Emerging market central banks, who seem to be growing apprehensions over the actions or policies of their developed contemporaries, continue to stockpile on gold at an accelerating pace.

From IBTimes

Central banks continued to purchase gold in the third quarter at near-record pace, driven by emerging market central banks looking to diversify away from traditional reserve currencies amid heightened economic insecurity and continuous unconventional monetary easing, according to World Gold Council data released Thursday.Gold reserves at central banks increased by 97.6 metric tons during the July-September period, albeit at a slower pace compared with a record year-ago quarter. The official sector accounted for 9 percent of overall gold demand during the third quarter.“I wouldn’t emphasize the fall of 31 percent [from a year ago],” said Marcus Grubb, managing director for investment at the WGC. “Anything close to 100 tons is very high by the last 15 years.”The world’s central banks collectively bought 374 tons of gold in the first nine months of this year. That’s higher than last year’s 343 tons for the same period.“We still think we might beat last year’s total for central banks of 456 tons, though it’s going to depend on Q4,” Grubb said. “[This year will likely come in at] somewhere between 455 tons and 500 tons, which will be another record since the early 1960s.”

As one would note, the combined balance sheet expansions of developed central banks have reached unprecedented scale.

And the price action gold has been highly correlated with the balance sheet expansion of major central banks (chart from Zero hedge)

I may further add that China’s record gold accumulation could have been understated

Notes the Zero Hedge (bold original)

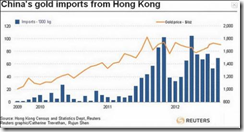

Year-To-Date China has now imported a whopping 582 tons of gold, more than the official holdings of India at 558 tons, and which through November has certainly surpassed the holdings of the Netherlands, and make China's gross imports in just 2012 nominally the equivalent of Top 10 largest sovereign holder of gold.This way at least we know where China is recycling all that vast trade surplus, which incidentally in October just printed, goalseeked or not, at the highest level - $32 billion - since January of 2009. Too bad China no longer recycles all those excess reserves into US Treasury paper (as we showed previously here).YTD China gross imports from Hong Kong:

In my view, the recent decline of prices of gold seems inconsistent with the real world events that drives the direction of gold prices. Or perhaps, I may have missed something.

No comments:

Post a Comment