Most investing mistakes come from a desire to sound smart and use over-complicated metrics. Most investing legends have always broken it down into very basic calculus and an ability to abstract the noise and strip the complexity down to verifiable quantums—Carlo Casio

In this issue

BSP QE 2.0 Variant Spurs Huge PSEi 30 Rally; Falling USD Reflates Everything Bubble

I. The Link Between Bank Liquidity and PSE Peso Volume and PSEi 30 Returns

II. The Impact of the BSP QE Variant to the PSE and PSEi 30

III. Bull Trap: Sharp Rallies Are Natural Occurrences of An Inflationary Bear Market

IV. Easing Global Financial Conditions: Short Covering Powers Financial Asset Boom

BSP QE 2.0 Variant Spurs Huge PSEi 30 Rally; Falling USD Reflates Everything Bubble

The BSP's stealth QE 2.0 variant has flooded liquidity into the asset markets sending stocks and fixed-income securities higher. However, while inflationary bear market rallies tend to be sharp, it represents "bull traps." "

I. The Link Between Bank Liquidity and PSE Peso Volume and PSEi 30 Returns

This post is a sequel to "The BSP Unveils Stealth QE 2.0 (Variant)!"

Let us start this terse analysis with the following premises: the correlation and causation of the bank liquidity, the PSE turnover, and the annual returns of PSEi 30.

The correlation: since 2013, the bank's principal liquidity metric, the downside gyrations of the cash-to-deposit ratio, has coincided with the fluctuating declines of both PSE peso volume % YoY change and the PSEi 30's annual return. (Figure 1: top and middle charts)

The causation: As principal financial intermediaries, the banking institution help channels savings or disposable income into the capital markets. It also helps intermediate credit to capital markets. That said, the decline in savings growth affects bank liquidity conditions, with second-order effects on the currency or the peso turnover of the stock market (bond market too).

Consequently, these percolate into the returns of the investments (in the PSEi 30, the PSE, and fixed-income securities).

And given the limitations of the structure of the marketplace, represented by low participation rates characterized by relatively low volumes compared with its regional peers, the financial industry, led by banks, plays a critical influence in shaping returns. Only about 1% of the population has direct exposure to the stock market.

It is not a surprise that the oscillations of bank credit to the financial industry have also resonated with the fluctuations of the nominal PSEi 30 index. Perhaps, a segment of its flows could have represented intra-industry margin credit. (Figure 1, lowest window)

II. The Impact of the BSP QE Variant on the PSE and PSEi 30

This perspective should help us understand the likely influence of the BSP's QE 2.0 variant, which likely involves reducing either government or bank deposits from its portfolio. It could also be about the redemption by the BSP of its bills payable.

At first glance, it means depositors gaining access to the money stashed at the BSP or creditors paid by the latter.

It is no surprise then that such excess funds may have found their way to the stock market, which could also represent the grand design for this policy shift—to push back against the risk of credit deflation by fueling higher prices of financial assets to keep collateral values elevated.

And because financial institutions are likely the beneficiaries, these funds could have also been used to bid up domestic capital markets to improve asset values necessary for their balance sheet valuations.

Hence, for this week and for the two weeks of the year, the bank stocks of the headline index have powered the PSEi 30.

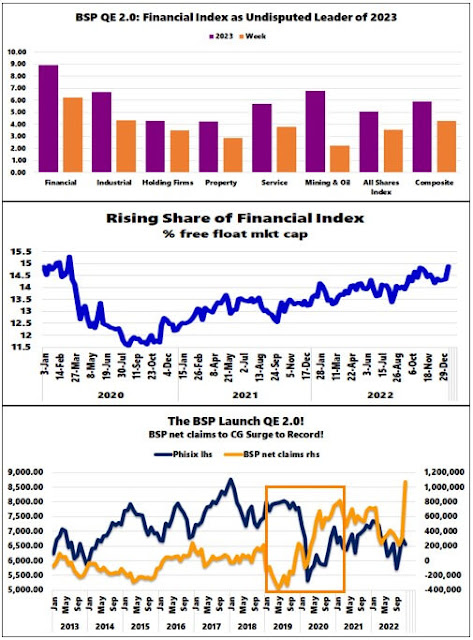

Figure 2

Although all sectoral indices were higher in the last two weeks, the financial index outsprinted its peers to soar by 8.89% in the first two weeks of 2023. The PSEi was up 4.25% this week and 5.87% in 2023. (Figure 2, topmost window)

As a % share of the free float market cap, the three top banks have consistently been climbing since the BSP's historic rescue in 2020. (Figure 2, middle pane)

Unfortunately, based on returns, the non-PSEi 30 banks have barely kept pace with them, which shows the difference between market cap heavyweight and non-PSEi members.

Yet, the present gains must have emanated from the torrent of liquidity flows from the QE 2.0 variant. (Figure 2, lowest window)

Of course, the inflationary conditions signify the critical difference in the launch of QE 2020 and its variant today.

Despite the rationalizations of the "return of the bull market" from "peak inflation," the masqueraded liquidity infusions are likely to fuel the next wave of street inflation. In 2015-2018, the PSEi 30 surfed the rising tide of the CPI. Such correlation stopped after. (Figure 3, upper chart)

Money supply, which has diverged with bank credit, will likely pick up the tempo from its recent downshift, anchored by credit-financed public spending.

In the first phase, or when the BSP unleashed QE 1.0, it sharply accelerated the upside trend of M2 in 2020 that climaxed in May 2020; but that didn't last. M2 roundtripped in just over a year. M2 grew by 6.3% in November to confirm its long-term downtrend. (Figure 3, lower chart)

All these reveal the changing phase of the impact of liquidity on asset and street prices.

III. Bull Trap: Sharp Rallies Are Natural Occurrences of An Inflationary Bear Market

Despite the emphatic assertion by some quarters, the sustainability of the so-called "return of the bull market" is highly doubtful.

Aside from the escalating leverage in the PSEi 30, the PSE, and the banking system, volatile and elevated inflation and interest rates are likely to keep any meaningful advance at bay.

Of course, institutional pumps can always bloat the gains. But artificial maneuvers will eventually succumb to economic reality.

Public debt should continue to ascend as the popular perception of economic development requires high rates of (credit and inflation-financed) deficit spending.

Increasing centralization also represents a structural political path baneful to sound economic growth.

And there are yet exogenous factors that serve as critical obstacles to the international division of labor and access to capital, labor, and investments, as well as substantial volatility and distortions in the prices of global financial assets, commodities, and services.

Figure 4

Its backdrop lacks vital structural support: relatively weak in volume (main board) and market internals represented by daily trades and daily traded issues compared to when the PSEi 30 reached the same levels powered by QE 1.0 in 2020-2021. (Figure 4)

Needless to say, sharp rallies are natural occurrences of an inflationary bear market.

Put differently, big rallies in an inflationary environment are likely a "bull trap."

IV. Easing Global Financial Conditions: Short Covering Powers Financial Asset Boom

Figure 5

Finally, reviewing the impact of BSP's QE variant on financial assets represents only one of the many aspects of the recent easing of global financial conditions. (Figure 5, highest chart)

The drastic fall of the USD has spurred massive short-covering worldwide, fueling a rally in almost everything from cryptos to fixed-income securities to meme stocks to commodities and others.

For instance, global credit markets posted their largest inflows (since June 2021) while the rebound in USD-priced industrial metals (GYX) has accelerated. (Figure 5, middle and lowest panes)

But of course, all these have been anchored on expectations of the return of the cheap money regime.

Yet, magnified volatility translates to select trading opportunities.

Be careful out there.

No comments:

Post a Comment