I had a gruesome first hand experience on how governments disdains the use of cash.

Sadly this has not been an isolated experience, but a deepening troublesome political trend around the world, particularly in developed economies.

Governments would like to confiscate more of the public’s resources to finance their lavish ways. So the compulsion to transact through their institutional accomplices, the politically endowed banking system.

Through stricter unilateral regulations or immoral laws, governments through the banking system place the public’s hard earned savings under intense scrutiny, and criminalize the actions of the innocent, whom have been uninformed by the rapid pace of changes in manifold regulations covering a wide swath of social activities through the banking system.

Private transactions which does not conform with the goals and the interests of the political authorities risks confiscation. Worst is the trauma of being labeled a criminal. Increasingly desperate governments have wantonly been in violation of the property rights of their citizenry.

A vote against government is to use cash transactions, that’s because cash, according to Charles Goyette at the LewRockwell.com, represents freedom

Mr. Goyette writes, (bold emphasis mine)

Governments hate that cash gives you anonymity. And they are often very anxious to track it and to control your use of it. They often attempt to criminalize the use of cash or at least criminalize having too much of it around.

Right now, 7% of the U.S. economy is cash-based. Across the Eurozone, it's a little bit higher, 9%, but in Sweden cash transactions are falling by the wayside. You can't use cash for buses there. A growing number of businesses are going entirely cashless. In fact, only 3% of all purchases in Sweden are transacted in cash. And some people think that 3% is too much.

Now, there are things you give up when you go cashless, and privacy is only one of them. Because you also give up a piece of every transaction to the facilitating financial institution, a state-approved financial institution that is going to take a cut one way or another of every purchase that it processes. And that cut will be paid by you.

In the United States, the government has implemented increasingly punitive and burdensome measures for those who use cash. Banks, for example, are required to file reports on the use of cash in certain circumstances, including suspicious persons reports for some cash activities. In fact, if you seem to be trying to transact in cash below the reporting threshold, that alone can trigger a suspicious persons report on you. Like a lot of the states' heavy-handed measures, this was all targeted at getting those drug dealers.

As earlier pointed out, governments has used all sorts of "noble" excuses like money laundering, tax evasion, the war on drugs and etc… to justify their confiscatory actions which in reality represents no more than financial repression.

And as governments tighten the noose on the public, people will intuitively look for ingenious alternatives to outflank such oppressive policies.

In the US, the liquid detergent Tide appears to have emerged even as an alternative to cash.

Writes Professor Joseph Salerno at the Mises Institute.

As has been widely reported recently, an unlikely crime wave has rapidly spread throughout the United States and has taken local law-enforcement officials by surprise. The theft of Tide liquid laundry detergent is pandemic throughout cities in the United States. One individual alone stole $25,000 worth of Tide detergent during a 15-month crime spree, and large retailers are taking special security measures to protect their inventories of Tide. For example, CVS is locking down Tide alongside commonly stolen items like flu medications. Liquid Tide retails for $10–$20 per bottle and sells on the black market for $5–$10. Individual bottles of Tide bear no serial numbers, making them impossible to track. So some enterprising thieves operate as arbitrageurs buying at the black-market price and reselling to the stores, presumably at the wholesale price. Even more puzzling is the fact that no other brand of detergent has been targeted.

What gives here? This is just another confirmation of Menger's insight that the market responds to the absence of sound money by monetizing highly salable commodities. It is clear that Tide has emerged as a subsidiary local currency for black-market, especially drug, transactions — but for legal transactions in low-income areas as well. Indeed police report that Tide is being exchanged for heroin and methamphetamine and that drug dealers possess inventories of the commodity that they are also willing to sell.

As governments stifle people’s social and commercial activities through tyrannical laws, expect the use of more cash, local currencies or commodities (such as Tide) as alternative medium of exchanges, as the informal or shadow economies grow.

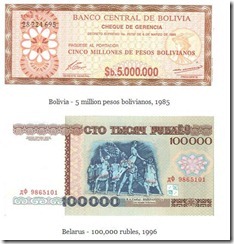

Most importantly, real assets will become more valuable and may become an integral part of money, as sustained policies of inflationism, as Voltaire once said, will bring fiat money back to its intrinsic value—zero.

Money which emerges from the markets will be emblematic of freedom.