The advice that sounds the best in the short run is always the most dangerous in the long run. Everyone wants the secret, the key, the roadmap to the primrose path that leads to El Dorado: the magical low-risk, high-return investment that can double your money in no time. Everyone wants to chase the returns of whatever has been hottest and to shun whatever has gone cold. Most financial journalism, like most of Wall Street itself, is dedicated to a basic principle of marketing: When the ducks quack, feed ‘em. --Jason Zweig

In this Issue

Phisix: Real Time Market Crashes and The S&P Smells Domestic Credit Bubbles

-Strong US Dollar Wreaks Havoc to Asia’s Stock Markets

-Bulls Desperately Yearns For Steroids

-Have Stock Market’s Price Discovery and Discounting Function Been Lost? The Russell 2000 Example

-Phisix: The Massaging of the 7,000 Level

-Real Time Market Crashes: the Appetizer, the Main Course and the Dessert

-The S&P Smells Credit Bubbles in the Philippines

Phisix: Real Time Market Crashes and The S&P Smells Domestic Credit Bubbles

What a week.

Volatility has returned with a stunning vengeance!

Strong US Dollar Wreaks Havoc to Asia’s Stock Markets

I have warned in mid-September[1] that the sharp rise of the US dollar index has traditionally been accompanied or has highlighted a risk OFF environment.

Yet a rising US dollar has usually been associated with de-risking or a risk OFF environment. Last June 2013’s taper tantrum incident should serve an example.

The US dollar index zoomed by a whopping 8.7% from July until its recent peak October 3. Since the October zenith, the US dollar index has retraced some 1.7%.

The recent cascade in Asian currencies, based on Bloomberg-JP ADXY (upper window) relative to the US dollar, has been in conjunction with swooning Asian ex-Japan stocks (AAXJ).

The ADXY as I recently explained[2] comprises of the Chinese yuan 38.16%, Korean won 12.98%, Singapore dollar 11.07% Hong Kong dollar 9.22% Indian rupee 8.75% Taiwan dollar 6.1% Thai baht 4.92% Malaysian ringgit 4.3% Indonesia rupiah 2.85% and Philippine peso 1.65%.

The descend of Asian currencies only commenced at the end of August even as the US dollar index has risen against her Developed Market (DM) peers since July. The reinvigoration of the US dollar index undergirds a transmission mechanism which for me represents a symptom of the diffusion of declining “liquidity”.

Since the debilitation of Asian currencies, many major Asian equity benchmarks have exhibited meaningful deterioration in prices: based from the recent highs relative to Friday’s close; Japan’s Nikkei has been down 11.1%, Australia’s All Ordinaries off by 7%, Taiwan’s TWII retraced by 10.5% which has been larger than the June 2013 Taper Tantrum where the TWII lost 8.8%, Hong Kong’s Hang Seng slid 9%, South Korea’s KOSPI dropped by 8.7% and Singapore’s STI down by 5.54%.

Curiously the Taper Tantrum smoked ASEAN equity indices seems to have performed better this time; the Philippine Phisix surrendered 4.5%, her twin like chart Thailand’s SET has fallen 4.7%. Indonesia’s JCI retreated by 4.1% while Malaysia’s KLCI, which has been unscathed by the 2013 Taper Tantrum, has also lost 4.8%

But of course, I doubt that this scenario will last, since we seem to be seeing a spreading of the outbreak of the US dollar triggered global asset deflation.

As I recently noted[3]

Developed Asia has apparently borne the brunt of the selling pressures relative to emerging Asia. Apparently, this has been due to the stronger US dollar which has affected the relatively more export dependent nations.Also the degree of response differs.In June 2013, Developed Asia’s drastic response has equally been met by dramatic recoveries. For emerging Asia, the recovery has been gradual and only picked up speed during the second quarter of 2014.So a divergence developed, emerging Asia’s belated ferocious rally came in the face where developed Asia began to reveal signs of stock market strains as the US dollar gained momentum against the region's currencies.Developed Asia’s weakness has been reinforced by the US. Since the US has been de facto leader of the world, in terms of central bank sponsored debt financed asset inflation, the recent tremors in her booming overextended and overvalued stock markets has spread to cover most of the major world equity benchmarks. Such strains seems to have diffused to Asia’s high flyers which aside from ASEAN, includes the New Zealand (NZ50), India (SENSEX) and even Vietnam (Ho Chi Minh).So divergences seem as transitioning into convergence.As one would note, initial pressures surfaced on Emerging Markets (June 2013), then this spread to Developed Markets (revealed by divergent market internals), and now a seeming convergence (both developed and emerging markets)—the periphery to the core dynamic.The feedback from such phenomenon loops in a two way transmission mechanism. If the downside volatility will continue to reassert its presence in the stock markets of developed economies led by the US, then this should reinforce the current convergence downhill trend in Asia and in emerging markets. And pressures on Asia and EM markets will likewise reverberate on Developed Markets.

From the mainstream perspective weak currencies translates to strong exports. This hasn’t been true. But this hasn’t been the issue.

Yet current events have been more than an issue of exports but of liquidity and debt.

When Asian central banks support their domestic currency, they effectively sell their foreign currency reserves and buy local currency mainly through the banking system. The current infirmities in Asian currencies has led to either the cresting or to declining foreign exchange reserves for many Asian governments such as Hong Kong (September), South Korea (September), Singapore (September), Australia (August), India (October), Malaysia (August), Thailand (September) and the Philippines (September).

Indonesia’s rupiah has been testing the January 2014 lows (USD-IDR). Curiously, Indonesia’s foreign exchange reserves as of September 2014 have been rising since July 2013 (but still down 10.8% from July 2011 record high). This ironically comes in the face of swelling twin deficits, particularly fiscal deficit (2013), a big part of which has been from fuel and electricity subsidies, and current account deficit (2Q 2014). It looks as if the Indonesian government has been stuffing their foreign exchange reserves through external borrowings in 2013 or as seen from 11% year-on-year growth based on August figures from Bank of Indonesia. This may have been intended to superficially improve their macro outlook

The siphoning of domestic currency in the financial system could be seen as partial tightening. This is unless the domestic banking system continues to rollout liquidity through credit expansion to neutralize such actions.

Yet weak domestic currency relative to a strong US dollar means more domestic currency required to pay for US denominated liabilities.

The region, like a sponge, has been soaking up humungous amount of foreign (aside from domestic) debt, Morgan Stanley recently warned that emerging Asia’s foreign debt has ballooned to $2.5 trillion from $300 billion over the last decade, which has “surpassed extremes seen just before” the Asian financial crisis[4]. The above is an example of the dramatic upscaling of Asia’s foreign borrowing growth (chart from Financial Times’ Alphaville).

A weak domestic currency relative to stronger US dollar also means more domestic currencies required to pay for imports which should add to consumer price inflation pressures.

Price instabilities from currency volatility function as obstacles to real economic growth as they distort economic calculation and the economic coordination process.

Yet price instabilities are products of interventionism, or in the present case inflationism, as part of the financial repression policies.

So systemic high debt levels in and of itself are stumbling blocks to economic growth, while slowing growth increases risks of a credit event. Because high debt levels extrapolates to increased fragility, thus they are vastly sensitive to changes in domestic and foreign interest rates, foreign exchange ratios and inflation rates which may serve as a trigger for their unraveling.

Thus a sustained rise in the US dollar relative to Asia and emerging Asia increases the risks of a regional credit event.

Coming from an electrified ramp, the US dollar index and the US dollar-Asian currencies for now seems in a pause. So the lull may serve as a window for a technical bounce.

With the collapse in the yields of US treasury long term (10 year notes and 30 year bonds), I doubt if such hiatus will last.

Bulls Desperately Yearns For Steroids

Yes a technical bounce may be due early next week.

Friday’s monster ‘short covering’ rally in US-European markets from oversold conditions should filter into Asia. But the question is how lasting will this rebound be?

Friday’s gigantic rally has been largely anchored from hopes of more central banking support.

The seeds of Friday’s rally have been sown when San Francisco Federal Reserve President John Williams said that “If we really get a sustained, disinflationary forecast ... then I think moving back to additional asset purchases in a situation like that should be something we should seriously consider”[5]

US markets recovered from Thursday’s over 1% lows for the S&P and Dow Jones Industrials when St. Louis Federal Reserve Bank President James Bullard said “Inflation expectations are declining in the U.S. That’s an important consideration for a central bank. And for that reason I think that a logical policy response at this juncture may be to delay the end of the QE.”[6]

Markets starved for support responding in exemplary Pavlovian classical conditioning fashion may have read Mr. Williams and Mr. Bullard’s statements as representing the sentiment of the Fed.

Friday’s run came as the European Central Bank’s Benoit Coeure stated that they will “start buying assets within days”[7].

Such statements intended to mitigate the current selloff demonstrates what I have been saying as political agents fearful of short term consequences from a financial market downturn: I recognize the problem of addiction but a withdrawal syndrome would even be more cataclysmic

It has been in a not so distant past we saw the same furious degree of rally, predicated on Fed minutes which signaled an extended low interest rates regime and a talk down of the US dollar, only to be neutralized the following day, so a fantastic rollercoaster ride in a span of two days (October 8th and 9th). What this suggests has been of the narrowing room for the market’s permissiveness to central bank jawboning.

Will the effect of last week’s signaling of more S-T-I-M-U-L-U-S last longer? Or will the recent past repeat?

Have Stock Market’s Price Discovery and Discounting Function Been Lost? The Russell 2000 Example

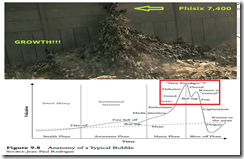

When the bulls stormed back to reclaim the Philippine Phisix 7,400 which they failed to hold, I wrote[8],Logic also tells us why the current stock market conditions are unsustainable: Has the stock market permanently lost its fundamental function as a discounting mechanism for it to permit or tolerate a perpetual state of severe mispricing as seen by excessive valuations of securities???If the answer is YES, then PEs of 30, 40,50, 60 and PBVs 3,4,5,6,7 can reach, in the words of cartoon Toy Story character Buzz Lightyear “to infinity and beyond”!!!If the answer is NO, then the obverse side of every mania is a crash.

Take the US small cap Russell 2000 (RUT), which has been the de facto leader to the current downturn of the US markets.

From its twin March and July peaks (double top?) to its recent lows last week, the small cap benchmark has declined by 13%. Yet following the substantial two day bounce, the RUT remains down 10.45% as of Friday.

Paradoxically the RUT departed from the crowd involved in Friday’s colossal rally and closed .35% down.

Yet according to Wall Street Data’s market data center on P/E and Yields of Major Indices, RUTs trailing 12 month PE ratio remains at a staggering 69.99 also as of Friday. Bulls would say this is a buy. But such a call would be absurd for the simple reason of overpaying for a security or egregious mispricing. Unless the rate of earnings growth races far far far faster than its price increase, increases in the RUT equates to PE multiple expansion.

Yet based on small business sentiment from National Federation of Independent Business (NFIB) survey in September[9], optimism seems to have climaxed. Small business optimism has hardly grown in 2013. However there has been a short burst of optimism sometime in the second quarter from whence it has been a struggle. Government mandates, red tape and taxes remain as the largest impediment to small business growth according to the survey.

So there has barely been any worthwhile justification for buying at current levels since doing so would necessitate reliance on a “Greater Fool” who would expect PE ratio to rise to even more ridiculous levels. When crowds buy because of expectations of a greater fool, then this isn’t about investing but about GAMBLING.

For the week, the RUT closed 2.8% up. But according to the Bank of America, the small cap rebound has been due to “net short positioning largest since 2008 after fifth consecutive week of selling.”[10] In short, the RUT’s rebound has essentially been about a massive short squeeze.

Such massive short squeeze, which represents the “biggest weekly short-squeeze in 11 months” according to the Zero Hedge has been evident in the most shorted issues and has contributed to the “miraculous surge in Dow Transports, Small Caps, and Homebuilders”[11]

That’s exactly the role of modern day inflationism: destroy the market’s price discovery mechanism so that people will be hardwired to see asset levitation as permanent feature.

Unfortunately some political groups seem to have realized that such an arrangement isn’t sustainable.

An example the IMF[12] (bold mine, italics original): Policymakers are facing a new global imbalance: not enough economic risk-taking in support of growth, but increasing excesses in financial risk-taking posing stability challenges… At the same time, prolonged monetary ease has encouraged the buildup of excesses in financial risk-taking. This has resulted in elevated prices across a range of financial assets, credit spreads too narrow to compensate for default risks in some segments, and, until recently, record-low volatility, suggesting that investors are complacent. What is unprecedented is that these developments have occurred across a broad range of asset classes and across many countries at the same time. Finally, corporate leverage has continued to rise in emerging markets.

Phisix: The Massaging of the 7,000 Level

Such perversion of market mechanism can also be seen in the Philippines.

The Philippine Phisix would have seen larger losses if not for price massaging last Thursday.

The 2.78% dive by the domestic equity benchmark last Monday has been offset by mid-week gains. The Phisix closed 2.29% over the week.

Following the 1% decline in the US markets, the Phisix opened Thursday down by 44 points.

But certain entities ensured that the downside momentum wouldn’t take hold. So the same parties spent three-fourths of the session in a scramble to push up 3 key index heavyweight issues in order to buoy the index. At the pinnacle, the Phisix approached the 1% gain while almost all bourses in the region hemorrhaged, except for Australia ASX 200 which closed marginally higher (.18%). Even Indonesia’s JCI which was marginally up near the end of the session closed in the red.

It was a bizarre spectacle: Domestic panic buying in the face of an apprehensive region!

At one point I even asked myself, have domestic punters become so dense?

When the session closed, market breadth didn’t share the sanguinity of the Phisix. Declining issues were down relative to advancers by a ratio of almost 2:1. The day’s 37.39 or .53% gains had been centered again on a two sector-three company pump.

Yet this can’t be about momentum, since the attempted crossover to a new high, momentum seems to have faded. Monday’s 2.78% drubbing underscored this point.

The only possible explanation for such peculiar reaction has most likely been not about profits but about symbolisms.

The 7,000 level has served as a symbolical trophy which wounded bulls have been reluctant to relinquish and has fought fiercely to hold. Or that stock market operator/s had to ensure that 7,000 level would be maintained regardless of valuations or profits but for other agenda.

As I recently wrote[13],

Phisix 7,000 and 7,400 will have to be reclaimed as the 2016 national election nears. Rising stocks because of G-R-O-W-T-H may help spur chances for a re-election or for the election of an appointed representative. So much of these 3 company pump or massaging of the Phisix may have been part of the publicity machinery campaign to boost the political capital of the incumbent. If public pension money have been used, then pensioners may likely face future funding problems.Sad to say economic realities have began resurface which should upend and expose all the delusions that has enthralled the public during the past 6 years.The bottom line: the obverse side of every mania is a crash.

Real Time Market Crashes: the Appetizer, the Main Course and the Dessert

The obverse side of every mania is a crash.

This isn’t just my slogan anymore, it has become a reality.

There is no exact numerical threshold to define a crash.

However if stocks of developed economies as Japan and Taiwan fall by 5% in a week, this looks like a crash for me. Emerging Asia Vietnam has been the third nation to fall over 5% for this week. For three Asian national benchmarks to collapse is a worrying sign for me.

But this is just the appetizer.

Now to the main course.

If Friday’s titanic rally (see red bars) has made people believe that Europe’s crash[14] has been averted then they are misreading the whole market action.

Let me cite an example: Greece’s Athens Index flew by 7.21% Friday, but at the end of the week the same Greek index has been down by a staggering -7.27%. This implies that Friday’s rally chipped off only half of the Greek benchmark’s horrific losses over the week. Without Friday’s gains, the Greek bellwether would have been down by a shocking 14.4%!

Those huge gains last Friday has not been able to cover the weekly losses (blue bars) of Portugal (-3.36%), Italy (-2.6%) and Spain (-2%).

I placed a green oval on them for emphasis.

Interestingly, Friday’s stock market surge has also failed to erase the weekly losses of the bigger European peers, France 1%, Switzerland 1.5% and Netherlands 1.8%.

In addition, it has not been just stocks anymore. Pressures have begun to spillover to Europe’s periphery bonds. The Greek government’s 10 year bonds have endured most of the selloff so far, followed by Portugal, Italy and Spain.

Once market carnage shifts to cover bonds then a crisis can be expected.

So will Europe has fully recover this week’s crash? Or will the crash find a second wind? My bet is on the latter.

Bullish eh?

Now for the dessert.

Since oil has collapsed to $80 level, apparently equity benchmarks of Gulf oil producing nations have crashed by even a larger scale.

As caveat, since their bourses have been closed last Friday, they haven’t partaken of the rally which should come early this week.

Anyway, Oman’s Muscat has collapsed by 7.06%, UAE’s Dubai Financial crashed 9.84% and Saudi’s Tadawul dived by 12.02%! Nonetheless year to date the returns have mostly been positive: Bahrain 15.87%, Oman .55%, Saudi 24.69% and UAE 26.73%. Kuwait is the exception down -1.84%. The obverse side of every mania is a crash.

A collapse in oil prices has very significant ramifications for the welfare states of these nations. Current levels of oil prices have now been below the break-even point to maintain the welfare states of most oil producing nations. Only Kuwait, UAE and Qatar have a small surplus.

It’s not just welfare state, sinking oil prices will affect the region’s economic activities, debt exposure as well as domestic, regional and geopolitics.

Here is what I recently wrote[15]

Some will argue that this should help consumption which subsequently implies a boost on “growth”, but I wouldn’t bet on it.Current events don’t seem to manifest a problem of oversupply. To the contrary current developments in the oil markets seem to signify a problem of shrinking global liquidity and slowing economic demand whose deadly cocktail mix has been to spur the incipient phase of asset deflation (bubble bust)Others argue that this could part of an alleged “predatory pricing” scheme designed as foreign policy tool engaged by some of major oil producers to strike at Russia, Iran or even against Shale gas producers in the US.This would hardly be a convincing case since doing so would mean to inflict harm on the oil producers themselves in order to promote a flimsy case of “market share” or to “punish” other governments.Say Shale oil. There are LOTS more at stake for welfare states of OPEC-GCC nations than are from the private sector shale operators (mostly US). Shale operators may close operations or defer investments until prices rise again. There could also be new operators who could pick up the slack from existing “troubled” Shale oil and gas operators. Such aren’t choices available for oil dependent welfare governments of oil producing nations. As one would note from the above table from Wall Street Journal, at current prices only Kuwait, the UAE and Qatar remains as oil producers with marginal surpluses.And a shortfall from oil revenues means to dip on reserves to finance public spending. And once these resources drain out from a prolonged oil price slump, the risks of a regional Arab Spring looms.And the heightened risk of Arab Springs would further complicate the region’s social climate tinderbox. Add to this the economic impact from a weak oil prices-strong dollar, regional malinvestments would compound on the region’s fragility.Thus, the adaption of "predatory pricing" supposedly aimed at punishing other governments would only aggravate the region’s already dire conditions that risks a widespread unraveling towards total regional chaos.

Let me add more. Government adaption of "predatory pricing" will have far reaching effects than just economics. That’s because governments of oil producing nations have the welfare functions to consider. And it is because of such welfare mechanism that has provided political privileges to those incumbent leaders such that losing grip on political power would hardly be an option. So there will most likely be counteractions. The repercussions won’t be seen in media until it becomes evident.

Saudi Arabia has lately stated that they will protect their oil market share[16]. What if those affected oil welfare deficit governments resist? What if Russia or any of Saudi’s chief adversaries, say Iran, for instance finance rogue groups within Saudi to sabotage the latter’s pipelines?

So predatory pricing will spur more geopolitical complications that would heighten the region’s stability risks already hobbled by intensifying wars.

Greater stability risks in the Middle East are bullish for stocks?

The S&P Smells Credit Bubbles in the Philippines

I was once the lone crusader in saying that the Philippine financial markets and her economy has been a bubble.

Not anymore. The establishment is beginning to smell of bubbles, as in the case of the S&P.

From Bloomberg[17]: (bold mine)

By year-end, Philippine companies would take as long as a record four years to repay debt using operating earnings, said Xavier Jean, the Singapore-based director of corporate ratings at Standard & Poor’s. By comparison, the figure is one year or less for Indonesian businesses, and about two years for Malaysian ones. Philippine corporate exposure to foreign debt climbed to 26 percent of total debt last year from 15 percent in 2011, he said, citing a study of 100 Southeast Asian firms.“The big risk is that they mis-time market conditions and they don’t slow down capital spending soon enough before another financial crisis occurs,” Jean said in an Oct. 15 interview. “If one of the conglomerates starts facing some financial tightness, you could have confidence issues between the banking system and the conglomerates.”

More…

“At present, we view refinancing risk as moderate because companies have a lot of cash,” Jean said. “But large cash balances aren’t going to remain there forever if they keep spending the cash they have.”In a financial crisis, company revenue and cash flows can suffer, creating the potential of short-term debt repayment problems, he said. In such a situation, banks mightn’t be willing to extend additional lines of credit, he said.Debt held by the 17 Philippine companies included in the study nearly trebled to $40.7 billion in the first quarter of this year from end-2008, S&P estimated.

On San Miguel…

San Miguel, the biggest Philippine company, saw its debt surge more than five fold to 631.9 billion pesos ($14 billion) in the second quarter from end-2008 as it expanded into energy and infrastructure, according to data compiled by Bloomberg…

Debt Servicing…

The median ratio of net debt to earnings before interest, taxes, depreciation and amortization of Philippine companies is estimated to be 3.5 times to 4 times by the end of 2014, from 1.9 times in 2008, S&P’s Jean said.The companies reviewed had varied financial risk profiles, S&P said in an Oct. 7 report. About 30 percent had large debt loads while some 25 percent had conservative balance sheets with moderate-to-low debt levels, according to the report.

The S&P rightly reads on the statistics of the surfacing Philippine debt problem. This is only because the substance of debt growth rates and levels can’t be ignored anymore.

However, the S&P fails to appreciate debt’s logical connection to the political economy, as well as how financial crisis unfolds.

In one of his latest speeches the BSP chief gives an update of the banking system[18]; as of March 2014, the Philippine banking system had 37.8 million depositors who had saved 7.7 trillion pesos in 46 million deposit accounts.

The implication here is that of the 100 million population, only 37.8% are banked. I am not sure how the BSP defines “depositors” so I’ll just take on the top line number as it is. But if depositors include corporations, partnerships or even perhaps same individuals then the banking penetration number level could be a lot smaller than the nominal number cited.

My point is here is that there are only a minority group of people who have access to the banking and financial system.

Because only a minority group of people have access to the banking and financial system, debt absorption by these segment of people due to zero bound rates will tend to be large. This implies that both benefits and risks have been concentrated.

So consumer debt in the Philippines has been low because of the lack of access by the majority to the formal banking system. So it would foolhardy to make a statistical comparison with nations whose consumers have larger access to formal sector debt as against consumers who hardly share the same faculties or even on overall debt levels alone.

In addition because Philippine economic opportunities have been cornered by the elite where “just 40 of the country’s richest famillies account for, control and enjoy the benefits of 76 per cent of annual production” according to analyst Martin Spring, this means most of the country’s debt has been concentrated on the myriad of companies owned by these elites.

A wonderful example is San Miguel Corp, my prime candidate for a Lehman moment, whose debt which the Bloomberg quotes at 631.9 billion pesos ($14 billion) likely includes short, long term debt and financial lease liabilities[19].

In perspective, as of June 2014, the Philippine banking system’s total resources have been quoted at Php 10.606 trillion. So SMC’s liabilities represents around a startling 5.9% of the Philippine banking system! While a significant segment of SMC may come from non-banking sector debt, outside foreign holders of SMC debt, SMC’s debt papers may likely be held by domestic banks or by non bank financial institutions or by individuals (mostly elites through the formal financial system). Again this is because given the lack of access to the formal banking system by the majority, financial depth has been limited. In short SMC’s bank and non bank loans will circulate within the same concentrated system.

This implies that the supply side, which SMC has been part of, has provided the bulk of the statistical economic growth through the accelerated racking up of debt. And because of the rapid outgrowth in debt levels the supply side has now become too dependent on zero bound.

But again even at zero bound, debt has natural limits. Philippine debt uptake has become too evident to disregard, such that the usually blind establishment can already see them

And because the supply side which again has been the key source of demand for the economy, from which debt levels has grown far more than the output it provides, see 2Q GDP BSP Loan ratios table here, this means that if these companies follow the S&P’s prescription to “slow down capital spending soon enough” then the economic growth in the formal economy will follow suit or statistical economic growth will swoon.

And a slowdown in growth will bring about “confidence issues” that would lead to “financial tightness” and expose on the nature or degree of credit risks in the system.

And the reason there still has been a lot of cash has been because there is still “confidence” in the system, whereby access to the financial system remains ‘loose’ thus the system remains highly ‘liquid’.

However when confidence becomes an issue, or once there will be a corrosion in confidence such would lead to “financial tightness”. For instance a financial system margin call will evaporate excess cash almost instantaneously. Likewise, all assets will have to be repriced to reflect on the intensified demand to raise and acquire cash in order to settle obligations. And since every participant had been doing the same thing during the boom (borrow and spend), then the corollary would be that same participants will do the same thing when credit issues arise (sell to pay back loans).

Credit expansion led to money supply growth which provided artificial boost to the economy. In contrast credit contraction will shrink money supply and lead to a recession and a crisis due to the intensive build up of imbalances.

So whatever fundamentals we are seeing today (under the ambiance of confidence) will vastly be different with the fundamentals in the future (under the face of loss of confidence). Remember, confidence signifies a behavioral response or a symptom of entropic fundamental underpinnings. They don’t just happen.

The establishment is starting to grasp at what I have been saying all along.

The obverse side of every mania is a crash.

[1] See Phisix: BSP Panics, Raises BOTH Official and SDA Rates!!!! September 15, 2014

[2] See Phisix: 7,400 is not the Technical Hurdle, the BSP Governor Is October 16, 2014

[3] See Start of the Breakdown? Signs of Decaying Asian Stock Markets October 18, 2014

[4] Ambrose Evans Pritchard Morgan Stanley warns on Asian debt shock as dollar soars Telegraph.co.uk September 29, 2014

[5] Reuters.com Exclusive: Fed's Williams downplays global risks, eyes U.S. inflation October 14, 2014

[6] Bloomberg.com U.S. Stocks Erase Loss as Fed’s Bullard Suggests More QE October 17, 2014

[7] Bloomberg.com European Stocks Rise Most Since 2011 on Stimulus Pressure October 17, 2014

[8] See Phisix: The Untold Story of the Two Faces of the 7,400 Historic Highs September 28, 2014

[9] NFIB.com NFIB: SMALL BUSINESS OPTIMISM INDEX DECLINES IN SEPTEMBER October 14, 2014

[10] Zero Hedge Here Is Why The Russell 2000 Has Not Only Shaken Off The Market Rout, But Is Rising October 17, 2014

[11] Zero Hedge WTForced Buy In: Shorts Crucified By Biggest Squeeze Since 2013 October 17, 2014

[12] José Viñals The New Global Imbalance: Too Much Financial Risk-Taking, Not Enough Economic-Risk Taking, IMF Direct Blog, October 8, 2014

[13] See Phisix: Another Panic Buying Day Amidst Global Meltdown October 16, 2014

[14] See Start of the Breakdown? European Stocks Collapse! October 16, 2014

[15] See Will a Collapse in Oil Prices Burst the Middle East Bubble? October 15, 2014

[16] New York Times Oil Prices Continue Decline, Pressured by Saudi Action to Defend Market Share, October 2, 2014

[17] Bloomberg.com Debt-Hungry Philippine Firms Exposed as Markets Falter October 17, 2014

[18] Amando M Tetangco, Jr: Banking on social safety nets Balikat ng Bayan Awarding Ceremonies and the launching of the Personal Equity and Savings Option Fund of the Social Security System, September 25, 2014

[19] San Miguel Corporation Sec Form 17-Q Second Quarter 2014 p 29