What you do need is the right temperament. You need to be able to detach yourself from the views of others or the opinions of others. You need to be able to look at the facts about a business, about an industry, and evaluate a business unaffected by what other people think. That is very difficult for most people. Most people have, sometimes, a herd mentality which can, under certain circumstances, develop into delusional behavior.-Warren Buffett from a 2011 interview

In this issue:

Phisix: As Mania Rages, BSP’s Chief Warns on “Complacency” and “Chasing the Market”!!

-Bullish eh? BSP’s Tetangco Institutes an Escape Hatch, Warns on Complacency!

-Connecting “Chasing the Market” with BSP’s Aggregate Demand Policies

-Why “Chasing the Markets” Means Massive Overvaluations

-Popular Delusions: The Perpetuity of High Valuations

-BSP Chief’s Caveat: TOO LATE the HERO or Conditioning a Scapegoat?

-Lessons from the Crash of 1929; the Stock Market as Propaganda Tool

Phsix: As Mania Rages, BSP’s Chief Warns on “Complacency” and “Chasing the Market”!!

Bullish eh? BSP’s Tetangco Institutes an Escape Hatch, Warns on Complacency!

The trend from bubble denials to instituting escape hatch has not only gone global but has apparently landed on Philippine shores.

Here is what I recently wrote[1]: (bold mine)

The point is the IMF, like many other global political or mainstream institutions or establishments, CANNOT deny the existence of bubbles anymore. So their recourse has been to either downplay on the risks or put an escape clause to exonerate them when risks transforms into reality which is the IMF position.

Has BSP governor Amando M Tetangco Jr. been affected? It seems so. Here is the punchline echoing the above from his recent speech at Bloomberg’s Foreign Exchange Forum[2]: (bold mine)

Clearly, the Philippines is in a good spot, and the prospects are bright. Our sound fundamental story is intact. This should not, however, lull us to complacency. I admonish each of you to use this time of low volatility wisely – take stock of your positions and carefully reassess these against the risks.

Implicitly recognize the bubble (here in terms of low volatility risks), but downplay it. I might add that this ensures an escape clause against any eventualities.

It’s also palpable that this warning has been in response to concerns raised that domestic markets have become “too” complacent amidst what he sees as “uncertainty”.

Yet the BSP chief seems as confusing ‘uncertainty’ with ‘risk’: “See, the thing with “uncertainty” is that the degree of uncertainty is itself uncertain. Therefore, we really cannot, and should not be complacent. Because however quiet markets seem to be now, risks remain”.

The basic difference is that risk is measurable while uncertainty is not. University of Chicago Frank Knight explained of the difference[3]:

But Uncertainty must be taken in a sense radically distinct from the familiar notion of Risk, from which it has never been properly separated. The term "risk," as loosely used in everyday speech and in economic discussion, really covers two things which, functionally at least, in their causal relations to the phenomena of economic organization, are categorically different. The nature of this confusion will be dealt with at length in chapter VII, but the essence of it may be stated in a few words at this point. The essential fact is that "risk" means in some cases a quantity susceptible of measurement, while at other times it is something distinctly not of this character; and there are far-reaching and crucial differences in the bearings of the phenomenon depending on which of the two is really present and operating. There are other ambiguities in the term "risk" as well, which will be pointed out; but this is the most important. It will appear that a measurable uncertainty, or "risk" proper, as we shall use the term, is so far different from an unmeasurable one that it is not in effect an uncertainty at all. We shall accordingly restrict the term "uncertainty" to cases of the non-quantitive type.

So when the BSP chief extrapolates: “the thing with “uncertainty” is that the degree of uncertainty is itself uncertain”, he was referring to “risk” and hardly about “uncertainty”. That’s because “a known degree of uncertainty” again as Professor Knight wrote, “is practically no uncertainty at all”[4]

Uncertainty can be summed as what US former secretary of Defense Donald Rumsfeld once called as the unknown, unknown.

This isn’t merely to nitpick. The fundamental premise of his speech was on “uncertainty”. This has been manifested even in its title, “Sustaining growth while riding the uncertainty”. And so if the definition of “uncertainty” has been obscured, then it should follow that arguments predicated on this can be discerned as irrelevant.

Simply stated, to say that there is “uncertainty” while diminishing the potential harms from it represents a flagrant self-contradiction: just how can one justify minimizing the effects of “uncertainty” when uncertainty IS NOT known at all???

Say earthquakes. Earthquakes represent a climate or environmental uncertainty because seismic dislocations can hardly be predicted.

We know earthquakes exist. But we don’t know where, when, the magnitude and the area coverage of the impact or even the secondary causes which may arise from it, e.g. tsunami, fires, disease or other ramifications like in Japan’s 2011 Tōhoku earthquake and tsunami—the Fukishima Daichi Nuclear Power meltdown). So it would be misguided to aver something like “because of today’s modern buildings the effect of an earthquake will be minimal”. What if an intensity 9 or 10 earthquake hits, are these buildings built to withstand such magnitude? Again how about the other side effects? As Japan’s unfortunate 2011 triple whammy of earthquake-tsunami-nuclear meltdown attest, “uncertainty” may produce a black swan event that only becomes known after the fact.

Nonetheless the BSP seemingly eschews domestically sourced risk and substitutes this with exogenous factors: specifically, monetary policy normalization in advanced economies, the monetary policies in the ECB and BOJ, Geopolitical risks and Natural disasters.

Well this is a wonderful demonstration of the self-attribution error which latches on the positives as one’s accomplishments, but overlooks on the faults and instead blames them on other agents.

Such position would be understandable. To raise the issue of domestic risk would be tantamount to self-incrimination of one’s own policies. Confessing to mistakes is a rare thing in the realm of politics.

Yet again in another demonstration of self-righteous inconsistency, the BSP even preaches self-discipline (bold mine): “It is a fundamental truth – in everything we face, there are two circles of concern that confront us: 1) those concerns that are within your control, and 2) those outside of your control. Quite often, the latter circle is larger than the former. As market practitioners, you need to be mindful of these two circles. What can you control? Certainly your risk appetite. Controlling this when greed gets the better of you is very difficult. So in a period of low volatility such as what we have been experiencing, practice the discipline of setting limits. This discipline will not only help you to avoid the pitfalls of “chasing the market”. More importantly, this discipline will help you take advantage of the obvious opportunities, as well as unearth those that are hidden. Discipline set during the sober low volatility period will guide you when you are confronted with factors that are not within your control, especially during a frenzied high volatility period. The BSP practices the same discipline.

Please do read again and again: “To avoid the pitfalls of “chasing the market”. Wow!!!!

Such statement can hardly be seen as an “off the cuff” superficial treatment of risk, instead it is a powerful expression depicting an existing concealed malady! Why would there be “chasing the market” if not for flagrant mispricing???

This marks a shocking admission of the excessively valued asset prices or of prices having gone out of the kilter with fundamentals! This can even be construed as discreet recognition of accruing imbalances or the RISK of BUBBLES!

Hasn’t it just been last week when I warned of the natural limits of inflationism[5]?

Yet as to which markets has been at risk in the public monologue, has not been made explicit. Has it been stocks, property, bonds or the Peso? Or could it be that this cautionary advice may apply to all of domestic financial assets?

Curiously too BSP boss even mentions how retail investors get burned. With reference to global asset managers whom has been imputed to have informational advantage, and have ‘similar risk management frameworks’, the BSP honcho even interposes a political dimension which pits retail investors against global asset managers: a “common goal to outperform their benchmarks, global asset managers are able to (and often do) get out of trades more quickly and nearly at the same time, leaving the small institutional investors and retail investors “holding the bag”, when the music stops”.

In the world of politics, it has always been some “us” against some “them”.

As I have been saying here, the BSP’s missives appear as becoming more opaque, self-contradictory and non-transparent.

Yet why even the mention “leaving the small institutional investors and retail investors “holding the bag”, when the music stops” at al? Is the BSP governor sensing the end to the current revelries?

While I wholeheartedly agree on the self-discipline prescription, the BSP governor seems perplexed with associating the role of individuals from that of the monetary politburo.

Individual risk appetite has been mostly about profit and losses. In the case of losses arising from a reversal of the risk environment, such loss/es will be contained to the individual/s. But even when leveraged, the losses by an individual will spread only to the creditor. Individual losses become a system-wide issue only when everyone has been doing the same thing, in particular borrowing to speculate.

And this should be distinguished from government. While it is true that the BSP is run by individuals, the BSP’s objectives have NOT been about profits or losses but about politics. And it is through political objectives from which policies have been put into place.

To extend the logic further, since the BSP sets the nation’s monetary policies, the impact from BSP’s actions will have a systemic impact (theoretically both in positive or negative dimensions).

Said differently, there is a structural difference between the markets and the political operators, something which the BSP chief has all mixed up. The individual’s gains or losses are NOT the same as the centralized effects from social policies. Individual gains or losses are decentralized. Since social policies are centralized, the cost of failures will be carried or borne by the constituents of a specific political domain more than the political agents. Will the BSP’s monetary board be held accountable or liable for policy errors manifested by an economic downturn or a recession? Thus, it would be misguided to impute the same ‘discipline’ faced by individuals relative to the BSP’s decision-making process.

Nonetheless, the BSP head doesn’t even bother to explain what has been the cause of the ‘low volatility’ or ‘complacency’ or expanded risk appetite or even how external forces affect domestic markets in that speech.

Connecting “Chasing the Market” with BSP’s Aggregate Demand Policies

And therein lies the rub.

Whatever happened to the BSP’s grand pirouette in 2009 where monetary policies have been overhauled in favor of “aggregate demand”? Then the good governor said that Asia and the Philippines “must boost domestic consumption and end its dependence on exports” by “Maintaining an expansionary monetary policy stance to the extent that the inflation outlook allows, could support market confidence and assure households and businesses that risks to macro-stability are being addressed decisively”[6].

Why has there been a vacuum of how such ‘expansionary monetary policy stance’ impact or affect “risk appetite” and “low volatility”?

Have asset inflation via “low volatility” or “chasing the markets” not been connected with the policy goal of frontloading of domestic demand effected through credit expansion? Has there been no transmission flows from credit expansion, designed to boost domestic demand, into asset markets thereby combusting asset inflation? If people can borrow to spend, which has been the policy’s objective, then why can’t people borrow to speculate, thereby stimulating “chasing the markets” that forges “low volatility” and vice versa? Once the beneficial effects have gone, then why hide from the public of its unintended consequences?

And why the shift of burden to entirely external forces?

In a recent paper published at the Bank of International Settlements, Philippine BSP Deputy Governor, Diwa Gunigundo gives us a clue of their externally based concerns[7] (italics mine): “The risk-taking channel of international monetary policy transmission became more prominent after 2008, when policy rates in advanced economies reached near zero and prompted fund holders to seek higher returns elsewhere. Low policy rates and the significant asset purchases implemented in advanced economies have boosted the confidence of investors, increasing their appetite for relatively higher-yielding (and riskier) EME assets, especially equities, but also government and corporate bonds and credit default swaps (CDS).”

So if foreigners sought “higher returns” via increased appetite on higher-yielding assets, especially equities and others, financed by central bank subsidies to carry trades or “chasing the markets” dynamic here and abroad, then why the same dynamics can’t be applied domestically? Are locals not predisposed to do the same? Has domestic institution not been willing to accommodate such demand to speculate? Hasn’t banking sector loans been exploding?

Have these not been configured in their models? Or has it been just a political penchant to blame someone else while relieving oneself of culpability from the unintended effects of policies?

AND hasn’t it been ironic, if not contradictory, to worry about a change in risk environment if indeed the prospects are ‘bright’ or fundamentally ‘sound’? Again why the anxiety from external forces, if prospects are indeed bright?

The 2008 US crisis should serve as example. The Philippine stock market crashed but the economy remained resilient in spite of a global meltdown. Why? Because public and private sector balance sheets hardly had material risk exposure on leverage. So when the BSP tweaked policy rates in 2009 and embarked on “aggregate demand” measures, the ensuing overindulgence on leverage, by previously relatively unlevered entities, produced the ‘magical’ effects of the so-called boom which has been mistakenly construed as sustainable and trumpeted as ‘transformational’ or expressed as acclaims centered on a variety of versions of ‘this time is different’.

Now the payback time has arrived. The BSP’s consumer price inflation metric has reached the upper limits of their goalpost. The current inflationary pressures seem as being ventilated on the yields of Philippine peso based 10 year sovereign bonds (chart from investing.com).

Yields appear as climbing back to April highs. Remember, Philippine sovereign bond markets have been tightly held (largely illiquid) having been dominated mainly by domestic banks and the government agencies[8]. Thus rising yields in response to the CPI pressures extrapolates to possibly some of these institutions feeling the brunt from the previous massaging of those yields and from incipient uneasiness from higher consumer price inflation. Remember rising yields equates to a decline in bond prices.

The next vital question is, will yields continue to rise and pose as harbinger to more upside adjustments in official interest rates?

AND importantly WHY suddenly all these precipitate—signaling channel and policy—dissonance by the BSP? WHY 5 policy actions in 5 months??? And importantly, WHY raise the “complacency” concerns NOW, which seem to dispute, if not neutralize claims of “sound” fundamentals?

Or WHY have strains of apprehensions now emerged in BSP communications, despite the repeated incantations of “bright prospects”?

Does the BSP governor know something which they haven’t been saying, except for “complacency” and “low volatility”? Have there been economic or financial skeletons in the closet, something like rising consumer NPLs in the property sector and Auto loans[9] and or ghost condos[10]?

Or could it be that like all their contemporaries, the BSP chief has established a Keynesian ‘sound banker’ stance by establishing an escape hatch?

And paradoxically the following quote exhibits a stunning insight on how the BSP supposedly sees and plans to address bubbles; again from Deputy Governor Gunigundo’s paper to the BIS (italics mine)[11]: “monetary policy may need to lean against potential credit-driven bubbles; yet there is an interaction between monetary policy and macroprudential policy whereby tighter macroprudential policy would require easier monetary policy and vice versa. However, the empirical evidence in this area remains thin and reflects the difficulty in specifying the relevant mechanisms involved in the interaction between monetary policy and macroprudential policy. In the case of the BSP, macroprudential measures are a necessary complement to more conventional monetary tools.”

“May need to lean against potential credit-driven bubbles”??? Huh? Can this not be interpreted as tacit admission that BSP policies have been sowing or even fostering “potential credit-driven bubbles”? The difference is that they have signaled complete control over “bubbles”, thus the tandem of policy actions of regulations (macroprudential policy) and monetary policies will depend on their discretion, hence “may need” to restrain or to “lean against” bubbles.

What the BSP seem to be saying is that they have spawned a credit inflation Godzilla, but they are confident that they have the right and adequate tools which will prevent the monster from rampaging in cities. Nice!

Furthermore in deciphering through the vague and abstruse semiotics of the world of central banking, while the BSP leadership avers that regulations and interest rate manipulations should go hand in hand, contradictorily, they point out that the efficacy of such tools have not been established. Nonetheless these policies are assumed as ‘necessary’.

Isn’t this begging the question transformed into policies? So they assure as of control over the inflation Godzilla with unproven tools!!! Doubly Nice! The next $64 trillion question is, but what of the costs from such policies???? What if these tools enrage Godzilla even more?

Moreover, the citation of the lack of evidence on the viability of regulatory-monetary policy framework through “remains thin” and most importantly “difficulty in specifying the relevant mechanisms involved” can be translated in layman terms as: The BSP hardly can see or know which parts of the economy will be affected by both monetary policies and regulations. In other words, the BSP has not only been CLUELESS on the effects of their policies, they have, most importantly, been mainly BLIND to identify, diagnose and consequently address the risk of bubbles.

And if they are uninformed of the effects from their policies, whether these generate positive or negative externalities, then how exactly will they know whether their responses will be appropriate or not, or if their cure will be worse than the disease? Will their policies increase or decrease risks in specific activities? Or will they have a systemic impact (uncertainty) in the economy?

The BSP’s knowledge dilemma represents a splendid example of what the great Austrian economist F. A. Hayek has warned about:

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.

Yet even more incongruity or self-contradictions from Governor Tetangco’s warnings; this statement seems unfounded: “global asset managers are able to (and often do) get out of trades more quickly”.

If such a claim is true, then why has Lehman, Bear Stearns and Merrill Lynch “disappeared” in the wake of the 2008 crisis? Here is a list of US and foreign banks acquired or bankrupted during the great Recession, hasn’t these institutions been ‘global asset managers’ who should have gotten out of trades more quickly?

The simple logic is that there wouldn’t have been a 2008 crisis if ‘global asset managers’ have gotten out of trades more quickly. So the innuendo of the politicized plight of the retail investors, whom has seemingly been projected as ‘victims’, from the actions of global asset managers, who seems to have been portrayed as ‘oppressors’, is not only unwarranted but can be construed as invalid or false. This not only misreads forest for the trees, it is an appeal to the emotion which attempts to seemingly demean foreign asset managers or appears as part of the conditioning of the public that sets foreign money as the “fall guy” in the re-emergence of market distress.

Bottom line: All these goes to show that despite the intensifying low volume manic blow-off stock market ‘denial’ rally phase, there has emerged an uneasy or squeamish tone being exhibited even from the principal proponent and the engineer of the so-called Philippine economic boom!!!

Bullish no?

Why “Chasing the Markets” Means Massive Overvaluations

Curiously, this “complacency” speech seems to have only been covered by two media outlets Manila Standard and Sun Star Cagayan de Oro. This means that most of mainstream media has opted to ignore the BSP governor’s caveat. Why? Is it because outlandish valuations don’t jive with the desired storyline by the consensus?

And the intensifying mania in the Philippine Stock Exchange which has prompted the Phisix to break beyond 7,100, this week’s cautionary advice from the BSP governor has apparently fallen into deaf ears.

I have long noted here that the BSP has been boxed into a corner where the monetary magistrates will only respond when the markets reveal of its imbalances and compel them to act.

Apparently there have been unseen forces working behind the recent rash of policy actions implemented by the BSP as well as the complacency alarm bells as indicated by no less than the BSP Governor.

This means that no such thing as “preemptive measures” as so claimed by officials. Preemptive, as defined by dictionary.com, “taken as a measure against something possible, anticipated, or feared; preventive; deterrent”. If the BSP doesn’t even know of how their money policies and macroprudential policies impact specific “relevant mechanisms involved”, then how can they anticipate or even act preemptively or supposedly impose discipline???

Recent events attest to this. Again the initial hike in official rates, aside from the 4 other previous BSP responses, SDA rate increase, 2 reserve requirement adjustments and bank stress tests came amidst raging consumer price inflation which has been sold to the public as a “preemptive” move. But how can this be preemptive when CPI has now reached (at the very least) the upper bound of their targets? Remember, officials make their targets, but they also make the statistics. So their statistics can always be made to dovetail within those targets.

Yet the same authorities don’t even bother to explain how these have been associated with or how these could have been repercussions from the 9 months of 30% money supply growth!

This week’s word of caution on complacency from the BSP Governor is also another evidence of reactionary—and not a preemptive—response.

So why has Governor Tetangco raised the issue and admonished the public against “chasing the markets”? The answer is simple: Again, there would be NO “chasing the markets” if there has been no blatant mispricing.

Let us just focus on the stock markets, even if the same “chasing the markets” can be applied to other financial markets.

If stock market valuations are supposed to reflect on investor claims on future cash flows, then those valuations figures, as seen through earnings price earnings multiples or even book value ratios have been entirely OUTRAGEOUS.

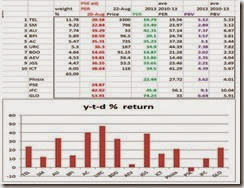

The top 10 Phisix composite issues with biggest capitalization can be seen on the upper table above. These has been accompanied by updated Price Earnings Ratio PER from the Philippine Stock Exchange’s data as of August 20 (perhaps incorporating 1Q 2014; red font), the 2013 Price Earnings Ratio (PER) [green font], my average 4 year PER and 2013 Price Book Value (PBV) [violet].

Aside from the top 10, I included in the above are Globe Telecoms [PSE: GLO], and Jollibee Foods Corporations [PSE: JFC] due to stupendously outlandish ratios, as well as the Philippine Stock Exchange [PSE: PSE] which serves as proxy to the Phisix.

The 10 biggest market cap constitutes 63.09% weighting of the Philippine Phisix benchmark as of Friday. This means that should any group desire to maneuver the Phisix to go beyond the previous milestone at 7,400, all they have got to do is to train their guns into these issues.

And of the 10 issues, 5 firms have PERs of a whopping 35++! Two has 20+ PERs and THREE with PERs at the teens. In short, MORE than HALF of the top 10 issues are vastly, and not marginally, overpriced.

Most of these HIGH PER firms have been instrumental in levitating the Phisix to its current levels. Additionally most of these HIGH PERs have equivalent HIGH PBVs!

Yet the logical elementary reason for such grotesque valuations is because returns have immensely outpaced earnings or book value growth

As I have previously explained[12],

Has the essence of earnings multiple expansions been about earnings growth? Obviously the answer is a BIG NO!What this exhibits instead has been that “growth” has been used as pretext (or a rally cry) to justify wanton and reckless speculations based on popular fantasies.Negative real rates have made conditions conducive for the susceptible public to believe that PERs of 30, 40, 50, 60—that are already above pre-Asian crisis highs—will even be HIGHER!!!This is a clear demonstration that for the mainstream, valuations and risks do NOT really matter at all. This one way trade mentality which represents the consensus thinking has been promoted by media, their favorite bubble ‘expert’ apologists, and interest groups who benefits from the BSP’s inflationism that has been naively ingested by the gullible public.

Yes all these have represented “chasing the markets”, as warned by the BSP Governor.

Note for instance of Jollibee’s staggering PERs and PBVs, in particular PBVs of 8-9 (assuming the inclusion of 2014 growth)!!! From end of the year of 2010, JFC’s earning CAGR rate has been 13.26% with the bulk of these gains acquired in 2013 at 19.5%. This is in contrast to the CAGR in returns of 24.85% over the same period where the meat of the gains has also been in 2013 at a fantastic 69.71%! JFC reportedly grew by 17% in the first semester of 2014 but y-t-d gains have only been at 10.34%. Note if we assume that this earnings trend persist through the year, then JFC’s PER growth in 2013 at 19.5% has peaked and may have begun to decline. Yet buyers of JFC at present levels reveal that they have been afflicted by a tunnel vision, thinking that earnings can only rise.

Also note GLO’s incredulous 50+ PERs! GLO’s earnings have been in a decline for THREE successive years! Yet GLO returned an annualized 27.03% over the same period with the gist of the gains at 47.8% in 2013. GLO reportedly posted a “fourfold increase” in 1Q 2014 due to mostly “lower depreciation charges”, or in short, accounting magic. So y-t-d returns have been 22.44% or marginally higher relative to the returns of the Phisix in the face of still staggering 50++ PERs. Incredible.

JFC and GLO are not in the top 10. This only reveals how massively overpriced the Phisix has been. The PSE’s 24.87 PERs are also a testament to such humongous price distortions.

It is quite obvious that the consensus has been extrapolating the dramatic returns of 2013 into the future. Again ironically none has seen how these coincide with the BSP’s goosing up of the money supply in 9 months.

And because multiple expansions represent returns growing faster than earnings and book value, the year to date returns as shown above reveals why most price multiples of earnings and book values of these issues will continue to balloon if these stocks remain bid. Much of the year-to-date returns have already enormously exceeded any earnings growth for the year!

So “growth” epitomizes the tomfoolery of the manic crowd.

Popular Delusions: The Perpetuity of High Valuations

Will high valuations bring about even higher valuations? Or are high valuations sustainable?

The answer to the first is depends on the time frame. In a mania, where rationality has been junked in favor of momentum, then high valuations may lead to even higher valuations. I elaborate on this below.

This leads us to the second question. Are high valuations sustainable? The answer is definite NO.

As explained last week, in finance 101 there is a thing called Present Value[13], where future cash flows are dependent on discount rates. The higher the discount rate, the lower the present value of the future cash flows. So when inflation rises and gets to be reflected on interest rates, or when “risk free rates” move up (such as the BSP’s official increase in rates), then obviously future cash flows will be lower. Therefore those high valuations that have been anchored to low discount rates represent fantastic misperceptions that will eventually discover what is known as “gravity”.

Next, people hardly ever consider how such asset overvaluation has been financed. The BSP correctly raises the concern that low interest rates around the world has prompted for yield chasing. But as for how these have been consummated they never seem to explain. The main answer to this is DEBT.

During the second week of August, a Financial Times article branded today’s world as the Matrix Moment. Like the sci-fi film of 1999, the article has been anxious on the developing disconnect between liquidity and pricing in the global bond markets, which brings to fore increased mismatches (imbalances) and risks.

From the Financial Times (bold mine)[14]: For the past five years, investors have poured money into riskier assets such as the junk bonds sold by low-rated US companies or in emerging markets as part of a relentless search for yield. They have done this primarily through mutual funds and exchange traded funds (ETFs) that provide instant exposure to the debt. Retail investors now own 37 per cent of credit, compared with 29 per cent in 2007, according to data from Royal Bank of Scotland. By one estimate, the rapid rise of investment funds has been enough to swallow all of the new corporate debt sold since 2008. At the same time, liquidity in the market, or the ease of trading, has not kept pace with booming demand. Strong sales of bonds in the so-called primary market have largely concealed an increasingly illiquid secondary market, where it is difficult to exit old positions without having to pay up significantly for the privilege.

In stock market perspective this will be like a stampede on IPOs rather than trading on the main board. But the point of the above is that the global mania phase is being financed by debt which levels have now gone beyond the pre-2007 crisis!

Lastly history tells us how both forces work to undermine popular delusions.

The pre-Asian crisis episode serves as a fantastic roadmap. In 1993, Philippine PE ratios stormed to an astronomical 38.8 (!!!) following a monumental and breathtaking 154% nominal return. See the chart here.

Following the fantastic run, the Phisix endured THREE bear market strikes where the Phisix lost 33% peak-to-trough or fell into a highly volatile quasi-bear market in 1994-95. There was no economic mess then, but imbalances had been accumulating, which is why the attempt to adjust via the quasi-bear market. Such retracement effectively reduced PE ratios to a still high 19 in 1995.

The bulls recovered and sent the Phisix back to the previous record 1993 high in the denial rally of 1996 that culminated in early 1997. This rally pushed Phisix PE ratios back to 20 in 1996. By early 1997, the Phisix collapsed about six months ahead of the official advent of the Asian crisis in July. The rest is history.

Notice that the current PE ratios of the Phisix or the PSE have been materially ABOVE pre-crisis 1995 or 1996 levels.

One may suggest that the Phisix may head towards 30+ again before a collapse. Perhaps. But this is a likely condition when risk free rates are headed lower than they going up today. Second, this is likely the case during the first attempt such as in 1993. The current Phisix rally comes in response to a bear market strike in June 2013. Today’s breakout of 7,000-7,100 has come amidst a relatively lower volume which implies less vigor. But less vigor doesn’t mean the denial rally can’t persist.

Also an orgy of speculative activities has become a dominant feature of today’s market. Market participants have been wildly churning in terms of number of trades (left window) and issues traded (right window) far far far more than the May 2013 highs at 7,400 (red arrows). This implies that retail participants have been actively scalping, wherein such punts have spread through a broader range of publicly listed securities, thereby providing liquidity to formerly illiquid issues. In short, the mania has been broad based.

All these highlights that uncertainty and risks has all been brushed off, markets are seen as one way street and that raw emotions (hope, greed, overconfidence) have virtually ruled market activities.

This stands as the defining moment of the BSP governor’s “chasing the market”.

As a side note, the Phisix at 7,100-7,000 reveals why the so-called August “Ghost month” is just that…a superstition!

BSP Chief’s Caveat: TOO LATE the HERO or Conditioning a Scapegoat?

Nonetheless outside the surfeit of inconsistencies, Mr. Tetangco’s advice to the individual investor as indicated above has laudable merits:

What can you control? Certainly your risk appetite. Controlling this when greed gets the better of you is very difficult. So in a period of low volatility such as what we have been experiencing, practice the discipline of setting limits. This discipline will not only help you to avoid the pitfalls of “chasing the market”.

This resonates with the wisdom of value investors like Warren Buffett.

Yet the Janus faced speech by the BSP governor—one wearing the hat of the investor as against one donning the hat of the politician—seems very revealing. Its value comes with the perspective of the investor while all the rest has been splashed with political balderdash. So heed the former than the latter.

In essence, the wisdom of Governor’s Tetangco’s caveats emanates from the perspective of the investor and not from the eyes of the politician/bureaucrat.

And even if the BSP’s chief’s admonition is to be interpreted on face value or from the angle of noble intention; I’d say that this comes WAY TOO LATE.

Manias, which operate around the principle of the “greater fool”, signify a self-reinforcing process.

Rising prices induce more punts which lead to even higher prices as the momentum escalates. Suckers draw in more patsies into a mindless wild and frenetic chase to scalp for marginal “yields” and or from the psychological fear of missing out and or from peer pressures all predicated on the belief of the eternity of a risk-free one way trade. The intensifying hysteria will continue to be egged on by the beneficiaries from such invisible political redistribution both in public and private sectors, supported by bubble ‘expert’ apologists and media cronies.

Therefore, recklessness will compound on the accrued recklessness. Again this isn’t just a problem of overvaluations (from which the BSP’s perspective has been anchored) which merely is a symptom, instead this represents deepening signs of intensive misallocations of capital expressed through the massive contortion of prices and the disproportionate distribution of resources on a few sectors at the expense of the others that which has mostly been financed by debt accumulation, thereby elevating risks of financial instability or an economic meltdown. The BSP’s increasing use of communications with sanitized “alarm bells” signify on such emerging risks

And like typical Ponzi schemes, the manic process goes on until the ‘greater fools’ run out, or that every possible ‘fool’ has already been “IN” (crowded trade), or that borrowing costs has reached intolerable limits to expose on foolhardy speculative activities

American journalist and author, Garet Garrett, describes this best such mania[15].

A delirious stock-exchange speculation such as the one that went crash in 1929 is a pyramid of that character. Its stones are avarice, mass-delusion and mania; its tokens are bits of printed paper representing fragments and fictions of title to things both real and unreal, including title to profits that have not yet been earned and never will be. All imponderable. An ephemeral, whirling, upside-down pyramid, doomed in its own velocity. Yet it devours credit in an uncontrollable manner, more and more to the very end; credit feeds its velocity.

And so no amount of sensible or rational persuasion will dissuade zealots of the mania whose belief has been pillared on the creed of the “greater fool” and of the “unicorn” syndrome of the risks from their actions.

And this is why the BSP’s chief’s warning looks like a charade. It has been the BSP’s policies that has spurred, ignited and lubricated today’s mania, yet the burden is being laid on the feet of the individual for partaking in the spree of risk appetite based on the central bank put or in particular NEGATIVE REAL RATEs.

And this is why such a warning looks like a Keynesian sound banker escape outlet. First such signaling portrays the BSP as politically and morally upright. Next, it gives them a free get-out-of-jail card or absolution of their policies. Lastly this set up the private sector as the convenient scapegoat. Both retail investors and foreign money will be blamed for the coming meltdown. Retail participants will be held liable for not listening to the BSP’s caveat of not “chasing the markets”!!!

Unfortunately in a world of scarcity, inflationary booms are no free get out of jail card, so eventually soon the markets will give these worshippers of the bubble a rather rude and nasty awakening.

Finally, current developments reveal why this will not be about price levels anymore but about the gathering storm called RISK. Perhaps a fat tailed risk is in the near horizon.

As the BSP chief pointed out, the issue now is about “risk appetite” and the “pitfalls of “chasing the market”, this only means the HIGHER the Phisix, the GREATER the risk!

And if the Governor Tetangco truly means what he has warned about, or if he is true to his word, then the public should expect that this caveat will get to be transmitted into monetary policies via HIGHER policy rates. If not, then all these have merely been about political and moral posturing.

Either way, market risks have now gone mainstream!!!

Lessons from the Crash of 1929; the Stock Market as Propaganda Tool

History provides us clues of the life experiences of our ancestors. These experiences help us to understand the past mistakes which we may be able avoid if and when faced with similar circumstances.

Keynesian economist John Kenneth Galbraith has a wonderful narrative of the crash of 1929 from his book The Essential Galbraith[16] from which I will be quoting passages from his book.

I believe that there significant psychological parallels between today and 1929.

First, the sowing of the behavioral seeds towards a speculative mania (p 250) [bold mine]

The more obvious features of the speculative episode are manifestly clear to anyone open to understanding. Some artifact or some development, seemingly new and desirable — tulips in Holland, gold in Louisiana, real estate in Florida, the superb economic designs of a political leader — captures the financial mind or perhaps, more accurately, what so passes. The price of the object of speculation goes up. Securities, land, objets d’art and other property, when bought today, are worth more tomorrow. This increase and the prospect attract new buyers; the new buyers assure a further increase. Yet more are attracted; yet more buy; the increase continues. The speculation building on itself provides its own momentum.

As I noted above, all manias signify a self-reinforcing process.

The development of a one way trade mindset…

This process, once it is recognized, is clearly evident, and especially so after the fact. So also, if more subjectively, are the basic attitudes of the participants. These take two forms. There are those who are persuaded that some new price-enhancing circumstance is in control, and they expect the market to stay up and go up, perhaps indefinitely. It is adjusting to a new situation, a new world of greatly, even infinitely increasing returns and resulting values. Then there are those, superficially more astute and generally fewer in number, who perceive or believe themselves to perceive the speculative mood of the moment. They are in to ride the upward wave; their particular genius, they are convinced, will allow them to get out before the speculation runs its course

In a bull market, everyone is a genius! (p 251-252)

Those involved with the speculation are experiencing an increase in wealth — getting rich or being further enriched. No one wishes to believe that this is fortuitous or undeserved; all wish to think that it is the result of their own superior insight or intuition. The very increase in values thus captures the thoughts and minds of those being rewarded. Speculation buys up, in a very practical way, the intelligence of those involved. This is particularly true of the first group noted above — those who are convinced that values are going up permanently and indefinitely. But the errors of vanity of those who think they will beat the speculative game are also thus reinforced. As long as they are in, they have a strong pecuniary commitment to belief in the unique personal intelligence that tells them there will be yet more. In the nineteenth century, one of the most astute observers of the euphoric episodes common to those years was Walter Bagehot, financial writer and early editor of The Economist. To him we are indebted for the observation that “all people are most credulous when they are most happy.”

The statement “As long as they are in, they have a strong pecuniary commitment to belief” represents both endowment effect and the self-attribution bias. This also represents the interests of the industries benefiting from the boom and those of the experts.

The ONE way trade mindset also embraces deity like qualities of “omniscience”.

The favorite Bull Market mantra: This time is different!

Strongly reinforcing the vested interest in euphoria is the condemnation that the reputable public and financial opinion directs at those who express doubt or dissent. It is said that they are unable, because of defective imagination or other mental inadequacy, to grasp the new and rewarding circumstances that sustain and secure the increase in values. Or their motivation is deeply suspect.

The reinforcement of the convictions from the one way trade mentality develops into a “religion”. The religion is called “bubble”. And any dissent on the bubble would be considered as blasphemy.

My current experience[17] seems no different from that of 1929

Then the bust: a sudden reversal of confidence: (p 250-251)

Built in also is the circumstance that it cannot come gently or gradually. When it comes, it bears the grim face of disaster. That is because both of the groups of participants in the speculative situation are programmed for sudden efforts at escape. Something, it matters little what — although it will always be much debated — triggers the ultimate reversal. Those who had been riding the upward wave decide now is the time to get out. Those who thought the increase would be forever find their illusion destroyed abruptly, and they, also, respond to the newly revealed reality by selling or trying to sell. Thus the collapse. And thus the rule, supported by the experience of centuries: the speculative episode always ends not with a whimper but with a bang.

This is what seems to trouble the BSP.

And contra the mainstream, who believes stock markets represent the economy, the 1929 stock market crash exposed on the concealed economic imbalances, rather than the other way around (p 276-277)

In fact, any satisfactory explanation of the events of the autumn of 1929 and thereafter must accord a solid role to the speculative boom and ensuing collapse. Until September or October of 1929, the decline in economic activity was very modest. As I shall argue later, until after the market crash one could reasonably assume that this downward movement might soon reverse itself, as a similar movement had reversed itself in 1927. There were no reasons for expecting disaster. No one could foresee that production, prices, incomes and all other indicators would continue to shrink through three long and dismal years. Only after the market crash were there plausible grounds to suppose that things might now for a long while get a lot worse.From the foregoing it follows that the crash did not come — as some have suggested — because the market suddenly became aware that a serious depression was in the offing. A depression, serious or otherwise, could not be foreseen when the market fell. There is still the possibility that the downturn in the indexes frightened the speculators, led them to unload their stocks and so punctured a bubble that had, in any case, to be punctured one day. This is more plausible. Some people who were watching the indexes may have been persuaded by this intelligence to sell, and others may then have been encouraged to follow. This is not very important, for it is in the nature of a speculative boom that almost anything can collapse it. Any serious shock to confidence can cause sales by those speculators who have always hoped to get out before the final collapse but after all possible gains from rising prices have been reaped. Their pessimism will infect those simpler souls who had thought the market might go up forever but who now will change their minds and sell. Soon there will be margin calls, and still others will be forced to sell. So the bubble breaks.

In short, from the confidence perspective, a stock market crash has been seen as potential triggers to an economic depression.

This represents the Keynesian version of a stock market boom-bust cycle. They have primarily been anchored on “confidence” that hardly covers on other important aspects such as market responses to distortive government policies. For instance, they don’t see how easy money policies fuel a debt driven psychological ‘animal spirits’ bandwagon that incites a unbridled binge in speculative activities.

The Great Recession of 2007 runs in the opposite direction, the real economy suffered first via a subprime housing meltdown and this spread to the stock market.

While they may share some shared qualities, every recession and crisis is essentially unique.

Of course, 2014 is different from 1929. Today the world seems headed towards a digital economy, as against the transition from an agricultural economy to industrial economy during the 1920-30s.

Importantly in 1929 the world operated in a gold exchange monetary standard. Since the Nixon Shock in August 15, 1971, monetary standard has operated on a central bank fiat money (US dollar) mostly floating exchange rate standard.

The current monetary environment which has induced massive debt accumulation and which has allowed governments a free hand to inflate from which has benefited stock markets, a stock market crash will make the 1929 episode look like a walk in the park for reasons stated below.

This stock market-economic downturn via “animal spirits” linkage has been instrumental in the shaping of global government policies post Lehman crisis.

Even prior to his appointment at the Fed, and yet as a tenured professor at Princeton University, former Fed Chief Ben Bernanke already signaled the direction of his regime; policies in support of stock markets.

At the Foreign Policy in 2000 Mr. Bernanke wrote[18] (bold mine): There's no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

In 2010 then Fed Chair Ben Bernanke makes explicit the Fed’s role to support of the stock market (bold mine)[19]: This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion..

This has been what I call as the Bernanke Doctrine. And policies in support of the stock market have become modern central banking standard tool kit.

And there can hardly be any doubt that the stock market has been used as an instrument to project political economic goals.

Government institutions led by central banks around the world have intervened in various ways to the tune of $29 TRILLION (!!!) since “aftermath of the financial crisis” to “invest” in the stock market, according to a recent study.

From the New American (bold mine)[20]: The shocking data on central banks’ activities in the market, released on June 17, came from a survey compiled by the global research and advisory organization known as the Official Monetary and Financial Institutions Forum (OMFIF). The Global Public Investor (GPI) 2014 publication, for the first time, takes a broad look at some $29.1 trillion in investments held by hundreds of public-sector institutions in more than 160 countries. Among those entities are 157 central banks, 156 government pension funds, and almost 90 sovereign-wealth funds.

Amidst the stock market Bernanke “taper” meltdown in mid-2013, even the Philippine government via the government pension plan, the Government Service Insurance System (GSIS), promised support to the domestic stock market[21].

And as I recently noted, the Bank of Japan (BOJ) has an implied "the 1% rule" as recently coined by traders where BOJ aggressively intervenes via the ETF markets each time the Nikkei falls below 1%. Also the Chinese government has directed new IPOs to be priced below industry value which naturally created an IPO “boom” that has spilled across the board[22]. So these governments have been trying to shield their economic problems by maneuvering the stock markets higher.

Stock markets have become propaganda tools

So all these interventions in support of stocks only means reallocation of resources to beneficiaries of stocks (mainly Wall Street) at the expense of the economy or the general public. The growing disconnects between stocks and the economy will have both economic and political ramifications. For instance, (Marxist?) Thomas Picketty’s book on “inequality” has touched a raw nerve in the political economic community and has become a popular talking, if not debating, point.

And stimulating confidence or the stoking the “animal spirits” which has been the mechanism for the enormous subsidies or transfers with the use of “finite” resources will hit a natural barrier: the law of scarcity

And when this happens, as observed by Mr. Galbraith back then in 1929: Those who had been riding the upward wave decide now is the time to get out. Those who thought the increase would be forever find their illusion destroyed abruptly, and they, also, respond to the newly revealed reality by selling or trying to sell. Thus the collapse. And thus the rule, supported by the experience of centuries: the speculative episode always ends not with a whimper but with a bang.

Unfortunately, given the estimated $29.1 trillion of taxpayer “invested money” in global stock markets, the coming “bang” will not only hurt private sector investors but likewise these multifarious government agencies that have been used to buttress the stock markets. This is why the modern day version of 1929 will make its predecessor look like a picnic.

The bottom line: There is NO such thing as a Free Lunch

[1] See Phisix: Will the Global Black Swan Be Triggered by Economic Sanctions? August 11, 2014

[2] Amando M Tetangco, Jr: Sustaining growth while riding the uncertainty, Speech by Mr Amando M Tetangco, Jr, Governor of Bangko Sentral ng Pilipinas (the central bank of the Philippines), at the Bloomberg’s Foreign Exchange Forum, Makati, 13 August 2014

[3] Frank H. Knight Risk, Uncertainty, and Profit Part I Chapter 1, Paragraph 26 Library of Economics and Liberty

[4] Frank Knight loc cit Part I Chapter 2 Paragraph 43

[5] See Phisix: 7,000 Breaks on Regional Melt-UP; The Natural Limits of Inflationism August 18, 2014

[6] See Phisix: In 2009, the BSP Engineered a Crucial Pivot to a Bubble Economy April 14, 2014

[7] Diwa C Gunigundo What have emerging market central banks learned about the international transmission of monetary policy in recent years? The Philippine case Bank of International Settlements p.270

[8] See Phisix: The Convergence Trade in the Eyes of a Prospective Foreign Investor November 11, 2013

[10] See Phisix: PNOY’s 5th SONA: Desperately Seeking The Return of Boom Time Conditions August 3, 2014

[11] Gunigundo loc sit p. 277

[12] See Phisix: Understanding the Dynamics Behind ‘Pump and Dump’ June 29, 2014

[13] Investopedia.com Present Value - PV

[14] Financial Times, Investors in junk bond funds face a Matrix moment August 8, 2014

[15] Garet Garrett, The Bubble That Broke the World p.38 Mises.org

[16] John Kenneth Galbraith The Essential Galbraith Houghton mifflin company Digamo.free.fr

[17] See Is Economics about Vox Populi, Vox Dei? May 13, 2014

[18] ForeignPolicy.com A Crash Course for Central Bankers September 1, 2000

[19] Ben S. Bernanke What the Fed did and why: supporting the recovery and sustaining price stability Washington Post November 4, 2010

[20] New American Central Banks Now Dominate Stock Market, Study Finds June 19, 2014

[21] See Phisix: The Myth of the Consumer ‘Dream’ Economy July 22, 2013

[22] See Phisix: 7,000 Breaks on Regional Melt-UP; The Natural Limits of Inflationism August 18, 2014