In the wake of the bailout, Congress created a special position to oversee how the funds were spent. Like anything else in government, they used an unnecessarily long name followed by a catchy acronym–Special Inspector General for the Troubled Asset Relief Program, or SIGTARP.(The first SIGTARP was a former federal prosecutor who had previously indicted 50 leaders of the Revolutionary Armed Forces of Colombia… just the right man to keep a watchful eye on bankers.)SIGTARP just released its quarterly report to Congress… and it’s scatching, suggesting that “the toxic corporate culture that led up to the crisis and TARP has not sufficiently changed.”There are some real zingers in the 518 page report, including:

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, October 30, 2013

How Wall Street Gamed the TARP

Saturday, May 25, 2013

Iceland’s Recovery: Hardly about Currency Devaluation

Iceland’s recent devaluation was highly orthodox policy condition for wards of the IMF (strings attached to a $2 bn. loan). Unfortunately, such devaluations often backfire by inflating commodity costs, interest rates and the burden of foreign debt. The Icelandic krona fell from 64 to the dollar in 2007 to 123.6 in 2009, before strengthening with the economy to nearly 116 in 2011.Since oil, grains and metals are priced in dollars, the 2008-2009 devaluation inflated Iceland’s cost of production and cost of living. Inflation rose from 5.1 percent in 2007 to 12 percent or more in 2008 and 2009; real GDP fell by 6.8 percent in 2009 and 4 percent in 2010. Faced with a collapsing currency, the central bank interest rate was hiked to 18 percent by October 2008. It could have been worse. If Iceland’s Supreme Court had not nullified loans indexed to foreign currencies in June 2010, devaluation would have doubled the cost of repaying foreign debt.Devaluation was supposed to boost GDP by making imports costly and exports cheap, thus narrowing the trade deficit. The current account deficit did fall after 2008, but that always happens when recessions slash imports. Ireland had a current account surplus from 2010 to 2012 without devaluation, even as Iceland’s current account deficit was still 7-8 percent of GDP.Iceland’s economy grew by 3.1 percent in 2011 when the currency appreciated and the budget deficit was deeply cut to 4.4 percent of GDP. Devaluation explains the previous spike in inflation and interest rates, but little else.

Tuesday, April 30, 2013

Implied Government Guarantees on BRIC Banking system

The ability of Brazil, Russia, India and China to support their leading banks is tightly correlated to the credit rating on the banks, according to ratings agency Moody’s. The agency compares the ratings of four of the biggest BRIC banks which it says are likely to enjoy sovereign support if they run into trouble…In a self-perpetuating cycle, ratings will be higher because governments are prepared to provide high levels of support to the banks, reflecting the lenders’ systemic importance and in some cases government ownership.

Moreover this implies that the public's savings, even in emerging markets, will continue to be under duress from indirect and direct confiscations in favor of the banking system.

Sunday, March 17, 2013

War on Savers: Cyprus’ $13 Billion Bailout to be Funded by Taxing Depositors

Euro-area finance ministers agreed to an unprecedented tax on Cypriot bank deposits as officials unveiled a 10 billion-euro ($13 billion) rescue plan for the country, the fifth since Europe’s debt crisis broke out in 2009.Cyprus will impose a levy of 6.75 percent on deposits of less than 100,000 euros -- the ceiling for European Union account insurance -- and 9.9 percent above that. The measures will raise 5.8 billion euros, in addition to the emergency loans, Dutch Finance Minister Jeroen Dijsselbloem, who leads the group of euro-area ministers, told reporters early today after 10 hours of talks in Brussels. The International Monetary Fund may contribute to the package and junior bondholders may also be tapped in a so-called bail-in, the ministers' statement said.Officials have struggled to find an agreement that would rescue Cyprus, which accounts for just half of a percent of the euro region’s economy, without unsettling investors in larger countries and sparking a new round of market contagion. Finance Minister Michael Sarris said the plan was the “least onerous” of the options Cyprus faced to stay afloat.

The decision prompted a run on cashpoints, most of which were depleted by mid afternoon, and co-operative credit societies closed to prevent angry savers withdrawing deposits.Almost half Cyprus's bank depositors are believed to be non-resident Russians, but most queuing on Saturday at automatic teller machines appeared to be Cypriots.

Tuesday, November 27, 2012

Why Warren Buffett Loves to Tax the Rich

As Americans for Limited Government President Bill Wilson notes, the company openly admits that it owes back taxes since as long ago as 2002.“We anticipate that we will resolve all adjustments proposed by the US Internal Revenue Service (“IRS”) for the 2002 through 2004 tax years ... within the next 12 months,” the firm’s annual report says.It also cites outstanding tax issues for 2005 through 2009.

But on closer examination, one realizes that Mr Buffett never mentions doing anything to eliminate the tax-avoidance strategies that he uses most aggressively. In particular:1. His company Berkshire Hathaway never pays a dividend but instead retains all earnings. So the return on this investment is entirely in the form of capital gains. By not paying dividends, he saves his investors (including himself) from having to immediately pay income tax on this income.2. Mr Buffett is a long-term investor, so he rarely sells and realizes a capital gain. His unrealized capital gains are untaxed.3. He is giving away much of his wealth to charity. He gets a deduction at the full market value of the stock he donates, most of which is unrealized (and therefore untaxed) capital gains.4. When he dies, his heirs will get a stepped-up basis. The income tax will never collect any revenue from the substantial unrealized capital gains he has been accumulating.

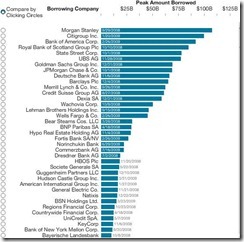

During the depths of the 2008 Credit Crisis and stock market selloff, “Wall Street was of fire,” recalls Peter Schweizer in his expose, Throw Them All Out. “[But] Buffett was running toward the flames…with the expectation that the fire department (that is, the federal government) was right behind him with buckets of bailout money…Indeed, Buffett needed the bailout…Beyond Goldman Sachs, Buffett was heavily invested in several other banks that were at risk and in need of federal cash. He began immediately to campaign for the $700 billion TARP rescue plan that was being hammered together in Washington.”“As the political debates surrounding the proposed $700 billion Troubled Asset Relief Program (TARP) bailout bill heated up,” recalls blogger, Pat Dollard, “Buffett maintained an appearance of naiveté, an ‘aw shucks’ shtick that deferred to the judgment of politicians. ‘I’m not brave enough to try to influence the Congress,’ Buffett told the New York Times.“Behind closed doors, however, Buffett had become a shrewd political entrepreneur,” Dollard continues. “The billionaire exerted his considerable political influence in a private conference call with then-Speaker of the House Nancy Pelosi and House Democrats. During the meeting, Buffett strongly urged Democratic members to pass the $700 billion TARP bill to avert what he warned would otherwise be ‘the biggest financial meltdown in American history.’”“If the bailout went through,” Schweizer correctly observes, “it would be a windfall for Goldman. If it failed, it would be disastrous for Berkshire Hathaway.”Buffett’s “hard work” paid off.“In all, Berkshire Hathaway firms received $95 billion in bailout cash from the Troubled Asset Relief Program (TARP). Berkshire held stock in the Wells Fargo, Bank of America, American Express, and Goldman Sachs, which received not only TARP money but also $130 billion in FDIC backing for their debt. All told, TARP-assisted companies constituted a whopping 30% of its entire company disclosed stock portfolio.”But these billions of dollars represented only the most visible portions of the bailout funds that flowed to Berkshire’s companies. Wells Fargo, for example, received “only” $25 billion of TARP funding, but it also received another $45 billion at the same time from the Federal Reserve’s Term Auction Facility (TAF).Incredibly, Wells Fargo’s borrowings paled alongside those of Goldman Sachs. Throughout the crisis, Goldman gorged itself at every available government trough. The morally challenged investment bank borrowed only $10 billion from the TARP. But at the same time Goldman was griping about “being forced” to take the $10 billion TARP loan, the company was borrowing tens of billions of dollars more from obscure government lending programs with acronyms like: CPFF, PDCF and TSLF.And that’s not all!Amidst much fanfare and self-congratulatory press releases, Goldman repaid its TARP loan in June 2009, but only after securing $25 billion of government capital at a different trough. As we observed in a December 15, 2010 edition of The Daily Reckoning:On June 17, 2009…thanks to some timely, undisclosed assistance from the Federal Reserve, Goldman repaid its $10 billion TARP loan. But just six days before this announcement, Goldman sold $11 billion of mortgage-backed securities (MBS) to the Fed. In other words, Goldman “repaid” the Treasury by secretly selling illiquid assets to the Fed.One month later, Goldman’s CEO Lloyd Blankfein beamed, “We are grateful for the government efforts and are pleased that [the monies we repaid] can be used by the government to revitalize the economy, a priority in which we all have a common stake.”As it turns out, the government continued to “revitalize” that small sliver of the economy known as Goldman Sachs. During the three months following Goldman’s re-payment of its $10 billion TARP loan, the Fed purchased $27 billion of MBS from Goldman. In all, the Fed would purchase more than $100 billion of MBS from Goldman during the 12 months that followed Goldman’s TARP re-payment.Is it any wonder that Buffett’s $5 billion “investment” in Goldman Sachs succeeded so nicely?“Later, astonishingly,” recalls Peter Schweizer, “Buffett would publicly complain about the bailouts in his annual letter to Berkshire investors, claiming that government subsidies put Berkshire at a disadvantage…”

[As a side note, maybe the Occupy Wall Street movement should consider occupying Berkshire Hathaway too]

Wednesday, June 13, 2012

Pavlovian Markets Rise on ECB’s Proposed Deposit Guarantees

US and European stocks went back into a Risk ON mode last night while Asian stocks climb again today on another report of a planned stimulus: Deposit Guarantees.

From Reuters

European Central Bank Vice-President Vitor Constancio made a fresh push for the bank to become the supervisor of the euro zone's biggest banks on Tuesday, saying the wording of Europe's founding treaty meant it would be an easy change to make.

The ECB is the driving force behind a three-pillar plan for a euro zone banking union, consisting of central monitoring of banks, a fund to wind down big lenders and a pan-European deposit guarantee.

As previously pointed out, ‘guarantees’ signify as the politician’s and mainstream’s travesty where the public has been made to believe that government’s stamp or edicts can simply do away with the laws of economics. Everyone is made to look at the intended goal, while ignoring the reality of who pays for such guarantees and how to get there. Yet the crisis, since 2008, continues to worsen. These guarantees are really meant to pave way for massive inflationism

Nevertheless the past few days has seen an incredible surge in volatility

Monday, the US S&P had a fantastic rollercoaster 2% ride. The major US benchmark was initially up on the news of Spain’s bailout, but the day’s gains had been reversed where the S&P closed sharply down 1.14%. Last night was another huge 1.13% upside close which offset Monday’s decline.

The Risk ON-Risk OFF landscape has obviously been intensifying, all premised on government’s Pavlovian classic conditioning. I worry that these huge swings could become a dangerous precedent that could ominous of, or increase the risk of a ‘crash’, which I hope it won’t.

Financial markets has been transformed into a grand casino.

Caveat emptor

Thursday, June 07, 2012

Eurozone’s Proposes Grand Bailout: Regional Banking Union

So the rally incited by the Eurozone yesterday may have been triggered by reports of a proposed region wide banking union.

From the CNN Money

The European Union unveiled a plan Wednesday to create a coordinated banking union rather than leaving troubled nations to deal with their own banking crisis.

But the plans for more a unified EU bank regulator and bailout fund won't come in time to deal with the crisis sweeping Europe right now, including the beleaguered Spanish banking system which has become the epicenter of the European sovereign debt crisis.

The EU proposal would include a single deposit guarantee organization covering all banks in the union, something similar to the FDIC that covers U.S. bank deposits.

There would also be a common authority and a common fund that would deal with bailouts needed for the cross-border banks that are major players in the European banking system.

G7 keeping close tabs on Euro crisis

In addition, there would be a single EU supervisor with ultimate decision-making powers for the major banks, and a common set of banking rules.

"Today's proposal is an essential step towards a banking union in the EU and will make the banking sector more responsible," said European Commission President Jose Manuel Barroso in a statement. "This will contribute to stability and confidence in the EU in the future, as we work to strengthen and further integrate our interdependent economies."

The amount of the common bank rescue fund was not disclosed.

Many substantially important questions that begs to be answered:

Guarantees based on what and paid for by whom? Mostly the Germans? And since resources are limited or scarce, up to what extent are the Germans and other productive EU nations be willing to redistribute their resources to the unproductive and capital consuming economies? How will this affect EU regional politics particularly the relationship between rescuers and the rescued? How will this affect domestic politics particularly of the rescuing nations?

The idea of ‘risk free’ from government guarantees has proven to be a mirage and a regional banking union will be no different.

And as previously noted, banking union based on deposit insurance will likely mean the endgame for the euro.

The only thing this does is to centralize the EU banking system which even magnifies systemic fragility. What really would emanate from this coordinated plan would be massive inflationism. It’s still a plan, though. But markets appear to be reading through the plan as something imminent. [As a side note, everything has been so fluid, such that I can’t find confidence on this until after an official response has been made.]

Bailout schemes have short term effects with nasty longer term consequences. As proof, the Euro debt crisis has been a continuing crisis since 2008 and seems self-perpetuating amidst the series of past failed bailouts.

Sadly the other cost of this region-wide banking union will be the loss of liberty for many of the freedom loving Europeans, over the interim, or until the dismemberment of the euro currency (and the EU), and of further economic tumult ahead.

Saturday, December 03, 2011

Sunday, October 16, 2011

More Evidence of China’s Unraveling Bubble?

A day after I pointed out my suspicions of a possible implosion of China’s bubble economy, China’s government announced that she will be intervening to support their banking and financial system by acquiring shares of major banks through her sovereign wealth fund, Central Huijin[1].

China’s reported interventions sent the Shanghai index up 3% over the week.

Financial bailouts has not been confined to China’s stock markets, but to the real economy too, China declared another bailout package for small companies[2]. The measure includes tax breaks, easier access to loans and leniency on appraising bad loans following the reported collapse of some manufacturers in Wenzhou which has been indicative of the growing risks to China’s economy.

Resorting to emergency stabilization policies basically confirms my suspicions, China is presently suffering from either a sharp economic slowdown or in the process of a bubble implosion. The latter is where I am leaning on, but this requires more evidence.

As earlier mentioned, China’s recent strains have been representative of the unintended consequences of China’s boom bust or inflationist policies. Part of which constitutes the aftereffects of the 2008 stimulus, combined with the impact from China’s struggle to contain her inner demons—elevated consumer price inflation (CPI).

And also as previously noted, the bear market of the Shanghai index since 2007 represents a continuing dynamic of China’s massive boom bust cycle that only has shifted from the stock market to the property sector.

Slowing money supply growth from the series of interest rates increases, the hiking of bank reserves requirements and the appreciation of her currency, the yuan, has been putting financial strains on the massive misallocation of capital due to the previous policies directed at preventing a bust and the political imperatives to maintain a permanent state of quasi booms[3].

And to further give weight to my suspicions, we seem to be seeing substantial outflows of hot money which has materially reduced China’s foreign reserve accumulation. Part of this has also been been attributed to China’s declining current account surpluses[4].

For now, the continuity of the outflows is not clear and will likely depend on the scale of economic and financial deterioration.

Seen from the perspective of China’s currency, we are unlikely to see the yuan appreciate further. And contrary to public expectations, the unwinding of China’s bubble economy would lead to a depreciating yuan.

While many see the current downturn to meaningfully reduce China’s lofty Consumer Price Inflation (CPI), which gives China’s government more latitude to ‘ease’ credit or provide additional bailout measures, economic downturns do not mechanically imply a disinflation of consumer prices. This will greatly depend on the actions of the Chinese government

But more bailouts should be expected as the political objectives for the China’s ruling class ensures such course of action. China’s political stewards will work to postpone an inevitable bubble meltdown. That’s because a sharp economic downturn will likely trigger China’s version of the Arab Spring uprising or a populist upheaval that magnifies the risk of toppling the incumbent regime. There have already been snowballing accounts of protest movements[5] over the country.

Put differently, signs of accelerating stress levels in the financial sector, where loan losses from bad debts could spike to 60% of equity capital according to the estimates the Credit Suisse[6], and a slowdown in parts of the China’s economy suggests that the campaign to contain inflation will shift towards promoting inflation as evidenced by the two bailout measures unveiled last week. There will be more coming.

And like the current policymaking dilemma in the Eurozone, where Euro officials have been struggling to thresh out a “comprehensive strategy” which would ring fence the Euro’s fragile banking sector[7], and similar to the sequential actions of US authorities leading towards the Lehman bankruptcy in 2008, Chinese officials are likely to apply a whack-a-mole approach in dealing with the emergent economic strains.

Unlike in 2008, last week’s twin bailout packages have been inexplicit or indeterminate as there has been no amount specified.

In short, expect Chinese policies to be reactive until such problems will become significant enough for the government to announce a massive specific systemwide bailout program.

Dissonant Market Signals

For the meantime, the current financial and economic environment remains fundamentally a guesswork.

China and the Eurozone’s bailout has hardly boosted copper prices.

Dr. Copper, whose price action have conventionally been interpreted as exhibiting the health conditions of the global economy seems unconvinced, as the recent price performance has evidently lagged the recovery seen in global equity markets.

For chartists, the current rally appear to have forged a bearish rising wedge pattern which seem ominous for another bout of selling episode.

And considering the newly announced expansions of QE measures by the European Central Bank (ECB)[8] and the Bank of England (BoE)[9] as well as the soaring money supply aggregates in the US (which is a fundamental reason why the US is unlikely to fall into a recession unless an external shock occurs like that of China), the same essence of skepticism can be construed to the underperformance of gold prices.

While threats to[10] and actual imposition of various trading curbs on the commodity markets are currently being waged by global authorities, the effects of these are likely to be short term. The greater and more lasting impact would emanate from the large scale redistribution schemes of bailouts, taxations and inflationism.

Nonetheless, the unfolding events in China poses as a black swan event that could undermine the current rally.

Thus, we should closely observe the developments in China and how Chinese and global authorities will react to the unfolding developments.

Grandiose Plans and Promises Meant To Be Broken

To repeat, the current state of the markets appear to be driven by the spate of newly implemented political programs such as QEs, bailouts (Drexia[11]) etc..., as well as, promises for a political resolution on what has mainly been a politically induced problem for the China, the Eurozone and the US.

The current European based QEs may not seem as large as the previous which, in my view, could be a source of liquidity strains on the financial markets starving for sustained massive injections of money or inflationism.

It would be interesting to see if the flurry of news of actual and proposed bailouts will succeed in the restoration of confidence (which means reduced market volatilities highlighted by a fortified upside trend) or if such narratives will be reinforced by concrete actions such as the recent ratification[12] of the European Financial Stability Fund (EFSF) or recently announced QEs by the ECB and the BoE. Again, size matters.

So far some stories or plans may just end up in the shelf or in the trash bins signifying another failed attempt at propping up a highly fragile and tenuous system.

In the Eurozone, a proposal being floated to ring fence the region’s banking system will be through the conversion of the EFSF into an insurance like credit mechanism, where the EFSF will bear the first 20% of losses on sovereign debts, but allows the banks to lever up its firepower fivefold to € 2 trillion[13]

Yet the lack of real resources, insufficient capital by the ECB, highly concentrated and the high default correlation of underlying investments could be possible factors that could undermine such grandiose plans. Besides, such plans appear to have been tailor fitted to reduce credit rating risks of France and Germany aside from allowing the ECB to monetize on these debts[14].

Again given the complexities of the system, it would be difficult to conceive how these centralized plans would ever succeed.

At the end of the day, the final intuitive recourse, like in most of our history, would be for political authorities to engage in inflationism.

[1] See Black Swan Event: Has China’s Bubble Been Pricked?, October 9, 2011

[2] Bloomberg.com China Offers Help to Small Companies Amid Wenzhou Risks, October 14, 2011 SFGATE.com

[3] See China’s Bubble Cycle Deepens with More Grand Inflation Based Projects, June 2, 2011

[4] Danske Bank China: FX intervention eased substantially in Q3, October 14, 2011

[5] See Does Growing Signs of People Power Upheavals in China Presage a ‘China Spring’? September 26, 2011

[6] Bloomberg.com Chinese Banks’ Bad Debt May Hit 60% of Equity Capital, Credit Suisse Says October 12, 2011

[7] Bloomberg.com Europe Crisis Plan Wins Global Backing as G-20 Urges Action, October 15, 2011 Businessweek.com

[8] See European Central Bank expands QE to include Covered Bonds, October 6, 2011

[9] See Bank of England Activates QE 2.0 October 6, 2011

[10] See War on Commodities: Eurozone Threatens to Impose Derivative Trading Curbs, October 15, 2011

[11] See Reported Bailout of Belgium’s Dexia Spurs a fantastic US Equity Market Comeback October 5, 2011

[12] See Slovakia ratifies Euro Bailout Fund (EFSF), October 14, 2011

[13] Reuters.com G20 tells euro zone to fix debt crisis within weeks October 15, 2011 Hindustantimes.com

[14] Das Satjayit A Psychiatric Assessment of the Eurozone's Leveraged Bailout Fund, October 5, Minyanville.com

Tuesday, October 11, 2011

China Announces Bank Bailouts

My hunch about China's bursting bubble has been getting some validation.

The Chinese government has announced that it will intervene by buying shares of select banking stocks.

From the Financial Times (bold emphasis added)

The Chinese government will boost its stakes in the country’s largest banks, as it attempts to shore up slumping financial stocks and to restore investor confidence.

Central Huijin, the domestic arm of China’s sovereign wealth fund, will purchase shares in Agricultural Bank of China, Bank of China, China Construction Bank and Industrial and Commercial Bank of China, the official Xinhua news agency announced on Monday. Xinhua added that the purchases by Huijin – its first such public intervention since a similar decision at the onset of the financial crisis three years ago – would “support the healthy operations and development of key state-owned financial institutions and stabilise the share prices of state-owned commercial banks”.

The announcement came too late for the Chinese stock market, which had closed at a 30-month low, but had an immediate effect on late trading in Hong Kong. ICBC’s Hong Kong-listed shares, which had been down 3 per cent, rallied to close up 1 per cent

Beijing also allowed the renminbi to record its biggest one-day gain in years on Monday. It rose 0.6 per cent against the dollar, squeezing traders who have been betting that the currency will weaken in tandem with a slowing economy.

Adding to my earlier commentary, a bust process-in China’s bubble economy or following an earlier money supply growth driven boom-is also a result of a rising yuan.

Corporate finance analyst and author Kel Kelly at the Mises.org provides an eloquent explanation

Therefore, letting its currency rise will cause a recession, since reduced money-supply and credit-growth rates are the usual initiating factors that bring on recessions (reduced rates of spending alone can cause recessions, but they are usually preceded by prior reductions in money and credit). It has been rapid increases in money and credit that have driven the current boom in China, and it will be the reduction in the growth rate of those variables that causes the bust.

The economic boom in China has consisted of rapid increases in true economic growth accompanied by — but not driven by — an increase in monetary spending. The increase in monetary spending, in turn, has been driven by wild credit growth, and has resulted in massive overinvestment in particular industries. There has been no shortage of commentaries and videos highlighting building booms, mania-type herd-mentality home buying, and the mass creation of buildings, shopping malls, and even multiple entire cities in China that stand unoccupied — all dramatic yet classic symptoms of credit bubbles.

So like the Eurozone, we see China’s government providing explicit support by jawboning or providing promises to buttress her banking sector.

However, the problem is that China’s current currency policies appear to contradict this (see chart below from Mr. Kelly).

The left hand does not know what the right hand is doing.

Again, we should see if such guarantees would suffice to forestall a bust or if market forces will continue to put pressure on China’s government, not only to make promises, but to forcefully act.

Very interesting times indeed.

Wednesday, October 05, 2011

Reported Bailout of Belgium’s Dexia Spurs a fantastic US Equity Market Comeback

Another day, another sharply volatile markets.

US equity markets made another spectacular comeback.

The actions of the US S&P exhibits the amazing turnaround today. Down by over 2%, the major US bellwether hit the bear market threshold then sharply recovered during the last hour to make a dramatic 4.1% swing as shown in the above chart from stockcharts.com.

The reported trigger: another bank bailout in the Eurozone.

This from Bloomberg (bold emphasis mine)

U.S. stocks rallied, driving the Standard & Poor’s 500 Index up 4.1 percent in the final 50 minutes, amid speculation European Union officials are examining how to recapitalize the region’s banks. Treasuries fell and the euro rallied.

The S&P 500 surged 2.3 percent to 1,123.95 at 4 p.m. New York time, sparing the benchmark measure of U.S. equities its first bear market, or 20 percent retreat from a peak, since 2009. Yields on Treasury 10-year notes climbed 6 basis points to 1.82 percent. The euro appreciated 1.1 percent to $1.3322. Futures on Germany’s DAX Index pared their loss to 1 percent from 4.9 percent.

Equities rebounded after the S&P 500 fell below 1,090.89, the closing level required to give the index a 20 percent slump from the three-year high reached on April 29. Stocks rose after the Financial Times quoted Olli Rehn, European commissioner for economic affairs, as saying there is an “increasingly shared view” that the region needs a coordinated approach to halt the sovereign debt crisis. After U.S. markets closed, Belgian Prime Minister Yves Leterme said a “bad bank” to hold Dexia SA (DEXB)’s troubled assets will be set up.

It is important to note that US municipal bond markets (state, cities and etc.) has significant but dwindling exposure to Dexia, from previously $54 billion to the current $9.6 billion (Reuters). Thus, the reported bailout sent US financial stocks leading the way for the fiery rally in the broader equity markets.

To add, the US Federal Reserve has a big loan exposure on Dexia in 2008, which most likely postulates that the Fed will be part of the rescue package.

From the telegraph

At the height of the financial meltdown, on October 24, 2008, Dexia's New York branch was used to borrow $31.5bn (£19.6bn). The total borrowing from all banks during that week climbed to $111bn, according to lending data released by the central bank on Thursday.

This serves as another evidence manifesting how financial markets have become deeply dependent on government bailout or steroids.

Importantly, that the heightened volatility in the markets have been due to the whack a mole strategy applied by policymakers on bank rescues. Remember, this is just one of the many banks that would 'require' bailouts.

Lastly, the exposure by the US Federal Reserve and US banks to Europe’s imploding banking system only means that team Bernanke will be reengaged in his helicopter option soon

Saturday, September 03, 2011

Quote of the Day: Nassim Taleb on Bankers Ethics

Celebrated author of the Black Swan theory fame Nassim Nicholas Taleb and Mark Spitznagel questions the propriety of nearly $5 trillion paid to bankers, who continues to operate on the model of privatizing profits and socializing losses.

They write, (bold emphasis mine)

One may wonder: If investment managers and their clients don’t receive high returns on bank stocks, as they would if they were profiting from bankers’ externalization of risk onto taxpayers, why do they hold them at all? The answer is the so-called “beta”: banks represent a large share of the S&P 500, and managers need to be invested in them.

We don’t believe that regulation is a panacea for this state of affairs. The largest, most sophisticated banks have become expert at remaining one step ahead of regulators – constantly creating complex financial products and derivatives that skirt the letter of the rules. In these circumstances, more complicated regulations merely mean more billable hours for lawyers, more income for regulators switching sides, and more profits for derivatives traders.

Investment managers have a moral and professional responsibility to play their role in bringing some discipline into the banking system.

So ad hoc conventionalism or peer pressures have been one of the key influences for the financial industry to shore up bank equities, which apparently has resulted to the unethical banking practices brought about by the sense of entitlement and moral hazard from continued government support.

Obviously this has been part of the comprehensive framework to buttress the decadent welfare state-central banking-banking system architecture.

Read the rest of their excellent piece here

Tuesday, August 30, 2011

Third Week for ECB’s QE: 6.7 billion Euros

Last week accounted for the third week where the European Central Bank’s (ECB) Quantitative Easing (QE) has been in action.

This from Reuters, (bold emphasis mine)

The ECB said on Monday it had more than halved its bond purchases to 6.7 billion euros last week. The central bank had bought a record 22 billion euros in the week to Aug. 12, when it intervened in the bond market after 19 weeks of inactivity.

Continued support from the central bank remains crucial to prop up investors' confidence in the short-term, analysts and traders said, amid uncertainties over a second bailout package for Greece.

Adding to markets' jitters, Italy is struggling to agree changes to a 45.5 billion euro austerity package the government hastily approved this month in return for the ECB's help and which is making its way through parliament.

"Italy needs to convince the market it can make it without help from the ECB," Cazzulani said.

This follows the previous two weeks of €22 billion and €14.3 billion of bond buying where ECB’s debt monetization facility has now reached €120.3 billion, according to Zero Hedge.

The above news account only exhibits that global financial markets have been artificially propped up by actions of major global central banks, in the hope that markets will be assuaged by the political tokenism applied by crisis affected governments in reforming their system.

The fact is that there hardly has been any meaningful free market reforms or reforms aimed to improve on the real economy. Resources are, in this process, merely being rechanneled or transferred from the welfare state to the banking system.

The underlying goal has been to preserve the banking system, which has over the years bankrolled the welfare state, through government bonds. And the welfare state-banking system relationship has been backed, regulated and implicitly guaranteed by the central banks.

Professor Gary North aptly writes,

Governments always announce and defend by monopolistic violence their legal sovereignty over money. They say that they will control the terms of exchange. All monetary standards are based on government promises and IOUs called government bonds. These contracts are always broken by governments.

Contracts are being broken consistently as governments’ inflate in order to uphold the current welfare based political system.

A system that depends on inflation is never sustainable.

Wednesday, August 24, 2011

Sensing Steroids, US Equity Markets Sharply Rebounds

Last night the US equity markets made a substantial move

Here’s how the mainstream sees it. This from Bloomberg, (bold emphasis)

U.S. stocks rallied, driving the Standard & Poor’s 500 Index up from the cheapest valuations since 2009, as weaker-than-estimated economic data reinforced optimism the Federal Reserve will act to spur growth.

Monsanto Co. (MON), Chevron Corp. (CVX) and Microsoft Corp. (MSFT) added at least 3 percent, pacing gains in companies most-tied to the economy. The Morgan Stanley Cyclical Index rose 2.9 percent, breaking a five-day losing streak. Sprint Nextel Corp. (S) jumped 10 percent, the most since May 2010, after the Wall Street Journal said it will start selling Apple Inc.’s iPhone. Financial shares reversed losses after the Federal Deposit Insurance Corp.’s list of “problem” banks shrank for the first time since 2006.

I have talked about this earlier here

This only shows that current behavior of stock markets

-has hardly been driven by earnings but by politics,

-have been artificially boosted

-reacts like Pavlov’s Dogs, and

-importantly like addicts, has totally become dependent on steroids.

Never mind if recent reports say that stimulus money ends up going to the coffers of the rent-seekers, as graph of the bailout money by the US Federal Reserve in 2008 shows

The important thing is to have the Fed print money to pacify Wall Street insiders, who constitute part of the cartelized incumbent political system.

Profit from folly.