Fisher was the most influential economic crank in American history. Fisher offered a simple formula that supposedly enables economists to understand the complexities of monetary policy and its effects on the price level: MV=PT. It relies on an intellectual construct, namely, the price level. This must be created by statisticians and economists. The formula does not explain cause-and-effect in terms of the transmission and spread of newly created money throughout the economy. It is totally an aggregate concept. It ignores individuals who make decisions: in government, central banks, commercial banks, and specific markets.Ludwig von Mises' theory of money begins with real central banks, real borrowers, and the spread of fiat money over time: none of which is considered by Fisher or Friedman.Fisher proved in 1929 that he was the most highly educated economic fool in the world. He went public with two predictions."There may be a recession in stock prices, but not anything in the nature of a crash." (i>New York Times, Sept. 5, 1929)"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months." (Oct. 17, 1929)Then, over the next four years, he lost his own personal fortune. He was so poor in 1933 that Yale University had to subsidize housing for him. Yet this consummate fool, whose economic theories not only led to a catastrophic personal error, but which to a great extent were responsible for the original monetary policies of the Federal Reserve, which it pursued in the late 1920s, is now heralded as some kind of economic genius. Friedman regarded him as "the greatest economist the United States has ever produced." (Money Mischief, p. 37).Fisher was a crank, and Mises exposed him as a crank within a year of the publication of Fisher's 1911 book. If you want to get an idea of how different their theories are, read Mark Thornton's article. Fisher believed that we can safely trust the government or its central bank to formulate monetary policy. He opposed the gold coin standard, because he thought it is inefficient. That was also true of Friedman. Neither of them ever understood that the free market is capable of providing a sufficient quantity of money, by means of gold mining, for a market economy. Supply and demand for goods and services are regulated by means of a private currency system that itself is created by market processes. Neither Fisher nor Friedman ever believed this. They both believed that the government must intervene in order to create a reliable monetary system, so that there can be economic growth, market clearing processes, and individual liberty. They both believed in the wisdom and power of the state with respect to the central commodity in an economy, namely, the money supply.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, January 23, 2013

Gary North on Irving Fisher: The Most Influential Economic Crank in American history

Sunday, January 13, 2013

Philippine Economy’s Achilles Heels: Shopping Mall Bubble (Redux)

An unbiased appreciation of uncertainty is a cornerstone of rationality-but it is not what people and organizations want. Extreme uncertainty is paralyzing under dangerous circumstances, and the admission that one is merely guessing is especially unacceptable when the stakes are high. Acting on pretended knowledge is often the preferred solution.

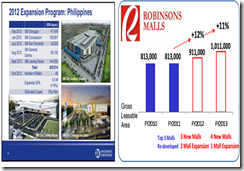

The current shopping mall boom will not only depend on a sustained low interest rate environment but will likewise depend on the greater rate of growth of income—via economic output from both formal and informal economy and from remittance transfers—relative to rate of growth of supply of malls. Debt will temporary augment spending, but has its limits.Once supply of malls grows faster than the consumer’s capacity to spend (income and debt), then trouble lies ahead.I don’t know yet how much of the banking industry’s loan portfolio are exposed to these malls. But given that the Philippine retail industry from which the shopping malls are categorized, accounts for approximately 15% of the domestic economy and 33% of the service sector and employs some 5.25 million people, representing 18% of the Philippines' workforce (according to Wikipedia.org), there is a possibility of significant exposure.This also implies that shopping malls will be faced with stiff competition among themselves. While this should be a good thing since competition should mean lower rental prices and provide more quality services, unfortunately the policy induced boom has clouded the effects of competition—giving the incentive for both consumer and investors to jump on the debt bandwagon which magnifies on such errors.It’s one thing to have bankruptcies as a result of failing to satisfy the consumers via competition, and it’s another thing when the public has been enticed to a cluster of business errors (malinvestments) which accrue from price signaling distortion brought upon by manipulated policy rates and from other forms of policy interventions.

(1) Debt liquidation leads to distress setting and to(2) Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes(3) A fall in the level of prices, in other words, a swelling of the dollar. Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be(4) A still greater fall in the net worths of business, precipitating bankruptcies and(5) A like fall in profits, which in a " capitalistic," that is, a private-profit society, leads the concerns which are running at a loss to make(6) A reduction in output, in trade and in employment of labor. These losses, bankruptcies, and unemployment, lead to(7) Pessimism and loss of confidence, which in turn lead to(8) Hoarding and slowing down still more the velocity of circulation.The above eight changes cause (9) Complicated disturbances in the rates of interest, in particular, a fall in the nominal, or money, rates and a rise in the real, or commodity, rates of interest.

The masses have never thirsted after truth. They turn aside from evidence that is not to their taste, preferring to deify error, if error seduce them. Whoever can supply them with illusions is easily their master; whoever attempts to destroy their illusions is always their victim.

Sunday, May 30, 2010

Does High Debt And Falling Credit Lead To Deflation?

``The chief source of the existing inflationary bias is the general belief that deflation, the opposite of inflation, is so much more to be feared that, in order to keep on the safe side, a persistent error in the direction of inflation is preferable. But, as we do not know how to keep prices completely stable and can achieve stability only by correcting any small movement in either direction, the determination to avoid deflation at any cost must result in cumulative inflation." Friedrich A. Hayek

Many say that huge debt loads carried by the world today would lead to deflation.

While there is some truth to this, the answer isn’t straightforward.

This mainstream view is best represented by economist Irving Fisher’s description of the events of the Great Depression, which we covered in 2008[1], ``Debt liquidation leads to distress selling and to Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes A fall in the level of prices, in other words, a swelling of the dollar.”

This simplistic narrative makes an impression that all debts are similar. Yet, this does not take into consideration the many other factors that hold sway to such an outcome, such as the monetary standard that the Great Depression operated on, regulations that limited interstate branch banking (McFadden Act[2]) which prevented banks from diversifying portfolios, the legal tender laws from central banking which prohibited the US banks from issuing their own notes[3], ‘bank holidays’ which denied depositors access to funding which equally increased uncertainty[4], and importantly the boom bust cycle or the clusters of malinvestment created by earlier monetary policies to uphold certain political interests.

According to Murray N. Rothbard[5], (bold emphasis mine)

``But a more indirect and ultimately more important motivation for Benjamin Strong's inflationary credit policies in the 1920s was his view that it was vitally important to "help England," even at American expense. Thus, in the spring of 1928, his assistant noted Strong's displeasure at the American public's outcry against the "speculative excesses" of the stock market. The public didn't realize, Strong thought, that "we were now paying the penalty for the decision which was reached early in 1924 to help the rest of the world back to a sound financial and monetary basis." An unexceptionable statement, provided that we clear up some euphemisms. For the "decision" was taken by Strong in camera, without the knowledge or participation of the American people; the decision was to inflate money and credit, and it was done not to help the "rest of the world" but to help sustain Britain's unsound and inflationary policies.”

So such storyline, which looks intellectually formalistic, sells well to the mainstream. What seems plausible is accepted without question or examining its basis.

But of course not all debts the same.

There are debts that are funded from savings and there are debts financed from ‘money from thin air’. The distinction is important because this defines the conditions that affirm or debunk the dynamics of Fisher’s debt deflation.

Dr. Frank Shostak[6] explains, ``when Joe lends his $100 to Bob via the bank, this means that Joe (via the intermediary) lends his money to Bob. On the maturity date, Bob transfers the money back to the bank and the bank in turn (after charging a fee) transfers the $100 plus interest to Joe. Observe that here money never disappears or is created; the original $100 is paid back to Joe.

"A fall in normal credit (i.e., credit that has an original lender) doesn't alter the money supply and hence has nothing to do with deflation."

``Things are, however, quite different when Joe keeps the $100 in the bank warehouse or demand deposit. Remember that by keeping the money in a demand deposit, Joe is ready to employ it at any time he likes.

``Now, if the bank lends Bob $50 by taking it from Joe's demand deposit, the bank will have created $50 of unbacked credit, out of "thin air." By lending $50 to Bob, the bank creates $50 of extra demand deposits. Thus, there is now $150 in demand deposits that are backed by only $100.

``So in this sense, the lending here is without a lender. The intermediary, i.e., the bank, has created a mirage transaction without any proper lender. On the maturity date, when Bob repays the money to the bank, that money disappears. The money supply falls back to $100, dropping by 33%.”

Robert Blumen[7] argues from the gold standard perspective,

``Suppose that on an isolated island the total money supply consisted for 1000 oz of gold and there are no fractional reserve banks. Now suppose that people lend either other various sums of money. Total debt could expand if the same money were lent and re-lent by the borrower more than once (which happens with a lot of securitized financial instruments). Suppose that total nominal debt reached 2000oz of gold, twice the money supply. Now if all of this debt defaulted (not realistic but for the sake of discussion), would there be any general deflation? No, because the money supply remained the same.”

In short, bank credit deflation as described by Mr. Fisher is conditional to debts funded by fractional banking system which causes contraction in the money supply.

According to Joseph Salerno[8],

``During financial crises, bank runs caused many banks to fail completely and their notes and deposits to be revealed for what they essentially were: worthless titles to nonexistent property. In the case of other banks, the threat that their depositors would demand cash payment en bloc was sufficient reason to induce them to reduce their lending operations and build up their ratio of reserves to note and deposit liabilities in order to stave off failure. These two factors together resulted in a large contraction of the money supply and, given a constant demand for money, a concomitant increase in the value of money.”

Yet if large debts presumptively results to a reduction in demand or a slack in credit takeup which leads to ‘deflation’, as linearly thought by the mainstream, inflation would be an imaginary event or that we would be seeing a fall in prices everywhere (see figure 8).

The upper window in figure 8 is a favourite chart by perma bears who love to spook themselves with the deflation phantom. It shows of the falling demand for credit, which according to them should be ‘deflationary’.

Yet since 2008, commercial and industrial loans have serially declined, yet inflation has been rising, after a short “foray” in the deflation territory in middle of 2009 until the end of the year.

So the deflation theory does not match real events. The reason for this is that there are many other factors, as government spending, QE, zero interest rates, steep yield curve, globalization and etc... that influences these financial, economic and political conditions.

But I see more problems for the perma bears. Commercial and industrial loans at all banks seem to cease declining and could be bottoming out. And if I am right, where the response to the yield curve will prompt for a material improvement in the health of the credit conditions by the end of the year, this chart will be excluded in the presentation for deflation.

Last word, today’s markets have been tidal driven, and there is little substance to argue for a micro based ‘decoupling’. Although inflationism has relative effects, global markets generally move in synch with the actions of the US markets. But this can be differentiated by the degree of gains or losses.

As such, the only way for the Philippine or Asian markets to outperform is for the US markets to trade sideways or head higher. Asian markets can’t and won’t defy a US crash. Nevertheless, we remain bullish with Asian markets for the simple reason that we don’t see a crash in the US markets or a redux of 2008.

[1] See Demystifying the US Dollar’s Vitality

[2] Wikipedia.org, McFadden Act

[3] Wikipedia.org, Federal Reserve Note

[4] Wikipedia.org, Emergency Banking Act

[5] Rothbard Murray N., Reliving the Crash of '29, Mises.org

[6] Shostak, Frank, Does a Fall in Credit Lead to Deflation? Mises.org

[7] Blumen, Robert Massive Debt Deflation in Store? Mises Blog

[8] Salerno Joseph T. An Austrian Taxonomy of Deflation

Sunday, November 09, 2008

Demystifying the US Dollar’s Vitality

``The Achilles Heel of the United States is the dollar. The reserve status of the US dollar is absolutely critical to the health of the US. If the dollar begins to lose it's reserve status, the US economy will be in shambles.”-Richard Russell

Some have found the recent rise of the US dollar as mystifying while the others have found the surging US dollar as a reason to gloat.

While there are many ways to skin a cat, in the same way there are many ways to interpret the US dollar’s vigorous advance, see figure 3.

Figure 3: stockcharts.com: US Dollar’s Rise Coincided with Market Breakdowns

From our end, we read the action of the US dollar index (geometric weighted average of 6 foreign currencies of major trading partners of the US) by looking at its relationship across different asset markets.

And as we can see, the dramatic surge of the US dollar index coincides with an astounding symmetry-the collapse of the oil market (lowest pane) and the equivalent breakdown of critical support levels (vertical arrows) of stock markets of the US (signified by the S&P 500- pane below center) and Emerging Markets (pane below S&P).

And market actions have fantastically been too powerfully synchronized for us to ignore its interconnectedness or the apparent simultaneous cross market activities.

While we can discuss other possible influence factors such as the shrinking trade deficits which may have contributed to a narrowing current account deficit or an improvement in US terms of trade or the ratio of export prices over import prices, the fact that the US dollar behaved in a spectacular fashion can’t be interpreted as a sudden market epiphany over some unlikely radical improvement in trade fundamentals.

What we understand was that by mid July, cracks over the financial markets began to surface with the US Treasury publicly contemplating to inject funds to support both Fannie Mae and Freddie Mac. From then, the deterioration in the financial markets accelerated which inversely prompted the skyward ascent of the US dollar. Fannie and Freddie were ultimately taken over by the US government in September.

DEBT DEFLATION Dynamics In Progress

So what could be the forces behind such phenomenon?

``Assuming, accordingly, that, at some point of time, a state of over-indebtedness exists, this will tend to lead to liquidation, through the alarm either of debtors or creditors or both. Then we may deduce the following chain of consequences in nine links: (1) Debt liquidation leads to distress selling and to (2) Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes (3) A fall in the level of prices, in other words, a swelling of the dollar. Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be (4) A still greater fall in the net worths of business, precipitating bankruptcies and (5) A like fall in profits, which in a “capitalistic,” that is, a private-profit society, leads the concerns which are running at a loss to make (6) A reduction in output, in trade and in employment of labor. These losses, bankruptcies and unemployment, lead to (7) Hoarding and slowing down still more the velocity of circulation.

``The above eight changes cause (9) Complicated disturbances in the rates of interest, in particular, a fall in the nominal, or money, rates and a rise in the real, or commodity, rates of interest.”

This according to Irving Fisher is what is known as the DEBT DEFLATION theory dynamics. As you would notice the chain of events leading to the current market meltdown and the precipitate rise in the US dollar have closely shadowed Mr. Fisher’s definition.

How?

One, a significant market of the structured finance-shadow banking system (estimated at $10 trillion) and derivatives ($596 trillion, Credit Default Swap $33.6 trillion down from nearly $60 trillion-left pane- see figure 4) have mostly been denominated in US dollars (foreign currency derivatives also mostly US dollar denominated-right pane), thus deleveraging or debt deflation means the closing and settlement of positions and payment in US dollars.

This also implies whether the counterparty is from Europe or from Asians settlement of such contract means payment in US dollars. Thus, the sudden surge in demand for US dollars can be attributed to the ongoing debt deflation-deleveraging process.

Two, cross currency arbitrage or 'carry trades' have also significant US dollar denominated based exposures.

For instance US mutual funds in 2007 totaled US $12 trillion (see Figure 5 courtesy of ICI) with 14% of the total allocated to International Stock funds or $1.68 trillion.

We may not know exactly how much of these funds flows were borrowed in order to buy into international stock funds, but the idea is, once the margin call came, highly levered funds were compelled to liquidate their positions in order to repay back their loans in US dollars.

Isn't it ironic that the epicenter of the present crisis emanated from the US and yet the debt deflation dynamics prompted a gravitational pull to the US dollar? Had these been something resembling like an Asian crisis then such dynamics would have been understandable.

The US Dollar’s Hegemon and Threats To Its Dominion

Lastly, we have always described the architectural platform of the US dollar standard as pillared upon the cartelized system of US banking network which extends to a syndicate of peripheral banks abroad or global central banks.

PIMCO’s chief Bill Gross in his latest outlook wrote a good analogy of this as a function of nuclear energy see figure 6.

From Mr. Bill Gross (all emphasis mine), ``Uranium-238 has something like 92 electrons circling its nucleus…And, importantly, uranium-238 is metaphorically quite similar to the global financial system of the past half century. At its nucleus was the overnight Fed Funds rate which, when priced low enough, led to an ever-increasing circle of productive financial electrons. The overnight policy rate led to cheap commercial paper borrowing and then leapfrogged outward and across the oceans to become LIBOR. In turn, government notes and bonds as well as markets for corporate obligations were created, leading to their use as collateral (repos), which fostered additional credit and additional growth. The electrons morphed into productive financial futures and derivatives of all kinds benefitting all of the asset classes at the outer edge of the #238 atom – stocks, high yield bonds, private equity, even homes and commodities despite their being tangible as opposed to financial assets.”

``This was how the scientists, the financial wizards with Mensa IQs, visualized the financial system a few years ago: leverageable assets held together by a central bank policy rate at its nucleus with institutional participants playing by the rules of conservative self interest and moderate government regulation. Out of it came exceptionally high returns on assets with minimal risk – the highest returns occurring with the most levered electrons farthest from the nucleus.”

Since financial flows appear to have revolved around the foundations of the US banking system with its core at the US Federal reserve, the recent logjam in US banking sector caused a ripple effect to the peripherals via shortages of the US dollar, a liquidity crunch and a subsequent scramble for US dollars which triggered several crisis among EM countries whose balance sheets have been vulnerable (excessive exposure to foreign denominated debt or currency risks, outsized current account deficits relative to GDP, excessive short term loans or highly levered domestic balance sheets).

Thus, the paucity of US dollars has compelled some nations to bypass the banking system and utilize barter (see Signs of Transitioning Financial Order? The Emergence of Barter and Bilateral Based Currency Based Trading?) such as Thailand and Iran over rice and oil. Whereas Russia and China have announced plans to use national currencies for trade similar to the recently established Brazil-Argentina (Local Currency System).

The recent crisis encountered by South Korea (heavily exposed to short term foreign denominated debt) and Russia (corporate sector heavily exposed to foreign debt) seem to be prominent examples of the US dollar squeeze.

Understanding the present predicament, the US Federal Reserve quickly extended its currency Swap lines to some emerging nations as South Korea, which has so far resulted to some easing of strains in the Korean Won, see figure 7. However, we are yet uncertain about its longer term effects although it is likely that access to the US dollar should demonstrably reduce the liquidity pressures.

The important point to recognize is that some nations have began to acknowledge the risks of total dependence on the US dollar as the world’s reserve currency and/or its banking system. A furtherance of the crisis with the US as epicenter can jeopardize global trading and finance. Hence, some countries have devised means of exchange around the present system or have been mulling over some alternative platform.

Such developments are hardly positive contributory factors that would buttress the value of the US dollar over the long term especially as the US government has been throwing much weight of its taxpayer capacity to resuscitate and bolster the present system.

Mr. Ronald Solberg, vice chairman and lead portfolio manager of Armored Wolf, in an article at Asia Times online articulates more on this (emphasis mine),

``According to Goldman Sachs estimates, the US Treasury faces an unprecedented financing need in fiscal year 2009.2 Excluding funding requirements under the Supplemental Financing Program (SFP), they estimate 2009 FY issuance at $2 trillion compared to last year’s $1.12 trillion, which itself was already outsized. This prospective amount is driven by an estimated budget deficit reaching $850 billion, funding TARP purchases of up to $500 billion and the rollover of maturing debt equal to $561 billion.

``On top of these needs, it would not be unreasonable to expect additional SFP funding requirements of $500 billion, the amount already issued to date in FY 2008 used to recapitalize the Fed’s balance sheet. The magnitude of such funding requirements will test the operational efficacy of the Treasury, requiring increased auction size, frequency and expanding maturity buckets on debt issuance, and will likely extend through FY 2009 and into FY 2010, prior to these pressures abating. Perhaps even more ominously, issue size will severely test market demand for such an avalanche of debt.”

Conclusion

All these demonstrate the two basic factors on why US dollar has recently surged.

One, this reflects the US dollar’s principal function as international currency reserve and importantly,

Second, most of the leveraged assets markets had been denominated in US dollars. And in the debt deflation dynamics as defined by Economist Irving Fisher, ``Debt liquidation leads to distress selling and to Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes A fall in the level of prices, in other words, a swelling of the dollar.”

Finally, with US government printing up a colossal amount of money within its system (yes that includes all swap lines extended to other countries as de facto central bank of the world), financing issues will be tested based on the (supply) issuance of its debt instruments and the (demand) market’s willingness to fund the present slew of government programs from internal sources (US taxpayers and corresponding rise in savings) and or from external sources (global central banks amidst normalizing current account imbalances).

We don’t buy the idea that US debt deflation will spur hyperinflation abroad which could further bolster the US dollar. Monetary inflation doesn’t necessarily require a private banking system to extend credit and inflate, because the government in itself as a public institution can inflate the system through its web of bureaucracy.

Zimbabwe is an example. Its banking system seems dysfunctional: savers don’t trust banks, the government has been using such institutions to pay for government employee salaries yet have suffered from government takeovers, while some of the banks have engaged in forex accumulation than operate normally.

Basically, Zimbabwe’s inflationary mechanism is done via the expansion of its bureaucracy to a leviathan and the attendant acceleration of the printing press operations.