Investing guru Mark Mobius, executive chairman of Templeton Emerging Markets Group says,

In some cases, a devalued currency can be an engine for future growth. A lower currency price means the nation’s exports will be more competitive (less expensive) in the global market, and imports will become more expensive, so many companies can benefit.

A discussion about currency values should include a discussion about inflation, which is closely interconnected. Inflation has been problematic for many emerging economies, and while it does seem to be ebbing temporarily in some markets, it’s important to remain vigilant about it. High inflation can cause a strong public response (even a mass uprising), as consumer purchasing power quickly erodes.

It would be patently misleading to present devaluation as a different animal from inflation. That’s because devaluation IS inflationism. Consumer price inflation signifies as the effect of prior monetary inflation.

Professor Jeffrey M. Herbener explains,

When a government announces devaluation, as the United States did in 1934 and again in 1971, it is merely recognizing the reality of the consequences of its monetary inflation. Its inflationary policy has eroded the purchasing power of its currency which will be suffered both domestically, with price inflation, and internationally, with devaluation.

The undesirable effects of monetary inflation cannot be eliminated with floating exchange rates. Then the price inflation and devaluation occur gradually instead of being bottled up behind the government’s unsustainable peg. But whether the currency is pegged, as the dollar was in the 1920s and 1930s, or floats, as the dollar has since 1971, monetary inflation and credit expansion cause a boom-bust cycle.

Yet prescribing devaluation is tantamount to, or a euphemism of saying poverty promotes growth.

By having to lower standards of living, as a consequence of the transference of resources to politicians and their cronies, people are expected to work harder in order to generate growth.

So inflationistas are essentially moral schadenfreudes—finding satisfaction in the miseries of people.

Not to mention that inflation represents highway robbery (plunder) by governments of their people.

Even the divine inspiration of statists and facists, John Maynard Keynes admitted to these. (Wikipedia.org; bold highlights original)

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become 'profiteers,' who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

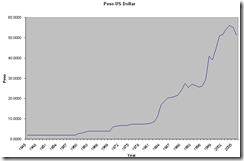

Let’s take the Philippines as example.

The Peso devalued from 2 pesos: 1 US dollar in 1960s to about 42 pesos to a US dollar today. This means the Peso devalued by about 4% annually.

From the perspective devaluation exponents, this should have made the Philippines an export giant. However the Philippines ranks only 57th based on 2011 data according to Wikipedia.org

Ironically, most of the top exporters are represented by ‘strong’ currencies from developed economies, and not from economies that has massively devalued their currencies as Zimbabwe.

It’s good news to see that the Philippine GDP per capital has skyrocketed from $257 in 1960 to $ 2,140.12 in 2010, according to Index Mundi.

But this only accounts for an average annual growth of about 1.7%. That’s way below the rate of devaluation (inflation) at 4%. Also the surge came amidst globalization. As a side note, to put a political spice on this, much of the increase came from the 2003 onwards.

And this has been the "magic" that has spawned PEOPLE exports or the Overseas Filipino Workers (OFWs) whom has been politically labeled as today’s economic heroes, out of the paucity of economic opportunities.

In reality, OFWs are MANIFESTATIONS of an uncompetitive economy borne out of interventionism and inflationism.

And much of that “economic growth” has not only emanated from OFWs, but from the INFORMAL economy which government statisticians downplays or deliberately hides behind the numbers. The informal economy has also been symptom of government failures and of the uncompetitive nature of the economy brought by sustained interventionism and inflationism.

Lastly the idea that exports or tourism benefit from the policy of poverty as a path to prosperity (devaluation) also misrepresents the reality. Devaluation or inflationism provides short term benefits at the expense of the long term.

The great Professor Ludwig von Mises exposes such deception,

If one looks at devaluation not with the eyes of an apologist of government and union policies, but with the eyes of an economist, one must first of all stress the point that all its alleged blessings are temporary only. Moreover, they depend on the condition that only one country devalues while the other countries abstain from devaluing their own currencies. If the other countries devalue in the same proportion, no changes in foreign trade appear. If they devalue to a greater extent, all these transitory blessings, whatever they may be, favor them exclusively. A general acceptance of the principles of the flexible standard must therefore result in a race between the nations to outbid one another. At the end of this competition is the complete destruction of all nations' monetary systems.

The much talked about advantages which devaluation secures in foreign trade and tourism, are entirely due to the fact that the adjustment of domestic prices and wage rates to the state of affairs created by devaluation requires some time. As long as this adjustment process is not yet completed, exporting is encouraged and importing is discouraged. However, this merely means that in this interval the citizens of the devaluating country are getting less for what they are selling abroad and paying more for what they are buying abroad; concomitantly they must restrict their consumption.

Legal plunder through currency inflationism or devaluation has neither provided long term (or lasting-sustainable) economic solutions nor has it been a moral one.

No comments:

Post a Comment