The New York Times presents America’s growing number of “Dead Malls”.

Sample pictures from their slideshow:

From the New York Times: (bold mine)

Inside the gleaming mall here on the Sunday before Christmas, just one thing was missing: shoppers.The upbeat music of “Jingle Bell Rock” bounced off the tiles, and the smell of teriyaki chicken drifted from the food court, but only a handful of stores were open at the sprawling enclosed shopping center. A few visitors walked down the long hallways and peered through locked metal gates into vacant spaces once home to retailers like H&M, Wet Seal and Kay Jewelers.“It’s depressing,” Jill Kalata, 46, said as she tried on a few of the last sneakers for sale at the Athlete’s Foot, scheduled to close in a few weeks. “This place used to be packed. And Christmas, the lines were out the door. Now I’m surprised anything is still open.”The Owings Mills Mall is poised to join a growing number of what real estate professionals, architects, urban planners and Internet enthusiasts term “dead malls.” Since 2010, more than two dozen enclosed shopping malls have been closed, and an additional 60 are on the brink, according to Green Street Advisors, which tracks the mall industry.Premature obituaries for the shopping mall have been appearing since the late 1990s, but the reality today is more nuanced, reflecting broader trends remaking the American economy. With income inequality continuing to widen, high-end malls are thriving, even as stolid retail chains like Sears, Kmart and J. C. Penney falter, taking the middle- and working-class malls they anchored with them.“It is very much a haves and have-nots situation,” said D. J. Busch, a senior analyst at Green Street. Affluent Americans “will keep going to Short Hills Mall in New Jersey or other properties aimed at the top 5 or 10 percent of consumers. But there’s been very little income growth in the belly of the economy.”

Excess capacity as main culprit…

One factor many shoppers blame for the decline of malls — online shopping — is having only a small effect, experts say. Less than 10 percent of retail sales take place online, and those sales tend to hit big-box stores harder, rather than the fashion chains and other specialty retailers in enclosed malls.Instead, the fundamental problem for malls is a glut of stores in many parts of the country, the result of a long boom in building retail space of all kinds.“We are extremely over-retailed,” said Christopher Zahas, a real estate economist and urban planner in Portland, Ore. “Filling a million square feet is a tall order.”Like beached whales, dead malls draw fascination as well as dismay. There is a popular website devoted to the phenomenon — deadmalls.com — and it has also become something of a cultural meme, with one particularly spooky scene in the movie “Gone Girl” set in a dead mall.

The numbers…

About 80 percent of the country’s 1,200 malls are considered healthy, reporting vacancy rates of 10 percent or less. But that compares with 94 percent in 2006, according to CoStar Group, a leading provider of data for the real estate industry.Nearly 15 percent are 10 to 40 percent vacant, up from 5 percent in 2006. And 3.4 percent — representing more than 30 million square feet — are more than 40 percent empty, a threshold that signals the beginning of what Mr. Busch of Green Street calls “the death spiral.”Industry executives freely admit that the mall business has undergone a profound bifurcation since the recession.

See the slideshow and the complete article here.

The Philippine counterpart has been been in a frenetic race to build all sorts of malls (major malls, strip malls, integrated resorts) to become possibly the shopping mecca of the world.

For a country that has a per capita GDP of $6,597 (IMF, 2013), the industry has been erecting capacity more than the US whose per capita is $53,001 as I wrote back of the Philippine shopping mall bubble in 2013.

It is as if Philippine consumers have limitless pockets to spend, for the mainstream to lavishly speculate and channel enormous amount of resources on them.

Yet the feverish race to build capacity comes in the face of declining statistical household consumption growth (based on 3Q 2014 NSCB data).

The decline in household spending comes even before the surge in statistical inflation rates in the first half of 2014.

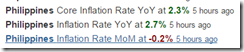

Interestingly, inflation rates have been down 2.7% in December with month on month changes at –.2% based on tradingeconomics data; NEDA data

Consumer prices even declined 0.2 percent in December from 0.1 percent drop in November notes the Tradingeconomics Blog. CPI Deflation! Spending by domestic consumers have been contracting!!! Why???

Yet the recent mall spending may have become reliant on the few that has access to the banking system where consumer loan growth rate continues to balloon (based on BSP November data).

Meanwhile, the growth contribution of the industry to the statistical economy has flat-lined, with a likely seasonal spike in wholesale trade in 2Q that petered out in the 3Q 2014. (data from NSCB)

Curiously the frantic supply side build up has been financed by surging growth of bank loans.

And interestingly too, soaring systemic banking loan growth rates comes in the face of collapsing money supply growth (data from BSP)! This has been consistent with the output of the December statistical consumer inflation data.

Where has all the money from credit growth been funneled to? Debt IN-debt OUT? What happened to the Philippine consumption boom story?!

So slowing consumption by Philippine households in the face of sustained bank financed shopping mall capacity buildup translates to excess capacity.

When the economic slowdown becomes pronounced or when the recession arrives (it will), the US version of “dead malls” will also emerge in the Philippines.

People hardly learn from either history or from developments in other nations.

No comments:

Post a Comment