The investor's chief problem - and even his worst enemy - is likely to be himself. Benjamin Graham

In this issue:

Phisix: 7,000 Breaks on Regional Melt-UP; The Natural Limits of Inflationism

-The Unicorn Syndrome

-Natural Limits of Inflation: Hyperinflation

-Natural Limits of Inflationism: Political Economy

-Even in DEBT, there is NO Free Lunch

-Another Natural Barrier: Valuations

-ASEAN Stock Market Melt-UP, Stock Market Massaging by China and Japan’s Governments

Phisix: 7,000 Breaks on Regional Melt-UP; The Natural Limits of Inflationism

The Unicorn Syndrome

Most people believe in political unicorns or the belief in the salvation of social ailments through the state.

Duke University Political Science and Economics Professor Michael Munger explains[1]:

Our problem is that we have to fight unicorns.

Unicorns, of course, are fabulous horse-like creatures with a large spiraling horn on their forehead. They eat rainbows, but can go without eating for years if necessary. They can carry enormous amounts of cargo without tiring. And their flatulence smells like pure, fresh strawberries, which makes riding behind them in a wagon a pleasure.

For all these reasons, unicorns are essentially the ideal pack animal, the key to improving human society and sharing prosperity.

Now, you want to object that there is a flaw in the above argument, because unicorns do not actually exist. This would clearly be a fatal flaw for the claim that unicorns are useful, if it were true. Is it?

Of course not. The existence of unicorns is easily proven. Close your eyes. Now envision a unicorn. The one I see is white, with an orange-colored horn. The unicorn is surrounded by rainbows. Your vision may look slightly different, but there is no question that when I say "unicorn," the picture in your mind corresponds fairly closely to the picture in my mind. So, unicorns do exist and we have a shared conception of what they are.

I’ll call this Unicorn syndrome. The same myth has served as the foundation of today’s financial markets.

The fundamental premise of the Unicorn syndrome is that there are NO limits or obstacles to inflationism. This comes in varying forms: This Time IS Different. Low interest rates have been foreordained to perpetuity. Uncertainty or risks have been permanently contained by central banks. Stocks are bound to go up forever and so on…

Let me just make a BASIC or elementary example of the natural limits of inflation.

The typical Rice production cycle takes 3 months. Yet it takes only a few minutes to underwrite a loan through deposit creation or for the government to issue money. This means credit and or money creation can only grow faster than the production of real goods and services. Yet if such money creation extrapolates to demand for rice, directly or indirectly (spillover effect), then naturally there will be impact on people’s preferences and values expressed through prices. And changes in prices will affect production, people’s consumption, distribution, budget and savings and even to sentiment.

In short, it is the PURCHASING POWER of money (what money can buy) relative to real goods of services that matter, regardless of capacity of governments to create infinite money. The limits in the production of real goods and services will serve as a NATURAL constraint on inflationism.

Natural Limits of Inflation: Hyperinflation

Let me first deal with the extreme: Hyperinflation. Why does hyperinflation exist if governments can inflate their economies to prosperity?

Hyperinflation is defined by Wikipedia[2] as “very high and usually accelerating rates of inflation, rapidly eroding the real value of the local currency, and causing the population to minimize their holdings of the local money”. Meanwhile, hyperinflation in the interpretation of Investopedia[3] “is a situation where the price increases are so out of control that the concept of inflation is meaningless.”

In reality, hyperinflation represents the complete breakdown of or a collapse of demand for currency due to sustained and accelerating increases in the quantity or the issuance of money. Hyperinflation signifies the economic backlash against the unicorn notion of free lunch or the desire of political authorities to consume resources substantially more than what their constituents can produce. Hyperinflation, whose policies are grounded on the misguided concept that money is wealth, epitomize the intended or unintended consequences of political greed.

As the great dean of the Austrian school of economics, Murray Rothbard explained[4]:

The lower demand for money allows fewer resources to be extracted by the government, but the government can still obtain resources so long as the market continues to use the money. The accelerated price rise will, in fact, lead to complaints of a “scarcity of money” and stimulate the government to greater efforts of inflation, thereby causing even more accelerated price increases. This process will not continue long, however. As the rise in prices continues, the public begins a “flight from money,” getting rid of money as soon as possible in order to invest in real goods—almost any real goods—as a store of value for the future. This mad scramble away from money, lowering the demand for money to hold practically to zero, causes prices to rise upward in astronomical proportions. The value of the monetary unit falls practically to zero. The devastation and havoc that the runaway boom causes among the populace is enormous. The relatively fixed-income groups are wiped out. Production declines drastically (sending up prices further), as people lose the incentive to work—since they must spend much of their time getting rid of money. The main desideratum becomes getting hold of real goods, whatever they may be, and spending money as soon as received. When this runaway stage is reached, the economy in effect breaks down, the market is virtually ended, and society reverts to a state of virtual barter and complete impoverishment. Commodities are then slowly built up as media of exchange. The public has rid itself of the inflation burden by its ultimate weapon: lowering the demand for money to such an extent that the government’s money has become worthless. When all other limits and forms of persuasion fail, this is the only way—through chaos and economic breakdown—for the people to force a return to the “hard” commodity money of the free market.

Going back to my rice example, brought about by expectations of sustained inflationism by the government, once people’s perception on money radically changes, the public will opt to hold rice (as reservation demand) than money. This will extrapolate to the “flight from money”. As one would note, the economic principle of the diminishing marginal utility applies to money.

Hyperinflation if pushed to the extremes leads to the death of the currency.

The biggest ever hyperinflation was endured by Hungary in 1945-46, with the highest monthly rate at 4.19 × 10^16%, according to data (Hyperinflation Table) compiled by Cato Institute’s Hanke-Kraus. At its peak, daily inflation rate was at 207% where it took every 15 hours for prices to double!

Zimbabwe has been one of the latest casualties of hyperinflation. Zimbabwe’s hyperinflation in 2007-2008 was the second biggest ever with the highest monthly rate at 7.96 × 10^10% which meant a daily inflation rate 98% where it took 24.7 hours for prices to double!

Before its demise, the Zimbabwean dollar had 3 redenominations with the highest face value issuance of $100 trillion banknotes! As economic theory goes, Zimbabwean’s junked the domestic currency which was instead used as toilet paper or for murals or for other non-money activities. And as economic theory predicted, Zimbabweans resorted to barter e.g. gold exchanged for food, and spontaneously adapted of foreign currencies as replacement: South African rand, Bostwana pula, UK pound sterling, Indian Rupee, euro, Chinese yuan and the US dollar.

The shift in the use of money by the average Zimbabweans is a splendid example of two noteworthy phenomena; nothing operates in a vacuum and importantly the guerilla free market forces in operation in spite of oppressive political regimes.

Yet one of the symptoms of hyperinflation has been soaring stock markets.

In the prelude to Austria’s 1921-22 hyperinflation, where highest monthly inflation climaxed at 129% or a daily inflation rate of 2.8% where prices doubled every 25.5 days, Adam Fergusson writes of the runaway inflation induced Austrian stock market boom[5] (bold mine)

Gambling on the stock exchange had become the fashion — the only way to avoid losing all one's money and perhaps to add to it. Many new bankers were giving people advice, the flight from the krone governing all transactions…

Speculation on the stock exchange has spread to all ranks of the population and shares rise like air balloons to limitless heights … My banker congratulates me on every new rise, but he does not dispel the secret uneasiness which my growing wealth arouses in me … it already amounts to millions.

As one would note, under runaway inflation, people hardly invest with the aim of profits. Rather, since stocks represent titles to capital goods, they provide the moneyness function of ‘store of value’ combined with liquidity. As such, due to the “flight from money”, the public sought refuge of their savings and wealth in equities.

Stock markets of Zimbabwe and Germany’s Weimar hyperinflation demonstrated the same dynamics. Realize that despite the thousands of percentage returns, in the case of Zimbabwe, the purchasing power of those returns, according to fund manager Kyle Bass “only buys you three eggs". In short, any perceived returns from stock markets under hyperinflation have really been an illusion.

We have real time examples of skyrocketing stock markets due to runaway inflation as seen in Argentina and Venezuela. Despite the recent interest raise hikes, Argentina has been on the fringes of hyperinflation. On the other hand, hyperinflation in Venezuela seems to be easing (from highs of 350% to now about 150% implied inflation, but still hyperinflation), which is why her stock market has partly retrenched or gains have moderated.

Again this is not to say that the Philippines or the world is at risks of hyperinflation, instead this is to exhibit why hyperinflation represents the real or structural LIMITs of inflationism.

The risks of a global hyperinflation seem remote yet. But this is conditional. If governments continue to inflate away their economies or debt, then the risks of hyperinflation will expand along their actions.

For now the clear and present danger is debt financed inflationary boom in the face of a contravening force rising inflationary pressures.

Natural Limits of Inflationism: Political Economy

I noted above and repeatedly in the past here that when money and credit grows faster than the real economy then the obvious economic ramification will be to increase the risks of inflation which will disseminate into many other forms of secondary or subsidiary risks, such as credit risks, interest rate risks, financial stability risks, political risks and so forth.

Hasn’t the surge in lending growth, ventilated through the 30% money supply growth rates compounded by 2013 BSP policies to limit SDA access, now become evident through a combination of events: elevated consumer price inflation which has now become a domestic headline concern, spiraling prices of 3-bedroom Makati condo units which has recently gained international prominence as the world’s hottest real estate market, rallying stocks, a sustained increase in self-diagnosed poverty or even defiance of government edict to return the country by OFWs in Libya due to survival concerns?

Have those sporting rose colored glasses ever considered how rising consumer price inflation and surging asset prices impacts earnings, profits, income, demand, debt conditions and future cash flows? Or how will consumer and asset price inflation be transmitted into interest rates? And equally what will be the feedback on earnings, profits, income, demand, debt conditions and future cash flows from changes in interest rates?

Say property prices. Will sustained turbocharged spike in property prices increase or decrease affordability? Or how will increase in rents affect household budgets or disposable income? These I have all covered or discussed here[6].

Has a surge in 1Q 2014 NPLs in consumer housing loans[7] been an aberration? If not, will such a trend not aggravate risks of financial instability? How about Manila’s ghost condos[8]? Does emergence of consumer NPLs and excess supply via “ghost condos” bear no impact on earnings, profits, income, demand, debt or future cash flows?

To ignore such risks is to invite losses.

The same applies to the US, I forecasted in January 2013 that rising Owner Equivalent Rent (OER) will add to inflationary pressures[9]: Rising rental prices will likely spillover to the US CPI basket considering that housing represents the largest share…In other words, if the US CPI index will begin to register higher CPI because of higher rents, then both Fed policies and the current environment of low interest rates may be jeopardized.

Well this has become a reality. The Federal Reserve of Cleveland says that rising rents has not been a fluke. Importantly rising rents can hardly be explained by the variables in their models (bold mine)[10]: Our results are surprising. OER inflation does not appear to be influenced by vacancy rates, unemployment rates, the real interest rate, or our gap measure. Of the variables investigated, only lagged house price appreciation appears to have a statistically significant relationship to OER inflation (previous OER inflation is also statistically significant). In one sense, this is a conundrum, because it suggests that we “cannot explain” OER inflation using the “usual suspects.” High vacancy rates do not appear to slow OER inflation down appreciably; neither do high unemployment rates, low interest rates, or a low price/rent ratio. The only usual suspect which appears to feed into OER inflation is lagged house price appreciation—and even then, it appears to be statistically significant in only about half of the cases investigated. The unemployment rate appeared to be statistically significant at the 10 percent level in two of the Census regions.

And it would be preposterous to even suggest that property prices can only go upwards.

For those with short memories, the recent US subprime crisis reveals why this has not been and will NOT be true.

In other words, the massive ballooning of the FED’s balance sheets from $800 billion to nearly $4.5 trillion today has all but failed to revive the US housing markets. This is because there have been substantial unworked out imbalances from the previous boom-bust cycle that has been carried through today which has become a baggage to the recovery. So what the Fed’s inflationism has done has been to rechannel or redirect debt financed speculative activities into the stock market.

Yet Fed policies have had other unintended consequences.

A study recently showed of the growing disparity in wealth distribution. The typical US households have reportedly lost a THIRD of their inflation adjusted net worth where “much of the damage has occurred since the start of the last recession in 2007” according to the New York Times[12] has been due to lethargic activities in the housing sector, as “the net worth of wealthy households increased substantially”. So asset speculation (in select housing areas, bond and stock markets) which has benefitted the wealthy has come at the expense of the average Americans.

In addition, rising operating and financing costs has reportedly hamstrung two of three small business establishments recently surveyed by the Federal Reserve Bank of New York[13]. So emerging signs of stagflation seems to fray on the pillars of the US inflationary boom. Since small business establishments have been the largest source of employment, rising inflation will put pressure on the labor market.

The consensus has been blind to the transmission mechanism of inflationism on politics.

By driving a wedge between the typical household and wealthy counterparts, has Fed’s policies been indirectly igniting societal friction or schism?

Also, like head of the Philippines executive branch, US President Obama’s approval rating reportedly hit a new low[14].

And going back to the Philippines, the once popular but now embattled presidency has now aired his desire to seek a second term through a charter change. And the stated reason for this is? Well to get back at the Supreme Court, for latter’s declaration as unconstitutional segments of the Pork Barrel, or specifically the Disbursement Acceleration Program (DAP), which the President supports!

From the Inquirer[15]: For Aquino to make another run for the presidency, the term limits set by the 1987 Constitution would have to be lifted. He had consistently rejected moves to amend the Constitution, a position he now seems to be reconsidering. “Before all of these happened, I admit I had a closed mind. But now I realized that there is judicial reach. Congress and the executive may act but they can be punished anytime,” he told TV5 legal analyst Mel Sta. Maria who asked if he was still not amenable to Charter change.

And the SONA melodrama has mutated into umbrage through faultfinding. Playing into the card of corruption-free virtousness, the Philippine president demands that the Supreme Court members file their respective Statement of Assets and Liabilities (SALN) in the name of transparency[16] while denying a constitutional crisis. The Supreme Court responded that they will reportedly disclose this by the coming week[17]

Transparency for thee, but not for me. The seemingly vindictive Philippine president has so far refused to fully disclose or have an audit on his favored Disbursement Acceleration Program (DAP)[18]

Isn’t it contradictory for the President to claim high moral ground yet fervently support a program that has been one of the MAJOR sources of public looting and instead shift the culpability to the others?

The desire for absolute control is a disturbing sign against any perceived self-declared righteousness. As admonished by John Emerich Edward Dalberg Acton, popularly known as Lord Acton[19]

And remember, where you have a concentration of power in a few hands, all too frequently men with the mentality of gangsters get control. History has proven that. All power corrupts; absolute power corrupts absolutely.

This caricature applies not only to the US president Obama but also the Philippine President.

As I have been saying all these has been nothing less than showbiz. Showbiz economy and Showbiz politics. Now the showbiz twist is for us to see the proverbial “pot calling the kettle black” (Tu quoque fallacy).

And despite this week’s breach of the Phisix 7,000 levels, the ongoing corrosion in populist Philippine politics exhibits of the escalating entropy of the so-called credit driven boom.

This brings us to the current activities by central banks.

Are central bankers really freewheeling inflationists to believe in free lunches?

Perhaps. But this has not been so based on current actions.

Why, for instance, has the US Federal Reserve commenced a tapering?

Here is the US Federal Reserve’s statement on its first tapering of Large Scale Asset Purchases (LSAP) or quantitative easing (QE)[20] (bold mine): However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

In the same plane, why did the Philippine counterpart, the Bangko Sentral ng Pilipinas (BSP) increase interest rates, the fifth policy action during the last 5 months?

Here is the BSP[21]: Given these considerations, the Monetary Board believes that an increase in the BSP’s policy rates will moderate inflation pressures and arrest potential second-round effects by helping anchor inflation expectations. The Monetary Board noted that the continued favorable outlook for domestic demand allows some scope for a measured adjustment in policy rates without adversely affecting the country’s economic growth prospects. Going forward, the BSP will remain vigilant against risks to price and financial stability and stands ready to undertake further policy actions as necessary.

I am certainly not a fan of central banking pronouncements as they can be opaque inconsistent and nontransparent. But at face value both central banks have indicated inflation as a key risk. Yet both have applied partial tightening, which somehow supports their claims, even if such moves have been intended as symbolical.

In addition, while most authorities have played the role of “we recognize the addiction problem, but a withdrawal syndrome will be cataclysmic”, central bankers like India’s Raghuram Rajan[22] and the Bank of International Settlements[23] have correctly predicted the last crisis even when ignored by their contemporaries.

The bottom line: the belief that there will be no end (or backlash) to central banking put, in the context of the political economy represents no more than a UNICORN Syndrome.

Even in DEBT, there is NO Free Lunch

This brings us to the issue of debt.

Bubble worshipers insinuate that debt can grow faster than the economy with little obstacles in perpetuity. Real world experience says otherwise.

Think of it, are there limits to lending by banks and financial institutions to their client borrowers? Are there limits to credit cards? The answer to both is yes.

How about governments? Can they borrow freely without limits?

If this is true, then governments don’t even need central banks. Central banks function as the critical backbone to the banking system from which both help finance government expenditures.

Why have governments around the world through central banks embarked on financial repression policies of zero bound rates? Why is there such as thing as debt ceiling? The US has one.

Because debt is free?

If debt is really a free lunch then governments need not intervene in the markets. All they can do is to just borrow. Interest rates won’t even matter or exist all.

But the basic problem will always be who will finance the borrowing?

Theoretically, one person’s borrowing represents someone else’s savings.

But in today’s paper money system, borrowing can be financed by government money issuance or mainly through bank credit expansion.

And as I have been saying, debt hasn’t merely been a statistics. For every debt issued or money created represents some form of spending or money allocation in the economic stream, so they will impact the economy or asset markets through prices.

My rice and credit interrelationship applies again here.

As one would realize, the ‘debt is free’ concept while subsidizing government liabilities encourages a debt build up in the private sector. The inflationary boom provides funding to the government coffers through two channels, interest rate and taxes. So government benefits from interest rate subsidy through lower cost of debt, as well as, tax subsidy from industries benefiting from credit expansion.

As one can see, all financial repression which inflationism has been a key part of, is about access to savings and output of the productive sectors of society which are usually coursed through credit or debt.

Unfortunately such transfers while seemingly free, isn’t. Costs are not benefits. Someone always pays for the price of debt accumulation. The burdens or the costs of debt whether private (in aggregate) or public sector or combined are transferred to or carried or borne by the creditors (credit risks), by currency holders (inflation risks, currency risks), by asset holders (market risks, financial instability risks), by the economy (economic risks via malinvestments) and through politics (political risks through higher taxes and or political repression)

So the fundamental flaw of the UNICORN syndrome of ‘debt is free’ concept is that this relies on a world of abundance. But we live in a world of scarcity which means, there is NO such thing called as a FREE LUNCH.

In the US, banks and financial institutions both domestic and international have been gorging on debt at a pace that has surpassed 2007 levels (see left window). Of course this comes in the backdrop of record stocks and zero bound rates. According to the Wall Street Journal (bold mine)[24]: These firms' debt sales hit $391 billion this year through Thursday morning, a 32% jump from the same period last year and a 19% rise from the same span of 2007, a year of record issuance, according to data provider Dealogic. That is a higher year-over-year increase than in the broader U.S. corporate-bond market. Sales by companies overall have exceeded $1 trillion so far this year, a 5% rise from the year-ago period.

Again such record take up of debt by banking and finance industry will have a cost to bear and that time may not be distant all.

In view of the recent abrupt declines in high yield credit, mainstream’s Citi Research in looking at the credit-equity relationship seems worried over the transition from phase 2 (where both credit and equity are on an uptrend) to phase 3 (divergence between declining credit and rising equity) which they see as ushering in a bear market.

The Financial Times quotes the Citi (bold original)[25]: If we really do see a move into Phase 3, then the lows for credit spreads in this cycle may have been seen. The drop in market-maker inventories in the corporate bond market mean that the transition may not be orderly. By contrast, our framework suggests the equity bull market is maturing, but not done. Global equities took another 16 months to rise 30% in the 1980s Phase 3. They took 32 months to rise 50% in the 1990s version. But Phase 3 in the last cycle was very short. Equities peaked only 4 months and 3% higher after credit spreads bottomed in June 2007.

Eventually even at zero bound rates, debt levels by highly levered institutions will have reached so much load that they will fall from their own weight

As a reminder that debt isn’t free, since 2007 the ratio of US household debt to GDP continues to decline which means still an ongoing deleveraging by US households. This is connected to the sluggish property markets as well as the unimpressive economic growth despite the gigantic $ 3++ trillion support from the US Federal Reserve.

Oh don’t forget Argentina has just been declared in default[26]

English Aldous Huxley was totally right[27]

That men do not learn very much from the lessons of history is the most important of all the lessons that history has to teach.

Another Natural Barrier: Valuations

There is this impression that valuations can be derived by merely looking at the charts and use price movements to assess whether a stock is cheap or not.

Take for instance, Company ABC with a starting point T-0 has been priced at 100 pesos per share. At point T-1, ABC has spiked to 300 pesos per share. At point T-2, ABC falls to 250 pesos per share or 16.7% decline. The optimist will say at 250 pesos this is cheap and therefore is a buy.

What’s wrong with this verbal illustration? Well the answer is the reference point used. The optimist disregarded point T-0 and instead chose to frame his decisions T-2.

The fundamental premise of such choice made through decision T-2 has been based on the idea that stocks will move up.

This is a behavioral blemish or a heuristic based on bias.

As psychologist Amos Tversky and Nobel laureate Daniel Kahneman noted[28] (bold mine): Theories of choice are at best approximate and incomplete. One reason for this pessimistic assessment is that choice is a constructive and contingent process. When faced with a complex problem, people employ a variety of heuristic procedures in order to simplify the representation and the evaluation of prospects. These procedures include computational shortcuts and editing operations, such as eliminating common components and discarding differences

Let us inject a qualitative variable behind the above example. Let say in the three periods from T-0 to T-2, earnings per share is 10 pesos. At T-0 PER is 10, at T-1 PER is 30 at T-3 PER is 25.

Does the fall from 300 pesos per share to 250 per share or from 30 PER to 25 PER make ABC’s stock cheap? From this perspective the answer is NO. Buying at 25 PER means a payback time of 25 years, so how can these be cheap?

People seem to forget that stock market valuations are about the discounted stream of the present value future cash flows which depends on the direction of discount rates. Higher discount rates extrapolate to lower present value of future cash flows, while the opposite lower discount rates mean higher present value of future cash flows.

As Hedge fund manager John P Hussman notes (italics original)[29]:

The Iron Law of Valuation is that every security is a claim on an expected stream of future cash flows, and given that expected stream of future cash flows, the current price of the security moves opposite to the expected future return on that security. Particularly at market peaks, investors seem to believe that regardless of the extent of the preceding advance, future returns remain entirely unaffected. The repeated eagerness of investors to extrapolate returns and ignore the Iron Law of Valuation has been the source of the deepest losses in history.

When the inflation premium affects interest rates, then this means lower present value of future cash flows.

When discount rates were down I was on the side of the bulls. This is in contrast today where discount rates or risk free rates are headed higher.

The sage of Omaha the former value investor Warren Buffet also echoed on this. In a 1999 piece he wrote[30] (bold mine):

To understand why that happened, we need first to look at one of the two important variables that affect investment results: interest rates. These act on financial valuations the way gravity acts on matter: The higher the rate, the greater the downward pull. That's because the rates of return that investors need from any kind of investment are directly tied to the risk-free rate that they can earn from government securities. So if the government rate rises, the prices of all other investments must adjust downward, to a level that brings their expected rates of return into line. Conversely, if government interest rates fall, the move pushes the prices of all other investments upward. The basic proposition is this: What an investor should pay today for a dollar to be received tomorrow can only be determined by first looking at the risk-free interest rate.

These insights come from real investors and not from gamblers who believe that chasing prices are equivalent to making money.

Post Script: Billionaire, crony and trade wizard George Soros has increased his S&P bearish PUT to account for a record 17% of his Asset Under Management (AUM)[31], why has Mr. Soros bet big on a substantial fall in the S&P? Easy answer, he is not afflicted by the Unicorn syndrome.

ASEAN Stock Market Melt-UP, Stock Market Massaging by China and Japan’s Governments

Let us apply the above from last week’s risk ON moment.

Contra to the perception that the Phisix breakout from the 7,000 levels has been a Philippine grand event after more than a year, the reality is that global stocks had mostly been on fire.

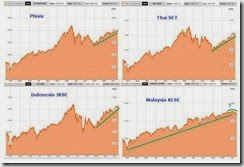

Let us put this week’s run in perspective. Indonesia’s JKSE led the pack with 1.88% w-o-w gains. This was followed by the Philippine Phisix with 1.86%, Thailand’s SET 1.73% and Malaysia’s KLSE 1.33%. Year to date, the JKSE leads at 20.47%, the SET next at 19.09% and the Phisix at 18.99%. Malaysia’s KLSE is the only laggard down by .14%.

I’d like to first point out that the correlation between the Phisix and the SET has been nothing short of remarkable. Both charts seem almost interchangeable with emphasis on the 2013-2014 undulations. Even from the 3 year perspective they look almost similar.

Stocks of the three major ASEAN nations are about to test the May 2013 highs. In contrast, the least affected from June 2013 tapering, the Malaysian KLSE which has been on a record runs seems showing signs of fatigue despite this week’s substantial gains. Very interesting developments.

Interesting because the Phisix breakout comes with Peso volume significantly less than the April 2013 version. The average Daily Peso volume has been about 30-35% off the 2013 average. Has inflation, which reduces disposable income, affected retail participants directly and indirectly (UITF, mutual funds)? Has the current breakout has been due to few but big domestic players in the face of diminished net foreign buying? The talks have been impressively stentorian, but the legs seem wobbly if not aged, will there be marked improvements going forward?

Another interesting development is that the Phisix has been approaching the 2013 record highs. During the last two bear markets, following bear market strikes, the Phisix recovers to old highs but only to fail. You can see the charts here. Will this time be different???

Interesting also because Indonesia has been one of the vulnerable “fragile 5”. It seems that the bigger the risks the greater the gains.

First as one can see rising rates don’t automatically translate to downturns. This is mostly because of the real rates rather than just nominal rates.

Second, I don’t trust the numbers. The weak rupiah, high bond yields, surging loans, widening fiscal deficits and M2 doesn’t square with inflation rates. Yet falling economic growth in the face of surging stocks as loans and M2 continue to balloon seems like signs of divergence or most possibly the shift of resources into yield hunting activities. And because the economy is slowing, then JKSE stocks which I assume represent the largest companies, means earnings growth will slow as stocks have been bid up. The result will be valuations multiple expansion which brings about increased risks of financial instability.

Another interesting story is Thailand. Thailand’s statistical economic growth has virtually been collapsing from 5.4% in the 1Q 2013 to NEGATIVE .6% in 1Q 2014 in the wake of the tumultuous political climate. The curious development has been that loans to the private sector continue to grow robustly, in the face of a lethargic economy, as M3 appears to have turned down. Why are Thais borrowing? Where are they putting the money on? Stocks only? Could it be that the Thais, like the Philippine residents, are borrowing to pay off loans?

The government has even cut rates during the 1Q despite lofty inflation, although CPI appears to have moderated in 2Q. The only I can make up from the Thai story is the same as Indonesia or the Philippines, and this is that of divergence where stock bids will push up valuations. This elevated valuation translates to lower present value of future cash via enhanced market risks.

Yet all four seem to be absorbing debt disproportionately relative to growth.

As a side note, Asian governments appear to be using the stock market as an instrument to communicate political economic goals.

The Chinese government has reportedly been mandating companies going on IPOs to be priced at values below industry levels[32]. Naturally this has motivated for a speculative ramp. IPOs have averaged a return of 43% during the first day! The prospects of easy money have lured waves of retail investors to borrow and speculate which seems to have provided a boost to the lackluster Chinese stock markets.

And given that Chinese credit has slumped in July which I believe that the $171 billion Quasi QE "Pledged Supplementary Lending" has been engineered to address, Chinese government has been desperately seeking to project economic growth by doling out credit to almost anyone including stock market punters. This is aside from the possible intent to drive up stocks via a boom bust cycle. The Chinese government appears to be so desperate to embellish an economy ripe for a crisis.

What’s the relationship between stocks and the economy? In the case of Japan, the relationship is contrary to what textbook says, viz, shrinking growth equals higher stocks. The Japanese economy was reported last week to have virtually collapsed by 6.8% in the 2Q 2014[33], yet stocks even powered a fabulous 3.65% gain over the same period! The economic meltdown came larger than the economic retrenchment from the 1997 tax hikes. The economic breakdown has been widespread from consumption, manufacturing, foreign trade, housing investments and business investments which has spread to corporate profits.

The only thing positive has been a build-up of inventories which has supposedly cushioned the quasi-crash[34]. Of course, if 2Q trends will barely improve in the coming months then those inventories will become unsold items that may further put pressure on manufacturers.

Well that’s the magic of Abenomics. By distorting prices via various interventions, economic calculation has been hampered. The natural effect is to induce depression.

Oh before I forget, one reason why Japanese stocks have been elevated has been that the Bank of Japan (BOJ) has been BUYING the stock market via ETFs in assuming the role of circuit breaker.

From the Wall Street Journal (bold mine)[35]: Through a trustee, the central bank purchased a combined ¥92.4 billion ($904.2 million) in ETFs over the first six business days of August. That's the BOJ's longest and largest consecutive buying streak since it started purchasing ETFs in December 2010. Many traders suspect that it may not be a coincidence that the central bank is scooping up ETFs at a time when both the Nikkei and the Topix are spending considerable amounts of time in negative territory. Speculation is rife that the BOJ is following an unwritten rule, called "the 1% rule" by traders, where it buys ETFs after the Topix index falls around 1% in the morning session.

The opportunity cost of central bank intervention to boost the stock market has been the economy.

Now you know why textbook stockmarket investing has been wrong. Better have a contact on the trust department of your respective central bank.

As for stocks, Warren Buffett has a good advice on current developments (bold mine): For some reason, people take their cues from price action rather than from values. What doesn't work is when you start doing things that you don't understand or because they worked last week for somebody else. The dumbest reason in the world to buy a stock is because it's going up

Being cocksure of the one way trade is equivalent to the dumbest reason to buy a stock.

Heeding touts who sell “buy high to sell higher” in the face of the prospects of higher risk free rates is like buying a financial rope to hang your portfolio.

The bottom line is to avoid the Unicorn syndrome.

[20] Federal Open Market Committee Press Release Release Date: December 18, 2013 US Federal Reserve