Reports the Inquirer.net

Inflation further eased in October, with the inflation rate slowing to 3.1 percent, from 3.6 percent in September and 3.8 percent in August, marking a four-month low in the consumer price index (CPI).Malacañang attributed the improvement to good governance and equitable and inclusive economic growth.“We have always maintained that good governance results in good economics. The effects of our reforms have already manifested in the lives of our countrymen,” said deputy presidential spokesperson Abigail Valte.“This is reflected in the exceptional public trust, satisfaction and support for the President and his administration,” she said.

So how exactly did the government bring down "inflation" (price inflation)? How does “good governance” translate to lower inflation? Did the government liberalize economic activities to generate surpluses via increased productivity which has pressured prices downwards? Or have government’s selective application of price controls been working?

What then is “good economics”? Does interventionism translate to more productivity? Does picking winners and losers or politicizing the marketplace equate to good economics?

Or could it be that the informal economy has been generating these surpluses? Or could this be signs of bursting bubbles (here or abroad)?

Maybe applied in the political sense, “good economics” is for the beneficiaries, particularly the political economic elites, and of not society.

From an anecdotal perspective, my favorite hangout just raised prices across the board by 5-10%. My gasul which I bought yesterday was up 10%. Could these instances been isolated?

Or has statistical inflation data been fudged to promote political agenda?

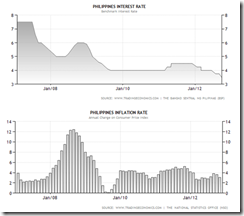

Yet does a negative real interest rate regime reflect “good governance”?

Does inflationism also represent “good economics”?

(charts above from tradingeconomics.com)

Does the Philippine government consider stealth redistribution of resources from society to the political class, the promotion of asset bubbles and the gambling culture (via the shortening of time preferences or orientation) as representing good governance and good economics?

Let me end this terse critic with a quote from the great Henry Hazlitt,

Inflation, to sum up, is the increase in the volume of money and bank credit in relation to the volume of goods. It is harmful because it depreciates the value of the monetary unit, raises everybody's cost of living, imposes what is in effect a tax on the poorest (without exemptions) at as high a rate as the tax on the richest, wipes out the value of past savings, discourages future savings, redistributes wealth and income wantonly, encourages and rewards speculation and gambling at the expense of thrift and work, undermines confidence in the justice of a free enterprise system, and corrupts public and private morals.

Next year when price inflation (stagflation) becomes a real economic and market risks, will the Philippine government own up to their mess or will they simply pass the blame on the markets for these?

No comments:

Post a Comment