``Demanding immediate success invariable leads to playing the fads or fashions currently performing well rather than investing on a solid basis. A course of investment, once charted, should be given time to work. Patience is a crucial but rare investment commodity. The problem is not as simple as it may appear; studies have shown that businessmen and other investors abhor uncertainty. To most people in the market place, quick input-output matching is an expected condition of successful investing.” David Dreman, Contrarian Investment Strategies: The Next Generation

Should your housemaid invest in the stock market?

All Actions Are A Function Of Tradeoffs

Recently, I chance upon a message advocating housemaids to invest their money in the stock market. The supposed goal is to help the underprivileged financially by capitalizing on the rising markets.

While I would agree with the underlying motive, the basic problem with this idea is that purported intentions hardly square with reality.

In the real world, all actions have consequences. And actions are driven by the preferences (value scale) and incentives of individuals to seek relief from discomfort.

In short, people’s actions represent purposeful behaviour.

As the great Ludwig von Mises explains[1], (all bold highlights mine)

``Acting man is eager to substitute a more satisfactory state of affairs for a less satisfactory. His mind imagines conditions which suit him better, and his action aims at bringing about this desired state. The incentive that impels a man to act is always some uneasiness. A man perfectly content with the state of his affairs would have no incentive to change things. He would have neither wishes nor desires; he would be perfectly happy. He would not act; he would simply live free from care.”

``But to make a man act, uneasiness and the image of a more satisfactory state alone are not sufficient. A third condition is required: the expectation that purposeful behavior has the power to remove or at least to alleviate the felt uneasiness. In the absence of this condition no action is feasible. Man must yield to the inevitable. He must submit to destiny.”

This means that the consequences of everyone’s action for betterment can have short term or long term effects. Hence, in a world of scarcity, everyone’s action is a consequence of a tradeoff in personal values and preferences.

And one cannot isolate actions taken by individuals from these underlying influences, even from the perspective of impulses.

Again from von Mises[2],

``He who acts under an emotional impulse also acts. What distinguishes an emotional action from other actions is the valuation of input and output. Emotions disarrange valuations. Inflamed with passion, man sees the goal as more desirable and the price he has to pay for it as less burdensome than he would in cool deliberation. Men have never doubted that even in the state of emotion means and ends are pondered and that it is possible to influence the outcome of this deliberation by rendering more costly the yielding to the passionate impulse.”

Take for instance in the recent infamous hostage taking[3] (at the Luneta Grandstand in the Philippines), which has now become a political controversy.

Some have suggested that the actions of the criminal signified that of a fit of rage. True, but again it was choice made from a tradeoff of what the culprit sees as a better way to resolve a personal unease or predicament.

In other words, a choice had been made based on short term time horizon (immediate gratification) which alternatively meant the failure of the felon’s emotional intelligence which paved way for a severe miscalculation that proved to be fatal for him, the victims and politically strained the relations diplomatic between the nationalities involved in the unfortunate incident.

Also there is a suggestion that the perceived depravity of the due process which prompted for the criminal’s misdeeds should be detached. False. Again people are driven by purposeful behaviour where actions and motives are inseparable, interrelated or intertwined, again from the Professor Mises[4], “It is impossible for the human mind to conceive a mode of action whose categories would differ from the categories which determine our own actions”

The point of the above is to show you that people’s choices are ALWAYS based on tradeoffs, all of which comes with intertemporal (occurring across time) consequences, positive or negative, where good intentions can lead to the opposite of the desired goals.

Housemaids And The Bubble Cycle

And how does this apply to the wisdom of housemaids investing in the markets?

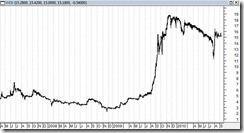

The fundamental reason for such advocacy is predicated on the broadening expectation of the linearity of the ongoing trend (see figure 1).

Figure 1: Bloomberg: The ASEAN Bull Market

As earlier explained[5], the ASEAN bullmarket appears to be segueing into what billionaire George Soros calls as the “growing conviction” phase of the boom cycle.

This simply means that as the uptrend becomes more entrenched, people will intuitively flock to where the returns are. In behavioural finance this is called the herding effect or the Herd Behavior.

Indonesia (JCI, green) is the first among the contemporaries to surpass the 2007 highs. All the rest, particularly Philippines, (PCOMP yellow), Malaysia (KLSI, orange) and Thailand (SET, red) appear to be at the threshold of testing their 2007 highs.

The point of my showing the synchronous action of ASEAN markets is to demonstrate that this hasn’t been mainly because of national political-economic issues, but because of other variables UNSEEN by the public or by even most of the experts. Yet among the popular experts, who at the start of the year, predicted that the Phisix will likely break 3,800?

Here is what I wrote in May 2009[6],

``Nonetheless, if the Phisix does end the year above 2,500, we may expect a full recovery (Phisix 3,800) by the end of 2010 or even an attempt at the 5,000.”

5,000 may seem too optimistic but one can’t discount the acceleration of the speed and depth of the shaping bullmarket. Sri Lanka and Bangladesh for instance on a year to date basis is up astoundingly by 73% and 49% respectively, compared to the Phisix at 22%[7] which makes ASEAN bourses look dismal. At any rate, my predictions are mostly becoming a reality.

And where money is seen as being picked up on the streets, even housemaids will, by their volition, perhaps prodded or influenced by their peers or their household employers, will gravitate to “easy money”.

Remember the stock market is a social phenomenon driven by expectations, whether these expectations are valid or not[8].

And the rising tide compels people to make various attributions to market actions, such as economic growth or earnings or mergers and acquisitions, no matter how loosely correlated they are or how little relevance they are with the genuine market drivers. Most of this account for as popular dogmatic fables or widely held superstitions as evidences does not support the causality nexus from such premises.

What has been driving today’s stock markets has been the tsunami of liquidity, or what I have long called as the Machlup-Livermore[9] paradigm, from the coordinated monetary policies by global central banks in an attempt to forestall the “deflation” bogeyman.

And these policies have had relative effects on the marketplace, where areas largely unblemished from the recent bubble implosion appear to have been “positively” influenced. This seems quite evident in the markets of the periphery more than that of the developed economies, from which most of these policies have been directed.

I say positive, in the context, where rising markets are being misconstrued as signs of rising prosperity, which is illusory, when in fact what such dynamic account for is the tacit depreciation of the currency, but presently seen in the dynamic of “asset price inflation”. As we have long said, these are symptoms of the seductive sweet-spot phase of inflation. Heck, why has gold been rising against ALL currencies[10], if this hasn’t been so?

Eventually this illusion morphs into nasty bubbles (see figure2), or at worst, inflation spiralling out of control.

Figure 2: World Bank: Paper Money and Banking Crisis

And it is NO coincidence that since the world went off the quasi gold standard of the Bretton Woods system in 1971 the account of banking crisis globally have exploded.

Why?

Because inflation, as a short term fix is like narcotics, is addicting.

Again Professor Mises[11],

``The popularity of inflation and credit expansion, the ultimate source of the repeated attempts to render people prosperous by credit expansion, and thus the cause of the cyclical fluctuations of business, manifests itself clearly in the customary terminology. The boom is called good business, prosperity, and upswing. Its unavoidable aftermath, the readjustment of conditions to the real data of the market, is called crisis, slump, bad business, depression. People rebel against the insight that the disturbing element is to be seen in the malinvestment and the overconsumption of the boom period and that such an artificially induced boom is doomed. They are looking for the philosophers' stone to make it last.

In short, the paper money-fractional reserve central banking system induces boom bust cycles only shifts around the world. And ASEAN economies, as well as other peripheral emerging economies, seem like candidates to a formative bubble.

And this is why we also have long been saying of a Phisix 10,000[12] or the potential of the Philippine Phisix to reach bubble proportions sometime in the future.

If experts hardly grasp the dynamic of bubble cycles, how the heck do you expect housemaids to understand?

The Housemaid Indicator

Housemaids investing in the stock markets have NOT been unusual. During the acme of the bubble cycle in China in 2008, the onrush of retail punters into stocks, which included housemaids, signified the peak of frenzied activities.

As Shujie Yao Dan Luo of The University of Nottingham wrote in their recent study[13], (emphasis added)

``Most of these investors, which included farmers, cleaners, taxi drivers and house maids, knew little about stock markets and how share prices were determined. Many of these people started investing in the stock markets when prices had already risen rapidly to peak levels, just before the market bubble burst. The participation of these ‘envious’ investors artificially prolonged the bullish market and created a much larger market bubble than would have occurred had they not become involved.”

In short, retail investors GOT SINGED and were left HOLDING THE EMPTY BAG. They accounted for as the FOOL in the Greater Fool Theory.

Former Morgan Stanley analyst Andy Xie describes the “Maid Indicator” as great way of looking at market tops, he says[14],

``Now housemaids are in the market. Who else? Never underestimate 1.3 billion people. In China, they say you should take the shoeshine boy’s advice. Many would listen to him. Welcome to China, the land of getting rich quick.”

In other words, retail money represents unintelligent money. Retail money is mostly drawn into the prospects of free lunches and who turn stock markets into casino-like gambling orgies. They signify as the culmination of irrational behaviour.

A most recent example has been in the US markets, where there has been a pronounced shift of retail investors OUT of stocks and INTO bonds.

And guess what? It would appear that the counterpart of the Maid Indicator or the RETAIL money indicator is accurate (figure 3).

Figure 3: Retail Investors Hardly Gets Investing Right

As the New York Times highlighted on this monumental shift, markets immediately sprung to the opposite direction against the bets of retail money.

As I recently wrote[15], ``I’d suggest that, like always, they are wrong and betting against them (in stocks) would likely be a profitable exercise.”

By the way things are developing, I could be validated anew.

And like my son’s finance professor who initially required that he and his classmates to invest in the stock markets for the semester (four months), to which I argued against, and instead told my son that his professor speak to me, it must be understood that profiting from stock markets is NOT a function of three or four months exposure unless one is positioned as a PUNTER than an investor.

Stock Market investing, like all other successful endeavours requires diligence, perseverance, perceptiveness and patience. And importantly, unlike other professions, it also requires the ability to think independently and to resist social or peer pressures, which alternatively means going against the crowd or popular wisdom even to the risk of ostracism.

For instance the world’s most successful stock market investor Mr. Warren Buffett, at the height of the dot.com boom was labelled a “dinosaur” for avoiding investments in technology companies. In hindsight, he was vindicated. His advice[16], “If you’re applauded, worry. Great moves are usually greeted by yawns.”

The same holds true with the fallacious notion of learning from simulated stock market games. When one deals with “monopoly” play money, the tendency is to GET aggressive because there is no real cost. To lose is simply a game. Yet repeated exposure to simulated games could amplify risk tolerance and aggressiveness at the expense of profit opportunities.

In other words, simulated trading games impart the wrong traits or attitudes in dealing with the financial markets. Since the market is a function of social actions, the understanding of people’s behaviour and the direction of such actions is a MUST.

Yet one must be reminded that since everyone has different value scales and preferences, these can’t be quantified or seen in aggregates, which has been the major flaw of mainstream economics.

Investing Is NO Free Lunch

Let me be clear with my position, I am not opposed to ANYONE, including maids, from engaging the markets. What I am vehemently opposed with is the idea of free lunches as path to prosperity.

Anyone who engages in the markets must be capable to deal with the intertemporal tradeoffs between risks and rewards.

Because every action has a consequence, the inability to reckon with such tradeoffs could translate into future losses far greater than any interim gains.

Another thing which I am rabidly opposed with is the pretentious morality of uplifting the underprivileged by advocating unnecessary exposure on the stock markets when the participants are under qualified to comprehend or imbue on the attendant risks involved.

To expose people to future losses which could be far greater than the current gains defeats the goal of social advancement.

Just ask the horde of speculators of the US housing bubble who had been apparent “victims” of Federal Reserve and US government policies. They who profited at first have now been suffering from the losses out of excessive speculations. These gullible participants were lured and abetted by the immoral policies of turning stones into bread.

Yet failed policies do NOT exonerate the individual’s recklessness because many have seen the potential impact of bubble policies prior to the bust per se. Warnings were unheeded because of the enticements of social pressure and the seeming perpetuation of rising prices.

And such consequentialist notion where “the ends justify the means” or the consequences of actions serving as moral propriety also fails to account for the tradeoff between present and future ramifications from such actions. Teaching housemaids to engage in risky ventures without the necessary understanding of risks is tantamount to gambling.

Another way to say it is that the reorientation of people’s behaviour towards reckless undertakings which is likely to result to adverse consequences is not morally justifiable nor is gambling, in anyway, going to create financial upliftment.

If the retail under qualified entities (housemaids, drivers or low skilled workers) insists on investing in the financial markets, then the right approach would be to let experts handle their money via mutual funds or UITF (Unit Investment Trust Funds) or through pooled discretionary accounts with able and qualified fund managers.

Yet, even if the experts do manage their accounts, the communication of the tradeoffs between risks and rewards should be a prerequisite or a sine qua non for the simple reason of harmonizing the expectations of the client and managers.

Unmatched expectations are often the root of most conflicts. In the financial markets, expectations in time preferences could be a principal source friction for a principal-agent relationship.

Thus, we go back to the simple operating precept: investing is NO Free lunch, period. That has to be understood by both retail investors (housemaids) and fund managers. Anybody who says otherwise is either being untruthful or deceiving oneself or the other party.

Beware of false prophets.

[1] Mises, Ludwig von The Prerequisites of Human Action, Human Action Chapter 1 Section 2

[2] Ibid

[3] See The Bloodbath At Rizal Park Hostage Drama Demonstrates The Pathology of Government, August 24, 2010

[4] Mises, Ludwig von The Alter Ego Human Action Chapter 1 Section 6

[5] See How To Go About The Different Phases of The Bullmarket Cycle, August 23, 2010

[6] See Kentucky Derby And The Global Stock Market, May 10 2009

[7] See Global Stock Markets Update: Peripheral Markets Take Center Stage, September 4, 2009

[8] See A Primer On Stock Markets-Why It Isn’t Generally A Gambling Casino, January 9, 2009

[9] See Are Stock Market Prices Driven By Earnings or Inflation?, January 25, 2009

[10] Gold.org, Daily gold price in a range of currencies since January 2000

[11] Mises Ludwig von, The Market Economy as Affected by the Recurrence of the Trade Cycle, Chapter 20 Section 9

[12] See Phisix 10,000:Clues From Philippine Bond Offering, July 15, 2009.

This has been a long held prediction of mine even prior to the last bubble cycle. The 2007-2008 bearmarket I had interpreted as a countercyclical trend in a secular uptrend. The current underlying secular trend reverses once the bubble dynamic, cultivated domestically, implodes. This has NOT been the case in the 2007-2008, which was largely a function of global contagion. This also why fundamentals (economic performances, earnings, etc..) and market actions went on the opposite ways serves as proof of the disconnect between popular wisdom and reality.

[13] Yao, Shujie and Lou, Dan Chinese Stock Market Bubble: Inevitable Or Incidental? University of Nottingham

[14] Investmentmoats.com, Andy Xie: Housemaid indicator says Chinese Bubble near to burst, April 28, 2010

[15] See US Markets: What Small Investors Fleeing Stocks Means, August 23, 2010

[16] KPMG.com "If you're applauded, worry"