These simple figures show perhaps better than lengthy disquisitions how the concentration of capital and the growth of bank turnover are radically changing the significance of the banks. Scattered capitalists are transformed into a single collective capitalist. When carrying the current accounts of a few capitalists, a bank, as it were, transacts a purely technical and exclusively auxiliary operation. When, however, this operation grows to enormous dimensions we find that a handful of monopolists subordinate to their will all the operations, both commercial and industrial, of the whole of capitalist society; for they are enabled by means of their banking connections, their current accounts and other financial operations—first, to ascertain exactly the financial position of the various capitalists, then to control them, to influence them by restricting or enlarging, facilitating or hindering credits, and finally to entirely determine their fate, determine their income, deprive them of capital, or permit them to increase their capital rapidly and to enormous dimensions, etc—Vladimir Ilyich Lenin

In this issue

The Centralization of the Philippine Banking System Magnifies Concentration and Contagion Risks

I. Centralization of the Banking System through the Eyes of Media

II. Through Loans, Universal and Commercial Banks Crowded Out Thrift and Rural/Coops Banks

III. How BSP’s Zero Bound Rates Benefited Universal and Commercial Banks

IV. How the BSP’s Policies Led to Centralization via Bank Loan Distribution

V. Centralization Means More Politics, Increasing Concentration and Contagion Risks

The Centralization of the Philippine Banking System Magnifies Concentration and Contagion Risks

The slippery slope of centralization has been enveloping the Philippine banking system. This post discusses its mechanisms and the likely repercussions.

I. Centralization of the Banking System through the Eyes of Media

The increasing centralization of the economy has been a foundational topic here.

This phenomenon is clearly demonstrated by the developments of the domestic banking system.

First, here are some quotes from major news outlets from 2022.

Citicorp, August 1, 2022: Citi today announced it had successfully completed the sale of its Philippines Consumer Business to UnionBank of the Philippines (hereafter “UnionBank”). The transaction covers Citi’s local credit card, unsecured lending, deposit and investment businesses, as well as Citicorp Financial Services and Insurance Brokerage Philippines Inc. (CFSI), which provides insurance and investment products and services to retail customers. The agreement covers related Citi staff, with approximately 1,540 consumer bank and supporting employees transferring to UnionBank.

Businessworld, June 24, 2022: ING BANK N.V.-Manila will leave the Philippine retail banking market before 2022 ends, just about three years after its foray into the space, due to uncertain global conditions that affected its operations in the country. “ING’s retail business in the Philippines was intended as the first step and foundation for a broader Asia retail banking plan. Since its launch in 2018, the business has demonstrated good progress, commercial momentum and growth potential,” the lender said in a statement on Friday. “However, the uncertain global macro situation in the last few years led to ING deciding not to expand the activities to other countries, which meant that the retail operations in the Philippines had to be re-assessed for its scalability as a standalone business,” ING Bank added.

Businessworld, December 7, 2022: HSBC PHILIPPINES is set to absorb its retail banking unit HSBC Savings Bank as the lender aims to streamline its operations in the country.

GMA News, January 7, 2022: The Bank of the Philippine Islands (BPI) on Friday announced that its merger with its wholly owned thrift bank unit BPI Family Savings Bank (BFSB) already took effect on January 1, 2022.

GMA News, January 17, 2023: The proposed merger between the Bank of the Bank of the Philippine Islands (BPI) and Gokongwei-led Robinsons Bank Corporation has secured the go signal from the Ayala-led bank’s shareholders.

Next, there are two angles from which the evidence of centralization has been taking shape: the industry's balance sheet and their distribution of loans.

II. Through Loans, Universal and Commercial Banks Crowded Out Thrift and Rural/Coops Banks

Figure 1

The principal channel from which Universal Commercial banks (UC) have been crowding out their smaller competitors has been through the loan portfolio. (Figure 1, upper chart)

Including repos and interbank loans, the UC's % share of the total loan portfolio (TLP) increased from about 84% in 2008 to over 93% in the 2H of 2022.

Unlike the TLPs, the UC % share of cash and investments were range bound or fluctuated within ranges in the same period. (Figure 1, lower chart)

So, among the assets, growth in the UC loans outpaced their rivals and thus continues to take a larger share of the industry's assets.

In figures, UC's share of the total banking assets climbed from around 87% in 2008 to over 94% over the same period.

To reiterate, the essence of the centralization of the banking system is through the loan channel.

III. How BSP’s Zero Bound Rates Benefited Universal and Commercial Banks

Why is this important?

Figure 2

Because critical to the dynamic has been the BSP's zero bound rates, which provided the UC's a decisive competitive edge. (Figure 2, upper window)

The biggest borrowers availed of cheap money from the UCs, which it used for expansion, mergers and acquisitions, market speculation, and debt rollovers. In effect, it also financed the centralization of the Non-Financial sectors.

The pandemic rescue policies accelerated the UC's advantage over their smaller contemporaries. The economic shutdown affected small and medium businesses the most, which must have affected the operations of their lesser peers.

Figure 3

Investment and loan growth of thrift banks has been in a downtrend since 2013, which led to the steady deterioration of their assets. This decay steadily eroded its share of the industry's assets. Worst, the pandemic aggravated their dilemma. To be sure, most of the mergers cited by the media are symptomatic of this industry's malady. (Figure 3, top and middle charts)

Curiously, though the YoY change of rural/coop banks has drifted sideways for most of the years, the 4Q 2020 to the present spike in lending growth recently buoyed its share of assets. Perhaps, elevated lending at the grassroots level has been representative of increased demand from the reopening and the response to inflation. (Figure 3, lowest window)

Aside from the elite-owned conglomerates taking advantage of the historic BSP rate cuts to secure cheap record loans, UCs also generated accounting profits from depressed deposit expenditures, which came at the cost of the average depositors, even when lending stalled.

The various relief measures also shielded UCs from revealing their under-the-hood conditions.

Because of the lack of data on bank closures from PDIC, one can only surmise that the smaller peers were affected most, hence the lower contribution to the industry's total assets.

Yet, the ramifications are incredible.

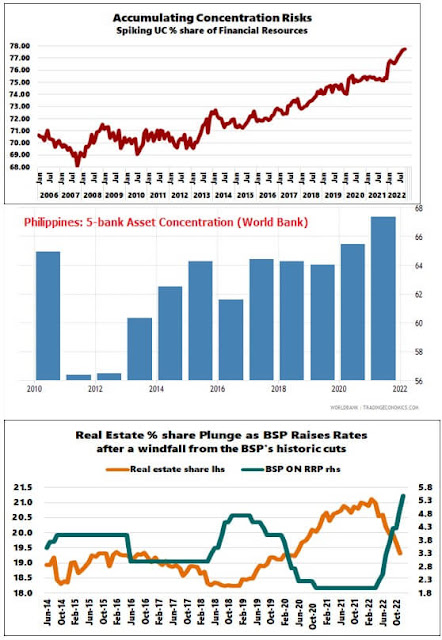

Figure 4

Last October, Universal and Commercial banks acquired an even more commanding 77.7% share of the total resources of the financial system, a jump from their pre-pandemic share of 74.35%. The uptrend in the UC share of the total financial resources started in April 2013. (Figure 4, topmost chart)

That's not all.

According to the PSA's Annual Survey of Philippine Business and Industry (ASPBI) in 2017 and 2020 of the financial industry, the number of establishments dropped by 5.7% in both periods covered.

Further, according to the World Bank's definition and data (via tradingeconomics.com), the 5-bank asset concentration reached 67.33% in 2021 and has been on an uptrend since 2011. (Figure 4, middle window)

Based on the 3Q BSP data, the cumulative assets of the top 5 banks (BDO, Landbank, BPI, Metrobank, and China Bank) accounted for 57.6% of total UC assets.

The industry morphed into "too big to fail." As evidence, the BSP launched one of the world's most aggressive rescue packages in 2020 carried through today. The BSP just inundated the financial system with a variant of QE last December.

IV. How the BSP’s Policies Led to Centralization via Bank Loan Distribution

Because bank lending has been the primary source of the marginal asset growth of the total banking industry's assets, BSP policies primarily reconfigured its distribution.

Among the biggest bank borrowers (total banking loans), the real estate industry has benefited most from the BSP's zero-bound policies. But the BSP's reversal (rate hikes) has prompted its share to plummet, or the loan growth of the other sectors has outpaced the real estate industry. (Figure 4, lowest pane)

Figure 5

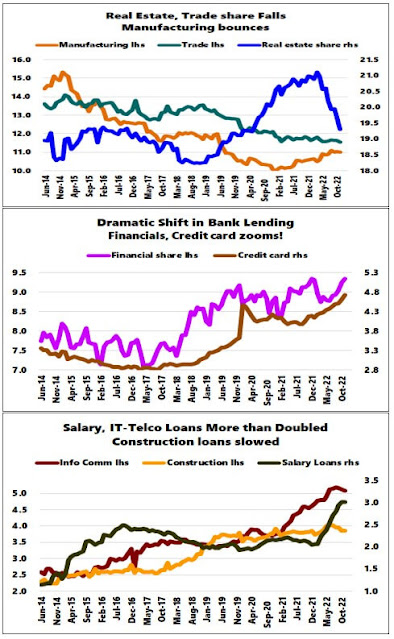

And though the manufacturing industry has recently rebounded from the global reopening, along with the trade sector, it has been a downtrend for their share of bank loans. (Figure 5, upmost window)

Meanwhile, the financial sector share of total bank borrowings hit the upside trail in 2018 as the BSP started to cut rates and reserves. The sector benefited from a tailwind in 2021 and the latter half of 2022 as domestic assets rebounded. (Figure 5, middle chart)

Consumers intensified leveraging their balance sheets through credit cards to plug the fall in their purchasing power, hence the spike in the share of bank borrowing. Many have also taken advantage of the interest cap on credit cards, which represents a subsidy to many credit card users. As an aside, the BSP revised its interest rate cap on credit cards, increasing it to 3% from 2% starting January 2023.

The other biggest gainers were the marginal sectoral borrowers, which consisted of consumer salary loans, information & communication, as well as the construction sector. (Figure 5, lowest chart)

The pandemic policies have boosted loans in the information and technology sector. The PLDT controversy could have been part of this growth.

Nonetheless, the policies of the BSP have played a crucial role in shaping the lending distribution portfolio.

The previous easy money regime inflated the significance of the real estate industry.

Even more, the phenomenal rescue of the banking system bolstered its intra-industry lending book. With this, the intra-industry portfolio amplified its share of the banking system's loan portfolio.

V. Centralization Means More Politics, Increasing Concentration and Contagion Risks

Centralization extrapolates to the increasing politicization of the industry.

This process is channeled via diminished competition, the greater importance of regulatory compliance at the expense of the consumers, and political institutions arbitrarily picking winners that results in the nurturing and entrenching systemic maladjustments or imbalances.

Proof?

From the latest BSP Financial Stability Report (2022):

The banks are also interconnected with NFCs, which poses a contagion risk. A network model allows us to visualize the linkages at which there is a growing level of concern. The presence of linkages and the emergence of conglomerates make up for an interconnected system of NFCs, banks, and non-bank financial institutions, and are what drives the economy. (BSP-FSCC, 2021)

The larger the centralization, the more vulnerable and fragile the financial system and the economy are to the risks of concentration and contagion.

Lastly, centralization and its ramifications; concentration and cartelization, also benefit the politically privileged few at the expense of society. Social inequality emanates from the prism of monetary and financial politics.

____

References

Bangko Sentral ng Pilipinas and The Financial Stability Coordination Council, Financial Stability Report 2022 P.30, December 2021 bsp.gov.ph

No comments:

Post a Comment