China remains on a week long holiday to celebrate their New Year. Yet curiously, in Hong Kong where financial markets has re-opened today, the latter's stock market greeted the New Year with a slump!

The major bellwether the Hang Seng index plummeted 3.85%. What a way to meet the New Year!

From Bloomberg:

Hong Kong stocks fell in their worst start to a lunar new year since 1994 as a global equity rout deepened amid concern over the strength of the world economy.The Hang Seng Index slumped 3.9 percent at the close in Hong Kong as markets reopened following a three-day trading closure, during which the MSCI All-Country World Index dropped 2.1 percent. The last time the gauge fell so much on the first day of the lunar new year, investors were worried about the health of former Chinese leader Deng Xiaoping...Hong Kong’s benchmark equity gauge tumbled 12 percent this year through Friday amid concern that capital outflows, a slumping property market and China’s economic slowdown will hurt earnings. Tuesday’s violence in the shopping district of Mong Kok threatens to deter mainland visitors and worsen a drop in retail sales, according to UOB Kay Hian (Hong Kong) Ltd.

The Hang Seng index have been in a full blown bear market down 34.79% from its April 2015 peak.

Yet today's selloff had been broad based. Such selloff had already been signaled by recent developments at the property sector.

Last week, media reported that Hong Kong's property bubble have begun to hiss...

From another Bloomberg report

In a city that saw demand propel property prices to a record last year, the estimate that transactions reached a 25 year-low in Hong Kong shows how quickly sentiment has turned.Home prices have slumped almost 10 percent since September and monthly sales in January fell to the lowest since at least 1991, according to Centaline Property Agency Ltd. Amid a spike in flexible mortgage rates this month and anemic demand for new developments, the low transactions volume for January is the latest evidence that prices have further to fall.

The point here is that frail conditions in China's economy has now spread to Hong Kong. Additionally, if equity markets performance of Hong Kong remains weak tomorrow, then this could foreshadow China's trading activities next week.

Worst, the feedback mechanism from Hong Kong's bursting property-stock market bubbles reinforces the emerging economic weakness that will amplify credit problems and which will feed on the ongoing asset deflation.

So China and Hong Kong's fragile and deteriorating economic and financial conditions are likely to intensify and spread within the region.

Increased social frictions are likewise ramifications of a bursting bubble. The recent riots (called as "fishball revolts") are likely to escalate too.

And speaking of contagion from China, the Australian equity bellwether the S&P/ASX 200 fell into the bear market yesterday.

Today's .95% rebound has brought the index slightly above the bear market threshold.

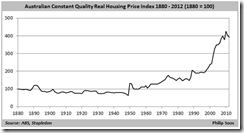

Yet this has not just been about contagion, but likewise signs of the unraveling of Australia's domestic asset bubbles.

More and more bourses have been falling into the clutches of the grizzly bears. The escalation of contagion only presages the imminence of a Global Financial Crisis 2.0.