The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, February 24, 2016

Saturday, May 31, 2014

Phisix: First Quarter GDP Drop to 5.7% has hardly been about Typhoon Yolanda

"Prejudices are what fools use for reason."

Thursday, July 28, 2011

Graphic: Global Distribution of Livestock Supply

Interesting data from the Economist

THE world’s average stock of chickens is almost 19 billion, or three per person, according to statistics from the UN’s Food and Agricultural Organisation. Cattle are the next most populous breed of farm animal at 1.4 billion, with sheep and pigs not far behind at around 1 billion. China’s vast appetite helps make it the world leader in the number of chickens, pigs and sheep, whereas beef-loving Brazil and cow-revering India have the greatest number of cattle. Expressed as livestock per person, New Zealand lives up to its reputation as the world’s most productive shepherd, with 7.5 sheep for each New Zealander. It is also the second biggest cattle herdsman, with the equivalent of 2.3 cows per person, second only to Uruguay's 3.7. For chickens, Brunei rules the roost, counting 40 birds for every person.

That’s the supply side. It’s interesting to see how global trade coordinates these supplies to meet with demand. Global trade of Livestock in 2005 was reported at $33 billion

Thursday, September 09, 2010

Are Food Shortages The Result of Extreme Weather?

This news from yahoo says so,

Deadly riots in the streets of Mozambique over sharply higher food prices have left 13 dead. Anger is growing in Egypt and Serbia as well. Panicked Russian shoppers have cleared the shelves of staple grains. And the devastating floods that have left as many as 10 million Pakistanis homeless are also raising concerns about the country's ability to feed itself.

A series of isolated disasters? Not at all. The common thread: extreme weather, which is putting pressure on food supplies around the globe.

Like any politically biased article, this seems focused on a post hoc fallacy (after this, therefore because of this) argument.

Extreme weather conditions has exacerbated but not caused the existing imbalances or shortages.

In almost every instance, shortages happens when the price mechanism isn’t allowed to function.

And because agriculture is one of the most, if not the most, politically sensitive sector in any economy, it has been the least open to international commerce, hence, the inherent imbalances from the lack of trade and investments which extrapolates to reduced output or the lack of supply. In short, supply constrains have been caused by government policies which has distorted the price mechanism.

This is especially accentuated in developing economies whom lacks capital to develop idle lands which has been aggravated by aforementioned protectionist measures.

Subsequently this has resulted to a massive loss in productivity from the underlying mismatch in the yield gaps and the land availability (abundance of fallowed lands) as shown below by the most recent World Bank Study Rising Global Interest In Farmlands.

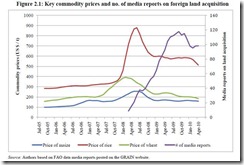

Of course, the law of demand and supply has always been at work, such that in the recent episode where food prices spiked in 2007-8 combined with the recent trends of globalization, governments have used current dynamics to exploit on these gaps by allowing for crossborder investments (seen below).

So obviously the answer to the problem of shortages is to allow markets to function, which hopefully the du jour acceptance of globalization might diffuse openness into the world’s agriculture sector.

And of course, no one has been talking about the way global governments have been printing money which has been artificially boosting demand for food and obversely depreciating value of currency relative to real goods.

For the mainstream, what is NOT sensational but real, hardly matters.

Tuesday, November 24, 2009

Will Vertical Farming Prevent A Food Crisis?

The following are the illustrated conceptual framework of vertical farming....

Now this article from CBC Canada,

Now this article from CBC Canada, ``Is it an elegant solution to pressing problems related to the food supply, or another example of putting too much faith in technology?

``That's a tough question to answer. But what is clear right now is that vertical farming is in its infancy.

``The idea is to grow food inside buildings — not conventional greenhouses, but multi-storey buildings, quite likely in cities — in closed ecosystems using hydroponics rather than soil, and without the use of pesticides.

``So far it has only been tried on a very small scale. Paignton Zoo in South Devon, U.K., for example, is growing produce to feed some of its animals.

``But advocates of vertical farming — notably Dickson Despommier, a Columbia University professor of public health — envision towering gardens in the heart of a city. Despommier, who is working on a book on the idea, sees vertical farming as part of the answer to global warming, water shortages and inner-city health problems.

The key arguments for vertical farming are these:

- Conventional farms waste water. Despommier says irrigation accounts for 70 per cent of worldwide water use, and much of that is wasted as runoff, but because it's contaminated with silt, pesticides and fertilizers, it can't be captured and reused. Vertical farms would grow crops hydroponically, in a water-and-nutrient solution, or perhaps aeroponically, using a mist of nutrient-laden water. The approach could grow the same crops with as little as 10 per cent of the water used in traditional agriculture, Despommier argues.

- Vertical farms would make it easy to grow food without chemicals. There is growing concern about the environmental effects of pesticides and fertilizers used in traditional agriculture. Some see organic farming as the answer, others argue organic farming can't deliver the yields necessary to feed the world. But vertical farming would virtually eliminate the need for pesticides because air coming in could be filtered to keep pests out, and whatever fertilizers were used could be kept within the system and out of lakes and rivers.

- Growing fresh produce in cities would make it more accessible to poor city-dwellers. As a public-health professor, this one particularly interests Despommier. "It's very difficult to find fresh produce in inner cities," he said, so people who live there tend to eat less nutritious foods. "The data is overwhelming," he added: If healthier food is available, people will eat it.

- Growing food close to where it's eaten would reduce transportation needs, which would cut greenhouse-gas emissions. Reduced use of fossil-fuelled farm machinery would also help cut emissions.

- Vertical farms would improve air quality in cities by consuming carbon dioxide and releasing oxygen.

``All this sounds too good to be true — and some people argue that it is.

``The arguments against vertical farming aren't as numerous as those for it, but one of them in particular stands out: Urban land is just too expensive for vertical farming to be commercially viable in cities."

This last statement appears to be reading present conditions into the future. Should a food crisis erupt, this equation will be radically altered-farm lands will likely be more expensive than urban lands.

Vertical farming seems designed for nations that lack agricultural lands than addressing a food crisis. That's why it is technology dependent.

As how will vertical farming impact the world today, Grant Buckler of CBC writes, ``We have never suggested that it will replace conventional agricultural systems," Bradford says.

``And whatever potential vertical farming has, it won't be realized overnight. Even Despommier, probably its most enthusiastic proponent, says the idea could take 50 years to take hold — but he does expect some significant experiments in the next couple of years."

Bottom line, we can't seek salvation from vertical farming should a food crisis emerge.

Thursday, November 27, 2008

Smelling Signs of Inflation: Stubborn High Food Prices and Shrinking Supplies

As we have been saying, media and experts have been insisting to us of the mutually reinforcing feedback loop of falling demand=falling prices centered on a global deflation theme.

But, we have been getting additional evidence of the obverse side, falling prices=falling supply!

This makes the entire episode a race to the bottom.

The chart above shows of the stubbornly high food prices despite falling prices in the commodity sphere. Yet, food prices are projected to remain high next year even under an expected recessionary environment.

From the New York Times,

``Now, even though costs for ingredients like corn and wheat have dropped, meat and poultry providers say they still have not raised prices enough to cover their increased costs. And packaged food manufacturers are unlikely to lower prices because commodity costs remain relatively high and they are still trying to rebuild eroded margins.

``Michael Mitchell, a spokesman for Kraft Foods, said that the company’s food ingredient costs this year were running $2 billion higher than in 2007, a 13 percent increase, but that the company had raised its overall prices by only 7 percent.

William P. Roenigk, senior vice president and chief economist for the National Chicken Council, said his industry had been losing money for more than a year. Chicken producers are now trying to recover those costs by reducing production, which will eventually alter the balance between supply and demand. “The time is coming when we’re going to see a very significant increase in the retail price of chicken,” he said….

``When costs go up for livestock producers, they are often unable to immediately raise prices because those prices are set on the open market, which is dictated by supply and demand. Instead, they begin reducing the size of their herds or flocks, which eventually leads to less meat on the market and higher prices. But reducing livestock production can take months to years, and in the interim it can actually suppress prices as breeding animals are slaughtered to reduce production.

``The prospect of more food inflation is inflaming a debate over its causes. Many food manufacturers and economists maintain that one culprit is government policies promoting the use of ethanol fuel made from corn.

``About a third of the corn crop is used for ethanol, putting ethanol producers in competition with livestock farmers and food manufacturers. The result, they contend, is that prices for corn are now higher and more volatile.”

So aside from the unintended consequences from ethanol subsidies, news accounts omit the fact that global government has been throwing tons of money to rescue the global financial system and the world economy and should likely impact food prices overtime.

Same account of falling prices and tighter credit equals falling supply in Brazil.

This from Bloomberg (all highlight mine),

``The collapse of global credit markets that is pushing the U.S., Europe and Japan into simultaneous recessions for the first time since World War II also threatens farmers in Brazil, the world’s biggest grower of coffee, oranges and sugar cane, the second-largest producer of soybeans and third-biggest of corn. Smaller harvests in Brazil may increase costs of commodities next year, said Andre Pessoa, an analyst at Agroconsult who conducts the country’s broadest crop survey.

``Reduced fertilizer use will lower Brazil’s soybean output as much as 2.7 percent, while corn may decline 7.3 percent, the government said Nov. 6. Brazil’s coffee harvest may drop 26 percent next year, said Lucio Araujo, the commercial director at Cooxupe, a cooperative representing 11,000 growers in the Guaxupe region.

``Brazilian growers were short of at least 15 billion reais needed to invest in crops, Agriculture Minister Reinhold Stephanes said Oct. 9. Banks and financial companies worldwide, suffering from $969.5 billion of losses and writedowns since the start of 2007, are restricting credit as they struggle to replenish reserves, according to data compiled by Bloomberg…

Ah, high Fertilizer costs has also been aggravating the supply woes, the same report from Bloomberg,

``Fertilizer costs remain high, even as funding dries up and prices fall. The price of the nitrogen-potash mix that Terra, the coffee grower, uses has more than doubled in the past year to 1,800 reais a metric ton, he said. Terra usually buys about 10 tons for his trees. This year he’ll go without.

``The lack of sufficient fertilizer will compound an already smaller crop in Brazil as trees enter the lower-yielding half of the two-year cycle for coffee harvests.

“A lot of people are ceasing to plant because it’s not viable,” the corn association’s Barbieri said. “People have lost hope.”

So of the two competing reflexivity feedback loop premises one will be umasked as a false premise.

Our guess: prepare for inflation.