Neither one of them has the vaguest idea what Austrian free-market hard-money economics is all about. But at the same time they know how to play the game and they represent a one party system…There is essentially no difference between one administration and another, no matter what the platform.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, October 13, 2012

Video: Ron Paul on the US Presidential Elections: It's a One Party System

Saturday, September 22, 2012

QE Forever and Obama’s Re-election

Mitt Romney, Republican presidential candidate, lately announced that should he win the presidency this November, according to a Bloomberg article, “he wouldn’t reappoint Bernanke, raising questions about the succession more than a year before Bernanke’s term expires in January 2014.”…

In the knowledge that the Fed can tweak policies to favor the stock markets, and in the prospects that Mr. Bernanke will be out of work from a Romney presidency, then the most likely guiding incentive for Mr. Bernanke will be to work to retain his tenure by promoting the re-election of President Obama through “stock market friendly” policies in September or October.

Earlier, expectations from Bernanke’s repeated signaling of QE 3.0 prompted US stock markets to surge.

The realization of QE forever accelerated this bullish momentum where the S&P 500 has reached a milestone (December 2007) high.

And since the announcement of the QE ‘Forever’…

This is one example of how policies have been used to promote the self-interests of political agents.

Friday, September 14, 2012

I Told You So Moment: US Fed’s Bernanke Unveils Open Ended QE 3.0 Bazooka

I guess this serves as another “I told you so moment”.

From Bloomberg,

The Federal Reserve said it will expand its holdings of long-term securities with open-ended purchases of $40 billion of mortgage debt a month in a third round of quantitative easing as it seeks to boost growth and reduce unemployment.

“We’re looking for ongoing, sustained improvement in the labor market,” Chairman Ben S. Bernanke said in his press conference today in Washington following the conclusion of a two-day meeting of the Federal Open Market Committee. “There’s not a specific number we have in mind. What we’ve seen in the last six months isn’t it.”

Stocks jumped, sending benchmark indexes to the highest levels since 2007, and gold climbed as the Fed said it will continue buying assets, undertake additional purchases and employ other policy tools as appropriate “if the outlook for the labor market does not improve substantially.”…

The FOMC also said it would probably hold the federal funds rate near zero “at least through mid-2015.” Since January, the Fed had said the rate was likely to stay low at least through late 2014. The Fed said “a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.”

Two important things from this development: the FED will engage in “open-ended purchases” of mortgage debt each month and that “federal funds rate near zero “at least through mid-2015.””

This essentially adds to the $267 Operation Twist 2.0 launched last June.

Chart from Doug Short/Business Insider

Bernanke’s panoply of bazookas has been intensifying. Inflationism is being piggybacked by greater inflationism. While this may not be enough (it never will), this may be near the zenith of the Fed’s arsenal of policies. Perhaps the FED will be buying other forms of debt or even equities in the future but may not beat the “open-ended option”

In short I expect diminishing returns from the Fed’s seemingly maxed out actions.

Yet as I previously noted,

With unlimited or open ended options (US Federal Reserve has already been taking this in consideration), central bankers have been increasingly signaling urgency and desperation.

While QE 3.0 provides short term boosts for the financial markets due to its narcotic effects (see the wonderful chart above), the risks is that this RISK ON environment may be short-lived because of the growing risks of stagflation

Chart from Moneyandmarkets,com

The open ended QE 3.0 comes amidst higher inflation expectations which only magnifies price inflation risks.

Of course Bernanke had to deliver, that’s because market’s expectations have built-in heavily to the Fed’s promises, I wrote,

Mounting expectations and deepening dependence from central banking opiate, which has been clashing with the unfolding economic reality, will prompt for more price volatility on both directions. The Bank of America posits that QE 3.0 has been substantially priced in.

Eventually stock markets will either reflect on economic reality or that central bankers will have to relent to the market’s expectations. Otherwise fat tail risks may also become a harsh reality.

Not only that, the fiscal conditions of the US government would require more funding from the FED. This will likely be done indirectly through banks, i.e. FED buys banks mortgages and banks are likely to buy US Treasuries in return. We’ve called the poker bluff (of claims that the FED won’t do QE) here before.

Lastly, Bernanke’s tidal wave of inflationism subtly proves the point that officials work to promote their self-interest; surging stock markets now tilt the balance considerably towards Obama’s re-election.

Again as I wrote,

Also considering that President Obama’s opponent, Mitt Romney, has piggybacked on Ron Paul initiative to have the US Federal Reserve audited, which thereby diminishes the political power of Ben Bernanke, we cannot rule out that Mr. Bernanke will use the banking system and the Fed’s monetary tools to ensure Obama’s re-election.

I’d gradually get exposed on gold related issues. Gold’s bull market has resumed.

Just one more point, the death cross seen in Gold’s price action last April is likely another chart pattern failure as the imminence to the “golden cross” reveals of another “whipsaw”. This once again shows that actions from policymakers shapes chart patterns and not vice versa.

People who claim of the supposed efficacy of begging the question “history repeats itself” have been misled by the gambler’s fallacy.

Sunday, September 02, 2012

Phisix: Why The Correction Cycle Is Not Over Yet

A delirious stock-exchange speculation such as the one that went crash in 1929 is a pyramid of that character. Its stones are avarice, mass-delusion and mania; its tokens are bits of printed paper representing fragments and fictions of title to things both real and unreal, including title to profits that have not yet been earned and never will be. All imponderable. An ephemeral, whirling, upside-down pyramid, doomed in its own velocity. Yet it devours credit in an uncontrollable manner, more and more to the very end; credit feeds its velocity- Garet Garett

Portfolio Pumping at the Philippine Stock Exchange

Friday’s session, which marked the last trading day for the month of August, manifested another probable sign of the politicization of Philippine equity market.

95% of Friday’s trading activities saw the sluggish Phisix in the red, albeit modestly. That was until the last few minutes where a spike occurred, as shown by the intraday chart from Bloomberg. Such fantastic comeback accounted for a hefty 1.4% move from bottom to the session’s close.

On social media, market participants occasionally yammer or bellyache about supposed price manipulations on certain issues, but Friday’s action makes them pale by comparison.

Because the event happened on the month end, I earlier noted[1] that the typical rationalization will be that of ‘window dressing’. And perhaps too some may say that last minute flow of new information might have prompted some fund managers with sizeable portfolios to urgently position based on an anticipated boom.

But I see none of the above. From the flow of circumstantial empirical evidences, the last minute juggernaut seems to have been well crafted, through coordinated executions.

For starters, it usually takes a handful of heavyweight blue chip issues to move the Phisix. Of course being that they are blue chips this entails huge amount of money as these issues are the most liquid or frequently the most heavily traded

However, a push based on select heavyweights, while providing a lift to the Phisix, would not be reflected on all sectors.

This is why Friday’s action has been remarkable. As illustrated by the intraday charts from citiseconline.com, the resurgent Phisix was not limited to Phisix component leaders but to the major market caps of ALL the sectors.

Coordinated and synchronized buying has been adeptly executed which targeted heavyweights of every sector.

The systematic buying activities, thus, projected a broad based advance. (table from the Philippine Stock Exchange)

Among the sectoral benchmarks, the service sector, led by PLDT, promptly stood out. PLDT remains as the largest free float market cap constituting 14.62% of the Phisix basket as of Friday’s close. PLDT closed 2.16% on Friday (see red arrow below).

Ironically, there were some major issues that closed in the red such as Ayala Corp and Metrobank.

But again, the well contrived buying operation ensured that their losses had been neutralized by gains on some other heavyweights. For instance, in the holding sector, Ayala Corp’s losses had been offset by the gains of larger market cap Aboitiz Equity Ventures [PSE: AEV] and SM Investments [PSE: SM]. Also in the banking sector, Metrobank’s losses were countered by material gains of Bank of the Philippine Islands [PSE: BPI] and BDO Union Bank [PSE: BDO]

In short, the strategy’s centrepiece was that PLDT ensured the gains of the benchmark, while other blue chips were meant to “paint the town red”.

Peso volume net of special block sales, for the day, accrued to a substantial 6.9 billion pesos (US 165 million).

Since foreign money posted substantial net outflows (Php 1.8 billion; USD 43 m) during the session, this means that the local institution/s, channelled through a variety of leading brokers, were responsible for the synchronized buying spree.

It would seem senseless, if not irrational, for money managers with substantial portfolios to undertake what seems as dicey actions, considering the current risk environment and given the recent correction phase the Phisix has been undergoing.

This also means that the parties involved may not be after pursuing Alpha (investment) returns[2] but intended to garnish the Phisix for whatever non-financial reasons.

Importantly, in the absence of economic incentives, the likelihood is that the hefty risk money used could have been third party money.

If such actions have been limited to a single issue, then this would be known as “marking the close” which under Philippine laws are considered illegal[3]

In the US “marking the close” is defined[4] as “the practice of buying a security at the very end of the trading day at a significantly higher price than the current price of the security”.

Even if these acts has been engineered for so-called “window dressing”, they are reckoned as unethical, if not illegal, through Portfolio Pumping[5]

The illegal act of bidding up the value of a fund's holdings right before the end of a quarter, when the fund's performance is measured. This is done by placing a large number of orders on existing holdings, which drives up the value of the fund.

Nonetheless because “marking the close” is technically hard to prove, the elaborate broad index “management” scheme may have also been designed to elude legal technicalities.

Such “marking the close” manipulation was part of the insider trading charge[6] levelled against crony Dante Tan on the BW Resources scam but whose twin cases were eventually dropped by the Supreme Court[7].

Bottom line is that whatever gains accrued from Friday’s ploy to artificially boost stock prices should be taken as temporary and with a grain of salt. Eventually markets will prevail.

Global Equities on a Correction Mode

Most of the weekly 1.03% gain by the Philippine benchmark, the Phisix, can be traced to Friday’s extraordinary recovery of .91%.

For the week, among major international bellwethers, only the Phisix posted positive results.

The rest of the world seems to be in a correction mode.

However, the emerging market majors, particularly the BRICs, endured the heaviest losses.

What seems even more worrisome is that backed by a string of negative developments, such as Saturday’s post-trading announcement where Chinese manufacturing activities shrank or contracted (and not reduced growth) for the first time in nine months[8], China’s Shanghai index continues to fathom new depths. This may point to greater possibility of a hard landing for China.

Ignoring developments in China would be a reckless proposition. Aside from being the second largest economy in the world, China assumes very important roles in many aspects of global trade. This only means that a sharp unexpected downturn in China may amplify the risks of contagion.

It would also seem foolhardy to become overly optimistic on the sustained narrative by mainstream media that Chinese authorities would eventually come to the rescue. Chinese markets have so far dispelled the torrent of propaganda.

Well, the global equity market downturn seems to have affected even the streaking hot Thailand equity bellwether, the SET. Thailand’s SET sizzled even as the other ASEAN peers fumbled over the past few weeks.

Thailand SET (green) now joins the Phisix (PCOMP, red orange), Indonesia’s JCI (orange) and Malaysia (FBMKLCI, red) in rolling over to what seems as a downside bias.

If the SET should continue to correct, then this goes to prove that the forces of “reversion to the mean” are at work. This should also debunks the anachronistic idea of decoupling.

Risks to Ben Bernanke’s Political Career Points to Fed Action Soon

On the other hand, the cumulative weekly losses by US markets has been apparently been mitigated by a strong Friday close.

Again, the one day rally came amidst promises made by the US Federal Reserve’s Ben Bernanke for more policy stimulus in his Jackson Hole speech.

The Bloomberg gives us a good account on the Pavlovian behavior adapted by the markets[9],

U.S. stocks rallied with commodities and Treasuries as Federal Reserve Chairman Ben S. Bernanke said he wouldn’t rule out more stimulus to lower a jobless rate he described as a “grave concern…

Bernanke’s 24-page speech at the Kansas City Fed’s symposium made the case for further monetary easing and concluded that the central bank’s non-traditional policy tools such as bond purchases have been effective in boosting growth and improving financial conditions. He said that declines in the unemployment rate would continue only if growth picks up above its longer term trend.

Mr. Bernanke’s speech seems to impart subtle political implications.

Mitt Romney, Republican presidential candidate, lately announced that should he win the presidency this November, according to a Bloomberg article[10], “he wouldn’t reappoint Bernanke, raising questions about the succession more than a year before Bernanke’s term expires in January 2014.”

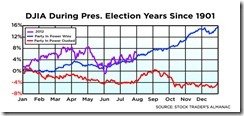

And as noted last week[11], the performance of the US stock market has had a strong correlationship with the outcome of the presidential elections. Strong stocks mostly led to the re-election of the incumbent (chart from yahoo[12]). This again may be due to public’s interpretation of rising markets as signs of economic “progress” even if in reality such artificially tweaked gains were mainly due to bank credit expansions.

This from USA News[13],

InvestTech Research, an investment firm out of Montana, says the stock market is the most reliable indicator of who will win the presidency and has been for more than 100 years.

"The election is a reaction to the stock market. If you see strength in the market, consumer sentiment and confidence among the voters is higher. If you see volatility, you are going to see investors take that out on the incumbent," says Eric Vermulm, an InvestTech Research senior portfolio manager.

Gains of the US stock markets have essentially been built around the slew of policy steroids or from repeated interventions by US Federal Reserve. This essentially postulates to the deepening politicization of US financial (equity) markets.

And as I pointed out in the recent past[14] the New York Federal Reserve even blustered about successfully boosting the US stock markets. Thus, the fate of equity markets seems largely beholden to the Fed’s sustained infusion of steroids.

In the knowledge that the Fed can tweak policies to favor the stock markets, and in the prospects that Mr. Bernanke will be out of work from a Romney presidency, then the most likely guiding incentive for Mr. Bernanke will be to work to retain his tenure by promoting the re-election of President Obama through “stock market friendly” policies in September or October.

Besides Mr. Bernanke seems to have a strong backing from FOMC members, according to the Carl Tannenbaum of Northern Trust[15], “more than half of the current FOMC members would be amenable to additional easing”

I previously said that the Mr. Bernanke may likely wait for the ECB to move first[16]. Now I am more inclined to the scenario or the probability that Fed action this September or in October may become a reality.

Two major variables yet could prevent Mr. Bernanke from doing so; one is a sustained surge in food prices, and the other, would be a more vocal opposition by the public on expanded Fed policies.

All Eyes On Central Bankers

Global equity markets have generally been on a correction mode, a dynamic which is likely to continue, until perhaps central banks lay down their cards.

Only the US markets seem to contradict this. Yet the strength of the US markets has been mainly erected from expectations of further policy easing by the US Federal Reserve.

On the other hand, the ECB may finalize the rescue mechanism within the first half of the month. This in spite of incipient signs of stagflation[17]; elevated inflation, high unemployment and contracting economic growth.

Mounting expectations and deepening dependence from central banking opiate, which has been clashing with the unfolding economic reality, will prompt for more price volatility on both directions. The Bank of America posits that QE 3.0 has been substantially priced in[18].

Eventually stock markets will either reflect on economic reality or that central bankers will have to relent to the market’s expectations. Otherwise fat tail risks may also become a harsh reality.

Market direction now depends on the details of central bank actions.

Mounting Stagflation Risks

Rising commodity prices appear to be factoring in the imminence of such actions. Gold’s recent recovery leads other commodities, Energy ($GKX-S&P GSCI Energy Index) and Industrial metals ($GYX-S&P GSCI Industrial metals) except Agriculture ($GKX-S&P GSCI Agricultural Index) which seems to have presaged the commodity rally.

For emerging markets, sustained high levels of food prices, which incidentally have now become a global phenomenon according to the World Bank, raises the risks of stagflation[19] which will force their respective central banks to tighten.

An environment plagued by stagflation will not be friendly to the stock market in general.

Perhaps China’s procrastination to pursue further aggressive stimulus has been due to the supposed huge disconnect between statistical CPI index and on the ground real food prices[20].

Surging food prices have been prompting many Asians to stockpile.

According to Wall Street Journal[21],

Reduced availability and higher prices are spurring importers to buy more, not less, as a hedge against even higher prices in the future. China, which accounts for more than 60% of the world's soybean imports, is also buying cargoes several months before shipment. Demand there is driven mainly by double-digit annual growth in dairy-product consumption, 5% to 6% growth in poultry consumption and 3% growth in pork consumpion, said Christopher Langholz, the business unit leader at Cargill Investments (China) Ltd.'s animal protein division in Shanghai.

Yet the prospects of Fed and the ECB simultaneously easing in the coming days, weeks or months will likely intensify not only on stagflation risks but the risk of a global food crisis as well.

Incipient stagflation, aside from micro bubble busts, may have been a principal reason why major emerging markets continue to underperform.

Correction Mode: PSE Capital Flows and the Peso US Dollar Trend

For the Philippine equity markets, the ongoing episode of correction has also been evident in the foreign fund flows.

Net foreign flows have begun to turn negative over the past weeks.

And negative foreign fund flows may have been influencing on the decline of the Peso.

According to an IMF paper[22], foreign capital flows dynamic via stock market transactions influence exchange rates more than the bond markets.

when it comes to external capital flows, it is foreign investors’ private information related to the stock market and not the bond market which drives the exchange rate.

This may hold some relevance to the relationship between the Phisix and the Philippine Peso

The correction phase of the Phisix (red candle), partly influenced by increasing net foreign sales, has likewise been manifested through the weakening of the Peso vis-à-vis the US dollar (black candle). The Phisix and the Peso exhibits strong correlations which may partly validate the theory that flows in and out of the stock market influence more the direction of the exchange rates.

So far, the Phisix correction cycle seems largely intact and could intensify

Domestic market technical picture and internal market dynamics, two items I discussed last week, along with capital flows and the trend of the Peso have converged to suggest that the correction phase of the Phisix has unlikely been over.

Add to these the external based dynamics which are likely to be transmitted to the local financial markets and to the real economy.

Don’t get lulled into the mainstream idea that the domestic central bank, the Bangko Sentral ng Pilipinas (BSP), will be able to successfully achieve so-called “inflation targeting” or contain price inflation through macro ‘policy toolkits[23]’ and that the statistical economic growth will remain robust as mainstream economists predict.

Had these policy toolkits “worked” then the world would not be experiencing what has been a lingering and worsening crisis since 2008. Technical gobbledygook has only been meant to project an aura of pretentious superiority in knowledge to justify the existence of unsound political institutions, even if they really don’t work.

Once price inflation accelerates through food and energy channels, which is likely to be accentuated by current easy money policies, and where stagflation becomes a clear and present threat, statistical economic growth, like a bubble, will simply pop. Then, the BSP will be in a state of panic. The public will discover that the emperor has no clothes.

[1] See Phisix: Another Fantastic Last Minute Upward Push August 31, 2012

[2] Wikipedia.org Alpha (investment)

[3] Security and Exchange Commission, CHAPTER VII Prohibitions on Fraud, Manipulation and Insider Trading Securities Regulation Code

[4] USLegal.com Marking the Close Law & Legal Definition

[5] Investopedia.com Definition of 'Portfolio Pumping'

[6] Philstar.com SEC favors random closing time for PSE December 3, 2002

[7] Manila Bulletin SC oks dismissal of Dante Tan charges in BW Resources case August 1, 2010

[8] Bloomberg.com China Manufacturing Unexpectedly Contracts As Orders Drop, September 1, 2012

[9] Bloomberg.com Stocks Rise With Commodities, Treasuries On Stimulus Bets, September 1, 2012

[10] Bloomberg.com Bernanke Makes Case For Further Stimulus To Help Jobless September 1, 2012

[11] See Phisix: The Correction Cycle is in Motion August 27, 2012

[12] Yahoo.com Obama’s Re-Election Odds Are Better Than You Think Says Hirsch, August 15, 2012

[13] USA News Stock Market Picks 90 Percent of Presidential Elections February 24, 2012

[14] See Bernanke Doctrine: New York Fed Boasts of Pushing Up the US Stock Markets, July 14, 2012

[15] Carl R. Tannenbaum The Message from Jackson Hole, Northern Trust Augst 31, 2012

[16] See Phisix: Managing Through Volatile Times August 6, 2012

[17] See Eurozone’s Nascent Signs of Stagflation September 1, 2012

[18] Zero Hedge, Chart Of The Day: With All Of QE3 Priced In, The Only Way Is Down Should Bernanke Disappoint, August 31, 2012

[19] See Stagflation Risk: Food Price Inflation is Worldwide August 31, 2012

[20] Zero Hedge, Big Outflow Trouble In Not So Little China? August 25, 2012

[21] Wall Street Journal Soybean Worries Spur Asian Buying August 29, 2012

[22] Jacob Gyntelberg, Mico Loretan, and Tientip Subhanij Private Information, Capital Flows, and Exchange Rates IMF Working Paper September 2012

[23] Businessonline.com BSP ready to tweak policy August 30, 2012

Monday, August 27, 2012

Phisix: The Correction Cycle is in Motion

The correction phase of the Phisix has become more evident.

Reversion to the Mean: Convergent Market Breadth and Technical Picture

Technical actions and domestic market internals seem to self-reinforce the ongoing cyclical dynamic.

First of all, a technical indicator suggests of a bearish pattern called the head-and-shoulders[1] where a breach of the 5,125 support could mean a test of the major support level at the 4,800 (or from a technical perspective the Phisix may even fall to 4,700).

While I am not a fan of technical charting, I do use it in the understanding that there are many practitioners of these. This implies that critical break points may lead to self-fulfilling momentum swings, albeit the impact could be on a short-term basis. Technical targets often miss.

Anyway, the principle of charting feeds on the pattern seeking behavior or cognitive biases inherent in people than from the more important scientific understanding of human action.

Second, developments in the market internals seem to chime with current chart dynamics.

When the impeachment trial of former Chief Justice of the Supreme Court concluded last May, I laid down my suspicions over the probable political interventions to prop up the Phisix. That’s because during certain periods last June, the Phisix strikingly defied major developments abroad. Amidst hemorrhaging global markets, the Phisix had a huge intraday swing from big losses to substantial gains.

I wrote[2],

The point is ‘interventions’ will eventually be smoothed out or neutralized by the underlying forces which drives the financial markets.

Such interventions had hardly been a one-time event. A deluge of popular self-congratulations over the supposed political accomplishment and mainstream media halleluiahs rationalized the accompanying euphoria in the Phisix.

Nearly a quarter after, circumstantial evidence appear to validate my hunches

The bullish market breadth as measured by the advance-decline spread peaked last January. This has not been surpassed by the recent rally, which ironically brought the local benchmark to a milestone all-time high.

This only means that the June-July rally had been mostly “concentrated” to major heavy cap issues that had large influence in the fluctuations of the local benchmark.

When the market is broadly sanguine, people are willing to take on more risk, thus, the tendency has been to accelerate trading activities.

That supposedly boisterous (politically based) bullish outlook has not matched with the July record setting high of the Phisix.

The same divergence has been exhibited in the number of daily trades (averaged weekly).

In other words, the record breaking rally last June-July has not improved the risk appetite of the median investor as aggressive trading apparently topped out last March.

Again when the market is generally confident, the increase in trading activities will similarly be manifested on the number of issues traded.

Has there been broad market bullishness here?

Nope. Media and popular blarney was not evident in real action.

The same story can be seen. Another divergence emerged, the total number of issues traded daily (averaged weekly) reveals that bullish market sentiment crested on March. The July landmark of the Phisix has not been reinforced by broad market gains.

From the picture based on the market breadth, the record Phisix in the face of divergences meant that correction became imminent. This is what we are encountering today. It simply shows of the forces of “reversion to the mean[3]” at work where artificial price levels supposedly revert to the average.

Oh, to add, the bear market in the Mining sector, which for me, signified as the proverbial shot across the bow for the imminent correction of the Phisix has partly been confirmed.

Then I wrote[4],

I lean on condition (B) or where the bear market of the mining sector will likely percolate into the general market, due to growing risks of contagion

For the holiday abbreviated week (which will be extended for the coming week), only the service sector has posted positive returns. All other sectors including the Phisix fell.

And in looking at the price actions of the different industries, this year’s biggest gainers; the property (violet), banking and finance (black candle) and holding (teal), including the Commercial Industrial sector (blue) have all exhibited signs of rolling over.

After a major selloff, the mining index (light orange) seems to be probing for a bottom.

Again, it is only the service sector (red), which has been this year’s second laggard after the mines, that has showed some signs of resiliency. But my guess is that the current correction cycle will be broad based.

The abovementioned divergences are in fact signs of distribution—where gains over the market have been narrowing. Again technical actions (chart patterns and broad sector activities) seem to reinforce this cycle. In short, previous divergences appear to be converging through a retrenchment phase.

The interventionists, whoever they maybe, managed to push up the Phisix by less than 5% in two months. Now and in the coming sessions, whatever gains they have accrued will likely be eroded if not entirely expunged.

As I have repeatedly been pointing out, the impact of financial market interventions tend to be short term.

Yet the clear lesson that can be gleaned from the above is that People’s action speaks louder than verbal “feel-good” but senseless utterance.

In the theory of human action this is called demonstrated or selected preference.

Central bankers have Rigged the Capital Markets

Of course, I keep emphasizing that the interim gyrations will depend on external developments, particularly from the US.

Even as the current domestic environment operates on bubble policies, the extent of misallocations of capital has not yet reached cataclysmic bubble proportions.

We are more prone to the risks of contagion.

Except for a few standouts, most of the major markets traded lower this week.

Except for blazing hot Thailand, for the rest of the ASEAN giants, the Phisix (PCOMP-red) along with Indonesian (JCI green) and Malaysian (FBMKLCI orange) bellwethers also seem to be topping out.

That should be natural considering the he unfolding developments in China which for me remains as a big concern.

The ballooning number of unsold goods[5], hot money outflows and worsening manufacturing activities[6] among many other economic indicators seem to be worsening and exhibiting signs of a “hard landing”.

A China hard landing or a recession which will likely involve a debt or financial crisis, which will most likely affect commodity exporters and the Asian supply chain network.

Moreover, the slew of negative economic developments has also been manifested in Friday’s breakdown of the Shanghai Index. This should be taken seriously.

China’s major bellwether has so far been in a slow motion decline. Where fear is the most powerful of human emotion[7], slomo can transform into panic in snap of a finger.

For the US and Europe, markets remained transfixed on the central bank actions with special attention over this weekend’s Jackson Hole meeting[8].

Friday’s substantial rally in US stock markets which mitigated the week’s losses, the first loss in 6 weeks, shows of deepening expectations of central banking rescue. From a Bloomberg article[9]:

U.S. stocks rose, paring the first weekly decline in almost two months for the Standard & Poor’s 500 Index, as Federal Reserve Chairman Ben S. Bernanke said he saw “scope for further action,” increasing speculation the central bank will act to boost economic growth.

Again this has been no different in Europe, where financial markets seem to seek for an escape mechanism for their real world problems with the narcotic effects from central bank policies. From another Bloomberg article[10]:

European stocks were little changed, with the Stoxx Europe 600 Index posting its first weekly drop since June, as German Chancellor Angela Merkel said Greece must stick to its commitments to stay in the euro area, and a news report said the European Central Bank is considering setting yield band targets.

Stock markets have been transformed into a game of anticipation on the prospective actions of central banks. It’s a game tilted towards politically connected insiders where the central bankers have effectively rigged the capital markets.

Audit the Fed and President Obama’s Re-election

US equities, for me, seem to have greater downside risk, considering developments abroad prompted for by dilly dallying central bankers and of seeming interminable political wrangling. That’s my bias based on my past analysis[11] [12].

However, given the effective politicization of financial markets, it would be a mistake to discount that US stocks may be manipulated to advance President Obama’s re-election goals[13].

The performance of the stock market have been said to have some influence on or connections to the outcome of US Presidential elections.

According to FoxNews[14],

Of the 28 presidential elections since 1900, an improvement in the S&P 500 prior to an election preceded an incumbent victory 80% of the time, or 16 of 20 of times. The S&P 500’s direction during that period carried an accuracy rate of 82%, according to S&P Capital IQ data.

“Either we have a tremendous situation of being fooled by randomness or we have an interesting stock market phenomenon,” said Sam Stovall, chief equity strategist at S&P Capital IQ.

Of the three out of the four times the incumbent lost following an S&P 500 upswing, outside factors such as third-party candidates were involved, like when Teddy Roosevelt created his own conservative political party ahead of the 1912 election, taking away votes from incumbent William Howard Taft and ultimately leading to the election of Democrat Woodrow Wilson.

When the market fell ahead of a presidential election, the incumbent was overthrown 88% of the time. The only time this predictor failed was in 1956, when Adalai Stevenson failed to overthrow incumbent President Dwight Eisenhower, which could have been a reflection of macro political pressures such as the Suez Canal crisis or Soviet headaches.

This may be coincidence. But advancing stock markets, perhaps, could be interpreted by the public as “progress” even when gains are manipulated or boosted artificially by bank credit expansion.

Besides, policymakers see stock markets as barometer for the animal spirits or market confidence. In the past, US Federal Reserve Chairman Ben Bernanke as an academic professor wrote that

History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

This is what I call as the Bernanke dogma. As proof that such dogma has been used as a major tool in today’s policymaking, recently the New York Federal Reserve even boasted of having successfully pushed up US Stock Markets[15].

The Bank of England recently admitted that their Quantitative Easing policies boosted asset prices of mostly the rich[16].

The Bernanke doctrine incorporates not only saving the stock market but of the other financial markets as well, through what he calls as financial accelerator

In a 2007 speech, Chairman Bernanke expounded on what he sees as the importance of keeping financial assets afloat[17]

financial conditions may affect shorter-term economic conditions as well as the longer-term health of the economy. Notably, some evidence supports the view that changes in financial and credit conditions are important in the propagation of the business cycle, a mechanism that has been dubbed the "financial accelerator." Moreover, a fairly large literature has argued that changes in financial conditions may amplify the effects of monetary policy on the economy, the so-called credit channel of monetary-policy transmission

The above underscores the academic justifications of central bank interventions. Also one cannot ignore that policy interventions can be timed to attain political goals.

Also considering that President Obama’s opponent, Mitt Romney, has piggybacked on Ron Paul initiative to have the US Federal Reserve audited[18], which thereby diminishes the political power of Ben Bernanke, we cannot rule out that Mr. Bernanke will use the banking system and the Fed’s monetary tools to ensure Obama’s re-election.

So far, in terms of growth of monetary aggregate, M2 has been on a decline but has now reached at a nominal record high.

The chart of the S&P shows of two contrasting patterns: a bullish rounded bottom (lower green arc) and a seeming double top (two upper green arcs).

So US markets and the economy seem both mixed to neutral for now.

Commodity Rally and the Risk of Stagflation

Current environment has not been about consumer price inflation or deflation. Focusing on these manifests of confused perception of what has been happening.

Instead the current environment has been about deflating bubbles and of the monetary inflation responses from central banks. The articles quoted above are clear manifestations of such dynamics.

Consumer price inflation signifies as one of the symptoms of monetary inflation. Yet bubble cycles can occur with or without excessive consumer price inflations.

As the great dean of the Austrian school of economics, Murray N. Rothbard wrote[19],

if new money is created via bank loans to business, as much of it is, the money inevitably distorts the pattern of productive investments. The fundamental insight of the "Austrian," or Misesian, theory of the business cycle is that monetary inflation via loans to business causes over-investment in capital goods, especially in such areas as construction, long-term investments, machine tools, and industrial commodities. On the other hand, there is a relative underinvestment in consumer goods industries. And since stock prices and real-estate prices are titles to capital goods, there tends as well to be an excessive boom in the stock and real-estate markets. It is not necessary for consumer prices to go up, and therefore to register as price inflation.

The bubble dynamics of Thailand in the 90s demonstrates that booms may not necessarily be accompanied by strong surges in consumer price inflation. When the Asian crisis emerged as exhibited by the collapse of the SET[20], Thailand’s CPI fell close to zero[21]. No CPI inflation or deflation here. But a bubble occurred.

A significant development over the past two weeks has been the resurgence of gold.

The price of gold has made a critical breakout from the one year consolidation phase which came along with significant upside moves from the broader commodity sphere.

The recent rally by gold has been backed by the major bellwether the CRB, the industrial metals ($GYX) and energy ($GJX), as well as, the frontrunning agriculture ($GKX) indices. The latter has been catalysed by the US drought and worsened by the distortions from the policies aimed at the promotion of ethanol and biofuel energy.

As Cumberland Advisor’s Bill Witherell points out[22],

The US is projected to divert about 40% of its corn crop into ethanol, and about 60% of Europe's rapeseed crop goes to the production of biodiesel. Brazilian ethanol production consumes half of their sugarcane crop.

I would suspect that these belated moves by commodities have been prompted by the same expectations that have driven the recent stock market rally.

But instead of the constant toggling from risk ON to risk OFF environment, this may seem more of a rotational process or of the relative impact of monetary inflation to the economy. Oh yes, this seems hardly been about fear….yet.

It is yet unclear if the recent gains by commodities will be sustained. These will heavily depend on the actions of policymakers of the developed world and of China.

A recovery of commodity prices should eventually put a floor on the Philippine mining sector.

We should remember that the commodity bull run over the last decade, has largely been a function of insurance against monetary disorder, asset diversification and a position on emerging market development.

Yet current rally may be more about the insurance aspect as China’s economy seems to be stagnating.

It is also unclear if a sustained recovery in commodities will accompany a RISK ON environment for emerging markets and Philippines.

High commodity prices are likely to influence emerging markets consumer price inflation more. Food makes up a large segment of consumption basket for emerging Asia including the Philippines. This would prompt for their respective central banks to reluctantly tighten. Monetary tightening will put pressure on the stock market.

Stagflation, thus, also represents both a contagion and internal (political and market) risk for the Philippines and for emerging Asia[23].

Yet the divergence in policy rates between emerging markets and developed economies may induce more commodity inflation which eventually could be transmitted to developed economies.

Under this environment, positions on resource companies would be more ideal than to hold cash.

And should a stagflationary environment escalate around the world, do expect more pressures on the debt laden developed nations to default as the cost of interest payments on current liabilities soar. And any inflationist response from central banks, to drive down rates, would likely backfire and even worsen the situation.

I might add that if the US economy faces imminent risks of recession, it is likely that the US Federal Reserve will engage in more balance sheet expansion to bailout by reflating the system, this may fire up consumer inflation.

In the US, signs of consumer price inflation have begun to emerge from a combination of reasons. Peter Luger Steak house[24] expects to increase prices of their products based on higher commodity prices. Papa John’s Pizza will raise prices due to compliance on Obamacare[25], so has Chipotle Mexican Grill Inc., McDonald's Corp. and Buffalo Wild Wings[26]

Maintain a Defensive Posture

For now, do expect the Phisix to playout the normal and ‘healthy’ correction phase unless external events deteriorate more than expected.

There will be interim sporadic rebounds but unless we see improvements on both domestic actions and external conditions, we should remain defensive.

Playing defensive means patient positioning. Current events should extrapolate to a buyer’s market.

In the interim, we need to monitor the conditions in China, as well as, watch over feedback loop between the responses of the G-7 policymakers (as well as China) and of the market’s impact on them.

This only means that events remain highly fluid and susceptible to sharp volatilities.

Also, if the commodity rebound will be sustained, then the beacon of an impending bottom of mining sector should be in the horizon.

[1] StockCharts.com Head and Shoulders Top (Reversal) - ChartSchool

[2] See Phisix: Will the Risk ON Environment be Sustainable?, June 24, 2012

[3] Investopedia.com Mean Reversion

[4] See Philippine Mining Index: Will The Divergences Last? August 13, 2012

[5] see China’s Mounting Glut of Unsold Goods, August 24, 2012

[6] see China’s Manufacturing Slump Deepens August 23, 2012

[7] see Why Not to Pay Heed to the Prophets of Ecological Apocalypse August 21, 2012

[8] US Federal Reserve What's Next

[9] Bloomberg.com U.S. Stocks Rise As Fed Sees ‘Scope For Further Action’ August 25, 2012

[10] Bloomberg.com European Stocks Little Changed; Stoxx 600 Falls On Week August 24, 2012

[11] See Phisix: Managing Through Volatile Times August 6, 2012

[12] See Phisix and ASEAN Equities in the Shadow of Contagion Risks July 22, 2012

[13] See Has US Federal Reserve Policies Been Engineered for President Obama’s Re-election?

[14] Foxnews.com Betting on a Romney Win? Check the S&P 500 First August 2, 2012

[15] see Bernanke Doctrine: New York Fed Boasts of Pushing Up the US Stock Markets July 14, 2012

[16] See Bank of England Study: QE Benefited the Elites August 24, 2012

[17] Bernanke Ben The Financial Accelerator and the Credit Channel Federalreserve.gov June 15, 2007

[18] Businessweek Romney Calls for Fed Audit as Party Mulls Platform Plank, August 20, 2012

[19] Rothbard Murray N. Money Inflation And Price Inflation Chapter 77 Making Economic Sense Mises.org

[20] Chartsrus.com Thailand SET

[21] IndexMundi.com Thailand Inflation rate (consumer prices)

[22] Witherell Bill Food Prices and International Equity Markets August 18, 2012 Cumber.com

[23] See Will Soaring Agricultural Commodity Prices Bring about Stagflation to Asia? August 2, 2012

[24] Bloomberg.com Peter Luger Steak Prices May Soar as Drought Culls Herds August 21, 2012

[25] Politico.com Papa John's: 'Obamacare' will raise pizza prices August 7, 2012

[26] MoneyMorning.com Rising U.S. Food Prices are About to Eat Away at Your Savings, July 31, 2012