``In a free economy the principal cause of a cumulative deficit in a country's international payments is to be found in inflation. Reference to it has been already made. A sustained policy of inflation leads a gold-standard country to a cumulative loss of gold and finally to the abandonment of that system; then the national currency can freely depreciate. In a country whose currency is not convertible into gold, inflation leads to its continuous devaluation in terms of foreign currencies.” Michael A. Heilperin, International Monetary Economics

I have more proof that the next wave of inflationism will take place not because of the political exigencies to restore “export competitiveness” (a.k.a currency wars) or about the US unemployment woes, even if the latter has been used as justification for the coming actions, but to save the US banking system.

QE 2.0 And The Legal Face Of The US Mortgage Crisis

The US Federal Reserve through Mr. Bernanke in a recent speech said that “the risk of deflation is higher than desirable[1]” and that “Given the committee’s objectives, there would appear — all else being equal — to be a case for further action[2]”

So there seems to be a strong likelihood of Quantitative Easing (QE) 2.0 will take place during the next Fed meeting in November 2-3.

Yet, what’s wrong with the two illustrations? (see figure 1)

Figure 1: US Stocks Rallying Without Financials

Basically, the US stockmarket has been rallying absent the financials, the former leaders. The financials, as seen by S&P Financials (SPF: left window, bottom pane), have lagged and has been weighed by the banking index (BIX-left window, main chart)

The poor performance of the US banks can be traced to the next phase of the mortgage crisis.

Apparently the US mortgage mess has been transformed from a financial and economic issue into a major legal morass: The issue of property titles—where the complexities of the Mortgage Backed Securities (MBS), during the boom days, may have led to string of fraudulent actions which may have caused a “chain of broken titles”.

Gonzalo Lira has the details[3] but here is the kernel,

``A lot of the foreclosed properties might not have been foreclosed legally. The people evicted might still have a right to their old houses. The new buyers might not actually own the REO’s they bought off the banks. The banks could be on the hook for trillions of dollars, and in the sights of literally millions of lawsuits.”

The initial tremor has been a wave of foreclosure moratorium.

According to Chad Fisher of USA News[4],

``JPMorgan Chase has suspended foreclosures in 23 states while the company looks at 115,000 mortgage foreclosure files to find potential errors in its documentation. Ally Financial and Bank of America are looking for errors in files for all 50 states and suspending foreclosures. Goldman Sachs' Litton Loan Servicing, PNC Financial, and OneWest Bank began are checking their files, but Wells Fargo and Citigroup are holding their ground, stating that their affidavits are valid and sound...This time the states are banding together to stop foreclosures based on illegal affidavits submitted by mortgage companies in foreclosure proceedings.”

One risk is that banks may be required to buy back mortgage securities if they are the originators. This could put under further strain the banking industry’s capital position that could trigger another seizure in the banking system.

And perhaps QE 2.0 is meant to assume this role—to provide another subsidy to industry by acting as lender or buyer or guarantor of last resort.

Of course the foreclosure moratorium presents as another burden to the housing industry, which serves as another reason why QE 2.0 will, once again, be in operation.

As we have long said, this has much less been about the US economy, but about protecting the banking system, which has been the anchor to the de facto US dollar monetary system, from the risks of collapse.

The problem with mainstream media is that they have been focused on the aspects of currency wars, emanating from so-called imbalances, when the predicament is apparently internal: Incumbent unsustainable policies and their unintended consequences.

The Deadly Effects Of Competitive Devaluation

I’d like to add that the impact of the so-called “currency wars” will greatly depend on the degree of reaction by Emerging Market central banks relative to the inflationism applied by their contemporaries in the developed economies.

Since currency wars or “competitive devaluation” function as a subtle form of protectionism, which implies of multiple participants, the effect isn’t likely to be temporary or short term but a lasting one with disastrous results.

We are not new to this, according to Murray N. Rothbard[5], (bold highlights mine, italics original)

``Of course, the world had suffered mightily from fluctuating fiat money in the not too distant past: the 1930s, when every country had gone off gold (a phony gold standard preserved for foreign central banks by the United States). The problem is that each nation-state kept fixing its exchange rates, and the result was currency blocs, aggressive devaluations attempting to expand exports and restrict imports, and economic warfare culminating in World War II.”

The major difference is that countries then went off the gold standard and eventually returned to a modified US dollar-gold fix, known as the Bretton Woods system[6], while today we are operating plainly on a paper money US dollar standard. So essentially, the competitive devaluation being staged by today’s global central banks sails on unchartered waters.

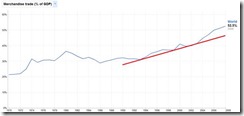

Figure 2: Imports Then And Today

Besides unlike in the 30s, global trade was much less of a factor (see figure 2). And less global trade translated then to geopolitics that had been mainly based on nationalism.

Today, the world has been alot more trade oriented. And so far, the responses by emerging market monetary authorities have been benign, defensive and less confrontational.

For instance, Thailand reportedly will remove a 15% tax privilege accorded to foreigners on income from domestic bonds[7]. Also lately Brazil’s government will move to “to raise the country's Financial Operations Tax, known as IOF, on certain types of incoming foreign investment will be insufficient to resolve the country's problems with an appreciated local currency, Brazil's National Confederation of Industries, or CNI, said Tuesday[8].”

South Korea also joins the clamp down on foreign currency speculation by increasing probes on currency derivatives[9].

And to confirm our suspicions[10], Asian central banks have been heavily intervening on their respective markets to curb currency appreciation. According to a news report ``Authorities in the region were estimated to have bought a combined $23.2 billion via intervention from last week until Tuesday, according to traders estimated compiled by IFR Markets.[11]”

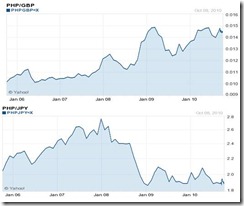

And signs are likely that reactive interventions also involves the domestic central bank (Bangko Sentral ng Pilipinas) in the slowing the appreciation of the Peso[12].

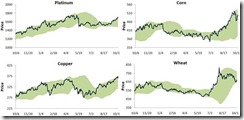

And of course the overall effect of competitive devaluation is to raise the price of commodities (see figure 3).

Figure 3: Stockcharts.com: Commodity Inflation

So whether it Gold (Gold), Agriculture commodities ($GKX-S&P GSCI Agricultural Index Spot Prices), industrial metals ($GYX S&P GSCI Industrial Metals Index - Spot Prices) or energy products ($GJX-S&P GSCI Energy Index Spot Prices) we seem to be witnessing broadening signs of commodity inflation emanating from these collective policies. This is aside from the financial asset inflation in Emerging Markets.

Author Judy Shelton quotes Euro currency founder Robert Mundell in an interview[13],

``'The price of gold is an index of inflation expectations," Mr. Mundell says without hesitation. "The rising price of gold shows that people see huge amounts of debt being accumulated and they expect more money to be pumped out."

In explaining the failure of the Bretton Woods system, Mr. Mundell again in the same interview says

"The system broke down," he hastens to explain, "not because of fixed rates. Fixed exchange rates operate between California and New York . . . the system broke down because there was no mechanism to keep the world price level in line with the price of gold." (emphasis added)

In other words, sustained interventions and inflationism deflected or distorted the exchange ratio between money relative to gold which induced huge unsustainable imbalances that caused the monetary system to disintegrate.

Applying this to competitive devaluation, this implies that protectionism via the currency valve will only risks leading the world to inimical trade wars or shifting bubble cycles or hyperinflation/breakdown of the currency system.

So for a full scale currency war to take place, the effects are certainly not negligible.

In A Currency War No Nation Wins

It’s even equally ridiculous to hear mainstream proponents advocate currency wars as solution to global imbalances such as “China wants to impose a deflationary adjustment on the US, just as Germany is doing to Greece”[14].

On the first place no one is trying to deflate other nations directly for their own benefit. Policies are most shaped to conform with perceived interests of local entities that takes external interests as secondary objectives.

For instance, QE 2.0 appears directed at the banking system rather than promoting demand via export competitiveness via the currency channel.

Next, people and not nations are the ones who conduct trade and trade balances likewise reflect on this.

Another, currency values are not the sole factor that determines trade balances, there are many issues such as scale of capital, technology, infrastructure, cost of doing business through tax and bureaucratic regime, legal institutions, property rights, state of the markets and labor and many others that influence the business environment.

Fourth, it isn’t true China or Greece has been deflating (see figure 4).

Figure 4: Tradingeconomics.com: Inflation in China and Greece

The problems of Greece, for instance, reflect more on the rigidity of a relatively closed economy[15] and the overdependence on a welfare state than from its Euro anchor. I’d suspect that even if Greece were to operate on its former currency, the drachma, and allowed to devalue; the internal rigidities won’t miraculously bring them to an export giant as misperceived by the mainstream.

So I wouldn’t know what kind of world these analysts live in, but their narratives has been far from appropriate accounting for the facts. They would seem to be like snake-oil salesman.

Lastly, since inflationism is a subtle form of redistribution, i.e. from savers to spenders and from creditors to debtors, this will be beneficial only to a few but at the expense of society. Therefore, claims that the US will benefit from a currency war is unalloyed canard.

Doug Noland of the Credit Bubble Bulletin rightly observes[16],

``The U.S. cannot win the “currency war.” In reality, central bankers in China, Japan, Brazil, South Korea and elsewhere aren’t even battling against us. They have, instead, been waging war on the market. If foreign central bankers had not intervened and accumulated massive dollar holdings (international reserves up an incredible $1.5 TN in 12 months!) – in the process providing a “backstop bid” for both our currency and the Treasury market – it would be an altogether different market environment today.

``There will be no answer for global imbalances found by the U.S. “inflating the rest of the world.” The problem with inflationism is that one year of inflationary measures leads only to the next year of greater inflation.”

And I certainly agree that inflationism is an addictive agent. But like abuse of use of illegal substances, such actions will have long term deleterious implications.

QE 2.0 Should Boost Emerging Market and Asian Equity Assets

As we have long repeatedly argued, global policy divergences has been prompting for cross border capital flows that has been buoying emerging market assets including that of Asia (see figure 5).

Figure 5: US Global Funds: QE 2.0 Should Lift Asian Equities

And the transmission mechanism that would boost liquidity flows isn’t only from external sources but likewise reflected from domestic channels.

Some confirmation of our view from Morgan Stanley’s Joachim Fels and Manoj Pradhan[17]

``Economies with greater slack in their economies and less inflationary pressures will try to keep their currencies from appreciating, either through FX intervention or, to a lesser extent, via the use of capital controls. Intervention in FX markets will likely mean higher domestic liquidity (in the absence of tight credit controls like in China). In turn, the domestic economy is likely to expand and goods and risky asset prices are likely to be pushed higher. These EM economies should see a boom, and higher incomes, leading to an increase in the demand for US exports. Other EM economies, whose output gaps are too small for comfort or whose inflation is already a concern, could decide to let their currencies accelerate to a greater extent. Domestic expansion here would be more limited, so there would be not so much of an income effect; but US exports would still benefit again, this time from an improved price advantage thanks to EM currency appreciation.”

Figure 6: Tradingeconomics.com: Philippines Total Forex Reserves (ex-gold)

In the Philippines, as cross border capital flow surges, domestic liquidity has likewise been expanding, as the local central bank, the BSP, intervenes in the currency markets, aside from the ramifications of the artificially suppressed interest rates.

So in the environment of the alluring sweet spot of inflationism and concerted currency debasement, cash is likely the worst form of investment.

[1] Businessweek.com Bernanke Ponders ‘Crapshoot’ Amid Deflation Risk, October 15, 2010

[2] New York Times, Bernanke Weighs Risks of New Action, October 15, 2010

[3] Lira, Gonzalo The Second Leg Down of America’s Death Spiral, October 12, 2010

[4] Fisher Chad, 5 Things You Should Know About the Foreclosure Moratorium, US News, October 15, 2010

[5] Rothbard, Murray N. The World Currency Crisis, Making Economic Sense

[6] Wikipedia.org Bretton Woods system

[7] Businessweek, Bloomberg Thailand to Levy 15% Tax on Foreigners’ Bond Income, October 12, 2010

[8] Wall Street Journal Brazil Industry: IOF Tax Not Enough To Resolve Forex Problems October 5, 2010

[9] Wall Street Journal, Korea to Inspect Forex Positions at Banks, October 5, 2010

[10] See Currency Wars And The Philippine Peso, October 10, 2010

[11] Business Recorder, Taiwan dollar at two-year high, October 6, 2010

[12] Inquirer.net, Jan.-Aug. BOP surplus rises by 25% to $3.48B, September 20, 2010

[13] Shelton, Judy, Currency Chaos: Where Do We Go From Here?, October 16, 2010

[14] Wolf, Martin Why America is going to win the global currency battle, Oct 12, 2010

[15] See Greece And Economic Freedom, October 16, 2010

[16] Noland, Doug Inflationary Biases And The U.S. Policy Dilemma, Credit Bubble Bulletin PrudentBear.com

[17] Fels Joachim and Pradhan Manoj, QE-20, Morgan Stanley October 15, 2010