What's been lost in this

frenzied competition for eyeballs and "likes" is the distinction

between opinion and journalism. The post-truth cliche is that

there is no distinction, that everything is mere opinion and spin, but this is

not true: journalism is different from opinion and spin—Charles Hugh Smith

In this issue

Unveiling the Reality

Behind the Philippine PSEi 30’s 7,000: Market Concentration, Divergence,

Manipulations, and the Overton Window

I. The PSEi 30 Closes

Above 7,000: Is This a "Historic Moment?"

II. Foreign Inflows Targeted

at Biggest Market Cap Issues, Historically Chasing Tops

III. PSEi 30 7,000: Primarily

an ICTSI Show; Diverging PSEi 30 and Market Breadth

IV. PSEi 30 Rose to 7,000

on Depressed and Concentrated Volume

V. Why Ignore the Impact

of the Flagrant Manipulations of the PSEi 30?

VI. The Unannounced "Historic

Moments"

Unveiling the Reality

Behind the Philippine PSEi 30’s 7,000: Market Concentration, Divergence,

Manipulations, and the Overton Window

I. The PSEi 30 Closes

Above 7,000: Is This a "Historic Moment?"

Along with the region's sanguine performance,

the Philippine PSEi 30 broke past 7,000. Could this signify the start of a bull

market, as the media and consensus have suggested?

Figure 1

Businessworld,

September 13: The PSEi achieved a significant milestone, closing above 7,000

for the first time in over 19 months. Strong foreign buying and expectations of

a US Federal Reserve rate cut contributed to this historic moment. (Figure 1, upper

picture)

Historic. Moment.

Sure, the PSEi 30 has traded above 7,000 for

the last five days and closed above this threshold in the last two. However, how

is reaching a 19-month high equivalent to a "historic moment?"

Media is said to reflect the prevailing mood

or express the public’s level of confidence. That’s according to the

practitioners of ‘Socionomics.’

Could this headline be indicative of the

market’s mood?

Let’s examine public sentiment by analyzing

the market internals.

II. Foreign Inflows Targeted

at Biggest Market Cap Issues, Historically Chasing Tops

Foreign buying was certainly a factor.

This week, aggregate net foreign inflows

amounted to Php 2.7 billion, marking the fifth consecutive week of net buying

and the second-largest inflow during this period. (Figure 1, lower diagram)

However, foreign inflows accounted for only 41.44%

of the average weekly turnover, the lowest in five weeks.

This suggests that local investors have begun

to dominate the transactions on the Philippine Stock Exchange (PSE).

Additionally, the scale of weekly foreign

investment was far from record-breaking.

As a side note, in today’s digitally

connected, "globalization-financialization" world, foreign inflows

could also include funds from offshore subsidiaries or affiliates of local

firms.

Figure 2Sure, expectations of the US Federal

Reserve's interest rate cuts have not only fueled a strong rebound in ASEAN

currencies but have also energized speculative melt-up dynamics in the

region's equity markets, driven by foreign players.

ASEAN currencies outperformed the global

market from July 10 (following the US CPI release) through September 11.

(Figure 2, topmost table)

Yahoo

Finance/Bloomberg, September 12: Southeast Asian equities have cemented

their position as a favorite play of money managers positioning for the Federal

Reserve’s policy pivot. Four of the five best-performing Asian equity

benchmarks this month are from the region, with Thailand leading the pack. The

buying frenzy has put foreign inflows on track for a fifth consecutive week while the MSCI Asean

Index is now trading near its highest level since April 2022. [bold added]

(Figure 2, lowest chart)

Moreover, the yield-chasing phenomenon has

spilled over into the worst-performing equities, or the laggards of the region.

Yahoo

Finance/Bloomberg, September 12: After being sidelined by investors for

much of this year, some smaller equity markets are suddenly winning favor. The trend is

particularly evident in Asia, where Thailand, Singapore and New Zealand rank as

the top performers in September. Their benchmarks have risen at least 3% each

so far, even as MSCI Inc.’s gauge of global stocks has fallen about 1%

following a four-month winning streak. Investor focus seems to be shifting

as the world’s biggest equity markets such as the US, Japan and India take a

breather, and China’s slump deepens. For many of the smaller Asian markets,

a limited exposure to the artificial intelligence theme means their valuations

aren’t expensive, making them attractive just as the Federal Reserve’s dovish

pivot helps boost their currencies and allows some central banks to embark on

rate cuts. [bold added]

The "core to the periphery" phase

indicates that investors have been pursuing yields in less developed and

less liquid markets, which are inherently more volatile and considered

higher risk. This shift could signify a late-cycle

transition.

So yes, while there may be a semblance of

increased confidence due to foreign participation, this dynamic appears to be limited

to the most liquid and largest market capitalization issues—those capable of

absorbing significant trading volumes.

And that’s exactly the case. Except for last

week’s drop to 81%, the percentage share of the 20 most traded issues relative

to the main board volume has risen in tandem with the PSEi 30 since mid-June.

(Figure 2, lowest image)

That is to say, the PSEi 30’s performance was

largely driven by concentrated trading volume in a select group of elite

stocks.

Figure 3Using the BSP’s portfolio flow data, July’s

portfolio flows represented the largest since April 2022. (Figure 3,

topmost image)

However, the larger point is that foreign

money flows tend to chase the peaks of the PSEi 30.

In fact, foreign investments often surged

during the culminating (exhaustion) phase of the PSEi 30’s upward momentum, a

pattern observed since 2013.

Will this time be different?

It’s important to note that the BSP’s

portfolio flows include foreign transactions in the fixed-income markets, but

the size of these flows is relatively insignificant.

In a nutshell, the purported

confidence brought about by foreign participation has been largely limited to

the PSEi 30.

III. PSEi 30 7,000: Primarily

an ICTSI Show; Diverging PSEi 30 and Market Breadth

Does media sentiment resonate with the PSE’s

market breadth?

In a word, hardly.

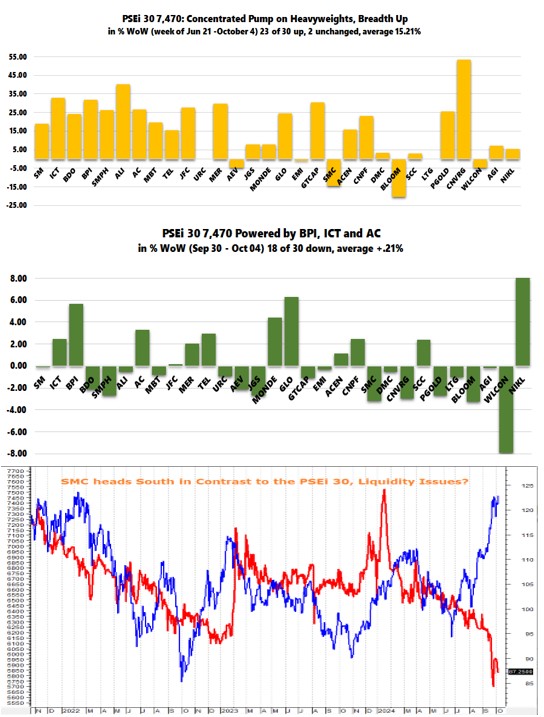

The PSEi 30 rose by 1.25%, marking its second

consecutive weekly advance and its ninth increase in 12 weeks since this upside

cycle began in the week ending June 28th.

This week’s rebound pushed its year-to-date

returns to 8.88%.

While we have seen some substantial returns due

to heightened volatility in some of the PSEi 30's underperformers, such as

Converge (+10.5%), Aboitiz (+8.4%), and Bloomberry (+8.3%), it was the

performance of the two largest market capitalization stocks, SM (+3.47%) and

ICT (+2.75%), that drove this week’s free-float gains. (Figure 3, middle pane)

The PSEi 30’s average return was 1.03%. The

difference between this figure and the index reflects distortions caused by

free-float weighting.

Yet, the increasing volatility in the share

prices of several PSEi 30 and non-PSEi 30 firms suggests the formation of

miniature bubbles.

With a 17-13 score, decliners outnumbered

gainers in the PSEi 30, indicating a divergence between market breadth and the

headline index.

Despite reaching the “historic moment” of the

PSEi at 7,000, market breadth continues to weaken. (Figure 3 lowest chart)

Declining issues have outpaced advancing

issues for the second consecutive week, with the 69-point margin nearly double

last week’s 37. Declining issues led the market in all five trading sessions.

Figure 4Yet, the market capitalization weighting of

the top five issues rose from last week’s 51.15% to 51.34%, primarily due to

ICT’s increase from 10.83% to 10.99%. (Figure 4, topmost chart)

Or, 5 issues command over half the PSEi 30 price

level!

This week’s pumping of the PSEi 30 pushed

ICT’s share price to a record high of Php 418.6 on Thursday, September 12th.

(Figure 4, middle graphs)

To put it another way, ICTSI has

shouldered most of the burden in pushing the PSEi 30 to 7,000.

Additionally, ICTSI's rise has been supported

by rotational bids of the largest banks, SM, SMPH, and ALI (the six

largest), which is publicly shaped by media and the establishment narratives through

the promotion of BSP and US FED easing as beneficial to stocks and the economy.

The public has been largely unaware of

the buildup of risks associated with pumping the PSEi 30, driven by a

significant concentration in trading activities and market internals

The market breadth exhibits that since only a

few or a select number of issues have benefited from this liquidity-driven shindig,

the invested public has likely been confused by the dismal returns of their

portfolios and the cheerleading of media and the establishment.

IV. PSEi 30 Rose to 7,000

on Depressed and Concentrated Volume

Does the market’s volume corroborate the

media’s exaltation of the PSEi reaching 7,000?

Succinctly, no.

To be sure, main board volume surged by 22%,

increasing from an average of Php 4.9 billion to this week’s Php 5.9 billion. (Figure

4, lowest image)

However, main board volume remains

substantially lower than the levels observed when the PSEi 30 previously

reached the 7,000-mark.

Figure 5Moreover, despite a 4.2% monthly surge in

August that pushed year-to-date returns (January to August) to 6.94%, the

eight-month gross volume fell to its lowest level since at least 2012. (Figure

5, topmost visual)

That’s in addition to the disproportionate

share weight of over 80% carried by the top 20 issues on the main board volume,

as noted above.

Incredible, right?

But there’s more.

The main board volume consists of:

-Client-order transactions

-Dealer trades (usually day trades)

-Cross-trades (trades from clients in the

same broker)

-Done-through (intrabroker/broker

subcontract) trades

Last week, the top 10 brokers controlled

53.84% of the main board volume, averaging 56.75% since the end of June.

Or, concentration in trading activities has

also been reflected in the concentration of broker trades.

The point is, what you see isn’t always

what you get.

Main board (and gross) volume doesn’t

necessarily reflect broader public participation.

The sharp decline in direct participation by

the public in 2023 underscores this reality. The PSE’s active

accounts comprised only 17.6% of the 1.9 million total accounts in 2023—the

lowest ever. (Figure 5, middle image)

Instead, trades within the financial industry

have played a significant role in the PSE’s overall turnover.

For instance, in Q1 2024, the BSP noted

that claims of Other Financial Corporation (OFC) on the other sectors "grew

as its investments in equity shares issued by other nonfinancial

corporations," and also “claims on the depository corporations rose

amid the increase in its deposits with the banks and holdings of

bank-issued equity shares”

Have OFCs been a part of the national team?

OFCs include bank subsidiaries, public and private insurance and pension firms,

investment houses, et.al. (BSP, 2014)

Why would the PSE’s volume endure a

sustained decline if there has been significant savings to support the alleged

increase in public confidence?

Historic? Hyperbole.

V. Why Ignore the Impact

of the Flagrant Manipulations of the PSEi 30?

Finally, why would everyone discount,

dismiss, or ignore the brazen "pumps-and-dumps" and "pre-closing

price level fixing" at the PSE?

In the last five days, managing the index

level involved early ICTSI-fueled pumps, aided by frenetic rotational bids on

the other top five to six market caps. (Figure 5, lowest images)

After surpassing 7,000-level intraday, the

local version of the "national team" dumped their holdings—using the

5-minute pre-closing float—onto unwitting foreign and retail buyers.

Despite this, the PSEi 30 managed to close

above the 7,000 level during the last two days—albeit on low volume, with

negative market breadth and concentrated trading activities.

Still, does everyone believe that the

mounting distortions in the prices of (titles to) capital goods will come

without consequences for the financial markets and the real economy?

What happened to the army of analysts and

economists? Has the fundamental law of economics escaped them?

Or does the management of the PSEi 30

levels represent part of the establishment’s manipulation of the Overton

Window?

Sure, the mainstream media has been so

desperate to see a "bull market" that they describe a 19-month high

as a "historic moment."

However, much of today’s media reporting

seems to be more than mere cheerleading: genuine journalism has been

sacrificed in favor of copywriting for vested interests paraded as news.

VI. The Unannounced "Historic

Moments"

But the so-called "Historic Moment"

has manifested in many unpopular and unannounced forms.

Let us enumerate the most critical ones:

First, systemic leverage, consisting

of PUBLIC

DEBT plus TOTAL

bank lending, has reached Php 28.515 trillion as of July 2024, accounting

for 113% of the estimated 2024 NGDP! Public

debt servicing has also reached unparalleled levels!

Second, Q2

public spending, the financial industry’s net

claims on the central government (NCoCG), and the banking system’s held-to-maturity

(HTM) assets have also reached all-time highs.

Third, the banking sector’s business model

transformation—from production loans to consumer loans—has been

unprecedented.

Fourth, the savings-investment

gap has reached a significant milestone.

Fifth, PSE borrowings, led by San

Miguel’s Php 1.484 trillion, have also reached historic highs.

Sixth, the money

supply (M1, M2, and M3) relative to GDP remains close to its record

highs in Q1 2021.

Figure 6

Seventh, the BSP’s

asset base remains near the record high attained during the pandemic

bailout period (as of June 2024.) (Figure 6 topmost chart)

While there are more factors to consider, have

you heard any media or establishment mentions or analyses of these issues?

Don’t these factors have an impact on the "fundamentals"

of the PSE or the economy?

Or are we expected to operate under a state

of "blissful oblivion," or the blind belief that "this time is

different?" (The four

most-deadliest words in investing—John Templeton)

It not only fundamentals, the current phase

of the market cycle also tells a different story than the consensus whose primary

focus is on a "return to normal" phase. (Figure 6 middle and lowest

graphs)

Good luck to those who believe that the PSEi

30’s 7,000 level signifies a bull market or a historic moment.

____

References

The OFCs sub-sector includes the private and

public insurance companies, other financial institutions that are either

affiliates or subsidiaries of the banks that are supervised by the BSP (i.e.,

investment houses, financing companies, credit card companies, securities

dealer/broker and trust institutions), pawnshops, government financial

institutions and the rest of private other financial institutions (not

regulated by the BSP) that are supervised by the Securities and Exchange

Commission (SEC).

Jean Christine A. Armas, Other

Financial Corporations Survey (OFCS): Framework, Policy Implications and

Preliminary Groundwork, BSP Economic Newsletter, July-August 2014,

bsp.gov.ph