I have been pointing out here how China’s bubbles are consequences of financial repression policies, with particular weight on inflationism.

Now comes a report saying that the main beneficiaries of blowing bubbles—the government, particularly the local government—have been hooked on the said policies.

Local governments in China are growing ever more addicted to revenue from land sales.That’s the takeaway from China’s Ministry of Land and Resources, which issued its second-ever annual report on land resources in China this week.According to the report, last year, local government officials sold 367,000 hectares of land, up 14% from the year before. The sales were a bonanza for local government finances, raising 4.2 trillion yuan ($682 billion), a 56% increase over the previous year.

Through bubble blowing policies, not only does the government get increased revenues from inflated earnings, such has also helped the local governments attain economic growth targets imposed by the national government partly through land sales.

Since local governments are responsible for about 70% of spending while receiving only 50% of tax revenues as shown in the left pane from the IMF, land sales signify as one important source of alternative funding for local government projects. The IMF chart in the right pane shows land sales as a share of revenues of select cities and of the national government.

Aside from land sales, the bigger source of local government bubble activities has been financed by debt.

China’s bubbles have been fueled by local government “investment” spending meant to attain economic growth targets. Much of these “investments” have been channeled through a construction binge, which became pronounced when the Chinese government launched a gargantuan (US $586 billion) stimulus as shield against the global crisis in 2008-2009.

And since local governments are legally not allowed to borrow, they have circumvented such rules by creating local government controlled special purpose units called LGFV (local government financing vehicles).

However when the national government tightened bank lending to LFGVs, the latter opted to secure financing via shadow banks.

Bubble blowing activities by local government units in response to negative real rates and to a political system which imposes growth targets at the local level have led China's local government units to swim in debt reportedly to the tune of US$2.9 trillion as of June 2013 as earlier discussed.

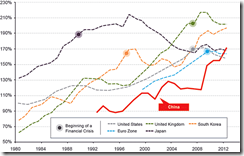

And this has not just been the local government, according to an analyst from Bank of America Merrill Lynch, compared with other countries, China’s private sector generated the most debt between 2008-2012

In short China’s economic 'state capitalism' model has been pillared by credit inflation which local governments has been chronically hooked to. Take away these artificial props and the whole credit house of cards falls.

The article also reveals signs of failed central planning: (bold mine)

Meanwhile, the government also made significantly more land available for residential and commercial purposes last year, up 20% and 28%, respectively. Sales of both kinds of land are significantly more lucrative than, say, land used for infrastructure construction and land used for industry, mining and warehousing, two other categories mentioned in the report. The amount of land set aside for infrastructure fell by 6% in 2013, while the land for industry, mining and warehousing only increased by around 1%.That’s a marked change. In previous years, the government tended to emphasize land for infrastructure more, setting aside 338,500 hectares of such land in 2012, a more than fivefold increase over what was dedicated to such use in 2008. During that same period, land for industry, mining and warehousing use increased 123%, compared with only 85% for residential land.At the time, the hope was that construction of more industrial parks and infrastructure would attract investment. But for many cities, such dreams haven’t materialized. Instead, the result is densely packed city-centers surrounded by sprawling suburbs left to stray dogs and tumbleweed.According to a recent report by the World Bank, if Shenzhen had the same urban density as Seoul, it could accommodate an additional 5.3 million residents.Now, it appears, local governments are finding that lucrative residential and commercial land sales are a quicker way to make a buck. But such appetite—and the prospect of even more people being forced off their land—is worrisome to the central government, which wants to ensure the country remains agriculturally self-sufficient.

So China's national government will have a very challenging balancing task of shifting economic activities away from the local (and national) government and into the private sector while at the same time dealing with a system burdened by excessive debt without falling into a crisis.

But such transition will hardly be smooth since authorities will be hampered by the knowledge problem (they have some idea of the problem but they don't know the particulars of the millions of moving parts of economic activities operating within her boundaries), and importantly, as mentioned above, there are huge entrenched “addicted” interests involved.