As of 2012, I posted here the global tally of Shadow Banks which have grown to 80% of GDP at $71 Trillion.

At the end of 2013 global shadow banks has inflated to over $75 trillion or still about 80% of GDP to a pre-crisis high!

From the Bloomberg: (bold mine)

The shadow banking industry grew by $5 trillion to about $75 trillion worldwide last year, driven by lenders seeking to skirt regulations and investors searching for yield amid record low interest rates.The size of the shadow banking system, which includes hedge funds, real estate investment trusts and off-balance sheet investment vehicles, is about 120 percent of global gross domestic product, or a quarter of total financial assets, according to a report published by the Financial Stability Board today.Shadow banking “tends to take off when strict banking regulations are in place, when real interest rates and yield spreads are low and investors search for higher returns, and when there is a large institutional demand for assets,” according to the report. “The current environment in advanced economies seems conducive to further growth of shadow banking.”

Related to the the informal economy, shadow banks are essentially regulatory arbitrages where markets “skirt regulations” in order to conduct credit related activities.

Record low interest rates only encourages the use of shadow banks when restrained in the formal banking system. As a reminder, because shadow banks are barely regulated, this implies statistical estimates may be prone to significant errors.

Here is a summary of findings from studies conducted by the FSB’s Regional Consultative Groups (RCG), as per the Financial Stability Board (bold mine)

The main findings from the 2014 exercise are as follows:-According to the MUNFI estimate, based on assets of Other Financial Intermediaries (OFIs), non-bank financial intermediation grew by $5 trillion in 2013 to reach $75 trillion.This provides a conservative proxy of the global shadow banking system, which can be further narrowed down.- By absolute size, advanced economies remain the ones with the largest non-bank financial systems. Globally, MUNFI assets represent on average about 25% of total financial assets, roughly half of banking system assets, and 120% of GDP. These patterns have been relatively stable since 2008.- Adjusted for exchange rate effects, MUNFI assets grew by +7% in 2013, driven in part by a general increase in valuation of global financial markets, while in contrast total bank assets were relatively stable. In the case of Investment Funds, adjusting for valuation effects reduced the 2013 FX-adjusted growth rate by about 10.3 percentage points (see Box 4-2). The global growth trend of MUNFI assets masks considerable differences across jurisdictions, with growth rates of OFIs ranging from -6% in Spain to +50% in Argentina.- Emerging market jurisdictions showed the most rapid increases in OFIs. Nine emerging market jurisdictions had 2013 growth rates above 10%. However, this rapid growth is generally from a relatively small base. While the non-bank financial system may contribute to financial deepening in these jurisdictions, careful monitoring is still required to detect any increases in systemic risk factors (e.g. maturity and liquidity transformation, and leverage) that could arise from the rapid expansion of credit provided by the non-bank sector.

My comment ‘small base’ doesn’t mean less risk. Risks are not a one size fits all phenomenon. The scale of credit risk depends on the distinctive character of the political economy of every nation to intermediate credit

- Among the MUNFI sub-sectors that showed the most rapid growth in 2013 are Trust Companies and Other Investment Funds. Trust Companies experienced the fastest 2013 growth rate of 42%, which is in line with the sector’s average growth over 2007-2012. Other Investment Funds, the largest MUNFI sub-sector, recorded 18% annual growth in 2013, which represents a sharp acceleration from the average growth rate in the preceding years. It should be noted that the Hedge Funds sub-sector remains significantly underestimated in the FSB’s exercise due to the fact that offshore financial centres, where most Hedge Funds are domiciled, are currently not within the scope of the exercise. More frequent updates of the IOSCO Hedge Fund Survey and further refinement of the data presented in the survey, including the availability of time series, could provide important additions to the Global Shadow Banking Monitoring Report.-Using more granular data reported by 23 jurisdictions, the broad MUNFI estimate of non-bank financial intermediation was narrowed down by some $27 trillion (see Section 5). The narrowing down items considered in this year’s report are comprised of assets related to self-securitisation, assets of OFIs prudentially consolidated into a banking group, and entities not directly involved in credit intermediation, including Equity Investment Funds, equity REITs, and OFIs which are part of a non-financial group and are created for the sole purpose of performing intra-group activities. This reduced total OFI assets for the 23 jurisdictions that reported granular data from $62 trillion to $35 trillion. Using the narrowed down estimate, the growth rate of shadow banking in 2013 was +2.4%, instead of +6.6% using the MUNFI. The FSB will continue to refine the methodologies in narrowing down the estimate as well as encourage its member jurisdictions to collect the relevant data.-The measures of the level of interconnectedness between the banking and the non-bank financial system were improved in this year’s report by adjusting for bank’s assets and liabilities to OFIs that are prudentially consolidated into banking groups. Overall, the level of interconnectedness between the banking and the non-bank financial system declined in 2013. However, the relevance of the findings in this area is hampered by the absence of reporting of this data by a number of large jurisdictions.

As I said statistical numbers will be incomplete or inacurate, which implies these estimates may be underreporting of the real size of shadow banks.

Assets of Shadow banks are at pre-crisis high levels.

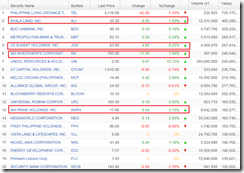

The National share of shadow banks

Sectoral composition of shadow banks

Annualized growth of shadow banks

The FSB elaborates on the potential transmission mechanism via the connection between the formal banking and shadow banks.

Systemic risks can spill over from shadow banking entities to the banking sector. This interconnectedness can take many forms, including direct and indirect linkages. For example, direct linkages are created when shadow banking entities form part of the bank credit intermediation chain, are directly owned by banks, or benefit directly from bank support, (either explicit or implicit). Funding interdependence is yet another form of direct linkage, as is the holding of each other’s assets such as debt securities. In addition, indirect linkages also exist through a market channel, as the two sectors may invest in similar assets, or be exposed to a number of common counterparties. These connections create a contagion channel through which stress in one sector can be transmitted to the other, and can be amplified back through feedback loops.

As one may realize zero bound regime has been inflating assets in both the formal and informal system.

This implies of a great degree of fragility or a Black Swan risk.