From this perspective I offer a different explanation. The two week spike in short term yields represents a scramble for liquidity!The short term rates 3 month, 6 month and 1 year have all reached June 2013 highs. To recall, June 2013 was when the taper tantrum PLUS BoJ’s QE 1.0 triggered turbulence in global financial markets, so the spike in short term rates then has been consistent with concerns over liquidity.There have been little signs of turmoil (yet). The peso has been nearly unchanged for the year even as the neighboring currencies have been severely buffeted on likely heavy interventions by the BSP. The Phisix remains above 7,000. Despite failing to meet consensus expectations, statistical growth remains above 5%. In addition, media and experts continue to serenade economic hallelujahs even as neighboring financial markets have been roiling from weak currencies.So this, in my view, may have been about debt IN debt OUT that may have reached proportions whereby demand for short term loans have become greater than long term loans, thus the spiraling demand equates to the public willing to pay for higher short term rates. And demand for such short term loans may have been reflected on the yields of short term treasuries.And demand may have originated from cash constrained borrowers who may be competing to secure funds to oversee the completion of their capital intensive based projects on mostly bubble sectors, and or from highly levered asset speculators (real estate and stock markets) who may be jostling to acquire short term funds in order to settle existing liabilities as returns have not been sufficient to cover levered positions. Could this be the reason behind the obsession over managing of the stock market index?The sharply expanding bank credit growth in the light of steeply decelerating money supply growth as statistical economic growth slows seems to dovetail with the greater demand for short term funds; the highly levered sectors of the economy haven’t been generating enough cash from a growth slowdown and from untenable debt levels so the dash for loans from the banking system to pay existing debt even at higher rates.It remains to be seen if the current developments represent an aberration or if my suspicions are right where short term yields have been about emergent signs of liquidity strains.But if my suspicions are correct, where short term rates continue to climb, this will affect many businesses via higher financing costs. There will be a cut back in expansions as losses will mount.And if the rise in short-term yields engenders an inverted yield curve–where short term rates are higher than longer term rates—then the consensus will even be more startled because inverted yield curves have mostly been reliable indicators of recessions!

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, December 17, 2014

Phisix Crushed as Yields of Short Term Philippine Treasuries Soar!

Tuesday, May 27, 2014

Hot: Fishing boat warfare: Chinese vessel sink Vietnamese boat

Vietnam said a Chinese vessel sank one of its fishing boats, the most serious bilateral standoff since 2007 and a move that underscores China’s assertiveness in pushing its claims in the disputed South China Sea.“It was rammed by a Chinese boat,” Foreign Ministry spokesman Le Hai Binh said by phone. The 10 fishermen on board DNa 90152 were rescued by other Vietnamese ships after yesterday’s scrap, according to a government statement posted on its website. The incident occurred after some 40 Chinese fishing vessels encircled a group of Vietnamese boats in Vietnam’s exclusive economic zone, the government said.The Vietnamese craft overturned as it harassed a Chinese fishing boat in the area, China’s official Xinhua News Agency reported.

A large number of People’s Liberation Army troops have reportedly been spotted heading towards the China-Vietnam border as tensions between the two countries continue to escalate, reports Hong Kong's Sing Tao Daily. Sing Tao Daily is generally considered to be aligned to Chinese state media.Thousands of Chinese nationals living or on business in Vietnam have already fled the country amid anti-China riots, which were sparked by a tense standoff between Chinese and Vietnamese naval ships near a Chinese oil rig in disputed waters off the Paracel Islands in the South China Sea on May 4.

Wednesday, February 13, 2013

War on Gold: India’s Smuggling Soars, Vietnam Charges Fees on Deposits, Turkey’s Gold Deposits

Cases of smuggled gold entering India are coming in thick and fast. Almost as fast as gold coins and jewellery pieces are flying off retail shelves…Despite India's best efforts to curb illegal gold imports, which included a boost to the nation's customs in 2012, gold smuggling has been rather rampant.According to the All India Gems and Jewellery Trade Federation, India imported 950 tonnes in 2012. Of this, 250 tonne has come into the country through the illegal channel.``In 2011, India imported over 900 tonnes of gold and none of it came through smuggling. The hike in customs duty has not stopped the import of gold into the country. It has only changed the route as smugglers earn a profit of around $3,719 (Rs 200,000) on every kilogram of gold smuggled into the country,'' said Federation Chairman Bachhraj Bamalwa.The duty rate hike has not dampened demand, it has just enhanced the profit margin of smugglers, he added.Finance ministry data shows $175 million (Rs 9.4 billion) worth of gold was seized from more than 200 cases of smuggling during April to July 2012. This was a 272% rise from the level of the previous year. Moreover, between 2006-07 and 2010-11, gold seizure was almost nil, data from the directorate of revenue intelligence shows.In the first 10 months of 2012-13, India's Directorate of Revenue Intelligence seized gold worth $11 million (Rs 601 million) which is some 200kgs at the current price, and cracked 36 cases of smuggling.The Directorate of Revenue Intelligence is an agency that monitors economic offences. Officers said the incidence of gold smuggling in the current fiscal year has grown by more than eight times as compared to the corresponding period in the previous year.They added that spot gold prices in India are 5.7% higher than in Dubai. Typically, gold is smuggled into India from neighbouring Dubai and Thailand.

Many Indians use gold to hedge investments against inflation. But a working group convened by India’s central bank recently advocated a range of alternative investment products which could be used by the public as an alternative to gold for inflation hedging. Gold-linked savings accounts, bonds and certificates that entitle a holder to physical gold could help reduce demand and quickly move more liquid assets into the country’s banking system, the group suggested.

From the same Business insider article (bold mine)

Vietnam’s government is trying to tackle a similar problem through aggressive intervention in the local gold market. More than 31 percent of Vietnamese households keep some of the shiny stuff on hand, according to a survey by a government finance committee cited in a recent Credit Suisse note. High inflation levels and a weakening Vietnamese currency have made Vietnamese investors even more eager to snap up gold.The Vietnamese government has intervened to mitigate the resulting spread between local and international gold prices. After temporarily suspending interest-bearing gold deposit accounts and certificates in 2011, the government has told banks and credit facilities to phase out gold deposits and loans for good. The government has also taken over the country’s largest gold refinery, and the State Bank of Vietnam is rolling out a new set of licenses allowing traders to buy and sell gold bars only if they meet strict requirements.

Recently, however, the government-run Vietnamese central bank disallowed loans in gold. Now, it is preventing banks from paying interest to customers on their gold. Instead, it is forcing banks to charge customer to store their gold, and requiring banks to regularly report on their transactions with account holders.What’s happening is that the government wants to prevent citizens from using alternatives to its own quickly devaluing currency. This, way, the government can continue to steal purchasing power from its citizens through inflation.

"Gold-based deposit accounts [in Turkey] surged 15% this year through the end of July," explained BusinessWeek back in October, "three times the increase in standard savings accounts.""Although much criticised for its use of 'unconventional measures'," the Financial Times added in December, "few would argue that the decision last year by Turkey's central bank to allow the country’s banks to buy gold was anything less than a roaring success."Buying gold isn't quite right. Starting in October 2011, the central bank began allowing commercial banks to hold a portion of their "required reserves" – needed to reassure depositors and other creditors they had plenty of money to hand – in physical gold bullion. Starting at 10%, that proportion was then raised to 30%.Private citizens were similarly encouraged to hold their gold on deposit with their banks. That gold was thus transferred to the central bank's balance sheet. Et voila! Privately-owned gold now backed the nation's finances. A smart idea, which has coincided with Turkey's currency rising, interest rates falling, huge current-account shrinking, and government bonds regaining "investment grade" status.Publicly targeting some of Turkey's estimated 2,200 tonnes of "under-the-pillow" gold, currently worth some $119 billion, the CBRT's governor Erdem Basci has meantime been awarded The Banker magazine's prestigious "Central Banker of the Year 2012" award.

Monday, November 26, 2012

Vietnam’s Keynesian Property Bubble Bust

Office and retail rents in Vietnam’s two largest cities have slumped as a wave of supply entered the market at a time when slowing economic and retail-sales growth curbs demand for commercial real estate. The Hanoi market added more office and retail space since the start of 2011 than in the previous four years combined, according to property broker CBRE.The average asking rent for top-grade central business district office space in Hanoi was about $47 per square meter per month in 2009, more than double the levels for the same grade space in Bangkok and Kuala Lumpur at that time, according to data from the Vietnam unit of Los Angeles-based CBRE. The rate was 11 percent lower at $42.01 per square meter in the third quarter…

Real estate loans totaled 203 trillion dong ($9.7 billion) as of Aug. 31, of which 6.6 percent were classified as bad debt, Minister of Construction Trinh Dinh Dung told the National Assembly on Oct. 31, citing a State Bank of Vietnam report. A broader category of real estate-related loans, including property-backed debt, account for 57 percent of total outstanding borrowing, or about 1,000 trillion dong, he said…Many of Vietnam’s 1,300 state-owned enterprises are reportedly facing losses because of their recent forays into property, said Alfred Chan, director of financial institutions at Fitch Ratings in Singapore.“It is not obvious, if you were just to look at the disclosure, what the potential risks to the banking sector are if you just look at the real estate sector,” Chan said. “Some of this exposure could well come from non-real estate companies that have ventured into that sector.”Non-performing loans at banks are “significantly understated” and could be three or four times higher than official estimates, Fitch Ratings said in a March report.The central bank chief, Nguyen Van Binh, said in April the level of bad debt at some lenders may be “much higher” than reported. Bad debts in Vietnam’s banking system may have accounted for 8.82 percent of outstanding loans at the end of September, Nguyen Van Giau, head of the National Assembly’s economic committee, told legislators in Hanoi Nov. 13.

Easy money policy fueled a boom which got reflected on the stock market, the property sector and the inflation index. This bubble has been abetted by speculations by state owned enterprises. Some of which had been justified as infrastructure spending. The boom led to higher interest rates which eventually popped these politically induced malinvestments.

Wednesday, July 13, 2011

How Global Equity Markets have Measured Up to the PIIGS Crisis

My favorite equity monitor site, Bespoke Invest has a nice updated graph on the performances of global equities as of yesterday.

Here are my observations:

Of the 78 global benchmarks shown, only 24 or 30% of the countries have registered gains.

Although most have been in the red, the degree of losses have not been on a bear market scale.

The current top performer has been Venezuela, who along with Greece shares, represents one of the highest default risks.

8 of the 24 top gainers hail from Asia.

As I keep pointing out, ASEAN mainstays have been among the biggest gainers: Indonesia (7th), Malaysia (14th) Philippines (18th) and Thailand (19th) which has been moving in near synchronicity.

Among the BRICs, only Russia is in the winning column. India and Brazil have suffered hefty losses.

Brazil may endure a recession next year, following an inversion of its yield curve—oops! chart below from Bloomberg

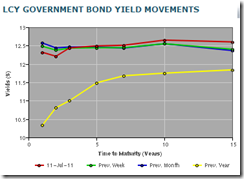

Vietnam's equity bellwether, which has been among the worst losers, has a yield curve that has likewise been leaning towards inversion ala Brazil.

chart from ADB’s Asian Bonds Online

Vietnam’s equity has been fumbling from her government’s attempt to contain inflation by tightening the monetary environment. So the yield curve has reflected on this concern.

Among the G-7, the US and Germany are the only gainers ranked 12th and 16th.

Sunday, May 29, 2011

Has China’s Bubble Popped?

Is something important because you measure it, or is it measured because it's important? Seth Godin

Some market observers have rightly pointed out to China as a possible principal source of concern.

Given the more mature stage of China’s inflation cycle, for me, she is more prone to a bust than her developed economy contemporaries. A China bubble bust would have a far reaching effect on many economies and on financial markets.

China’s major bellwether the Shanghai index [SHCOMP] has been on a rapid downswing (chart courtesy of Bloomberg) after a major bounce off a key resistance level last April.

The Shanghai index seems on path to test its critical support levels on what seems as a pennant chart formation.

The SHCOMP has been on tight trading range since its meltdown from the October 2007 peak at the 6,000 levels. From the said zenith, the index trades at loss of about 52% based on Friday’s close.

And following this week’s 5% rout, the Shanghai index has been down 3.5% on a year to date basis.

Chinese authorities have been tightening monetary policies to curb heightened risks of inflation.

According to a Bloomberg report[1],

The government has increased reserve requirements for banks 11 times and boosted interest rates four times since the start of 2010 to cool consumer prices

And if we go by the conditions of money supply as potential barometer to China’s economic directions, then it would appear that these compounded efforts against further ballooning of the evolving bubble may have began to affect the economy.

China’s falling money supply (right) appears to have triggered a slowdown on import growth, while consumer prices are also expected to decline according to a Danske Bank report[2].

As an aside, another option which China seems to have used on her fight against inflation has been to reduce her holdings of US treasuries for the fifth month[3] (but added on Japanese debts) and subsequently allowed for her currency the yuan to appreciate[4]. All these could also have added to the China’s process to “normalize” her monetary environment which translates to a potential slowdown.

In a discourse about current state of the US economy Austrian economist Dr. Frank Shostak writes[5],

Ultimately it is fluctuations in the growth momentum of the money supply that set in motion fluctuations in the pace of formations of bubble activities. As a result, various bubble activities that emerged on the back of the rising growth momentum of the money supply will come under pressure — an economic bust will be set into motion.

The above tenet has a universal application which means this applies to China as well.

And a possible evidence of such dynamics could be signs of deceleration in some segments of China’s property sector.

Residential sales in the elite or first tier cities have been on a downtrend.

According to the US Global Investors[6],

Residential house sales are seeing a slowdown in major Chinese cities this year. With the tightening of lending to property developers and restriction of purchases by the governments in China, developers are forced to raise money by selling at lower prices.

However, the current slowdown has not been apparent on China’s yield curve (as shown below[7]), which appears to have even steepened—manifesting signs of further inflation ahead.

Unlike Vietnam, whose unfolding stock market crash[8] appears to have dramatically flatten her yield curve over a short time span and seem to emit early signs of tipping over to an inversion (where long term interest rate are lower than the short term)—which could presage a recession over the coming year or so.

China’s immensely high rate of savings (as shown in the below chart[9]), has contributed substantially to the deferment of the unraveling of its policy induced homegrown bubble.

For as long as these savings would be able to finance economic activities that are both productive or not, the bubble activities may continue.

Nonetheless continued exposure to non-productive activities or malinvestments will eventually lead to wealth or capital consumption or the erosion of the pool of real savings which will force a painful adjustment via crisis or recession.

For now, predicting a bursting of China’s bubble may seem tricky. And I won’t tread on this path yet.

Aside from the yield curve, commodities prices appear to be rebounding, which according to the global-emerging market consumption demand story[10], China plays a significant role in the setting of prices.

Besides, the BRIC (Brazil Russia India China) story seems to share quite a strong correlation (except for Russia) in terms of stock market performance. The vertical lines exhibits the near simultaneous important turns on their respective benchmarks.

With signs that Brazil (BVSP), India (BSE) and Russia (RTSE) recently bouncing off their lows along with the current signs of recovery in commodity prices, China could as well experience an oversold rebound and return to its trading range.

Nevertheless I would need to see more signs or evidences of accelerated deterioration on several markets or economic indicators from which to predict (and take necessary action) on the imminence of a recession or a bubble busting environment.

For now, China’s market volatility could just be representative of the correction phase seen in many of the key global equity markets.

[1] Bloomberg.com China Stocks May Extend Slump, ICBC Credit Suisse, Goldman Say, May 24, 2011

[2] Danske Research China: Growth slows but inflation eased less than expected, May 11, 2011

[3] People’s Daily Online China trimmed holdings of US debt again, May 18, 2011

[4] Bloomberg.com Yuan Completes Weekly Gain on Signs Appreciation to Be Allowed, May 27, 2011

[5] Shostak Frank The Effects of Freezing the Balance Sheet, Mises.org, May 20, 2011

[6] US Global Investors Investor Alert, May 27, 2011

[7] asianbondsonline.adb.org, China, People’s Republic of

[8] See Vietnam Stock Market Plunges on Monetary Tightening, May 24, 2011

[9] Chamon, Marcos Liu, Kai Prasad, Eswar The puzzle of China’s rising household saving rate voxeu.org, January 18, 2011

[10] See War On Commodities: China Joins Fray, Global Commodity Politics Intensifies, May 14, 2011

Saturday, June 05, 2010

Quote Of The Day: Market Oriented Principles Makes The Difference

Sunday, November 29, 2009

Vietnam’s Inflation Control Measures And The Japanese Yen’s Record High

``If most of us remain ignorant of ourselves, it is because self-knowledge is painful and we prefer the pleasures of illusion.” Aldous Huxley

There are other issues that appear to have been eclipsed by the Dubai Debt Crisis.

Vietnam’s Inflation Control Measures

First, Vietnam announced a sharp hike in its interest rate to allegedly combat inflation. According to Finance Asia, ``The State Bank of Vietnam will increase its benchmark interest rate to 8% from 7% as of December 1”

In addition, Vietnam likewise devalued its currency the Dong by 5.2%. According anew to Finance Asia, [bold emphasis mine] ``The State Bank of Vietnam also reset the US dollar reference rate to 17,961 dong from its current level of 17,034 dong, in its third devaluation of the currency in two years. The central bank will also narrow the trading band of the dollar against the dong to 3% from 5%.

``This is an effort not only to bring confidence to the currency, but also to correct the difference versus where the dong is trading on the black market, which has been at about 19,700 per US dollar in recent weeks.”

Figure 6: Wall Street Journal: Vietnam’s Devaluation

Figure 6: Wall Street Journal: Vietnam’s Devaluation

In other words, currency controls have widened the spread between the black market rate of the Vietnam Dong relative to the US dollar and the official devaluation merely is an attempt to close the chasm. The Vietnamese economy has been suffering from a huge current account deficit to the tune of almost 8% of its GDP.

However, in spite of the fresh monetary actions (see figure 6) the black market rate for the Dong and the official rate remain far apart.

And because of the spike in interest rates, the Vietnam equity benchmark fell by 11.73% over the week.

However, a curious and notable observation is that Vietnam’s present policies seems like responding to a market symptom which can be characterized as our Mises Moment,

This from Thanhnien.com, ``Vietnamese lenders are facing a shortage of funds to meet rising demand for loans because gains in gold and the dollar are deterring people from putting money in the bank, according to a government statement. Commercial banks have had to raise deposit interest rates to as high as 9.99 percent over the past week and offered gifts and bonuses to depositors to lure them back, the statement on the government’s website said.” [bold emphasis original]

In other words, the Vietnamese people have been hoarding gold and foreign currency (US Dollar) and have shunned the banking system in response to Vietnam’s government repeated debasement of its currency. It’s seems like an early symptom of demonetization.

As we have previously quoted Professor Ludwig von Mises from his Stabilization of the Monetary Unit? From the Viewpoint of Theory,

``If people are buying unnecessary commodities, or at least commodities not needed at the moment, because they do not want to hold on to their paper notes, then the process which forces the notes out of use as a generally acceptable medium of exchange has already begun. This is the beginning of the “demonetization” of the notes. The panicky quality inherent in the operation must speed up the process. It may be possible to calm the excited masses once, twice, perhaps even three or four times. However, matters must finally come to an end. Then there is no going back. Once the depreciation makes such rapid strides that sellers are fearful of suffering heavy losses, even if they buy again with the greatest possible speed, there is no longer any chance of rescuing the currency. In every country in which inflation has proceeded at a rapid pace, it has been discovered that the depreciation of the money has eventually proceeded faster than the increase in its quantity.” [bold emphasis mine]

Will Vietnam follow the path of the most recently concluded Zimbabwean monetary disease?

I was thinking of Venezuela as next likely candidate but here we have a next door neighbor exhibiting the same symptoms that ails every government that attempts to control or manipulate the marketplace.

The Japanese Yen On A 14 Year High

The second issue overshadowed by the Dubai Debt Crisis is that the Japanese Yen soared to its highest level against the US dollar in 14 years.

According to a Bloomberg report, ``The dollar dropped to the lowest level versus the yen since July 1995 and fell against the euro as the Federal Reserve’s signal it will tolerate a weaker greenback encouraged investors to buy higher-yielding assets outside the U.S.”

The strength of the Japanese yen had been broad based against other major currencies but gains were marginal.

The news blamed the Yen’s rise on the carry trade ``delay debt repayments spurred investors to sell higher-yielding assets funded with the currencies.”

Such oversimplification is not convincing or backed by evidence.

As noted earlier, the US dollar fell to new lows on the Dubai incident before rallying back Friday but eventually giving back most of its gains.

Besides, not all markets had been severely hit. In Latin America, Brazil, Columbia, Chile, Mexico and Venezuela all registered weekly gains. Emerging markets are expected to take it to the chin when carry trades unravel. This hasn’t been the general case.

In Europe, Germany, Italy, Norway, Sweden, Switzerland and Italy survived the week on positive grounds. So even if the Dubai debt crisis exposed Europe more than the others, the selling pressure wasn’t the same. UK home to RBS suffered marginal losses (.11%).

Again none of these accounts for as any solid or concrete signs of an unwinding of carry trade.

While the rising Japanese Yen has so far coincided with a lethargic Nikkei since August (see figure 7 left window), it’s not clear that such correlation has causation linkages.

Although the Japanese government thinks it has.

Again from the same Bloomberg article, ``Finance Minister Hirohisa Fujii said he will contact U.S. and European officials about exchange rates if needed, signaling his growing concern that the yen’s ascent will hurt the economy. The Bank of Japan checked rates at commercial banks in Tokyo, seen as a type of verbal intervention, Kyodo News Service reported.

``Japan hasn’t sold its currency since March 16, 2004, when it traded around 109 per dollar. The Bank of Japan sold 14.8 trillion yen ($172 billion) in the first three months of 2004, after record sales of 20.4 trillion yen in 2003. Japan last bought the currency in 1998, purchasing 3.05 trillion yen as the rate fell as low as 147.66.”

Well it came to my surprise that after all the political gibberish about Japan’s so-called export economy or export dependency, we realized that Japan’s economy is hardly about global trade.

According to ADB data, Japan’s trade in 2006 only accounted for 28.2% of the nation’s GDP, where export (right window) is only 16% of the GDP pie (yes this stunned me as I had the impression all along that Japan’s trade was at the levels of Hong Kong and Singapore and I had to check on official or government data).

The Philippines has even a higher share of trade (84.7%) and exports (36.9%)!

In addition, Japan’s industry, as a share of GDP pie registered for only 26.3%, according to the CIA factbook in 2008.

So a policy for a weaker yen is likely to benefit a small but strong lobbying segment of the society at the expense of the consumers (via cheaper products) or the society.

All these are strong evidences on why the world is facing a greater degree of risks from a hyperinflation episode.

The fallacious Mercantilist-Keynesian paradigm wants a race to devalue currency values, based on a simplistic one product, single price sensitivity, one labor, homogenous capital model which presumes global trade is a zero sum game. They hardly think of money in terms of purchasing power but from political interests based on “aggregate demand”.

Finally, Finance Minister Hirohisa Fujii isn’t likely to succeed in convincing his peers to collaborate to prevent the yen from strengthening. That’s because all of them share the same line of thinking or ideology. And Fed Chairman Bernanke has been on a helicopter mission that will likely to persist until imbalances unravel to haunt the global markets anew.