Know how to listen, and you will profit even from those who talk badly-Plutarch

I was supposed to write about Japan as one of the potential triggers for the Black Swan event in 2014 and on the US shopping mall bust as this week’s topic but an unscheduled family event have forced me to truncate and alter my outlook for the week.

To add, another reason for this outlook is due to flash developments that have transpired in the global markets during the last two days. This may signal a change in the complexion of the markets.

Local bulls have been delighted by the apparent rekindling of the animal spirits as the Phisix roared anew for the second straight week.

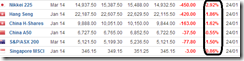

As one would note, the Phisix outsprinted her neighbors with a 3.41% jump (see blue square). The gains during the past two weeks at 5.88% have accrued to yield a 5.12% return year to date.

We can expect the mainstream Pollyannas to say, “you see the bull market is still alive. “Fundamentals” rule the day and that those bears are being “irrational”.

Of course “irrationality” applies to both the base instincts of fear and greed. And of course, whatever fundamentals these commentators will refer to are statistics that have been cherry picked to justify the current stock price surges.

In reality the impassioned rally by the embattled ASEAN stock markets, has been led by Indonesia (JCI-green) that has spilled over to Thailand (SET-red) and the Phisix (PCOMP-gold). The Phisix and the SET only picked up steam only during the last two weeks.

The story of Indonesia I will continue later as well as the late Risk OFF mode by European and US stocks (red ellipse in first chart)

Three Against One, Who will Prevail?

Now back to the Phisix.

There is big hole in the supposed Risk ON mode for the Phisix: it is called Divergence.

First of all, the Phisix rally has not been shared by the domestic currency, the Philippine peso. It is an irony to see that considering the modest net foreign buying in the Philippine Stock Exchange for the week, the peso’s decline has been accelerating. Who is doing all the selling, the locals? Why? Have they not been bullish the economy?

Second, in spite of the tightly held and controlled domestic bond markets by the banking system and the government, there have been little signs of improvement across the curve.

In fact during this week, yields have gained at varying degrees through the curve.

Yields of one month and 6 month Philippine peso denominated treasuries remains elevated despite inflation being “manageable” and “within target” story as trotted out by the BSP.

The one month yield has been up 50 basis points from December, the 6 month has also been up by more than 100 bps.

Meanwhile yields of the longer 10 year and 20 year has risen modestly compared to the shorter yields by about 80-90 bps from the lows of last year

Rising yields means that there has been selling pressure on the local bond markets. Have banks and financial institutions been selling out signs of inflation or from signs of credit strains?

Are these signs of cracks in the stranglehold by banks and the government on the local bond markets?

How much of an increase in interest rates can the Philippine financial system withstand?

The third factor has been that the price to insure debt via annual probability of default from CDS spreads has been rising for the Philippines.

Increasing CDS spreads means heightened concern over the credit quality of Philippine debt.

Again from the above are several concerns. How will the lower peso affect the financing cost of companies whose debts have been priced in foreign exchange? While there may be some companies who may benefit from weaker peso, to what extent will higher revenues from a weak peso offset rising input prices/operating costs? As for the local companies, how will higher consumer price inflation affect real demand? How will higher price inflation affect the cost of doing business, thereby profits? And how does growing concerns over quality of debt become a plus for stocks, especially for companies with substantial debt exposures?

These three factors, namely tanking peso, slumping bond prices (higher yields) and higher CDS spreads (concerns over credit quality) point to the opposite direction of the rose colored performance of the Phisix.

Obviously the current relationship isn’t sustainable. The question is who will fold? Will it be the Phisix or the latter three?

The Intensifying Emerging Market Turmoil

This brings us back to the Indonesian inspired ASEAN equity market rally.

At the start of the year I pointed out that the Indonesian government successful raised US $4 billion from global bond markets. This has prompted for a full risk ON mode for Indonesia’s financial markets as shown last week whether seen in bonds, stocks or the rupiah.

But it appears that the global bond magic, which seems to be eroding, has a very short life cycle.

Yields of Indonesian 10 year rupiah denominated bonds have skyrocketed anew to approach the former highs. The latest weakness in her bond markets seems to be reflected on the diminishing momentum of the stock market bulls in Indonesia.

I would add that the selling pressure in emerging markets financial markets have been accelerating, as this Bloomberg article entitled “Contagion Spreads in Emerging Markets as Crises Grow” notes

The worst selloff in emerging-market currencies in five years is beginning to reveal the extent of the fallout from the Federal Reserve’s tapering of monetary stimulus, compounded by political and financial instability.The Turkish lira plunged to a record and South Africa’s rand fell yesterday to a level weaker than 11 per dollar for the first time since 2008. Argentine policy makers devalued the peso by reducing support in the foreign-exchange market, allowing the currency to drop the most in 12 years to an unprecedented low.

Two issues of concern, as the article duly highlights. The concern over emerging markets is about growing risks “crises”. Since crises is plural then this means that it is not just one but many emerging markets are at risks of a crisis. Emerging markets account for 38% share of the global growth according to the Standard Chartered. A big share of EM economies hit by crises will have a negative effect on global growth.

Second, Indonesia’s first successful offering at the start of the year represents the initial tranche of the “record IDR 357.96 trillion (USD $29 billion)” bond sales it plans to conduct “from both international and local debt capital markets in 2014”.

The question is what if the current emerging market turmoil spreads to ASEAN, will the Indonesian government be able to raise money from her targeted bond sales? If yes, at what level of rates? If not will she resort to bigger taxes or more inflation by her central bank? Yet how much increase in coupon yields in the bond markets can the Indonesia’s government afford to finance the new round of debt? How will higher rates impact the political and the economic landscape?

These are stock market bullish?

Interesting no?

From the Periphery to the Core Dynamic

This leads us to the third issue. The Phisix ignored the Thursday’s selloff in US markets.

Unfortunately, instead of recovering from Thursday’s setback, the US and European stocks fell off the cliff from record highs on Friday.

The Dow Jones Industrial plummeted 1.96% or 318.24 points last Friday. Ironically the US stock market tremblor comes in the face of record optimism on the global economy.

Notes the Bloomberg:

International investors are the most upbeat about the global economy than at any time in almost five years, buoyed by the U.S.-led revival of industrial nations, according to the Bloomberg Global Poll.

I will show again the first graph above. Heavy two day losses from record high US and European markets have cumulated to losses from anywhere above 2-4% for this week (see red ellipse).

Yet based on the futures markets Friday’s losses in US and European markets may be sustained next week.

And Asian markets are expected to open on Monday deep in red territory.

The question is, have the selling pressure in US and European equities merely been a temporary profit taking shakeout or has this been the initial portent of a possible major inflection point that could lead to a Black Swan event?

The spiking yen have appears to have prompted an unwind in yen carry trades that seem to have escalated the plunge in equities of US (S&P), Europe (Stox 50) and the Nikkei.

Should selling pressures persist, will the Phisix and ASEAN markets be immune to such adverse developments?

Lastly the fear of financial instability has led China’s PBOC to infuse 255 billion yuan into the system. This has prompted for a rally in China’s stocks. How long will this band-aid treatment last?

Yet reports over anxieties on credit conditions in various parts of China continue to surface. As the Zero Hedge notes, “depositors in some of Yancheng City's largest farmers' co-operative mutual fund societies ("banks") have been unable to withdraw "hundreds of millions" in deposits in the last few weeks”.

Amidst signs of credit crunch, China’s runaway housing bubble reportedly reached record $1.1 trillion in new home sales in 2013

The Chinese will be celebrating their Spring Festival or New Year by the end of the month which is next week, for one week. It will be interesting to see how China’s financial markets will react to the escalating risk OFF mode prior to the holidays.

A bull trap according to Investopedia.com is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when, in fact, the security will continue to decline

Has the bullish consensus been right about the revival of the bull market? Or have many of these “greater fools” been suckered into a bull trap?

Will central bankers get into the picture? Will they be able to kick more cans? Yet in so far as central banks actions are concerned, Turkey’s central bank’s efforts to create a “shock and awe effect” to stop her hemorrhaging currency, the lira, has failed miserably. Certainly not a good sign.

We should expect sharp volatility in the global financial markets (stocks, bonds, commodities and currencies) in the coming sessions. The volatility may likely be in both directions but with a downside bias.

Oh don’t forget as I have been repeatedly saying, denial rallies tend to be dramatic. But they have consistently failed especially in the historical account of the PSE since 1980.

Will this time be different? Or will history rhyme?

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgzFXtYeD1nogvTgiWNDqaI2x8qlHvstPfLsysQvq8WZZ-tSTfV83cwdKB3LIdyMMy-fvXPUoynbNtH9cD4ZCmULKK0Vjehio5V1S0sAg4MeXYw9CnSQpy6L42kaSB2j7efwZkM/?imgmax=800)

No comments:

Post a Comment