I belatedly stumbled on the BSP’s November remittance data.

The official disclosure on personal remittances: Personal remittances from overseas Filipinos (OFs) reached US$2.3 billion in November 2014, higher by 1.8 percent than the year-ago level. This brought the cumulative remittances for the period January-November 2014 to US$24.4 billion, representing a year-on-year growth of 6.2 percent, Bangko Sentral ng Pilipinas Governor Amando M. Tetangco, Jr. announced today. The steady growth in personal remittances for the first eleven months of the year was supported by the sustained expansion of remittance flows from land-based workers with work contracts of one year or more (5.3 percent) as well as sea-based and land-based workers with work contracts of less than one year (7.3 percent).

The framing looks glossy of course, but here’s what the BSP didn’t say…

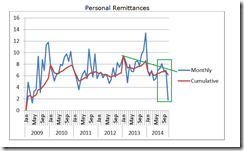

As the old saw goes: a picture is worth a thousand words.

On cash remittances, again the BSP: Likewise, cash remittances from OFs coursed through banks rose by 2 percent year-on-year to US$2.1 billion in November 2014. For the period January-November 2014, cash remittances increased by 5.7 percent to US$22 billion, compared to the US$20.8 billion registered in the same period in 2013. Cash remittances from land-based and sea-based workers reached US$16.9 billion and US$5.1 billion, respectively. The bulk of cash remittances came from the United States, Saudi Arabia, the United Arab Emirates, the United Kingdom, Singapore, Japan, Hong Kong, and Canada.

Again here is what the BSP didn’t say…

It’s their data.

Both personal and cash remittances reveal of a sharp drop in remittance growth rate as of November on a monthly basis. It’s the lowest since 2009!

Considering that November has over the past 5 years been one of the strongest months (most likely due to pre-Christmas seasonality), the collapse in November growth looks disconcerting.

On a cumulative basis, growth trends of both cash and personal remittances appears to have peaked in January 2013 and has seemingly been on a downtrend since.

So the cumulative data series (green trend lines on both personal and cash remittances charts) suggest that this may not be an anomaly but perhaps an incipient trend.

I am tempted to impute that this could be part of the repercussions of the collapse in oil prices and crashing stock markets in the Middle East.

As I recently warned: And yet how will the blowing up of the Middle East bubble extrapolate to Philippine OFW remittances? More than half or about 56% of OFWs according to the Philippine Overseas Employment Administration (POEA) have been deployed to this region. Will OFWs (and their employers) be immune from an economic or financial crisis? This isn’t 2008 where the epicenter of the crisis was in the US, hence remittances had been spared from retrenchment. For this crisis, there will be multiple hotbeds. The ongoing crashes in oil-commodity spectrum have already been showing the way.

But I will withhold judgment until more confirmation.

Yet the collapse in the growth rates of remittances seems to align or appears to be consistent with the government’s contracting or negative month on month consumer spending or consumer price inflation (CPI) data for two successive months through December (from tradingeconomics.com).

This implies of a materially slowing internal (domestic output) and external (remittances) financed consumer demand. By the way, contraction in the m-o-m in CPI means ‘deflation’ in technical lingo.

All these reveals that 4Q 2014 GDP, which will be released next week, will be very interesting.

.bmp)

No comments:

Post a Comment