDIRECT EXCHANGE Mises.org

[8] Wikipedia.org Discounted cash flow

[9] Wikipedia.org Net present value

[10] see Phisix: Don’t Ignore the Bear Market Warnings June 30, 2013

[11] Inquirer.net Aquino: No stopping change July 23, 2013

[12] Fitch Rating Complete Sovereign Rating History - Fitch Ratings

[13] BBC.com Timeline: The unfolding eurozone crisis June 13, 2012

[14] Fitch Rating Definitions of Ratings and Other Forms of Opinion

[15] See Hyperinflation: Venezuela’s Intensifying Stock Market Melt up Amidst a Currency Meltdown June 29, 2013

[16] Carmen Reinhart and Kenneth Rogoff, This Time is Different Princeton University Press p. 111

[17] Ibid p. 15

[18] See A US-Philippines Bases Treaty (2012 Edition) in the Making? January 26, 2012

[19] Inquirer.net Aquino defends use of bases by US, Japan July 3, 2013

[20] See Phisix: The Myth of the Consumer ‘Dream’ Economy July 22, 2013

[22] Reuters.com Japan central bank finds the pessimists come from within, July 26, 2013

[23] Sunstar Aquino seeks Congress' approval of priority measures July 22, 2013

[24] Inquirer,net Of heroes, anti-heroes: Biazon offers to quit July 23, 2013

[25] Gulf News.com Aquino: Philippines not Asia’s smuggling capital April 11, 2013

[26] New York Times Unusual Political Career of Calvin Coolidge, Never Defeated for an Office, January 6, 1933

[27] See Gold Smuggling: A Deepening Trend Not Just in the Philippines November 24, 2013

[28] See Why the Indian Government’s War on Gold will Fail May 18, 2013

[29] Wall Street Journal Gold Smuggling Takes Off in India July 26, 2013