The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Monday, March 10, 2014

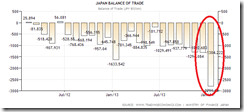

Japan’s Exports Plunge, Trade and Current Account Deficit Balloons

Wednesday, October 02, 2013

Shinzo Abe Increases Sales Tax as Japan’s Industrial Output Slumps

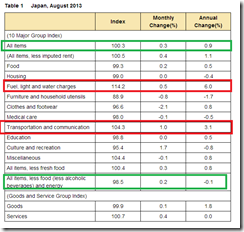

In a sign that Prime Minister Shinzo Abe’s aggressive economic stimulus has only produced mixed results at best so far, industrial production dropped a larger-than-expected 0.7% in August from the previous month, according to the Ministry of Economy, Trade and Industry on Monday. Economists were looking for a more modest 0.4% fall…By category, output for consumer durables, such as passenger cars, refrigerators, TV sets and notebook computers, fell an average 2.5%.“Recent data show that a larger portion of household income needs to be spent to pay for basic necessities, leaving much less money for discretionary items,” said the ministry official briefing reporters.The prices of daily necessities, such as energy, have been on the rise recently as businesses started passing on the higher costs of imported goods to consumers amid a sharply weaker yen.Output was also down in the important export sector. Production of capital goods, which are largely for export, fell 1.7%, despite the recent weakness of the yen, which should make Japanese exports more competitive. “Exporters are using a weaker yen to rebuild profit margins rather than cutting prices and boosting exports. We are waiting for them to start cutting prices and boosting output,” the briefer said.The only good news for Mr. Abe in the figures was itself something of a mixed blessing. There was strong demand for cement and other bridge construction materials, on demand from expressway operators. Output was up 1.3% for the fabricated metals category, and up 1.0% for the ceramics and stone category

The main unemployment reading came in at a surprisingly high 4.1% in August, the government said Tuesday, the first rise in six months and an apparent dark cloud on a day of otherwise bright economic data. It was also higher than the 3.8% predicted by economists surveyed by The Wall Street Journal.

However, logic tell us that when businesses dithers on investing, so will this be reflected on employment....unless the government goes on a hiring binge.

Prime Minister Shinzo Abe took a long-awaited decision to raise Japan's sales tax by 3 percentage points, placing the need to cut the nation's towering debt ahead of any risk to recent economic growth, as he now focuses on crafting a broader package of measures to address both problems further.Mr. Abe on Tuesday promised more stimulus to cushion the impact of the sales-tax rise on the economy, stressing the nation needs both fiscal consolidation and economic growth to end 15 years of debilitating deflation.The stimulus measures total around ¥5 trillion ($51 billion), including cash-handouts to low-income families, Mr. Abe said. On top of that, there will be tax breaks valued at ¥1 trillion for companies making capital investments and wage increases.

The reason for these outcomes is that people respond predictably to incentives – in this case, to incentives created by higher taxes. Obliged, for example, by such a tax to pay a higher price for apples, consumers will not buy as many apples as they bought before the tax hike. Similarly, obliged – because of the tax – to accept a lower take-home price on each pound of apples sold, sellers aren’t willing to sell as many pounds of apples with the tax as they were before the tax was raised.

Raising sales tax or whatever taxes will only accelerate the downside spiral of Japan’s economy. Japanese investors have already been reluctant to invest, how would higher taxes encourage investments and more economic output?

Saturday, December 01, 2012

World's Billionaires List: Indonesia Edges Out Japan

Forbes Indonesia’s latest list of the country’s richest people, released this week, sets its billionaire tally at a record 32 people and families, edging out Japan, which Forbes says is home to 28 billionaires. Last year Indonesia had 26 billionaires, according to Forbes’ calculations.While the archipelago’s crowd of coal magnates was hit hard by a plunge in coal prices, the commodities collapse was more than offset by the growing wealth of the people behind the country’s top retail, media, banking, food and tobacco companies.

While a lack of public disclosure can make it difficult to estimate exact wealth, Indonesia’s bulging batch of billionaires shows that family fortunes have been largely protected across the archipelago even as most of the world struggles with a slowdown.And though Indonesia’s billionaires club is still smaller than the ranks in China (more than 100 billionaires) and India (more than 50 billionaires), with less.

Wednesday, September 19, 2012

Inflationism and the Senkaku Islands Dispute

At the Minyanville Jonah Loeb postulates 5 factors behind the intensifying Senkaku Island dispute between Japan and China, particularly history, resources (vast oil reserves), economic stakes, provocation by both governments and impact on US presidential elections.

First below is the an abbreviated timeline of the Senkaku Dispute, the complete timeline can be seen at the Globe and Mail here

-1996: The nationalist group builds another lighthouse on another of the islands. Several activists from Hong Kong dive into waters off the islands on a protest journey. One of them drowns.

- 2002: The Japanese ministry of internal affairs starts renting three of the four Kurihara-owned islands. The other is rented by the defence ministry.

- 2004: A group of Chinese activists lands on one of the disputed islands. The then prime minister Junichiro Koizumi orders their deportation after two days.

- September, 2010: A Chinese fishing boat rams two Japanese coastguard patrol boats off the islands. Its captain is arrested but freed around two weeks later amid a heated diplomatic row that affects trade and political ties.

- April 16, 2012: Tokyo governor Shintaro Ishihara announces he has reached a basic agreement to buy the Kurihara-owned islands.

- July 7, 2012: Japanese Prime Minister Yoshihiko Noda says his government is considering buying the islands.

- August 15, 2012: Japanese police arrest 14 pro-China activists, five of them on one of the islands.

- August 17, 2012: All 14 are deported.

- August 19, 2012: Japanese nationalists land on the islands without permission.

It is important to point out the current geopolitical troubles on Senkaku essentially got resurrected in 2010-2012 when Japan’s fragile post-Lehman economy got slammed by the triple whammy natural disaster (earthquake, tsunami and nuclear power meltdown) and as China’s economy has turned south in response to the diminishing returns of the 2008-2009 stimulus as shield to the post Lehman crisis.

Meanwhile, the Bank of Japan has resorted to ever increasing amounts of quantitative easing to save the beleaguered crony banking and finance, the nuclear industry and other zombie crony firms.

Yet like the Scarborough-Spratly’s island dispute I do not believe that this has been about history nor has this been about resources, but both ideas have been peddled as popular rationalizations for the standoff.

Jonah Loeb writes,

4. Both countries' governments are being provocative. Tokyo Governor Shoharo Ishihara, an outspoken character with a long history of anti-Chinese comments, sparked the dispute by launching a public fundraiser to buy the islands from their private owners, forcing the Japanese government’s hand as China fought back against Ishihara’s bid…

5. It could have a major effect on the US presidential race. More and more American politicians, especially those on the right, have been spinning some pretty harsh anti-Chinese rhetoric for a while, and that’s only increased since this dispute started. Mitt Romney claims that he will declare China a “currency manipulator” if he’s elected, and China is therefore as suspicious of the United States as it is angry at Japan.

It is true that politicians have been stoking inflammatory statements; a Chinese general recently said that China’s military should “prepare for combat”.

In reality these are most likely smokescreens to the worsening internal problems experienced by both countries and to the mounting interventionism being applied by the increasingly desperate political authorities.

In a speech Professor Joseph T. Salerno made this very important point. (bold highlights mine)

War has a number of advantages for the ruling class. First and foremost, war against a foreign enemy obscures the class conflict that is going on domestically in which the minority ruling class coercively siphons off the resources and lowers the living standards of the majority of the population, who produce and pay taxes. Convinced that their lives and property are being secured against a foreign threat, the exploited taxpayers develop a "false consciousness" of political and economic solidarity with their domestic rulers…

The war rhetoric have been used as opportunity to deflect public opinions to a foreign bogeyman as greater interventionism are being applied to the economy

Again from Professor Salerno

A second advantage of war is that it provides the ruling class with an extraordinary opportunity to intensify its economic exploitation of the domestic producers through emergency war taxes, monetary inflation, conscripted labor, and the like. The productive class generally succumbs to these increased depredations on its income and wealth with some grumbling but little real resistance because it is persuaded that its interests are one with the war makers.

The point being:

We thus arrive at a universal, praxeological truth about war. War is the outcome of class conflict inherent in the political relationship — the relationship between ruler and ruled, parasite and producer, tax-consumer and taxpayer. The parasitic class makes war with purpose and deliberation in order to conceal and ratchet up their exploitation of the much larger productive class. It may also resort to war making to suppress growing dissension among members of the productive class (libertarians, anarchists, etc.) who have become aware of the fundamentally exploitative nature of the political relationship and become a greater threat to propagate this insight to the masses as the means of communication become cheaper and more accessible, e.g., desktop publishing, AM radio, cable television, the Internet, etc. Furthermore, the conflict between ruler and ruled is a permanent condition. This truth is reflected — perhaps half consciously — in the old saying that equates death and taxes as the two unavoidable features of the human condition.

This leads us to central banking inflationism. Today’s interventionism has become more pronounced through central bank inflationism. And war financing has intrinsically been tied with inflationism.

As Mises Institute's founder Lew Rockwell recently wrote

Through this convoluted process – a process, not coincidentally, that the general public is unlikely to know about or understand – the federal government is in fact able to do the equivalent of printing money and spending it. While everyone else has to acquire resources by spending money they earned in a productive enterprise – in other words, they first have to produce something for society, and then they may consume – government may acquire resources without first having produced anything. Money creation via government monopoly thus becomes another mechanism whereby the exploitative relationship between government and the public is perpetuated.

Now because the central bank allows the government to conceal the cost of everything it does, it provides an incentive for governments to engage in additional spending in all kinds of areas, not just war. But because war is enormously expensive and because the sacrifices that accompany it place such a strain on the public, it is wartime expenditures for which the assistance of the central bank is especially welcome for any government.

In short war gives political cover for authorities to inflate the system.

Of course, again as I previously argued, the territorial disputes could be used as an election campaign propaganda.

War has always been used as opportunities to exploit society (through financial repression) and suppress internal political opposition in order to advance the interests of the ruling political class whose interest are interlinked with the politically favored banking class, the welfare and the warfare class.

The Senkaku Island dispute has been no different.

Monday, September 10, 2012

China’s Imports Drop, Japan’s Economy Slows

Despite the recently announced $157 billion infrastructure spending based bailout, China’s economic decline continues…

From Bloomberg, (bold mine)

China’s imports unexpectedly fell and industrial output rose the least in three years, signaling more stimulus may be needed after the government last week said it approved subway and road projects across the nation.

Inbound shipments slid 2.6 percent in August from a year earlier as exports rose 2.7 percent, the customs bureau said in Beijing today. Production increased 8.9 percent, the National Bureau of Statistics said yesterday. Inflation accelerated for the first time in five months.

The data underscore risks that full-year growth in the world’s second-biggest economy will slide to the lowest in more than two decades, undermining support for the ruling Communist Party before a once-in-a-decade leadership transition due later this year. The rebound in inflation, excess capacity in some industries and banks’ bad debt risks from past monetary easing highlight the potential cost of ramping up stimulus efforts…

China’s trade surplus was a more-than-estimated $26.7 billion as imports fell for the first time since 2009 outside of the Lunar New Year, today’s report showed. Fixed-asset investment growth in the first eight months eased to 20.2 percent, yesterday’s reports showed.

Slowing imports corroborates signs of a steepening slowdown in China’s economic activities.

But for the steroid starved mainstream, inflationism has been never enough. People simply adore the idea of turning stones into bread.

However a rebound in consumer price inflation may put a kibosh on current bailout policies. (chart from Tradingeconomics.com)

Nonetheless, China’s economic deterioration gives more evidence of the seminal phase of the global stagflation dynamic

Well bad news has not been limited to China though, Japan’s economy has reportedly slowed materially.

From the same article…

Japan’s economy expanded in the second quarter at half the pace the government initially estimated, underscoring the risk of a contraction as Europe’s debt crisis caps exports, a government report showed today.

Gross domestic product grew an annualized 0.7 percent in the three months through June, less than a preliminary calculation of 1.4 percent. The nation’s current-account surplus fell to 625.4 billion yen ($8 billion) in July, the lowest for that month since 1996, according to a finance ministry report and Bloomberg historical data.

Both developments exhibit the ongoing global economic slowdown dynamic which stock markets seems to ignore.

The momentum from last week’s rejuvenated equity markets from the combined announcement of bailout packages from ECB and China has so far been carried over today.

It would be interesting to see how Chinese authorities will respond to sustained news of pronounced downswing of their economy.

China’s massive gold imports which in 2012 according to Zero Hedge, has “imported more gold than the ECB's entire official 502.1 tons of holdings” and the current inflationist bailout policies seem as conflicting political moves.

Friday, August 31, 2012

Contagion Risk: Japan’s Industrial and Consumer Prices Falls

Yesterday, I noted that despite the interventions by the Bank of Japan, retail sales have fallen markedly. Apparently, like China, Japan’s economic deterioration has been intensifying and spreading.

From Bloomberg,

Japan’s industrial production unexpectedly fell in July, adding to signs that faltering global demand is undermining the economy’s recovery.

Production slid 1.2 percent in July from June, when it advanced 0.4 percent, the Trade Ministry said in Tokyo today. The median estimate of 27 economists surveyed by Bloomberg News was for a 1.7 percent increase.

A slowdown in exports and the winding down of subsidies for car purchases are dimming the outlook for manufacturing and growth in the world’s third-biggest economy. Bank of Japan (8301) Governor Masaaki Shirakawa said on Aug. 24 that demand related to reconstruction from last year’s earthquake and tsunami is “gradually gaining momentum” and may help to sustain growth.

“Looking ahead, Japan’s economy will probably lose steam,” Kohei Okazaki, an economist at Nomura Securities Co. in Tokyo, said before the report. “Overseas demand is slowing, affecting production and capital spending.”

It’s really not about the lack of demand which has been more a symptom than the cause, but rather that much of productive capital have been diverted into unproductive undertakings through political rescues of the banking and other politically favored zombie companies.

Thus the ensuing dearth of capital spending means less output, less jobs and less demand.

And as much as Japan’s political economy has been tainted or economically weighed by crony capitalism so goes with the Western peers, thus a transmission of a global slowdown which amplifies the contagion risks.

Yet a substantial part of the economic adjustments brought about by the previous artificially inflated boom, has been liquidations of misallocated capital. Combined with lack of capital spending, the slowdown in economic activities has resulted to reduced consumer prices.

From another Bloomberg article,

Japan’s consumer prices fell for a third month in July, underscoring concern that the central bank is too optimistic about the outlook for achieving its 1 percent inflation goal.

Consumer prices excluding fresh food dropped 0.3 percent from a year earlier, the statistics bureau said in Tokyo today. That matched the median estimate in a Bloomberg News survey of economists. The jobless rate stayed at 4.3 percent, a government report showed.

Today’s data may reinforce doubts over the central bank’s efforts to reverse more than a decade of deflation as the European debt crisis hurts Japan’s economy by dragging down exports. Central bank Governor Masaaki Shirakawa last week said that it’s likely the inflation goal will be realized after the end of fiscal 2013.

“Japan is still in a deflationary phase,” Masayuki Kichikawa, Tokyo-based chief economist at Bank of America Merrill Lynch, said before today’s release. “The bad news is that the global slowdown has been prolonged so the BOJ will probably have to delay its time line to achieve the inflation goal.”

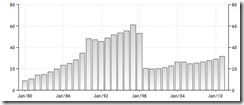

Despite bouts of negative consumer prices, which in a free economy means higher purchasing power of money out of more production, Japan’s supposed “deflation”, which has misled mainstream, has truly been about disinflation.

Notice that since the bubble bust in 1990, the Japan’s CPI index has wavered, and in times when it turned negative, the index hardly breached 1% except in 2009 to early 2010 which came in the aftermath of a global recession. (chart from tradingeconomics.com).

This is hardly “deflation” in the context of the US Great Depression which many try to erroneously correlate.

(From the Economist’s View).

The above is an example of the CPI "deflation" of the US Great Depression whose conditions are immensely dissimilar from Japan and today.

Instead, the vacillating inflation-deflation signifies as stagnation out of Japan’s sustained policies to prop up unsound and unprofitable but politically connected enterprises which has prompted for the “lost decades”, as I previously discussed.

Nonetheless the negative CPI will give the Bank of Japan (BoJ), whom will be pressured by Japan’s politicians, more excuses to expand monetary intervention via asset purchases.

So far, most of global equity markets have not factored in the intensification of a global economic slowdown which has become evident in China and Japan. Recession in the Eurozone compounds the dire global economic conditions. The US seems likely to follow.

Yet the simultaneous economic deterioration extrapolates to increasing risks of a world economic recession.

Global equity markets have artificially bolstered by the charm offensive made by central bankers on promises of rescue. But until now they have refrained from making any major moves.

If the current dynamic will worsen, and without or with less than expected central bank interventions, market expectations may shift swiftly and dramatically to incorporate the real risk environment.

Be careful out there.

Thursday, August 30, 2012

Despite BoJ’s Interventions, Japan’s Retail Sales Slump

A sharp economic retrenchment has not only been visible in China but in Japan as well

From Bloomberg,

Japan’s retail sales fell more than economists forecast in July as a winding down of government subsidies for car purchases threatens to further damp consumer spending in coming months.

The 0.8 percent decline from a year earlier was the first drop in eight months and compared with the median estimate of a 0.1 percent fall in a Bloomberg News survey of 13 economists. From a month earlier, sales slid 1.5 percent, according to data released by the trade ministry in Tokyo today. Cooler weather played a role, the government said.

Weakness in consumer demand and declining exports may make it harder for the government to prevent the economic contraction forecast for this quarter by Bank of America Merrill Lynch and Credit Suisse Group AG. Most of 274.7 billion yen ($3.5 billion) of subsidies for purchases of fuel-efficient cars is spent, with RBS Securities Japan Ltd. saying the program may run out of money next month.

“We can expect a plunge in spending in the fourth quarter because of the end of eco-car subsidies,” said Masamichi Adachi, a senior economist at JPMorgan Securities in Tokyo and a former central bank official…

Television purchases declined after a boost a year earlier from digital broadcasting replacing analog, while beer sales slipped because of cooler weather, the ministry said. Fast Retailing Co. (9983), the seller of Uniqlo brand apparel, says lower temperatures have crimped demand for summer clothing. Car sales, meanwhile, gained 32.5 percent from a year earlier.

“The government should try to boost growth momentum through immediate fiscal stimulus,” said Takahiro Sekido, a strategist at Bank of Tokyo-Mitsubishi UFJ Ltd. in Tokyo and a formerBank of Japan (8301) official. “In the second half, we will see a further slowdown in private consumption as a reflection of global uncertainty.”

Private consumption accounts for about 60 percent of Japan’s gross domestic product.

In today’s world, mainstream's logic has been emblematic of the theatre of the absurd.

The Bank of Japan (BoJ) has implemented serial expansion of her balance sheet in line with her Western contemporaries since 2008.

The BoJ lately upped her asset purchasing program to 45 trillion yen ($564 billion) from 40 trillion yen, which included massive purchases of stock market ETFs, yet all these stimulus has barely exhibited any positive effects at all.

Instead the compounded effect of such policies have only propped up the banking system and Japan’s zombie companies. (Chart above from Danske Bank)

Japan’s massive fiscal expansion in the 90s to stimulate the economy from a bubble bust have only led to a sharp deterioration in her fiscal conditions; the opposite effect of policy goals.

Japan has accrued debt to the tune of more than 200% of her GDP! This makes her a prime candidate for a default (direct or indirectly through inflation) in the face of declining population, diminishing savings and deepening crony (zombie) capitalism, as well as, competition for capital with her equally debt laden Western peers (chart above from Zero Hedge).

And this is why Japan’s intensifying political and economic predicament may prompt for a rampant exodus of capital that may find shelter in ASEAN markets which may accelerate the latter’s boom bust cycle.

And yet all these landmark money printing has done so far has been to give the Nikkei, Japan's major equity bellwether, a petty boost of nearly 7% gains year-to-date gain so far.

But the costs of these temporary gains will be much larger in the fullness of time.

Yet, after all these string of failures, the proposed solution by the mainstream has been more of the same: to have more steroids—doing things over and over again and expecting different results. Incredible.

Wednesday, July 11, 2012

Shoot the Messenger: Japan Authorities Targets Insider Trading

When markets don’t go in the way the politicians want them to, the intuitive reaction for politicians has been to shoot the messenger.

From the Bloomberg,

Japan’s crackdown on insider trading barely scratches the surface of a practice that allows traders to profit and brokerages to boost their underwriting business at the expense of shareholders and issuers.

The disclosures have undermined confidence in the world’s second-largest stock market, where the Nikkei 225 Stock Average (NKY) remains 77 percent below its 1989 peak and scandals such as the accounting fraud at Olympus Corp. and covered-up losses at AIJ Investment Advisors Co. deter investors from a waning economy.

In the five insider-trading cases uncovered since March, regulators have proposed fines for traders who short sold shares based on information leaked to them by underwriters before public offerings were announced in 2010. The revelations prompted at least two clients of Nomura Holdings Inc. (8604) to take their business elsewhere after Japan’s biggest brokerage acknowledged the breaches by its sales staff.

“Japan has been letting the animals run wild for two or three years now -- that wouldn’t happen in the U.S.,” said Takao Saga, a professor who studies the financial industry at Waseda University in Tokyo. “Insider trading is still going on in the Japan market.”

With the latest actions, the Securities and Exchange Surveillance Commission and its parent, the Financial Services Agency, are keen to show they are cracking down after it took them nine years to discover AIJ hid losses that reached $1.4 billion on pension money it managed. Olympus admitted to a $1.7 billion, 13-year coverup of losses after former President Michael Woodford blew the whistle last year on inflated fees the camera maker paid for takeovers.

Hindering Fundraising

Authorities are paying attention now because short selling by insiders is hindering corporate fundraising, not just burning investors who aren’t privy to the tips, according to consultant Robert Boxwell. The transactions involve traders selling borrowed shares, betting that the price will fall once the offerings become publicly known on concern over dilution.

“These types of insider trades cost Japan Inc. money,” said Boxwell, 54, who has lived in Japan and now studies global insider trading as director of consulting firm Opera Advisors in Kuala Lumpur. In Japan, “after years of ignoring protests from the West about cleaning up their act, they’re talking tough.”

Never mind if Japanese authorities have stubbornly refused or has procrastinated in adapting the necessary reforms and instead opted to prop up zombie institutions.

Such failure to reform has not only led to more than three decade slump in the Nikkei 225 (chart from yahoo), but also has put tremendous strains on Japan’s fiscal (debt) conditions.

Nevertheless, Japan’s authorities has joined their western peers to do more of the same thing, of escalating inflationism, which has led to their self perpetuating crisis. The Bank of Japan has even been supporting her stock markets, apparently, to no avail.

Japanese authorities repeatedly failed to comprehend that the root of their problem has not been insider trading but of having too much interventionism or excessive politicization of their markets and their economy

They should heed the prescient admonitions of the great Professor Ludwig von Mises,

The various measures, by which interventionism tries to direct business, cannot achieve the aims its honest advocates are seeking by their application. Interventionist measures lead to conditions which, from the standpoint of those who recommend them, are actually less desirable than those they are designed to alleviate. They create unemployment, depression, monopoly, distress. They may make a few people richer, but they make all others poorer and less satisfied.

Shooting the messenger and witch hunting won’t solve the problem of productivity, competitiveness and fiscal discipline. They are symptoms of the growing desperation of political authorities

To the contrary such repressive measures would only worsen the situation.

Wednesday, August 24, 2011

The Coming Global Debt Default Binge: Moody’s Downgrades Japan

The global debt default binge is in process with credit rating downgrades signifying as the initial symptoms.

US credit rating agency Moody’s today downgraded Japan.

From Bloomberg, (bold emphasis mine)

Japan’s debt rating was lowered by Moody’s Investors Service, which cited “weak” prospects for economic growth that will make it difficult for the government to rein in the world’s largest public debt burden.

Moody’s cut the grade one step to Aa3, with a stable outlook, it said in a statement today. Rebuilding costs from the March 11 earthquake and tsunami, along with continuing efforts to contain the Fukushima nuclear crisis, may make it hard for officials to meet their borrowing target this year, it said.

The first Japan downgrade by Moody’s since 2002 reflects deteriorating credit quality across developed nations from Italy to the U.S., which lost its AAA status at Standard & Poor’s this month. While the move adds to the challenges of the next Japanese prime minister, scheduled to be picked next week, the impact on bond yields may be limited by what Moody’s described as domestic investors’ preference for government debt.

The rerating has also been felt in the CDS markets…

The cost of insuring corporate and sovereign bonds in Japan against default increased, according to traders of credit- default swaps. The Markit iTraxx Japan index rose 7 basis points to 153 basis points as of 12:09 p.m. in Tokyo, on course for its highest level since June 10, 2010, according to CMA, which is owned by CME Group Inc. and compiles prices quoted by dealers in the privately negotiated market…

Today’s rating move brings Japan to the same level as China, showing the diverging paths of Asia’s two biggest economies. China replaced Japan as the world’s No. 2 last year and Moody’s has a positive outlook on its ranking

But debt acquisition won’t be curtailed despite the downgrade…

Moody’s said today’s decision was “prompted by large budget deficits and the build-up in Japanese government debt since the 2009 global recession.”

Japan’s public debt is projected to reach 219 percent of gross domestic product next year even before accounting for borrowing to fund reconstruction after the March 11 earthquake, according to the Organization for Economic Cooperation and Development.

The government has amassed a debt of 943.8 trillion yen, according to the Finance Ministry, after two decades of fiscal spending to energize an economy hobbled by the collapse of an asset bubble in 1990 and lingering deflation that’s sapped private demand. The yen’s advance to a post World War II high this year also threatens exports, a main driver of the nation’s economic growth…

The government has pledged to raise the sales tax to 10 percent by the middle of the decade, a rate that would still be below the IMF’s recommendations. The additional revenue is intended to pay for social welfare for the aging population.

Japan’s government plans total spending of 19 trillion yen over five years to rebuild after the magnitude-9 temblor and tsunami that devastated the northeast coast of Japan and triggered the worst nuclear crisis since Chernobyl.

Politicians won’t learn until forced upon by economic realities.

So the initial preemptive response to the anticipated downgrade has been to inflate the system using the recent triple whammy calamity as pretext.

Finally, it certainly is not true that current developments recognized as “fiscal austerity” have been about getting off the welfare state-big government-deficit spending path.

What has been happening instead is the political process where massive amount of resources are being transferred from the welfare state to the banking sector.

Global political leaders are hopeful that by rescuing the politically privileged interconnected banks, they can bring 'normalcy' back to the 20th century designed politically entwined institutions of the welfare state-banking system-central banking system.

Proof?

Just look how the Japanese government (and other developed governments) addresses their dilemma—mostly by raising taxes!

As the illustrious Milton Friedman once said,

In the long run government will spend whatever the tax system will raise, plus as much more as it can get away with. That’s what history tells us. So my view has always been: cut taxes on any occasion, for any reason, in any way, that’s politically feasible. That’s the only way to keep down the size of government.

So tax increases equates to the preservation of the welfare state or big government.

Unfortunately, the system has already been foundering from under its own weight. And importantly, politicians apparently blase to these risks, continue to impose measures that would only increase the system's fragility. What is unsustainable won't last.

Wednesday, March 16, 2011

The Declining Influence of Japan’s GDP

Yesterday’s widespread selloff had fundamentally been a black swan nuclear meltdown story. In other words, the market priced the uncertainty of a prospective contagion from radiation leaks.

The pivotal question is: Is the nuclear issue a systematic risk or is it a common factor risk?

One way to resolve this is to see the issue from the GDP prism.

BCA Research has this to share, (bold highlights mine)

According to IMF data, Japan’s share of global GDP has fallen over the past two decades from a high of about 10% in the early 1990s to under 6% today. Even more noteworthy is that on a purchasing power parity basis, the IMF estimates that Japanese growth has only accounted for about 1% of the world’s growth over the past five years. This is of course mostly due to the rapid expansion in emerging economies, but highlights that even without the devastating effects of last week’s earthquake, Japan is quickly becoming a small player in global growth. It also helps to explain why the blow to financial markets in the region (excluding Japan) has so far been fairly mild. In terms of the advanced economies, the country that is likely most susceptible to a slowdown in Japan is Australia – about 20% of Australia’s exports are destined for Japanese markets. Bottom line: Last week’s devastating earthquake in Japan may have limited impact outside of the country, given that global growth dynamics no longer rely heavily on a demand impulse from Japan.

Japan’s share is still substantial but has been steadily declining. Said differently, seen from the GDP perspective, the diminishing share of Japan’s GDP becomes more of a specific factor related risk—that is unless the radiation leaks spread to other nations which would transform fear into reality.

Thus, if fears from such uncertainty don’t gain ground, then the emotionally charged selloff could pose as an opportunity.

As a reminder, Japan isn’t the only source of uncertainty, but it has surely has diverted most of the public’s attention.