The US stock markets have been target of US Federal Reserve policies!

This is what I’ve repeatedly been saying all along since 2008! And have been validated anew.

First, Fed officials deny it.

Reports the Wall Street Journal Blog (bold highlights mine)

For many years, central bankers have declined to comment on the performance of stock markets, and have instead justified their actions in purely economic terms. To the extent financial markets entered into it, central bankers were most mindful of bond markets as the mechanism that translated changes in monetary policy into credit availability for businesses and households.

The stock market only entered into the picture in times of deep market disruptions, or as part of broader discussions about the “wealth effect,” wherein rising stock prices are thought to make households feel richer, and spend accordingly. Of course, stock market operators have always spoken of the a Fed “put,” in which the central bank will ease policy to arrest sustained stock market declines.

All of that has changed since the Fed restarted late last year a program to buy $600 billion in longer-dated government bonds, in a bid to spur higher levels of growth and get the unemployment rate down faster than would otherwise be the case.

Then they confirm it.

Again from the same WSJ Blog (bold highlights mine)

It isn’t clear whether Bernanke’s shift in focus represents a change in how the Fed does business, or whether his comments represent an effort to justify a policy that hasn’t worked as planned, leaving the chairman to support it in whatever way he can. It’s a potentially dangerous policy stance, because if stocks were to undergo an extended period of losses, it could argue for the Fed to keep policy easier than it may want to.

For Federal Reserve Bank of Minneapolis President Narayana Kocherlakota, the increased prominence of asset prices as a focus of monetary policy is not so much an enduring shift in how policy is made, as it is a recognition of what caused the huge economic and financial problems of recent years.

“This recession and the relatively slow recovery we’ve gone through, a lot of it can be traced back to net worth,” Kocherlakota told reporters after a speech in New York Wednesday. “The fall in net worth is what drove us into recession” and “in those circumstances you can see why asset values, both for land and for stocks, are really going to be a central ingredient in the recovery process,” he said.

To ensure the recovery will take hold, it’s important for the Fed to help re-flate asset prices and given households and businesses a chance to rebuild and rebalance their respective financial positions, the official explained.

“In this kind of post financial crisis, post net worth driven recession, it makes sense to be thinking about asset value as a way to try to generate more stimulus than you do in a typical recession,” Kocherlakota said.

I earlier quoted Ben Bernanke in November 2010 who already validated my views... (bold highlights mine)

This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

This has long been Chairman Ben Bernanke’s guiding principle since he was a professor at the Princeton University (unfortunately the link to foreignpolicy.com has been removed, nevertheless can be found in Wikipedia) [emphasis added]

There’s no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

If the imperatives of the “wealth effect” or that the Fed sees the importance “to help re-flate asset prices and given households and businesses a chance to rebuild and rebalance their respective financial positions” then ending QE, given current fragile "asset price" conditions, would mean that the FED will overturn her priorities. This would signify as a bizarre logic.

This only gives further clues that the Fed will continue to inflate the system, in spite of the current rhetoric about exits and the culmination of the QE which for me signifies as another episode of poker bluffs.

Incidentally, US household ownership of stocks has been on a big decline since 2007.

According to Gallup,

Even as stocks have returned to lofty heights from their March 2009 lows, the percentage of Americans saying they hold individual stocks, stock mutual funds, or stocks in their 401(k) or IRA fell to 54% in April -- the lowest level since Gallup began monitoring stock ownership annually in 1999. Self-reported stock ownership has trended downward since 2007 -- before the recession and financial crisis began -- when 65% of Americans owned stocks...

Americans still have still been enamored to properties.

Again the Gallup, (emphasis added)

The financial crisis and the losses it produced for many investors have combined with government bailouts and Wall Street scandals to turn many Americans away from investing in stocks. Even as stocks have surged over the past couple of years, it has been hard for most Americans to understand what is happening on Wall Street and why, leaving them hesitant to invest in the stock market.

On the other hand, housing and real estate have also experienced sharp losses in recent years and show no signs of significant recovery; still, many Americans see real estate as the best investment for the long term. In part, this may be because depressed prices in the real estate sector make it a relatively attractive investment when investors hold it for the long term. It could also be that Americans feel more comfortable with and better understand real estate as an investment compared with stocks and Wall Street.

My final two cents.

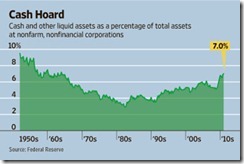

Rising equity prices seen in the backdrop of falling US household ownership means that the equity gains have primarily been benefiting financials companies, since nonfinancial corporations have also been sated with cash.

Chart from Wall Street Journal Blog

This is the obvious effects of the redistribution of wealth from the households to Wall Street and other Washington cronies.

Two, I doubt Americans see real estate as “best investment”. I’d rather surmise that falling real estate represents cognitive biases of “loss aversion” and the “endowment effect” where homeowners have been reluctant to realize or accept losses and instead hold out on their properties based on hope.

Maybe they are hoping that the crash would just go away soon. Or maybe that Fed policies could relieve them.

Either way, if asset prices has been the essential determinant of spending, as proposed by Fed officials led by Ben Bernanke, then obviously inflationism will be expected to continue.

And this seems one good reason why the campaign or war against commodities has intensified.