Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.-Charles Mackay

Let me open by saying that I remain a long term bull on the mining sector.

However given the current ‘blitzkrieg’ seen in most of the major mining issues, which has substantially bolstered the Philippine mining index, I am inclined to believe that bigger profits premised on lesser risk can be made on other sectors, over the interim.

Mining Index’s Remarkable Outperformance Needs A Reprieve

Even as most of the world’s major equity markets appear to stagger, ASEAN equity markets have remained buoyant. The biggest gains over the week had been posted by Thailand (+3.25%), Singapore (+2.07%), Philippines (+1.73%), Malaysia (+1.67%), Vietnam (+1.47%) and Indonesia (+.88%). Asia was largely but tentatively positive with decliners seen only in Bangladesh, Australia and Japan’s benchmarks.

Such buoyancy had likewise been reflected over the broad markets of the Philippine Stock Exchange.

Advancers modestly eclipsed decliners (376-309), while most of the sectoral averages registered positive except for the financial industry.

The Mining and oil sector remained the leader, whose gains were matched by the Holding sector (powered by the peripheral issues—JGS Summit +7.42% and DMC Holdings +6.84%) followed by the service sector (led by the heavyweights PLDT +2.98% and ICT +3.13%).

The turbocharged mining sector has unwaveringly advanced for 7 consecutive weeks!

In addition, the mining sector has assumed the market’s leadership (also co-leadership as the above) in the last 4 out 5 of the weeks.

Year to date, the mining sector, has exhibited such domineering trait: While the Phisix has been up by a meager 2.17%, the mining sector has skyrocketed by an astounding 27.98%! The rest of the other sectors have only to watch helplessly as they get left behind.

Yet such grand performance is likely to draw in much of the crowd. It is when the impulsive and emotionally driven crowd steps in is when we should exercise cautiousness. The greater fool theory works in a crowd driven trade.

In observing the crowd phenomenon, a popular quote attributed to author Gustave Le Bon[1],

When popular opinion is nearly unanimous, contrary thinking tends to be most profitable. The reason is that once the crowd takes a position, it creates a short-term, self-fulfilling prophecy. But when a change occurs, everyone seems to change his mind at once.

Given the above, there are two investing axioms to keep in mind:

One—no trend goes in a straight line

Second—never get married to an investing theme

Given such axioms, there are four factors which I think should make the mining sector vulnerable to a correction:

1. Buy the rumor sell the news,

2. seasonality,

3. war against commodities and

4. rotation

Buy the Rumor, Sell the News

‘Buy the Rumor, Sell the News’ is a popular trading strategy built around the premise where stock prices in reaction to rumors (based on myriad issues such as new products, new markets, mergers and acquisition, joint ventures, new investors and etc...) substantially rises. And once the rumors gets either confirmed or denied, the stock prices falls.

‘Buy the rumor sell the news’ functions like a miniature boom bust cycle applied to specific issues. Only that this phenomenon occurs mostly during bull market cycles which accentuates sharp gyrations of the marketplace given the underdeveloped state of the local equity markets underscored by the lack of depth, sophistication and alternatives.

The ranking of the Philippine mining index based on weightings as of Friday’s close are as follows, [this includes the year-to-date performances]

Philex Mining 26.6% [22.73%]

Lepanto Consolidated 26.06% combined [A-76.08%, B-80.22%]

Semirara Mining Corp 18.72% [15.03%]

Atlas Consolidated 10.62% [23.19%]

Manila Mining Corp 6.64% [A & B-108.7%]

One would easily note that the gist of the fantastic gains of the Philippine Mining Index revolves around two issues: Manila Mining [MA, MAB] and Lepanto Mining [LC, LCB].

In addition, the one year chart shows that three issues have relatively strong correlations—particularly Philex (blue line), Lepanto (red line) and Manila Mining (black candle) where the undulations appear to be synchronized. The difference is in the magnitude of price actions.

On the other hand, Atlas Consolidated (green line) has only partly shadowed the actions of her peers. While coal mining energy based Semirara has fundamentally distanced its price actions with activities of the precious metals group.

Last week, following a voluntary trading halt, the three companies with strongly linked movements disclosed that they have closed a deal[2].

Philex Mining [PX] will reportedly get a 5% interest of the Kalayaan Copper Gold Resources which is 100% owned by Manila Mining [MA], in exchange for $25 million. Philex has the option to expand its stakes to 60% in Kalayaan in the condition that the feasibility and other pre-development expenditures will be shouldered by the company.

Incidentally, Lepanto [LC] owns a 20% share of Manila Mining.

We see overbought technical conditions for mainly Manila Mining and Lepanto and partly with Philex. Such signs of euphoria combined with the confirmation of the rumor—which is now a news could be negative for their share prices. Without further developments to speculate on, profit taking will likely take hold.

Should my prediction hold true where a corrective phase on these 3 issues would occur, it is unclear if Atlas [AT] or Semirara [SCC] will follow their footsteps, as they have not been part of the event based actions.

As said above, “buy the rumor sell the news” are issue specific activities that may not necessarily influence the price actions of the contemporaries.

Considering that the weightings of participants of that deal constitutes about 59.3% of the Mining index, then any significant correction will likewise be reflected on the bellwether.

To add, given the variances in the degree of gains, the correction phase will also respond accordingly.

Seasonality

Based on seasonal performances, the precious metal groups appear to be most senstive to price corretions during May to September.

This is not limited to the metals as exhibited by the gold future[3] seasonals see top window in the above chart, but also to the Material sector[4] (S&P 500) (also see window below).

And since the metals function as the main drivers of the stock prices of mining securities then perhaps such seasonal forces may add to the profit taking mode.

Over the past 8 years the Philippine mining index has shown some semblance of seasonally influenced performance.

The Mines strengthened mostly during the last quarter then peaked during the first or second quarter then downshifted or consolidated. The timing may not be perfect or that there may be variances but the cyclical essence holds.

This applied in 5 out of 6 years, except in 2008, where the mining index responded to exogenous forces more than the seasonality flows.

One would also note that price declines (based on peak-trough) from anywhere 25-40% (ex-2008) delineates the downcycle phases of the mining index.

War Against Commodities

US, Europe and China has openly engaged in a supposed campaign[5] against so-called “speculators”.

These governments have actively or indirectly intervened in the marketplace by changing the rules of the game, particularly for the US and China, in abruptly raising of the credit margins of commodity trades.

This hasn’t been a one-time affair, but appears to have been deployed successively to almost the entire commodity sphere.

Such ‘Pearl Harbor strategy’ has been meant to “shock and awe” speculators to forcibly bring down prices.

Similar to the failed coordinated interventions by central banks against speculators to stem the rise of the yen last March[6], I expect these intrusions to have short term effects.

To add because such interventions does not address the fundmanental reasons why commodities have been rising, government actions will only exacerbate imbalances already put in place by earlier polcies. So this seems like another case where the cure is worse than the disease.

Since we should expect global governments to persist on such actions for unstated political goals, commodities will, thereby, be subjected to sharp gyrations.

So far the war on commodities has diffused to global mining indices such as the S&P/TSX Global Mining Index (SPTGM) and the Dow Jones US Mining Index (DJUSMG). This should serve as a temporary headwind against local mining industry.

Nevertheless such intrusions may also engender “regime uncertainty’, or an aura of regulatory risks which may also affect the general marketplace.

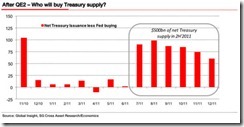

By June, the US Federal Reserve is scheduled to end QE 2.0 (Quantitative Easing or a.k.a. ‘Credit Easing’ policies).

I am not sure that the US Federal Reserve will automatically reengage in QE 3.0, since this seems largely a political issue. Although, I suspect that QE 3.0 will be implemented sometime within the year. Of course the other issue will be the controversial vote on debt limit which will likely be associated with QE 3.0. A vote to raise the US debt ceiling implies of more pressure for the US Federal Reserve to put QE 3.0 on the pipeline.

Besides, part of the ‘signaling channel’ or one of the tools used by central bankers to control or manage inflation expectations could be to project some market “volatility”. This may be used to justify the next round of money printing measures. Thus, for the interim, the marketplace could be subject to more of politics than of market based action.

Promoting fear seems as the best way to advance policies of social control.

Market volatility may be an outcome of deliberate tactical operations, or as unintended consequences in the battle being waged against the “inflation”.

Rotational Process

A prominent symptom of inflation is that prices are affected unevenly or relatively.

Eventually prices in general moves higher, but the degree and timing of price actions are not the same.

It’s the same in stock markets, which represents as one of the major absorbers of policy induced inflation.

Prices of some issues tend go up more and earlier than the others. At certain levels, the public’s attention tend to shift to the other issues which has lagged. This brings about a general rise in prices.

These are the spillover effects which I call the rotational process.

I have been predicting that the mines will outperform the rest of the equity markets[7] since 2003. Yet while this has been fulfiled, in retrospection, the path towards attaining today’s conditions hasn’t been straightforward.

The early periods had been marked by refusals and denials which gradually segued towards slow acceptance and finally transiting into today’s mid-cognizant phase. Yes even today’s boom has not fully convinced many disbelievers.

The path to glory isn’t without pain.

One would note that mines gyrated steeply from 2007-2010. And this period hallmarks the gradual acceptance stage.

Yet while the mines had racked up the biggest gains as exhibited by the index overtime, it suffered periods of the deepest losses (2008) and periods of ennui or underperformance (2010).

People tend to see what is recent (anchoring bias), and project the present into the future. That’s how I think many see them today.

Yet given the above outlook: war against commodities, overheating on several mining issues, buy the rumor and sell the news, the seasonality phases, and signs of euphoria—all these seem to point to a possible correction.

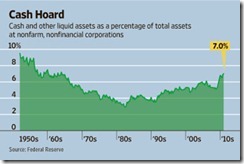

Importantly even if the Philippine central bank, the Bangko Sentral ng Pilipinas recently raised interest[8] for the second time this year, local policies still seem very accommodative as policy rates are considerably below previous[9] and projected (from 5[10]-7%[11]) economic growth rates.

Also I also believe that inflation rates have been meaningfully underestimated.

If the promulgated reason for raising interest is to “to control inflation expectations amid rising oil and food prices”, then the rates of increases of food and gas here and abroad would seem far been greater than current levels of interest rates.

This, essentially, points to a ‘negative real interest’ environment[12], the implication of which is throw more fuel to the boom phase of domestic financial asset markets.

This means that if the mining index declines, then some sectors would have to pick up the slack.

Trade The Opportunity

Bottom line: No trend moves linearly.

I predict that the local Mining index will undergo a corrective phase over the next quarter or so. But eventually should pick up steam anytime during the late 3rd quarter or during the last quarter of the year.

One could take some profits off the table while leaving most of one’s mining holding positioned for the long term or in the event of my miscalculation.

Proceeds from the profit taking could be used for repositioning to other sectors in anticipation of a rotational process or to relish the fruits of one’s triumph.

[1] Nowandfutures.com Some favorite quotes, A world of Possible Futures. I say attributed because I can’t find it in Gustave Le Bon’s The Crowd

[2] PSE.com Lepanto Consolidated Mining Company Agreement between MA and PX for exploration and development of Kalayaan Project; Lifting of trading suspension, May 12, 2011

[3] Equityclock.com, Gold Futures Seasonal Chart

[4] Ibid., Material Sector Seasonality

[5] See War On Commodities: China Joins Fray, Global Commodity Politics Intensifies, May 14, 2011

[6] See Did the Joint Currency Intervention for a Weaker Yen Succeed? May 14, 2011

[7] See Philippine Mining Index Surfs The Commodity Tide, April 24, 2011

[8] Philstar.com BSP hikes interest rates by 25 basis points, May 6, 2011

[9] Abs-cbnnews.com Philippines posts record 7.3% economic growth in 2010, January 31,

[10] Mb.com.ph Latest WB forecast puts Philippine GDP growth at 5% to 5.4% for 2011 and 2012, January 14, 2011

[11] Breakingnews.ph NEDA chief confident of 7-8% GDP growth, February 10, 2011

[12] Wikipedia.org Negative real interest rates