In a fiat-money regime, however, increases in credit and money are not a one-off affair. As soon as signs of recession appear on the horizon, public opinion calls for countermeasures, and central banks try their best to "fight the crisis" by increasing the fiat-money supply through bank-circulation-credit expansion, thereby bringing interest rates to even lower levels. -Thorsten Polleit

At a recent speech Non-voting FOMC member and President of Federal Reserve Bank of Dallas Richard Fisher said that he was puzzled with Wall Street’s obsession with Quantitative Easing[1],

I am personally perplexed by the continued preoccupation, bordering upon fetish, that Wall Street exhibits regarding the potential for further monetary accommodation—the so-called QE3, or third round of quantitative easing.

Such a statement signifies a bizarre denial of the impact to people’s incentives of the policies implemented by the US Federal Reserve.

In response to this statement Dr. Ed Yardeni posted on his blog charts which exhibited the tight correlations between actions of the S&P 500 (as well as the TIPs) and the Fed’s bond market interventions called as the Quantitative Easing.

Writes Dr. Yardeni[2]

Let’s review the market’s medical chart to see how it responded to the injections and withdrawals of the Fed’s monetary medicine:

(1) The S&P 500 rose 36.4% during QE-1.0, which spanned from November 25, 2008 through the end of March 2010.

(2) The S&P 500 rose 10.2% during QE-2.0 from November 3, 2010 through the end of June 2011. It rose much more, by 24.1%, if we start the clock on August 27, 2010, when Fed Chairman Ben Bernanke first hinted that a second round of quantitative easing was on the way.

(3) Operation Twist was announced on September 21, 2011. Since then, the S&P 500 is up 15.9%.

(4) Between the end of QE-1.0 and Bernanke’s speech on August 27, 2010, the S&P 500 fell 9.0%. Between the end of QE-2.0 and the beginning of MEP, it fell 11.7%.

There is an even better correlation between the Fed’s QEs and expected inflation implied in the spread between the 10-year Treasury nominal and TIPS yields.

The relevance and relationship between monetary policies and financial markets has not been limited to the United States but to the global marketplace.

As I have been pointing out global stock markets have been on a tear on central bank steroids.

I plotted the Bloomberg charts of the Phisix [PCOMP:IND] along with major world’s major bourses as the US S&P 500 [SPX:IND], Japan’s Nikkei [NKY:IND] and Germany’s DAX [DAX:IND] as futher exhibit to this tight relationship.

Since the bottom in October of 2011, the wave-like motions or undulations of three bourses have almost been in identical. The difference can only be seen in the degree of gains (where Germany’s Dax has outperformed the pack).

A near synchronized motion can also be seen in the Phisix, but to a lesser scale than the developed economy peers.

The point of the above is that any perception that sees actions of specific markets as demonstrating “fundamentals” will signify as patent misimpression or a misread—that will be eventually exposed once the tide of monetary liquidity subsides.

And a further point is that I am dubious of the impact of Operation Twist to the recent market run up.

Operation Twist which was announced in September[3] during the heat of the Euro crisis was designed to manipulate the yield curve. Then the US Federal Reserve announced that their goal[4] was

to sell $400 billion of shorter-term Treasury securities by the end of June 2012 and use the proceeds to buy longer-term Treasury securities. This will extend the average maturity of the securities in the Federal Reserve's portfolio.

By reducing the supply of longer-term Treasury securities in the market, this action should put downward pressure on longer-term interest rates, including rates on financial assets that investors consider to be close substitutes for longer-term Treasury securities.

In other words, Operation Twist has been a modified QE with sterilization[5] functions (or the act of central banks to soak up new cash that would otherwise circulate in the economy).

Since sterilized monetary actions soak up freshly injected money, there won’t be similar narcotic effects on the markets as unsterilized interventions.

Instead I believe that other forms of interventions helped boosted global markets.

The US Federal Reserve opened foreign currency swap lines mainly targeted at the ECB and was also made accessible to many central banks at the end of November[6]. The announcement of the swap lines placed a floor on the plummeting S&P (as well as to major global markets) which at that time reeled from the eroding short term stimulant impact of the announcement of Operation Twist.

Also, the European Central Bank launched in December 22nd of 2011, the first round of the massive rescue program by the infusion of €489 billion of credit[7] to the European banking system through the Long Term Refinancing Operation (LTRO) facility or repurchase auctions with expanded to maturity of 36 months[8] (typically during normal times LTROs had three month maturity[9]).

Both the Fed’s Swap Lines and the ECB’s LTRO operated like a 1-2 punch.

In addition, major interventions had been conducted during February of 2012, these had a follow through effect on the market’s speculative vim.

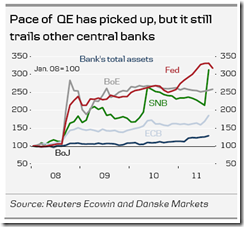

The Bank of Japan[10] along with the Bank of England[11] reengaged in more QE programs, while the ECB reopened the second round of LTROs which was met with record borrowings[12]. The second round of LTROs resulted to an expansion of the ECB’s balance sheets which has now topped the US Federal Reserve[13].

The asset purchasing program by developed central banks has been in conjunction with many major central banks slashing policy rates. This week India aggressively cut bank reserve requirements[14], while Brazil accelerated the reduction of policy rates[15].

This article has essentially captured today’s foundations which revolves around central banking actions

Reports the Dow Jones[16]

Central banking has become a global growth industry. But it is not just the size of balance sheets that's changed: so too have their composition. With rates close to zero, the U.S., U.K., Japanese and European central banks have pumped cash into the financial system. But each has chosen a different method - and will face different challenges when they try to shrink again. The growth in balance sheets has been startling: the combined assets of the four central banks will top $9 trillion by the end of March compared to $3.5 trillion five years ago, Deutsche Bank says. The European Central Bank's EUR3 trillion balance sheet is the biggest relative to the economy, at 32% of nominal euro-zone GDP, followed by the Bank of Japan with 24%, the Bank of England with 21% and the Federal Reserve with 19%. The BOE's balance sheet has expanded fastest in the crisis, more than tripling to GBP321 billion. But the change in composition and maturity profile of the balance sheets has been equally noteworthy. In January 2007, the Fed held $779 billion of U.S. Treasurys, of which 52% matured in under a year and only 19% in more than five years. Now, it holds $1.65 trillion of Treasurys, of which 57% mature in more than five years. Of the BOE’s GBP255 billion face value of gilts, 72% mature in more than five years, with 26% maturing in more than 20 years

Recently rumors of innovative QE via a reverse repo[17] have been floated. This is probably in designed as transition to the end of Operation Twist and could be part of the signaling channeled used by the Fed to see how the public would react.

Going back to the Wall Street’s fetish for QE, the answer is simple, the US Federal Reserve has been providing the narcotics and Wall Street became addicts. The inflationary dynamics has been accelerating because governments around the world has been working to protect an unsustainable welfare (and warfare) based political system that has been financed by debt and operates on the platform of cronyism.

As the great Ludwig von Mises wrote[18],

A government always finds itself obliged to resort to inflationary measures when it cannot negotiate loans and dare not levy taxes, because it has reason to fear that it will forfeit approval of the policy it is following if it reveals too soon the financial and general economic consequences of that policy. Thus inflation becomes the most important psychological resource of any economic policy whose consequences have to be concealed; and so in this sense it can be called an instrument of unpopular, i.e., of antidemocratic, policy, since by misleading public opinion it makes possible the continued existence of a system of government that would have no hope of the consent of the people if the circumstances were clearly laid before them. That is the political function of inflation. It explains why inflation has always been an important resource of policies of war and revolution and why we also find it in the service of socialism. When governments do not think it necessary to accommodate their expenditure to their revenue and arrogate to themselves the right of making up the deficit by issuing notes, their ideology is merely a disguised absolutism.

And the politics of inflation requires piggybacking inflationism one after another until the whole structure self-implodes.

[1] Fisher, Richard W. Not to Be Used Externally, but Also Harmful if Swallowed”: Projecting the Future of the Economy and Lessons Learned from Texas and Mexico Remarks before the Dallas Regional Chamber of Commerce Dallas, Texas March 5, 2012 Dallasfed.org

[2] Yardeni Ed Stocks & QE, March 8, 2011

[3] CNN Money Federal Reserve launches Operation Twist September 22, 2011

[4] Federal Reserve.gov What is the Federal Reserve's maturity extension program (referred to by some as "operation twist") and what is its purpose? September 21, 2011 Official statement FederalReserve.gov FOMC Press Release September 21, 2011

[5] Wikipedia.org Sterilization Capital account

[6] Wall Street Journal Real Times Economics Blog What Are Fed Swap Lines and What Do They Do? November 30, 2011

[7] Wikipedia.org Long Term Refinancing Operation (LTRO) European sovereign-debt crisis

[8] European Central Bank Press Release ECB announces measures to support bank lending and money market activity 8 December 2011

[9] European Central Bank, THE LONGER TERM REFINANCING OPERATIONS OF THE ECB, working paper series, May 2004

[10] See Bank of Japan Yields to Political Pressure, Adds $128 billion to QE February 14, 2012

[11] See Bank of England Adds 50 billion Pounds to Asset Buying Program (QE), February 9, 2012

[12] See Record Bank Borrowing from ECB’s Second Round LTRO March 1, 2012

[13] See ECB’s Record Balance Sheet Tops the US Federal Reserve March 7, 2012

[14] New York Times In India, Bank Moves To Stimulate Economy, March 9, 2012

[15] Bloomberg.com Brazil Accelerates Interest Rate Cuts Amid Signs of Lackluster Growth, March 8, 2011

[16] Dow Jones News Wires, Now, Sterilized QE? PrudentBear.com March 9, 2012

[17] Hilsenrath Jon 'Sterilized' Bond Buying an Option in Fed Arsenal March 7, 2012 Wall Street Journal

[18] Mises Ludwig von 3 Inflationism CHAPTER 13 Monetary Policy The Theory of Money and Credit, Mises.org