From rn-t.com:

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, July 26, 2013

US Home Builders Slammed as 10 Year UST Yield Rise

In my post yesterday I noted that the rebound in US housing looks increasingly tenuous in the face of the continuing turmoil in the bond markets.

Yields of 10 US Treasury Notes has rebounded strongly during the past few days. Yesterday, 10 year yields recaptured the 26 levels

The result of yesterday’s bond market sell-off?

The US largest residential house builder, DR Horton (DHI) fell off the cliff, down by 8.58%!

This comes even amidst a reported “better-than-expected profit” for the second quarter of 2013. Good “past” news didn’t deter the selloffs on the prospects of sustained elevated higher mortgage rates.

Rising yields also smacked Pulte Homes (PHM) largest homebuilding company hard. PHM essentially collapsed—down by 10.3%!

Lennar Corporation (LEN) the second largest homebuilder has had a better fortune yesterday. The bulk of the early steep losses was recovered. Nonetheless LEN still posted a 1.62% loss.

(charts above from stockcharts.com)

These has important implications

During the 2003-2007 boom phase of the US stock market, the housing downturn preceded the collapse of the S&P 500 by about a year. This has been manifested by the decline in the stock price of DR Horton DHI (leftmost arrow) and eventually the S&P 500 (second or middle arrow).

The same story holds true with Pulte Homes (PHM).

(charts from bigcharts.com)

As in 2006-2007 boom phase, US stock markets may continue to rise, but if the recent downshift in US homebuilders should deepen or intensify, prompted by higher mortgage rates, the lessons of the 2008 US mortgage crisis tells us that such widening divergences would likely spell the Wile E Coyote moment for US stocks in the fullness of time.

Interesting times indeed.

Labels:

Bond vigilantes,

divergences,

homebuilders,

US economy,

US housing bubble,

US housing crisis

Chinese company uses drones for cake delivery services

Drones serve as instruments to an end.

In politics, drones have been used to kill political opponents or for spying/surveillance. As a destructive weapon to attain foreign policy goals, for every drone strike, 50 civilians are killed for every terrorist, notes the Policymic.com. The children death toll from drones attacks in Pakistan has now reached 94 according to Foreign Policy

But there is a brighter side for the alternative uses of drones.

A company in China uses “cheap drones” to service cake deliveries

From Shanghai Daily: (hat tip zero hedge)

HAVE the cake and eat it too.And get it delivered in style as well.In a crazy story that would make even spy master James Bond sit up and take notice, a local cake factory is using drones to deliver cakes in Shanghai! And China's civil aviation authorities are not too happy about it.The factory used remote-controlled aircraft on five different occasions to "fly" cakes across the Huangpu River to customers in downtown, claimed Men Ruifeng, the marketing manager of the Incake company, which only accepts orders online.The drone, measuring 1.1 meters in diameter and fitted with five propellers, flies at a height of about 100 meters and can be remotely controlled over several kilometers. It has two cameras and the controller can pilot it from a nearby vehicle, Men said.The company has three such drones, all of them refitted from a Chinese-made aviation model.

Commercial applications of drones, as previously pointed out, will largely be positive or constructive for society.

Thursday, July 25, 2013

Quote of the Day: The main difference between non-profit and for-profit

The main difference between non-profit and for-profit is that non-profits are accountable to donors and for-profits are accountable to customers. This means that the non-profit sector is going to be more elitist and more less efficient than the for-profit sector. It does not mean, as so many people think, that the non-profit sector operates from better motives or provides more social benefit.I am not saying that a non-profit sector is a bad thing. Just remember that it is inherently paternalistic, and that is problematic.

(italics original)

This is from economist, author and entrepreneur Arnold Kling at his blog.

Labels:

Arnold Kling,

charity,

non profit,

profits,

quote of the day

Will Slowing Foreign Buying of US Properties Derail the Housing ‘recovery’?

Foreign buying of US real estate appears to be slowing, will these compound on the recent setback brought by rising bond yields?

Reports the CNBC.com

The flood of money pouring into U.S. real estate from the overseas rich may be slowing.Foreign purchases of real estate in the U.S. dropped 17 percent in the 12 months ended in March compared with the same period a year ago, according to the National Association of Realtors. The high end of the market felt the brunt of it.Sales of homes priced at $1 million or more to overseas buyers dropped to about 6.5 percent of sales from 10 percent—the sharpest drop in any price category.There are several possible reasons for the slowdown. A stronger dollar makes U.S. real estate less attractive on a currency basis. The NAR said mortgage standards also tightened, making it harder for overseas buyers to qualify for loans.But the main reason is economic weakness overseas. "Economic slowdowns in a number of major foreign economies appear to have been a major reason for a drop in sales; a number of potential customers apparently held off on purchases," the report said.Wealthy buyers from China, Brazil and Russia have been critical to the real estate recovery at the high end of the market—especially in Miami, New York and parts of California. Brokers fear that if wealth creation slows in emerging markets, high-end home sales could also weaken.

Since bond yields exploded last May, the “recovering” US real estate industry has shown signs of fatigue strains.

Mortgage applications has gone down along with rising mortgage rates (lower window, rates are inverted).

This has also been reflected on a sharp downturn in Home Sales (upper window) according to the Zero hedge

Housing starts and housing permits has also tumbled, again from another Zero Hedge report

The Reuters recognizes of the June decline of US existing home sales, but attempts to paint a bullish picture by referencing year on year increases. But last year bond yields were at a low, the tumult in the bond markets began only this May. So one data covers differing conditions at different time frames.

Meanwhile contra Reuters, the cynical Zero hedge notes of negative month on month changes on existing home sales.

Construction trends haven’t been rosy too. Multi starts and single family starts have been in a short term decline even as builder’s sentiment soared.

Don’t worry, be happy. The Northern Trust economic team believes that the “bloom is not off the housing recovery yet” since they see a “steep and rapid climb” of mortgage rates as “unlikely”. This means that experts from Northern Trust see the recent “steep and rapid climb” as an anomaly.

However, stock prices of major homebuilders as DR Horton (top) and Lennar (bottom) have hardly been lifted by record US equity bellwethers.

Both interest rate sensitive stocks plunged on the re-emergence of the bond vigilantes.

The general decline of Lumber prices have also barely been in support of a sustained recovery on US housing.

And so with copper prices (which has also been a China story)

And finally, while negative equity has fallen, many millions of “Americans still owe more than what their homes are worth”, according to the Dr. Housing Bubble.

Delinquent loans continue to rise.

These indicators don’t seem to support a "robust" "real" housing recovery but instead reveals of a fragile boom prompted by easy money speculations.

Yet if the bond market vigilantes continue to impose their presence on the global markets, then yes, growth in emerging economies are likely to suffer a pullback, which will also likely affect buying patterns on US properties.

Equally, higher bond yields transmitted to higher mortgage rates risks reversing the current boom phase of the reflated US housing bubble.

So the bond vigilante triggered headwinds confronts both internal and external dynamics of the US housing boom.

Interesting times indeed.

Interesting times indeed.

China’s Railroad Stimulus is now Official: It’s an $85 billion boondoggle

So the rumored railroad stimulus has become official.

From Bloomberg:

Chinese Premier Li Keqiang said the nation will speed railway construction, especially in central and western regions, adding support for an economy that’s set to expand at the slowest pace in 23 years.The State Council also yesterday approved tax breaks for small companies and reduced fees for exporters, according to a statement after a meeting led by Li. China plans a railway development fund, the government said.Additional spending would help the world’s second-largest economy, after the government signaled this week it will protect its 7.5 percent growth target for this year following a second straight quarterly slowdown…China had planned to invest 520 billion yuan ($85 billion) in railway construction this year, according to a rail-bond prospectus published July 19. Total fixed-asset investment by the railroads, which also includes train purchases and maintenance, will be 650 billion yuan.

The report didn’t say that the Chinese government embarked on a massive US $586 billion fiscal stimulus program in 2008-9 as shield against the global US epicenter based crisis.

Yet, Chinese economic growth has been faltering, that’s after a short period of “traction” from such policies (chart from tradingeconomics.com).

This means that stimulus work only for the “short term”. Also if $586 billion didn't do the job, then why would $85 billion of 'targeted' spending work?

Adding railroads to what seems as faltering railway activities (chart from Business Insider), not only reflects on an ongoing downshift of economic activities, but importantly such would translate to surpluses or wastages of capital—where losses of public companies will be passed on to taxpayers.

So the Chinese government appears to be buying time by providing a short term statistical boost to a floundering economy.

Of course, another thing the report didn’t mention is that much of the 2008-2009 stimulus has been funded heavily by debt.

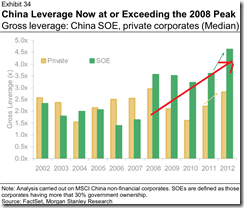

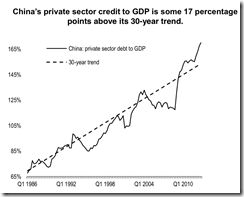

Debt of State Owned Enterprises (SoE) have now been estimated at an eye-popping 4.5x leverage. Private sector debt has also ballooned. One shouldn’t forget that a lot of private sector companies are tied to or related to the government, a lot of of them as vehicles for the local government.

The outcome of the 2008-2009 stimulus has been a colossal credit bubble that has fueled a runaway property bubble.

So the freshly installed Chinese government essentially will implement the same policies as the former administration. The more things change the more they stay the same…

The thrust towards public works means that Chinese stimulus program will be channeled via SoEs, which transfers economic opportunities to the political class and to the politically connected firms.

Public works also heightens credit risks on both the public and the private sector, as these $85 billion projects would be funded by more debt.

Such would further magnify bubble conditions, despite the cosmetic measures to curtail the shadow banking.

Unfortunately for taxpayers, $85 billion spending means higher taxes overtime.

While it may be true that part of Li’s program would be to cut taxes for small businesses which should be good news…

Resolutions passed at yesterday’s cabinet meeting included the exemption of companies with monthly sales of less than 20,000 yuan from value-added and business taxes starting Aug. 1, according to the statement. The move will benefit more than 6 million small businesses and affect jobs and income of tens of millions of people, the government said.

…such is likely a superficial attempt or effort.

The hope is that China’s economy would grow enough to pick up the public spending tab seems as wishful thinking as the 2008-2009 stimulus has shown.

Japan has had the same post-bubble fiscal and monetary stimulus experience through the 90s into the new millennium, or the lost decade, a failed practice which have been repackaged today as “Abenomics”, or differently put, doing the same things over and over again (but at a bigger and more audacious scale) and expecting different results—insanity.

Also the Chinese government’s grand 2008-2009 stimulus program has a growing list of public work disasters.

Politicization of economic activities means lower “real” economic growth as resources are allocated on non-market preferences and to vote or approval generating political pet projects, thus compounding on imbalances (bubbles), increasing waste and losses, higher taxes overtime, redistribution to the political class which implies greater inequality and cronyism, capital consumption and a lowered standards of living.

Wednesday, July 24, 2013

Meredith Whitney: Detroit as precedent to the staggering aftershocks of the largest municipal bankruptcy in US history

Bank analyst Meredith Whitney who correctly called on the Citibank fiasco during the 2007-2008 crisis warns in the Financial Times that the Detroit episode serves as precedent to a coming wave of municipal bankruptcies. (bold mine)

As jarring as the reality may be to accept, Detroit’s decision last week to declare bankruptcy should not be regarded as a one-off in the US municipal market – which is what the bond-peddlers are now telling their clients. The aftershocks of the largest municipal bankruptcy in US history will be staggering, and Detroit will set important precedents.Municipal bankruptcies have historically been rare for a number of reasons – including the states’ determination to preserve their credit ratings, their access to cheap funding and the stigma of bankruptcy. But, these days, things are very different in the world of municipal finance.At the root of the problem is the incentive system that elected officials used to face. For decades, across the US, local leaders ran up tabs for future taxpayers; they promised pensions and other benefits for public employees that have strong legal protection. That has been a great source of patronage for elected officials: they can promise all sorts of future perks to loyal supporters (state and local workers) with very little accountability on the delivery of those promises.Today, we are left with the legacies of this waste. The bill for promises past is now so large for some cities and towns that it is crowding out money for the most basic of services – in the case of Detroit, it could not even afford to run its traffic lights. Across many American cities, cuts to basic social services have already been so deep that they have made the communities unpleasant places.

Read the rest here.

Ms. Whitney has had strident critics for predicting defaults by 50 to 100 cities to the tune of of “$100s of billion dollars” in 2010 such as David Kotok of the Cumberland Advisors.

Nonetheless currently the unfunded state and local pension liabilities has been estimated at a huge $3.8-4 trillion. This should gobble up a huge share of state budgets in the backdrop of a highly fragile steroids dependent economy. Also, pension shortfalls increases state or muni credit risks, if expected or targeted returns are unmet.

Yet if bond vigilantes continue to unsettle the interest rate markets, and or, if the FED does “taper”, where Dr. Bernanke said last week, “If we were to tighten policy, the economy would tank”, then it wouldn’t be far fetched for Ms. Whitney’s predictions to come to fruition.

Has the Skyscraper Curse Hit China?

The Skyscraper Index introduced by Dresdner Kleinwort Wasserstein research director Andrew Lawrence has been a reliable but a not perfect leading indicator of business cycles.

Skyscraper booms tend to highlight the peak of a business cycle, as I discussed in 2009, or tends to rise on “the eve of economic downturns” according to Wikipedia.org.

The peak of the Skyscraper cycles has frequently signaled the advent of recessions, the Wikipedia.org elaborates, “where investment in skyscrapers peaks when cyclical growth is exhausted and the economy is ready for recession”

Has the Skyscraper curse become a reality in China?

The construction of the world’s tallest building in China has reportedly been suspended.

According the Dubai Chronicle: (bold mine)

In May, the Dubai Chronicle reported that China is planning to challenge Dubai’s Burj Khalifa’s status as world’s tallest building. The Asian country is preparing to build a skyscraper which is even taller than Burj Khalifa’s 2,716 feet. The building, called Sky City, was initially planned for completion by the end of the year. However, the date is now pushed forward, slowing down the mega project.Only a couple of months ago, China’s Sky City project was said to be ready by end of 2013. The developers behind the ambitious project were confident in their prognosis even though the construction works on the tower had not even begun. According to them, the 2,739-feet Sky City would take only half a year to complete due to its unique construction process.But despite the forecasts, Sky City’s completion is now delayed to April 2014. There is no specific information on why the project is taking so long, given that it is enjoying the great support of the Chinese government.In addition, this is not the first time in which Sky City’s opening is being delayed. Originally, the project was supposed to be ready at the beginning of 2013. However, the construction work started last week.The cost of the record-aiming building has also been changed. In May, Sky City was expected to consume only $625 million. Now, its construction is estimated at over $855 million.

Skyscraper manias have always been accompanied by overconfidence, similar to the stock market.

Next, the cost overrun has simply been a manifestation of the inadequate savings in sustaining of such grandiose project. As the great Austrian economist Ludwig von Mises explained:

The whole entrepreneurial class is, as it were, in the position of a master builder whose task it is to erect a building out of a limited supply of building materials. If this man overestimates the quantity of the available supply, he drafts a plan for the execution of which the means at his disposal are not sufficient. He oversizes the groundwork and the foundations and only discovers later in the progress of the construction that he lacks the material needed for the completion of the structure. It is obvious that our master builder's fault was not overinvestment, but an inappropriate employment of the means at his disposal.

The “lack of material needed” has been expressed by higher input prices as the construction-real industry earlier bid up on input prices, enabled and facilitated by cheap interest rates, thus resulting to the ballooning cost of the project.

The Zero Hedge has an illustration of the Sky City…

…and of China’s simmering skyscraper mania.

Unraveling of malinvestments are presently being manifested through cash squeezes which has been ventilated via higher interest rates.

Austrian economist Professor Mark Thornton, who expanded the study on the Skyscraper Index to cover the Austrian Business Cycle, notes that,

Higher interest rates discourage the building of taller buildings and of construction in general because capital is scarcer and land is less in demand and available at lower prices.

And the weakness in the Chinese economy seem to be intensifying. This would further expose on the massive misallocations of capital that would further translate to even higher interest rates or higher costs of capital.

A fresh Bloomberg article reports that China’s manufacturing index “weakened further in July, signaling the worst of the nation’s slowdown has yet to be reached, according to a preliminary survey of purchasing managers”

And its not just in the economy, current social policies may help prick the runaway property bubble.

In what seems as another attempt by the Chinese government to curtail such property bubbles, a 5 year ban has been imposed on construction of new government buildings.

From another fresh Bloomberg report:

China banned government and Communist Party agencies from constructing new buildings for five years and told them to suspend projects that have already won approval as the country seeks to cut wasteful spending.The ban includes construction for purposes of training, meetings and accommodation, the government said in a statement on its website yesterday, calling for resources to be spent instead on developing the economy and improving public welfare. All localities should report the implementation of the new rules by Sept. 30, according to the statement.

The suspension of the construction of the world’s tallest building, intermittent cash squeezes, the reappearance of the bond vigilantes, tanking stock markets, signs of intensifying weakness of the economy, declining yuan-US Dollar (see above) and the Chinese government’s policy path to break the runaway property bubble seem to reinforce the Skyscraper curse.

And a severe downturn may lead to a "period of instability" says a state researcher.

And a severe downturn may lead to a "period of instability" says a state researcher.

Oh, don't forget, ASEAN has her own Skyscraper mania.

Ignore these signs at your own peril.

Tuesday, July 23, 2013

Quote of the Day: Social Engineering is about Unequal Justice

Understand that social engineering, by its very nature, calls for a double standard. Under social engineering, blacks with night sticks at voting stations are given a pass. Union thugs beating up a black Tea Party member is no problem. Killing more than a million unborn (and some born) babies a year is okay. Make no mistake about it, social engineering is not about equal justice. It’s about unequal justice. It’s about the power thugs having it all their way.

This is from self help and libertarian author Robert Ringer at his website discussing implementing socialism via social engineering.

Labels:

quote of the day,

Robert Ringer,

social engineering,

socialism

Asian Markets Jump on Rumors of US$106 Billion Railway Stimulus

Asian markets posted strong gains today led by Chinese Equities.

It appears that steroid addicted markets has found another inspiration from rumored or unofficial plans for a railway stimulus by the Chinese government.

From Bloomberg:

The government may spend more than the originally planned 650 billion yuan ($106 billion) on railway construction this year, the China Business News reported today, citing an unidentified person close to senior government officials. New high-speed rail lines could help reduce over-capacity in industries such as steel and cement, the Shanghai Securities News reported today, citing railway officials.

The Shanghai composite leapt by 1.95%. ASEAN markets spiked too.

The floated rumors are signs that the policies of the newly installed Chinese officials will hardly distinguish from the previous administration in terms of bailouts and rescues, except via the form of interventions. Policies to "reduce over-capacity" will extrapolate to short term gains that would lead to capital consumption and that will exacerbate on the current unsustainable imbalances.

But the good news is that the Chinese government has also liberalized caps on lending by the banking system last Friday. This should be positive over the long term growth.

But this will hardly resolve on the current debt based malinvestments and the runaway property bubble brought about by the previous policies which has prompted a shift towards the huge $2.4 trillion shadow banking system.

One thing seems clear, there has to be promises for more inflationary interventions by global governments to guide the markets higher. And this collective jawboning-the-markets communications strategy appears to have become a daily activity.

Yet, my question is will these constant promises of easy money policies experience diminishing utility or diminishing returns? We will see.

Nonetheless, interesting developments.

Iceland’s Recovery Model: It’s a story of how to fool people

Sovereign Man’s impressive contrarian Simon Black argues against the Iceland Recovery Model which he sees as a “complete lie”. (bold mine)

Yet unlike the bankrupt countries of southern Europe, Iceland dealt with its economic emergency in a completely different way.Politicians here are proud that they never resorted to austere budget cuts that are so prevalent in Europe.They imposed capital controls. They let the banks fail. And, as is so commonly trumpeted in the press, they ‘jailed their bankers and bailed out their people.’Today, Iceland is held up as the model of recovery. Famous economists like Paul Krugman praise the government for rapidly rebuilding the economy without having to resort to austerity.This morning’s headline from The Telegraph newspaper sums it up: “Iceland has taken its medicine and is off the critical list”.It turns out, most of these claims are dead wrong.For example, they say in the Western press that Iceland bailed out its people and jailed the bankers.Not exactly. A few bankers were investigated and charged with fraud. The CEO of one of Iceland’s biggest failed banks was even convicted, and sentenced.Now, how long of a sentence does someone get for railroading his nation’s economy? Life? 30-years? 10-years?Actually nine months. Six of which became probation.Meanwhile, the government ended up taking on massive amounts of debt in order to bail out the biggest bank of all– Iceland’s CENTRAL BANK.This was a bit different than the way things played out in the US and Europe.In the US, the Fed conjures money out of thin air and funnels it to the government.In Iceland, since the Kronor is not a global reserve currency, the government had to go into debt in order to funnel money to the Central Bank, all so that the currency wouldn’t collapse.As a result, Iceland’s state debt tripled, almost overnight, in 2008. And from 2007 until now, it has increased nearly 5-fold.Today, the government is spending a back-breaking 17.3% of its tax revenue just to pay interest on the debt.And this is real interest, too. Iceland’s central bank owns very little of the government debt. The rest is owed to foreign creditors… putting the country in an extremely difficult financial position.At the end of the day, the Icelandic people are responsible for this. They were never bailed out. They were stuck with the bill.Meanwhile, although unemployment in Iceland is low, wages are even lower. And the weak currency has brought on double-digit inflation.So while people do have jobs, they can hardly afford anything.This is most prevalent in the housing market, most of which is underwater. Interest rates have jumped so much that many Icelanders are now on negative amortization schedules, i.e. their mortgage balances are actually INCREASING with each payment.Meanwhile, home prices have been falling dramatically.So each year, mortgage balances are going up, and home values are falling. Hardly the picture of recovery.The freshly elected Prime Minister is now promising everyone relief from their mortgage debts via a special state ‘debt correction fund’.The only problem is that the state doesn’t actually have any money to do this… and they’re running a budget deficit every year.The only way this can happen is if Iceland defaults… which is becoming a much more likley scenario.A few years ago, Iceland’s banking system was nearly 10 times the entire country’s GDP. And it collapsed. You don’t paper over a crisis of that magnitude with a few years of good PR.Despite being so widely reported by the mainstream financial media, Iceland is not a story of model economic recovery. It’s a story of how to fool people. And for now, it’s working…They’re not in the EU or on the euro, so they’re relatively isolated in their fiscal troubles. This implies that default is inevitable.And when that happens, Iceland will be shut out of international debt markets and be FORCED to pull out all the stops to attract foreign investment.

Few charts to support Mr. Black’s claim

Iceland’s debt to gdp has skyrocketed from less than 30% to nearly 100% of gdp over the past few years.

This serves as another great and wonderful example of how rapid and dramatic changes on what previously seemed as a “sound fundamentals”, which in reality had been masked by credit inflation, deteriorate in the face of a crisis.

Iceland’s external debt tells of the same story: previously low debt levels spiked in the advent of a crisis. (charts from tradingeconomics.com)

“Low” external debt and “low” government debt to gdp has been the stereotyped justification for populist “sound” statistically based "fundamentals" which in reality has been propelled by unsustainable credit inflation…sounds familiar?

Nonetheless today’s ‘don’t worry, be happy’ crowd can be seen in Iceland’s recovering 10 year bond yields

Iceland’s stock market (chart form Bloomberg.com) has also shown signs of recovery, partly due to PR campaign and also from the global credit easing policies.

“Complete lie” have hardly just been an Iceland story but a conventional dynamic as revealed by the growing disconnect between global financial markets, which essentially stands on Ben Bernanke’s and central banker’s promises and the real economies.

It’s a falsehood which the financial and the political world gladly embrace as sustainable framework.

To paraphrase John 8:32 “…and you will know the truth, the truth (economic reality) will set the markets free.

Labels:

euro debt crisis,

iceland,

political propaganda,

Simon Black

Social Security Funds as Government Milking Cow: Spain Edition

I previously pointed out what seems as Ponzi financing scheme where the Spanish government has raided its pension reserve fund in order to boost Spanish bonds or to lower bonds yields, by buying up to government debt up to 97% share of its assets.

For the cash strapped Spanish government, this hasn’t been enough, as they squeeze money from the social security fund to finance state pension.

According to a report from Reuters:

Spain tapped its social security reserve fund for the second time in a month on Monday, the Labour Ministry said, to help with extra summer pension payments as unemployment and retirement costs deplete government funds.The government turned to the fund for 3.5 billion euros ($4.6 billion) on July 1 then for a further 1 billion euros on Monday. Spanish pensioners receive two cheques in summer and two over the Christmas holidays.Spain was forced to tap the reserve for the first time last year to help pay pension costs, using some 7 billion euros.Record high unemployment, which hit over 27 percent in the first quarter, and a growing number of retirees on a state pensions have put an unprecedented strain on Spanish social security funds.

Social security or pension funds have become a favorite tap for governments, especially for the cash strapped variety. These funds are not only subject to to government’s predation, they can also be used as instruments to effect political agenda. For instance, in the Philippines, government retirement fund the GSIS has been used as a tool to promote the popularity of the incumbent government via stock market purchases. Not only does the GSIS intervene directly via actual purchases, they also provide signaling mechanism to the marketplace by pledging to buy stocks at certain levels.

And like the Detroit saga, if the Spanish government defaults on their debt, pension fund beneficiaries will get cleaned out.

It’s sad to know how government tapping of or dabbling with people’s savings would eventually lead to hardships.

Subscribe to:

Posts (Atom)