``Key question then: why do smart people engage in negative thinking? Are they actually stupid? The reason, I think, is that negative thinking feels good. In its own way, we believe that negative thinking works. Negative thinking feels realistic, or soothes our pain, or eases our embarrassment. Negative thinking protects us and lowers expectations. In many ways, negative thinking is a lot more fun than positive thinking. So we do it. If positive thinking was easy, we'd do it all the time. Compounding this difficulty is our belief that the easy thing (negative thinking) is actually appropriate, it actually works for us. The data is irrelevant. We're the exception, so we say. Positive thinking is hard. Worth it, though.”- Seth Godin The problem with positive thinking

For many, the basic premise for today’s global market rebound has due to a “bear market rally”.

Dem Dry Bones

This especially holds true for the advocates of the global ‘deflation’ outcome and for those who interpret markets based on conventional methodology.

Nevertheless, predictions have underlying analytical foundations.

The basic pillar for such sponsorship is that the US will remain as the irreplaceable source of demand for the world. But laden with too much debt and hamstrung by a vastly impaired banking system, US consumers will be unable to take up the slack emerging from the recent bust, while the world will unlikely find a worthy substitute, and as consequence, suffer from the excruciating adjustments from the structural excesses built around them during the boom days.

Hence, the Dem Dry bones deduction-Toe bone connected to the foot bone, Foot bone connected to the leg bone, Leg bone connected to the knee bone. BOOO! We are faced with a Global Deflation menace.

We have spilled too much ink arguing against the seemingly plausible but fallacious argument simply because all these oversimplifies human action without taking into account how people will respond to altering conditions (creative destruction), overemphasis on the rear view mirror and importantly, such arguments tremendously underestimates the role money plays in a society (inflationary policies).

Moreover, the assumption that the world has been scourged with its arrant dependence on the US seems downright exaggerated as today’s market actions have shown.

In other words, yes while increased globalization trends has indeed integrated or has deepened the interlinkages of a large segment of global economies, particularly financial and labor markets and investment flows, it hasn’t entirely converged every aspect of the marketplace or the economy.

That’s because nations have their own cultural, religious and geographical traits that are unique to themselves that function as natural barriers.

Yet all these have significant impact on the motional profile of a country’s political economy. So every country (in terms of government and its constituents) will have to deal with its inherent domestic forces as much as it has to deal with fluctuating external factors, and all these dynamics will result to different or divergent responses.

Hence, national idiosyncrasies (or decoupling dynamics) will be retained and will continue to do so because of such intrinsic barriers. This, in spite of a prospective deepening globalization trends.

So individual values and actions will significantly matter more than perceived macro assumptions advanced by sanctimonious ivory tower experts.

This also means that the assumption that markets or economies will be totally convergent or “coupled” to each other is another false concept.

Four Stages of Bear Markets

Many have used this chart, the “four stages in the typical secular bear market”, which has floated around in the cyberspace, to justify the significance that today’s rising markets account for as a bear market rally (see figure1).

Right at the nadir of the market meltdown, triggered by the institutional bank run in the US [see October 26th Phisix: Approaching Typical Bear Market Traits], we described how the Philippine Phisix reached the typical bear market levels in terms of depth or degree of losses and the timeframe covered, ``We are presently 15 months into the present bear market which begun in July of 2007. The last time the Phisix shadowed the US markets it took 28 months for the market to hit a bottom. I am not suggesting the same dynamics although, seen in terms of the US markets, the recent crash seems different from the slomo decline in 2000.”

From a hindsight view, we have been validated anew- we did not match the longest “slomo” decline of 28 months during the 1999-2001 cycle, but nevertheless clocked in as an extended cyclical bear market (15 months peak-to-trough), in terms of duration compared to 1987 (13 months) and 1989 (11 months).

Nonetheless the above chart of the 4 stages of a bear market has indeed traced out the bear market dynamics of the Phisix over the 1999-2002 period (see figure 2) but on a different timeframe scale relative to the US.

Figure 2: PSE Phisix: 4 Stages of Phisix Bearmarket

The Philippine market appears to have a slightly shorter cycle than its US counterpart if we are to base it on the first 3 stages (59 months US vis-à-vis 56 months). That is to repeat, in the context of a SECULAR bear market cycle.

But, I would caution you from interpreting the same operating dynamics today as that with 2001.

Besides, I would admonish any tautology that actions in the US markets should correlate with the Philippine markets-they shouldn’t. Not because of exports and not because of remittances.

Secular Bull-Cyclical Bear, Where The Rubber Meets The Road

The Philippines (Phisix and the economy) has essentially had some mixed blessings from its less globalized economy and market; she didn’t outperform during the boom days and conversely, didn’t fare as badly during the global recession.

But overall I don’t see this as being net beneficial for the country since trade openness and economic freedom is the source of capital accumulation. The semblance of any of today’s success could be attributed to more on luck than from any policy induced measures.

However, because boom bust or business cycles are fundamentally credit driven, then our eyes must focus on where the rubber meets the road.

The Philippine economy and its banking system have currently been operating from significantly reduced systemic leverage (in fact the private sector debt has been one of the lowest in Asia see Will Deglobalization Lead To Decoupling?).

Another, the crisis adjustment pressures or the market clearing process coming off the excesses from the pre-Asian crisis boom have had most of its imbalances ventilated during the 1997-2003 cycle. That’s the essence of bear markets-sanitizing excesses and balancing imbalances.

In addition, the Philippine banking system has been extremely liquid, where total resources in the banking system as of April 2009 at Php 5.8 trillion (BSP Tetangco speech August 11th).

Domestic banking system’s Non Performing Loans (NPL) has returned to pre-Asian Crisis levels of around 4%, which serves as evidence of the market clearing process (BSP Tetangco).

Besides, because the domestic banking system’s balance sheets have been least impaired due to largely missing out on the highly levered securitization shindig, the Philippine banking system remains adequately capitalized, well above the risk ratios as per BSP regulations (10%) and Bank of International Settlement (8%) standards (BSP Tetangco).

This low systemic leverage reflects, as well as, on our emerging Asian market peers, in contrast to the US and European counterparts.

Thus, Philippine economy and its financial markets appear to be coming off on a clean slate, enough to imbue additional leverage in the system to power the Philippine Phisix and the economy to another bubble.

Sorry to say, but central bankers, being legalized cartels, are innately enamored to blowing bubbles, due to the unlimited potentials to issue credits via the fractional reserve banking platform (or issuing of money more than bank holds in reserve) from which all global central banks operate on.

Lastly, the recent bear market cycle emanated from contagion effects than from internal adjustments from massive structural misallocations, which is what the US economy has presently been undergoing. This means that adjustments from the bust are likely to be minor.

So, distinctions matter.

In short, the last bear market cycle that the Philippine Phisix suffered WAS NOT a secular bear market but a cyclical one.

Inflation: Keys To Future Investment Returns

The same reasons are behind why the historically low interest rate regime pursued by the Bangko Sentral ng Pilipinas (BSP) has generated significant traction in the economy, as we have been anticipating.

Proof?

According to the BSP, Real estate loans have been picking up as of June 2009, so as with Automobile loans, credit card receivables and other consumer loans (appliance and other consumer durables and educational loans) over the same period.

And all these have likewise been reflected on the Phisix, which as of Friday’s close has been up 51.16% on a year to date basis, driven by local investors [as discussed in last week’s Situational Attribution Is All About Policy Induced Inflation].

This compared to the 2003-2007 cycle which had been foreign dominated. That’s another key point to reckon with.

Moreover, from a chartist viewpoint, not all the bearmarkets have the same patterns, (see figure 3)

Figure 3: Philippine PSE: 18 year Cycle

At over the 23 years from where the Philippine Phisix has undergone a full cycle (secular bull and secular bear market 1985-2003 or 18 years), the ‘cyclical’ bear market in 1987 (45% loss in 13 months) did show a short resemblance to the 4 stage bears, but the 1989 market had been a V-shaped recovery (62% loss in 11 months) [pls see blue ellipses].

The point is that there is a material difference in the performance of bear markets during secular and in cyclical trends.

In cyclical markets, while bear markets can be deep, they are likely to recover rapidly compared to secular bear markets, whose correction process takes awhile, for structural reasons stated above.

Apparently, the action in today’s market appears to account for such cyclical trend dynamics.

Because no trend moves linearly, we should expect bouts of interim weaknesses. However, this should serve, instead, as buying opportunities.

Moreover, I’d like to bring to your perspective the long term cycle of the Phisix as exhibited by the pink channels. You’d notice that the long term channel isn’t sideways or down BUT UP!!!

While other observers, especially those colored by political bias, could impute economic fortunes on this, my thesis is that the nominal long term price improvements reflect more on “inflation” than real output growth.

This is why the Phisix seems so highly sensitive to monetary fluxes. The lesser the efficient the market, the more sensitive to inflationary ebbs and flows.

And this long term chart has likewise been giving us a clue to where the Phisix is likely headed for-10,000, as emerging markets and Asia takes the centerstage of the bubble cycle.

But this inflation driven pricing isn’t relegated to the Phisix alone, but has been accelerating its influence over the world and even in the US markets.

Proof?

I am now really finding some “comfort with the crowds” (pardon me, I am also vulnerable to cognitive biases, but at least one that I am aware of) among big investing savants. Aside from Warren Buffett whom we featured in Warren Buffett’s Greenback Effect Weighs On Global Financial Markets, the world’s Bond King PIMCO’s top honcho, Mr. William Gross recently wrote about how asset pricing dynamics will be fueled by inflation.

These are the strategic scenarios which he enumerated as having a high probability of playing out:

(bold/underline highlights mine)

-Global policy rates will remain low for extended periods of time.

-The extent and duration of quantitative easing, term financing and fiscal stimulation efforts are keys to future investment returns across a multitude of asset categories, both domestically and globally.

-Investors should continue to anticipate and, if necessary, shake hands with government policies, utilizing leverage and/or guarantees to their benefit.

-Asia and Asian-connected economies (Australia, Brazil) will dominate future global growth.

-The dollar is vulnerable on a long-term basis.

In other words, US dollar vulnerability, QE and other monetary ‘bridge financing’ non interest rate tools, aside from fiscal policies and low interest rates are all inflationary policies that are “keys to future investment returns”.

Whereas Asia and Asian-connected economies, given their edge of low systemic leverage, unimpaired banking system and the thrust towards trade and financial integration with the world commerce, are likely to assimilate most of the circulation credit “inflation”, hence their likely dominance in terms of attaining the highest global economic “growth”.

I’m not suggesting that credit expansion equals sound economic growth. Instead what I am saying is that economic growth in Asia and emerging markets will be based on the public’s response to the incentives set forth by policies to sop up credit.

In short, conventional analysis will continue to find enormous disconnect as inflationary policies amalgamates its presence on the markets.

But at least Mr. Gross have been candid enough to unabashedly admit looking for opportunities to strike lucrative deals with the government based on special ‘privileges’, “shake hands with government policies, utilizing leverage and/or guarantees to their benefit”…or euphemistically this is called political entrepreneurship or economic rent seeking from the US government!

Well, more signs of the Philippinization of the America.

The Applause Goes To Inflation

I wouldn’t shudder at the thought of policy tightening given the near unison of voices from the global authorities to extend the party.

Since inflation is a political process, then let us tune in to the statements of the political authorities to get a feel on their pulse and the possible directions of the markets.

From Caijingonline, ``China's economy is at a crucial juncture in its recovery and the government will not change its policy direction, Premier Wen Jiabao was cited as saying by Xinhua news agency September 1”…``China will stick to its moderately loose monetary policy as it strives to meet economic goals, Wen said during a meeting with visiting World Bank President Robert Zoellick.” (emphasis added)

From Bloomberg, ``China’s banking regulator said it will take years to implement stricter capital requirements for banks, seeking to assuage concerns the rules will cause a plunge in new lending.”

From Wall Street Journal, ``World Bank President Robert Zoellick said Wednesday it is too early for China to roll back its stimulus measures as the country's economic recovery could still falter.”

From Bloomberg, ``European Central Bank President Jean-Claude Trichet said the bank won’t necessarily raise interest rates when the time comes for it to start withdrawing other emergency stimulus measures. The term ‘exit strategy’ should be understood as the framework and set of principles guiding our approach to unwinding the various non-standard measures,” Trichet said at an event in Frankfurt today. “It does not include considerations about interest policy.”

From Wall Street Journal, ``Dominique Strauss-Kahn, managing director of the International Monetary Fund, warned world governments against “premature exits from monetary and fiscal policies” despite signs that “the global economy appears to be emerging at last from the worst economic downturn in our lifetimes.”

From Bloomberg, ``Federal Reserve officials in their August meeting discussed extending the end-date for purchases of mortgage bonds to minimize any market disruptions, and expressed concern about the pace of a likely economic recovery.”

As presciently predicted by Ludwig von Mises in Human Action, ``The favor of the masses and of the writers and politicians eager for applause goes to inflation.”

The global political leadership sensing short term triumph from current policies will continue to exercise the same “success formula” to limn on the illusion of prosperity.

Their actuations are so predictable.

The Deflation Bogeyman

I wouldn’t be a buyer of the global deflation thesis especially under the context that deflation is a monetary phenomenon.

That’s because the only transmission mechanism from so-called deflationary pressures, via the recession channel, would be from remittances and exports, which isn’t deflationary in terms of the potential to wreak havoc on the domestic banking system or even on the 40% informal cash based economy.

Said differently: Slower or negative exports or remittances will NOT contract the money supply and won’t be a hurdle from a Central Bank determined to inflate the system!

In the US, the fact that tuition fees from Ivy League Schools have been exploding to the upside, in spite of today’s crisis, dismisses the deflationary nature in the absolute sense for the US economy [see Black Swan Problem: Deflation? Not In Ivy League Schools].

What the US has been undergoing is a statistical deflation- a price based measure from the preferred numbers by the establishment.

In terms of political dimensions, scare tactics (deflation bogeyman) has been repeatedly used by authorities to justify inflationary policies to wangle out concessions aimed at rescuing select (political interest groups) entities or industries at the expense of the society.

And I think that the ultra low inflation (BSP) in the Philippines reflects on the same statistical mirage.

Just this week my favorite neighborhood sari-sari store (retail) hiked beer prices by 5%! While beer may not be everything (it may even be a store specific issue, which I have yet to investigate), looking at oil prices at $68 today from less than $40 per barrel in March signifies a price increase of 70%!

Seen from a lesser oil efficient use economy, the transmission mechanism, whose effect may have lagged, could be more elaborate than reflected on government based statistical figures.

To consider both the US and the Philippines will have national elections in 2010, senatorial and Presidential-senatorial respectively. So it wouldn’t be far fetched that the incentive for incumbent authorities from both countries to intervene (directly or indirectly) in order to create the impression of a strong economic recovery for the sole purpose of generating votes.

The fact the Philippine Peso continues to slide against the US dollar in the face of stronger regional currencies seems so politically suspicious.

The Peso’s woes can’t be about deficits (US has bigger deficits-nominally or as a % to GDP), or economic growth (we didn’t fall into recession, the US did), remittances (still net positive) or current account balances (forex reserves have topped $40 billion historic highs) or interest rates differentials (Philippines has higher rates).

In sum, when you factor in all the major variables that could influence the Phisix- local politics (national elections), geopolitics (such US elections), the “anxiety” from global central bankers which should translate to prolonged or extended monetary inflation, continued loose domestic monetary policies, long term technical trends, inflation sensitive fundamental issues (as systemic leverage, banking system) and the potential response from the public to loose monetary policies-it would seem highly probable that the domestic stock market is likely to continue with its long term ascent.

So I would NOT reckon this to be a bear market rally especially not from the flimsy excuse of global deflation.

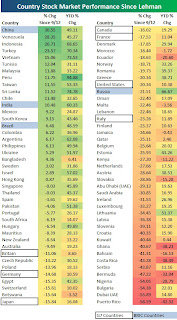

Figure 4:

Bloomberg: Possible Bear Market Rally

Bear market rally could be a US phenomenon (see figure 4), but is unlikely for Asia and Asian Emerging Markets.

Nevertheless, I would use the US dollar index, gold and oil as my main barometers for measuring liquidity conditions.