If you run a business, get a lot of lawyers and lobbysists. He who writes the regulations will make a lot of money. He who does not will lose. Make sure you make the right political contributions and don't say anything critical of those in power. You will need a discretionary waiver of something, and these rules are so huge and so vague, the regulators can do what they want with you. Don't be the one to get "crucified" (EPA). We live in the crony-capitalist system that Luigi Zingales describes so well. Live with it. Political freedom requires economic freedom, taught us Milton Friedman. You don't have the latter, don't expect the former.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, November 08, 2012

Quote of the Day: Business Advise: Get Lawyers and Lobbyists

Monday, July 16, 2012

Video: Repealing Obamacare Isn't Enough, Ending the Third Party Payer System is the Main Issue

Tuesday, July 03, 2012

How Obamacare will Self Destruct

Austrian economist Bob Wenzel explains. (bold emphasis mine)

It's clear that, under Obamacare, premiums will go through the roof, especially for the young. It will be cheaper for almost everyone to pay the penalty rather than buy insurance. And since, Obamacare requires that insurers take on those who already have pre-existing conditions, there is no risk for those who simply pay the penalty. If a penalty payer comes down with a catastrophic condition, he can simply buy "insurance" at that point.

This will eventually collapse the system, unless penalties are made higher than the cost of insurance (which would require congressional approval--imagine that circus).

Monday, July 02, 2012

Global Financial Markets: Will the EU Summit’s Honeymoon Last?

Intense global market volatility continues. Today’s ambiance seems conducive for adrenaline seeking high rollers.

The Philippine Phisix has been experiencing sharp volatility too. But contrary to my expectations, gyrations has swung mostly to an upside bias.

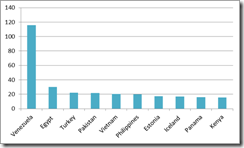

Along with Pakistan, the local benchmark has been outperforming the rest of the Asian region. The Philippine Phisix ranks as the sixth best performer based on year-to-date nominal currency benchmark returns.

Of the 71 international bourses on my radar screen, about a hefty majority or 67% posted gains on a year-to-date basis as of Friday’s close.

This hardly has been representative of a bearish mode.

In addition, the Phisix is just about a fraction or spitting distance away (1%) from the May record highs at the 5,300 level. And considering that equity markets of the US and European markets skyrocketed Friday, a new Phisix milestone record seems to be a “given”.

Repeated Doping of the Markets Triggered a RISK ON Environment

Yet global stock markets appear to be detached from real world events.

Bad news has prominently been discounted and bizarrely treated as good news. It’s a sign of abnormal conditions, as well as, the amazing complexity of the nature of markets behaving in response to massive price distortions from political actions.

Global equity markets began with their creeping ascent in June. This excludes China’s Shanghai (SSEC) index though.

Each week since, global equity markets rose on a barrage of bailout related developments. The evolving events can be categorized as actualized bailouts and events that accommodated a prospective bailout.

Spain’s bailout[1], the extension[2] of Operation Twist by the US Federal Reserve and the latest EU summit[3] could be seen as examples of the actualized bailouts. They account for as promises made good through actions.

The culmination of the Greece elections[4], the easing of collateral rules[5] and pledges for stimulus[6] signifies as both market conditioning, and of the prospective accommodation for future bailouts. People saw these events as indicators of prospective political actions

I drew and noted of the timeline of the actualized bailout events along with the chart of the major indices. Clearly we see Europe’s STOX 50, the US S&P 500 and Dow Jones Asia (P1Dow) responding to political actions.

Friday’s supposed “breakthrough” from the EU summit sent global markets into a frenzied RISK ON spiral.

The deal reportedly[7] facilitates a direct injection mechanism into stricken banks by EU’s rescue funds, particularly the temporary European Financial Stability Facility (EFSF) and the permanent European Stability Mechanism (ESM). The rapprochement also included the option of intervening in the bond markets, the waiving of preferred creditor status on ESM’s lending to Spanish banks and the creation of a “single banking supervisor” which marks the first step towards a banking union and an allegedly a backdoor route towards a fiscal union.

Since the deal has been seen as a “shock and awe” policy, and went beyond market’s expectations and partly fulfilled the mainstream’s yearnings for a union, global financial markets went into a shindig

The soaring Phisix has given some the impression of decoupling. This hasn’t been accurate. While there have been some instances of short-term divergence, decoupling or lasting divergence may not be in the cards.

What has distinguished the Phisix is her OUTPERFORMANCE. The repeated doping of the markets which has been inciting the current “recovery” benefited the Phisix and the top performers most.

Yet both developed economy markets and ASEAN markets (Thailand’s SETI, Malaysia’s MYDOW and Indonesia’s IDDOW) have virtually and coincidentally “bottomed” during the start of June and ascended in near consonance from then. The point is that the underlying trend has been similar but the returns have been different.

And since shindig from Friday’s EU summit has yet to be priced in on ASEAN markets, perhaps Monday’s open will likely reflect on the newfound euphoria.

The elation from the EU Summit deal has not been limited to the global stock markets but was likewise ventilated on the commodity markets and on the currency markets.

Gold, Oil (WTIC), Copper and the benchmark CRB or an index accounting for a basket of 17 commodities all scored hefty one day gains.

Non-US dollar currencies like the Euro likewise posted a huge one day 1.83% gain. The Philippine Peso also firmed by .7% to 42.12 to a US dollar. The Peso is likely to break the 42 levels if this momentum continues.

Overall, this is your typical RISK ON environment.

EU Summit’s Honeymoon: Sorting Out the Cause and Effects

The ultimate question is does all these represent an inflection point that favors the bulls?

Candidly speaking this “rising tide lifting all boats” scenario are the conditions that would make me turn aggressively bullish. BUT of course, effects shouldn’t be read as the cause.

In the understanding that the markets have thrived throughout June on REPEATED infusions of bailouts and rescues, my question is what happens if markets are allowed to float on its own? What happens when the effect of the bailouts fade? Or outside real political actions of bailouts, will markets continue to rise on the grounds of mere pledges or from hopes of further rescues?

The current environment seems so challenging.

Yet there seems to be many kinks or obstacles to the supposed EU deal.

First, while the premises of the EU deal have been outlined, the details remain sketchy.

Second, a change in the lending conditions of Spain’s bailout may also trigger demand for changes of other bailed out nations to seek similar terms. This may lead to more political squabbling.

Third, the ESM has yet to be ratified[8] by members of the Eurozone

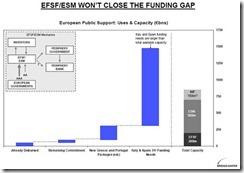

Fourth, EU’s combined capacity for the EFSF and ESM, even if complimented by the IMF, represents a little over half of the total funding requirements[9]. Thus, the proposed therapy from the EU summit will likely only buy sometime.

Fifth, the controversial deal rouse a popular backlash against Germany’s “surrender” or “blackmailed” into accepting the conditionality set by the EU. Such views have been ventilated by major media outfit[10].

Even after the German parliament immediately passed bailout pact, several German lawmakers along with opposing political groups responded swiftly by filing suites to challenge the accord at the Federal Constitutional Court[11]. Since the German President President Joachim Gauck said that he would withhold the passage of the new laws pending the resolution of lawsuits, the rescue mechanism may suffer risks of delay, or at worst, a reversal from the courts.

Sixth, the preferred path towards centralization will likely exacerbate the problems caused by regulatory obstacles and by deepening politicization of the marketplace[12]. Politicians don’t seem to get this. They have been inured to treat the symptoms and not the causes.

Yet the problems have not been confined to the EU. There remains uncertainty over China’s seemingly intensifying economic woes. The local Chinese government have reportedly resorted to selling cars to raise finances[13]. As of this writing, a new report shows that China’s manufacturing conditions have been worsening[14]. Most importantly Chinese authorities seem to be in dalliance over demand by the media for more rescues.

Developments in the US have not been upbeat either. The Supreme Court’s upholding of the Obamacare will have massive impacts to the economy and to US fiscal balances[15]. “Taxmaggedon” or massive tax increases[16] slated for 2013 out of the expiration of tax policies may also impact the economy. There is also the contentious US debt ceiling debate. All three are likely to become critical issues for the coming US elections, this November.

Importantly the rapid deceleration of money supply is likely to pose as a headwind for the US markets as well as the economy.

Bottom line:

Yes momentum may lead global markets climb the wall of worry over the interim. But the dicey cocktail mix of political deadlock, escalating economic woes and the uncertain direction of political (monetary) policies contributes to the aura of uncertainty that may induce a fat tail event.

[1] See Expect a Continuation of the Risk ON-Risk OFF Environment June 11, 2012

[2] See US Federal Reserve Extends Operation Twist, Commodities Drop June 21, 2012

[3] See Markets in Risk ON mode on Easing of EU’s Debt Crisis Rules June 29, 2012

[4] See Shelve the Greece Moment; Greeks are Pro-Austerity After All, June 18, 2012

[5] See ECB Eases Collateral Rules as Banking System Runs out of Assets, June 23, 2012

[6] See From Risk OFF to Risk ON: To Stimulus or Not?, June 7, 2012

[7] Reuters.com EU deal for Spain, Italy buoys markets but details sketchy, June 29, 2012

[8] Wikipedia.org, Ratification European Stability Mechanism

[9] Zero Hedge Last Night's Critical Phrase "No Extra Bailout Funds", June 29, 2012

[10] Telegraph.co.uk EU Summit: How Germany reacted to Merkel's 'defeat', June 30, 2012

[11] Bloomberg.com Germany’s ESM Role, EU Fiscal Pact Challenged in Court June 30, 2012

[12] See What to Expect from a Greece Moment, June 17, 2012

[13] See Out of Cash, Local Chinese Governments Sell Cars, June 27, 2012

[14] See Deeper Slump in China’s Manufacturing, Will Bad News Become Good News? July 1, 2012

[15] See Obamacare’s 21 New or Higher Taxes for the US economy, July 1, 2012

[16] Heritage Foundation Taxmageddon: Massive Tax Increase Coming in 2013, April 4, 2012

Sunday, July 01, 2012

Obamacare’s 21 New or Higher Taxes for the US economy

The Supreme Court’s upholding of Obamacare will translate to 21 new or higher taxes for the US economy.

Ryan Ellis enumerates them (hat tip Bob Wenzel)

1. Individual Mandate Excise Tax(Jan 2014)

2. Employer Mandate Tax(Jan 2014)

3. Surtax on Investment Income ($123 billion/Jan. 2013)

4. Excise Tax on Comprehensive Health Insurance Plans($32 bil/Jan 2018)

5. Hike in Medicare Payroll Tax($86.8 bil/Jan 2013)

6. Medicine Cabinet Tax($5 bil/Jan 2011)

7. HSA Withdrawal Tax Hike($1.4 bil/Jan 2011)

8. Flexible Spending Account Cap – aka“Special Needs Kids Tax”($13 bil/Jan 2013)

9. Tax on Medical Device Manufacturers($20 bil/Jan 2013)

10. Raise "Haircut" for Medical Itemized Deduction from 7.5% to 10% of AGI($15.2 bil/Jan 2013)

11. Tax on Indoor Tanning Services($2.7 billion/July 1, 2010)

12. Elimination of tax deduction for employer-provided retirement Rx drug coverage in coordination with Medicare Part D($4.5 bil/Jan 2013)

13. Blue Cross/Blue Shield Tax Hike($0.4 bil/Jan 2010)

14. Excise Tax on Charitable Hospitals(Min$/immediate)

15. Tax on Innovator Drug Companies($22.2 bil/Jan 2010)

16. Tax on Health Insurers($60.1 bil/Jan 2014)

17. $500,000 Annual Executive Compensation Limit for Health Insurance Executives($0.6 bil/Jan 2013)

18. Employer Reporting of Insurance on W-2(Min$/Jan 2011)

19. Corporate 1099-MISC Information Reporting($17.1 bil/Jan 2012)

20. “Black liquor” tax hike(Tax hike of $23.6 billion)

21. Codification of the “economic substance doctrine”(Tax hike of $4.5 billion).

Read the explanation or details here

All these will negatively impact corporate profits, business investments, employment and productivity.

Yet all these means more bureaucracy, greater government spending, MORE Fiscal DEFICITS and SURGING DEBTS.

Add Obamacare to the existing welfare, warfare and other growing spending programs, a Greece crisis seems like a destiny.

This means that the US Federal Reserve will only continue to pump massive amounts of money to system into prevent interest rate from rising. An upward trend of interest rates will jeopardize funding for all these social spending programs.

This possibly extrapolates to continuation of the US Federal Reserve as the buyer of last resort.

Put differently, inflationism will function as the lipstick on the pig for these economically unsustainable programs. One would already note that interest on debt already exceeds many spending programs. (charts from Heritage Foundation)

Sometimes you’ve got to wonder: Are these purposely designed to destroy society?

Updated to add: Since the Heritage chart embed didn't work out as I expected, I had to redo the entire post.

Video: Robert Reich on the Shocking Truth about Obamacare

Friday, June 29, 2012

Video: The Difference between Obamacare and Medicare; What to Expect Next

(thanks to Learn Liberty's Tim Hedberg for the video)

Meanwhile Cato's Chris Edwards has an amusing satire of what to expect next after the Supreme court's decision on Obamacare

Federal Broccoli Act of 2013: Eat your broccoli, else pay the IRS $1,000.

Federal Recycling Act of 2014: Fill your blue box and put on the curb, else pay the IRS $2,000.

Federal Green Car Act of 2015: Make your next car battery powered, else pay the IRS $3,000.

Federal Domestic Jobs Act of 2016: Don’t exceed 25 percent foreign content on family consumer purchases, else pay the IRS $4,000.

Federal Obesity Act of 2017: Achieve listed BMI on your mandated annual physical, else pay the IRS $5,000.

Federal National Service Act of 2018: Serve two years in the military or the local soup kitchen, else pay the IRS $6,000.

Federal Housing Efficiency Act of 2019: Don’t exceed 1,000 square feet of living space per person in your household, else pay the IRS $7,000.

Federal Population Growth Act of 2020: Don’t exceed two children per couple, else pay the IRS $8,000.

Quote of the Day: Obamacare is Against a Free Society

Today we should remember that virtually everything government does is a 'mandate.' The issue is not whether Congress can compel commerce by forcing you to buy insurance, or simply compel you to pay a tax if you don’t. The issue is that this compulsion implies the use of government force against those who refuse. The fundamental hallmark of a free society should be the rejection of force. In a free society, therefore, individuals could opt out of “Obamacare” without paying a government tribute.

Those of us in Congress who believe in individual liberty must work tirelessly to repeal this national health care law and reduce federal involvement in healthcare generally. Obamacare can only increase third party interference in the doctor-patient relationship, increase costs, and reduce the quality of care. Only free market medicine can restore the critical independence of doctors, reduce costs through real competition and price sensitivity, and eliminate enormous paperwork burdens. Americans will opt out of Obamacare with or without Congress, but we can seize the opportunity today by crafting the legal framework to allow them to do so.

That’s from Ron Paul commenting on today’s Supreme Court ruling

Saturday, June 23, 2012

Video: Can the Federal Government Mandate Health Insurance?

From LearnLiberty.org.

States can require people to buy insurance for automobiles and health care. So why can't the federal government? According to Professor Elizabeth Price Foley, the U.S. Constitution gives the federal government limited and enumerated powers that confine it. The Constitution gives different powers to the states than it does to the federal government. Just because states have the power to establish mandates for insurance does not suggest that the federal government has the same power.

Thanks to Learn Liberty's Tim Hedberg for the video.

Friday, July 30, 2010

Graphic: Obamacare And The Law

This is how the Obamacare is supposedly structured...

chart from Joint Economic Committee (Republican) /hat tip Daniel Mitchell of Cato

According to Frederic Bastiat, [The Law (p.69)] (all bold emphasis mine, italic original)

The mission of the law is not to oppress persons and plunder them of their property, even though the law may be acting in a philanthropic spirit. Its mission is to protect persons and property. Furthermore, it must not be said that the law may be philanthropic if, in the process, it refrains from oppressing persons and plundering them of their property; this would be a contradiction.

The law cannot avoid having an effect upon persons and property; and if the law acts in any manner except to protect them, its actions then necessarily violate the liberty of persons and their right to own property.

The law is justice--simple and clear, precise and bounded. Every eye can see it, and every mind can grasp it; for justice is measurable, immutable, and unchangeable. Justice is neither more than this nor less than this.

A law that is perplexing in complexity like the Obamacare exemplifies or embodies what we call as arbitrary law--a law opposed to the fundamental concept of clear, precise and bounded (observable), of protecting property rights and of equal treatment of application (enforceability). Hence, Obamacare is unlikely a law that would serve to promote its mission--social justice.

Monday, March 29, 2010

What Obamacare and Rising Yields Mean

``The public will think the health-care system is what Democrats want it to be. Dissatisfaction with it will intensify because increasingly complex systems are increasingly annoying. And because Democrats promised the implausible -- prompt and noticeable improvements in the system. Forbidding insurance companies to deny coverage to persons because of preexisting conditions, thereby making the risk pool more risky, will increase the cost of premiums. Public complaints will be smothered by more subsidies. So dependency will grow.” George F. Will, A battle won, but a victory?

One of the seemingly uneventful but seismic political shifts just occurred in the US.

Last week, President Obama’s signature health reform program, the Obamacare, had finally been forced into a law through procedural manipulations, in both the House of Congress dominated by President’s Obama’s party.

With over a year in power, and with elections drawing nearer, the risks of a decline in the political power held by the Democratic Party eventually prompted a desperate power manuever. As an old saw goes, what are we in power for? Or to quote Emmanuel Rahm, White House’s Chief of Staff popular view on the last crisis, `` it's an opportunity to do things you think you could not do before.” That could have been the rallying cry of the progressives, in passing a highly unpopular law, regardless of the public’s opinion, as manifested in almost every polls.

So only after a year in office has President Obama successfully convinced several dissent partymates to shift sides, after several horse trading and compromises, from initially opposing his European style welfarism.

There could be several reasons why the market seemed to have discounted the enactment of Obamacare.

One, markets already expected the eventuality of this program considering the dominance in the political spectrum by President Obama’s Democratic Party.

Two, markets assumed that since many parts of the law will take place years from now, the adverse affects will unlikely have an impact soon. Besides, with Senate elections slated this year, there could be manifold amendments that result to a massive facelift.

Three, markets may not be the normal functioning markets as we know of. Like most US markets today, they could be under the influence of various agencies of government, just possibly in disguise.

Fourth, the initial impact of the Obamacare, ignored mostly by mass media and the experts, could possibly be the surge in yields of the US treasuries, which came a day late.

Obamacare Equals Greater Risks Of Fiscal Wreck

How can Obamacare be related to rising yields? In essence; increased government spending.

There is one thing we can be sure of; when government promises to curb deficits or produce savings with massive new redistribution program, it is likely to be unfulfilled.

In the case of the US Medicare, which was signed into a law in July 30, 1965[1], the initial estimates and actual expenditures turned out to be…you guessed it, was a mile apart. (see figure 4)

Cato’s Daniel Mitchell refers to the testimony of Robert J Myers to the Joint Economic Committee as evidence, ``The federal government’s ability to predict healthcare spending leaves much to be desired. When Medicare was created in the 1960s, the long-range forecasts estimated that the program would cost about $12 billion by 1990. It ended up actually costing $110 billion that year, or nine times more than expected.[2]”

Government estimates that Obamacare’s spending will be modest, ``The CBO estimates the bill would cost $940 billion over a decade and that it would cut the deficit by $130 billion in the first 10 years and some $1.2 trillion in the second 10 years” notes the MSNBC.

However, Alan Reynolds of Cato argues otherwise, saying that government spending will vastly accelerate after the next 4 years[3], [bold emphasis mine, italics his]

``In fact, new spending is negligible for four years. At that point the government would start luring sixteen million more people into Medicaid’s leaky gravy train, and start handing out subsidies to families earning up to $88,000. Spending then jumps from $54 billion in 2014 to $216 billion in 2019. That’s just the beginning.

``To be unduly optimistic (more so than the CBO), assume that the new entitlement schemes only increased by 7% a year. At that rate spending would double every ten years — to $432 billion a year in 2029, $864 billion a year in 2039, and more than $1.72 trillion by 2049. That $1.72 trillion is a conservative projection of extra spending in one year, not ten. How could that possibly not add to future deficits?

``Could anyone really imagine that the bill’s new taxes and fines could possibly grow by 7% a year? On the contrary, most of the claimed revenues are either a timing fraud (such as treating $70 billion for long-term care premiums as newly found treasure) or self-defeating. The hypothetical tax on Cadillac plans (suspiciously postponed until 2018), for example, is designed to discourage such plans from being offered by employers or wanted by employees — that is, it’s designed to yield less and less over time.”

Figure 5: US Treasury on Government Debt Estimates and Heritage.org on welfare programs

Figure 5: US Treasury on Government Debt Estimates and Heritage.org on welfare programs

In the Secretary of the Treasury’s ‘2009 Financial Report of the United States Government’ report which does not include the Obamacare in its estimates, it recently warned (see figure 5 left window), ``But the Government must simultaneously address the medium- and long-term fiscal imbalance resulting from past budget deficits, the impact of the economic downturn, and demands on the nation’s social programs, notably Medicare, Medicaid, and Social Security. As currently structured, the Government's fiscal path cannot be sustained indefinitely and would, over time, dramatically increase the Government's budget deficit and debt.[4]” [emphasis added]

So Obamacare is likely to shorten the reckoning period for the current unsustainable path of growing fiscal risks from a vastly expanding welfare program.

Politicization of US Healthcare

Moreover, the 2,400 page law is a quagmire of bureaucracy[5]. This means much of the America’s healthcare will be politicized and effectively rationed by the unelected officials. And the traditional symptoms from increased bureaucracy will likely adversely impact health care distribution via more red tape, cost overruns, risks of fraud, risks of corruption, shortages, delays in payment, higher taxes on the wealthy, delayed or waiting list treatment, possibly reduced payments to hospitals and physicians, diminished competition and innovation and etc.

Hence, rising taxes, added regulatory compliance and more bureaucracy is likely to lead to lesser productivity, reduced incentives for entrepreneurship and competition or an increase in the cost of doing business or higher economic cost structures.

Protectionists are likely to blame other countries for job losses anew, when redistribution programs as massive as this would likely be a major factor in reducing investments.

This, is aside from, the prospects of heightened inflation and credit risks which may have seminally manifested itself on the treasury markets, last week. Of course as explained above, the sweetspot of inflation may blur such risks for now.

As Robert Higgs aptly explains[6], ``because health-care-related economic activity is such a huge part of the overall economy, what happens in this sector will have significant consequences for the operation of other sectors. For example, when Obamacare turns out to be much more costly than the government has claimed it will be, the government’s demand for loanable funds will be greatly increased, with far-reaching effects on interest rates, investment spending, economic growth, and even the U.S. Treasury’s creditworthiness. It is not inconceivable that the burden of supporting this health-care monstrosity will prove to be the (load of) straw that breaks the back of the government camel in the credit markets, where the U.S. Treasury has long been able to borrow the greatest amounts at the lowest rates of interest because its bonds were considered virtually riskless” [bold highlights mine]

Nevertheless one of the investment opportunities from the pollicisation of American health care, which concerns us non-Americans, should be off shore or medical tourism.

The rest will just be more like today, more offshoring and outsourcing and diversification in search for cost effective ways to maximize profits.

[1] Medicare, Wikepidia.org

[2] Mitchell, by Daniel J Will Federal Health Legislation Cause the Deficit to Soar? [Joint Economic Committee, “Are Health Care Reform Cost Estimates Reliable?” July 31, 2009. The JEC cites 1967 testimony by Robert J. Myers.]

[3] Alan Reynolds, Cato.org, It’s NOT a Health Bill, NOT a Medicare Tax and It Can’t Possibly Cost Only $940 Billion

[4] Secretary of the Treasury, Director of the Office of Management and Budget (OMB) and and Acting Comptroller General of the United States, “2009 Financial Report of the United States Government,”

[5] Businessweek, Obamacare's Cost Scalpel

[6] Higgs, Robert The Health-Care Reform Act: Que Paso?, Independent.org